The CRA Disability Tax Credit 2025 provides essential tax relief for Canadians living with long-term physical or mental impairments. The credit helps reduce income tax payable and serves as a gateway to other federal and provincial supports, including the new Canada Disability Benefit launched in mid-2025.

Table of Contents

CRA Disability Tax Credit 2025

| Key Fact | Detail / Statistic |

|---|---|

| Maximum federal credit (adult) | $9,872 for 2025 |

| Child supplement (under 18) | Additional $5,758 |

| Eligibility duration | Impairment must last at least 12 months |

| Application form | T2201 Disability Tax Credit Certificate |

| Related benefits | Canada Disability Benefit, Child Disability Benefit, CWB Disability Supplement |

| Official Website | CRA |

Understanding the CRA Disability Tax Credit

The Disability Tax Credit (DTC) is a non-refundable federal tax credit designed to reduce the amount of income tax owed by individuals with severe and prolonged impairments. It also enables access to other government programs that support Canadians with disabilities, helping to offset the additional costs of daily living and care.

The program’s goal is to promote financial fairness for people facing chronic medical challenges. It recognizes that long-term impairments often lead to ongoing expenses — from medical treatments to assistive devices and support services.

Eligibility Criteria for CRA Disability Tax Credit 2025

Who Qualifies

To qualify for the DTC, an individual must have a severe and prolonged impairment in physical or mental functions that:

- Has lasted, or is expected to last, at least 12 consecutive months; and

- Significantly restricts one or more basic activities of daily living; or

- Requires life-sustaining therapy on a regular basis.

A medical practitioner must confirm the impairment and complete a section of the T2201 Disability Tax Credit Certificate, verifying its duration and how it affects daily life.

Marked and Cumulative Restrictions

The CRA defines a “marked restriction” as being unable to perform, or taking three times longer than usual to perform, an essential daily activity — such as walking, feeding oneself, or managing mental functions. The restriction must exist at least 90% of the time.

People with multiple moderate restrictions may also qualify under the “cumulative effect” rule. For example, someone who experiences both limited mobility and communication difficulties might still qualify even if neither condition alone meets the full threshold.

Recognized Impairments

Typical qualifying conditions include:

- Severe mobility impairments (such as multiple sclerosis or paralysis)

- Sensory impairments (vision or hearing loss)

- Chronic illnesses requiring daily treatment (such as Type 1 diabetes)

- Cognitive or developmental conditions (autism, ADHD, or dementia)

- Mental health disorders (anxiety, PTSD, major depression) that substantially restrict daily functions

Benefits of the Disability Tax Credit

1. Tax Savings

For the 2025 tax year, the federal disability amount is $9,872. If the person is under 18 at year-end, a child supplement of $5,758 applies, for a combined value of $15,630.

As a non-refundable credit, the DTC reduces the amount of income tax owed but does not provide a direct payment. However, the unused portion can be transferred to a supporting spouse, parent, or caregiver to help them offset taxes.

The DTC can also be claimed retroactively for up to 10 previous years, meaning eligible individuals may recover thousands of dollars in overpaid taxes once approved.

2. Access to Additional Programs

Approval for the DTC opens eligibility for several related federal supports:

- Canada Disability Benefit (CDB): A monthly income supplement for low- to moderate-income Canadians with disabilities (ages 18–64).

- Child Disability Benefit (CDBen): A tax-free monthly payment for parents of children under 18 with disabilities.

- Canada Workers Benefit (CWB) Disability Supplement: An additional refundable tax credit for eligible working individuals.

- Registered Disability Savings Plan (RDSP): A long-term savings program that allows matching federal grants and bonds.

These linked programs amplify the impact of the DTC, making approval highly valuable beyond tax savings alone.

