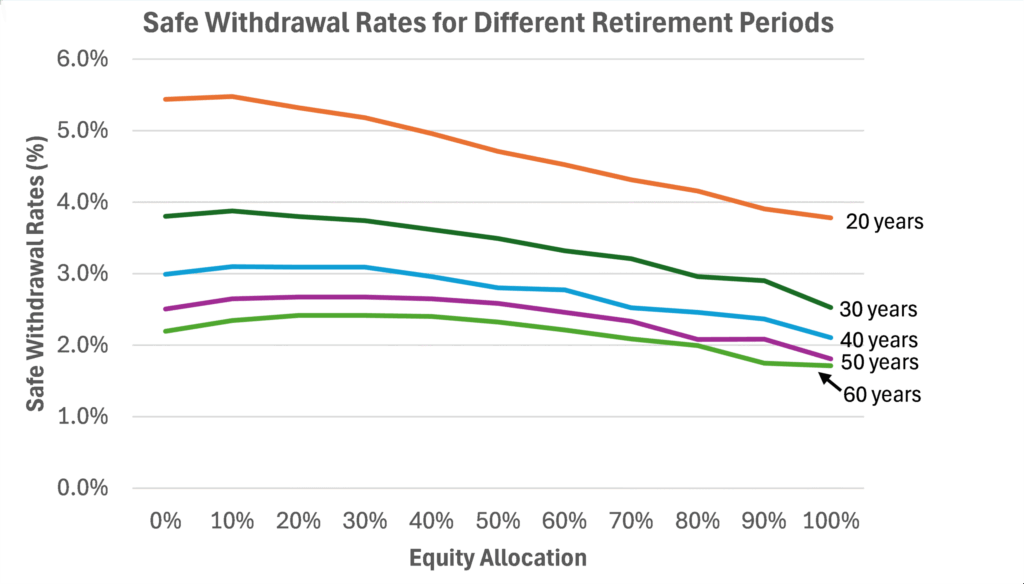

For millions of Americans, deciding how to draw down their 401(k) and Individual Retirement Accounts (IRA) is one of the most consequential financial decisions they will make in retirement. The sequence and timing of these withdrawals can shape not only their annual tax bills but also their total lifetime wealth.

A growing body of research suggests that strategic withdrawal planning can preserve savings longer, reduce required minimum distributions (RMDs), and minimize the impact of taxes on Social Security and Medicare premiums.

Table of Contents

Smartest Way to Tap Your 401(k)

| Key Fact | Detail/Statistic |

|---|---|

| RMD Age | Required minimum distributions start at age 73 |

| 401(k) Penalty | 10% penalty applies for most withdrawals before age 59½ |

| Strategic Order | Taxable → Traditional 401(k)/IRA → Roth IRA |

| Tax-Free | Roth IRA withdrawals are typically tax-free |

| RMD Age to Increase | RMD age will rise to 75 by 2033 |

| Official Website | IRS.gov |

Why Withdrawal Order Matters for Retirement Income

Many retirees believe that retirement planning ends at their final day of work. Experts argue the opposite: decumulation—how you spend your savings—is as important as accumulation.

Withdrawing from taxable accounts first allows 401(k) and IRA funds to continue growing tax-deferred. This also helps retirees stay in lower income brackets early in retirement, preserving tax efficiency.

“People often assume they should tap their 401(k) right away in retirement,” said David Blanchett, managing director at PGIM DC Solutions. “But a more deliberate sequence can save retirees tens of thousands of dollars in taxes over their lifetime.”

For example, a retiree withdrawing $50,000 annually can pay dramatically different lifetime taxes depending on the order of account withdrawals. Analysts at Morningstar estimate that optimized withdrawal sequencing can increase after-tax retirement income by up to 15%.

Understanding the Tax Impact of 401(k) Withdrawals

Early Withdrawal Penalties

Withdrawing from a 401(k) or IRA before age 59½ typically results in a 10% early withdrawal penalty, on top of regular income taxes. Exceptions exist for certain medical expenses, disability, and the IRS Rule of 55, which allows penalty-free withdrawals from a 401(k) if you leave your job after age 55.

“Even a modest early withdrawal can trigger a large tax bill,” said Kimberly Lankford, a certified financial planner and retirement columnist. “It’s essential to know the rules before you touch these accounts.”

Delaying Withdrawals and Managing RMDs

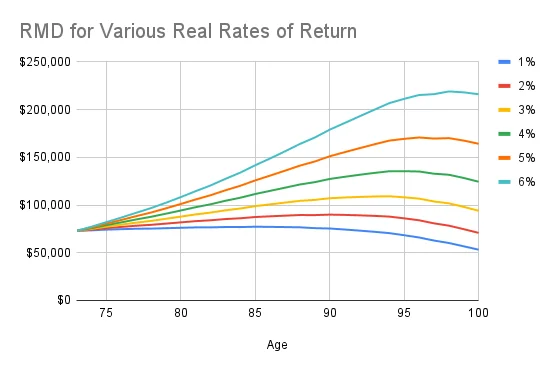

Delaying withdrawals from tax-deferred accounts allows savings to compound longer. It can also reduce the size of future RMDs, which become mandatory at age 73. Lower RMDs mean lower taxable income, potentially helping retirees avoid higher Medicare Part B premiums and taxation on Social Security benefits.

Coordinating 401(k), IRA, and Roth IRA