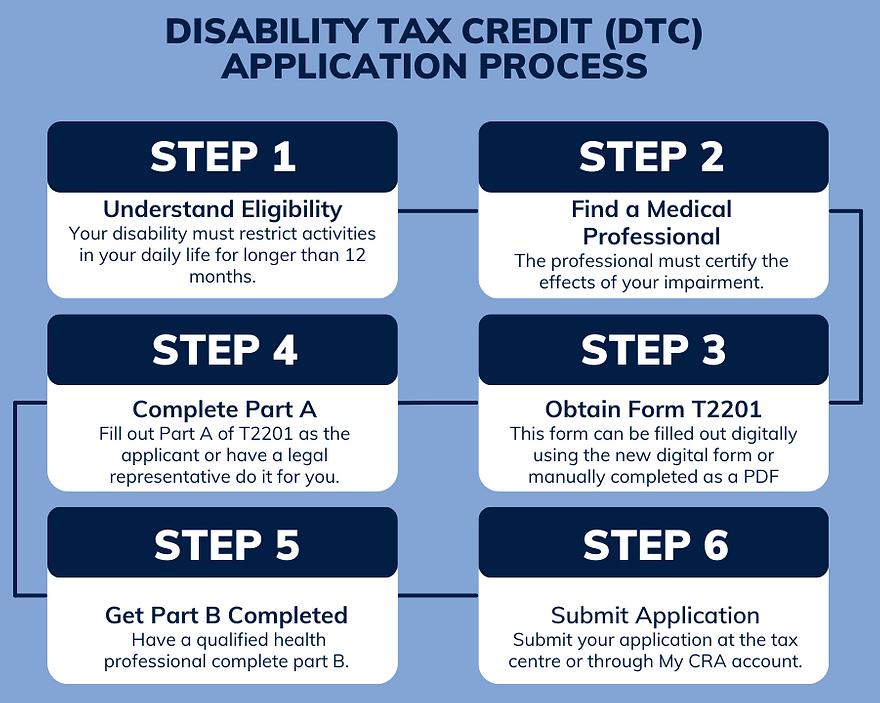

How to Apply for the Disability Tax Credit

Step-by-Step Guide

- Obtain the form: Download Form T2201 – Disability Tax Credit Certificate from the CRA website or by calling their toll-free number.

- Complete Part A: The applicant fills out basic personal information and consent sections.

- Have Part B completed by a medical professional: The doctor or qualified practitioner must certify the impairment’s duration, type, and how it restricts daily life.

- Submit the form: Mail the completed document or upload it digitally through CRA’s “My Account” online service.

- Wait for CRA review: Processing typically takes 8–12 weeks. Applicants will receive a Notice of Determination confirming whether they are approved and for which years.

- Claim the credit: Once approved, the disability amount can be entered on your tax return for the current year and previous years, if applicable.

If Your Application Is Denied

If CRA denies the application, individuals have the right to:

- Request a review or appeal by submitting new information or clarification from their medical professional.

- Reapply in the future if the impairment worsens or if additional documentation becomes available.

Many successful appeals result from clarifying how the condition restricts daily activities rather than from new diagnoses.

Common Mistakes to Avoid

1. Insufficient Medical Detail

The most frequent reason for denial is vague or incomplete descriptions in the medical certification. Practitioners must specify how the impairment affects the person’s ability to function, not just list the diagnosis.

2. Not Claiming Retroactive Credits

Applicants often overlook the 10-year look-back rule, which can yield significant refunds. Always check previous tax years for eligibility.

3. Ignoring Cumulative Restrictions

People with multiple moderate restrictions may mistakenly assume they are ineligible. The cumulative-effect rule allows CRA to consider combined impacts.

4. Missing Provincial Opportunities

While the DTC is a federal credit, many provinces have parallel disability tax credits or related programs that use DTC approval as proof of eligibility. For instance:

- Ontario: Coordination with the Ontario Disability Support Program.

- British Columbia: Recognition through the provincial Disability Assistance program.

- Quebec: Access to its provincial tax credit for people with severe disabilities.

Recent Developments for 2025

The 2025 tax year marks an important evolution in federal disability policy.

- The Canada Disability Benefit (CDB) officially launched in June 2025. DTC approval is now the primary gateway to this monthly income supplement.

- CRA enhanced its online application process, allowing medical practitioners to submit certificates directly through secure digital channels.

- New public-awareness campaigns aim to improve access for Canadians with mental-health impairments and reduce barriers to application.

- CRA has also introduced proactive expiry notifications, alerting individuals before their DTC eligibility period ends.

These changes reflect a broader government effort to simplify access and reduce administrative delays.

Expert Commentary

Tax and policy experts say the modernization of the DTC represents a “shift from charity to equity” in how Canada supports people with disabilities.

According to Dr. Raj Singh, a public policy professor at the University of Ottawa:

“The DTC remains a cornerstone of Canada’s approach to tax fairness. The 2025 changes bring long-overdue alignment between fiscal relief and actual living costs for people with disabilities.”

Disability advocates have also praised new recognition for invisible and mental-health-related disabilities. However, they continue to call for clearer communication between CRA and medical practitioners to ensure fairness in application assessments.

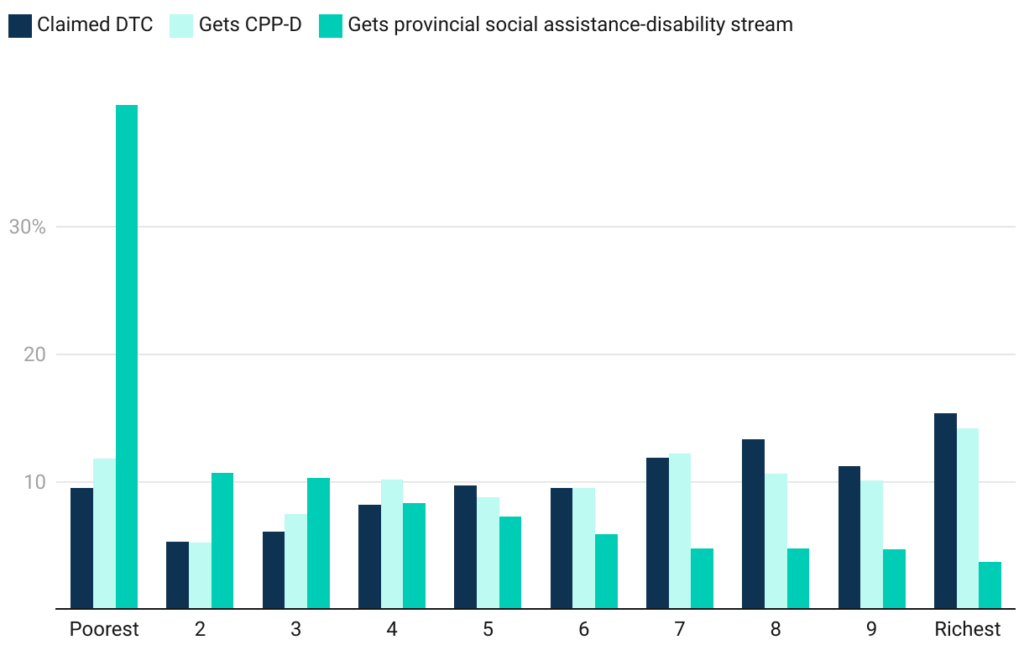

Policy Context and Broader Impact

The Disability Tax Credit has existed for decades, but public awareness remains uneven. Experts estimate that thousands of eligible Canadians have never applied, often due to confusion about eligibility or documentation.

The 2025 updates — including online applications, broader recognition of mental-health conditions, and integration with the Canada Disability Benefit — aim to improve accessibility and equity.

Economists note that the DTC not only provides direct tax relief but also stimulates the broader economy by freeing household income for medical expenses, home modifications, and caregiving services.

Looking Ahead

The CRA is expected to continue refining the DTC program through 2026, focusing on:

- Faster digital processing of T2201 forms.

- Stronger coordination with provincial and territorial programs.

- Simplified renewal procedures for permanent disabilities.

- Enhanced outreach to ensure that underrepresented groups, including Indigenous and rural Canadians, are aware of their eligibility.

Tax professionals encourage Canadians to apply early and maintain thorough medical documentation to prevent delays or denials.

CRA Confirms $3900 One-Time Payment – When It’s Coming and Who’s Eligible in Canada

CRA Payment Dates for October 2025: What Benefits Are Arriving & How Much You’re Getting

Canada Child Benefit October 2025: CRA’s $666 Deposit Date is Almost Here – Are You on the List?

FAQ About CRA Disability Tax Credit 2025

Q: Is the Disability Tax Credit a monthly payment?

No. The DTC is a tax credit, not a direct monthly benefit. However, DTC approval allows access to other monthly programs like the Canada Disability Benefit or the Child Disability Benefit.

Q: How long does DTC approval last?

Approval can be permanent or time-limited depending on the nature of the condition. CRA specifies the duration in the Notice of Determination.

Q: Can I apply retroactively?

Yes. If you were eligible in past years, you can request adjustments for up to 10 previous tax years, potentially recovering significant tax refunds.

Q: Does DTC approval guarantee the Canada Disability Benefit?

No. It’s a prerequisite, but you must also meet income and filing requirements to receive CDB payments.

Q: What should I do if CRA denies my application?

You can request a review, file an objection, or reapply with additional medical evidence if your condition changes or documentation improves.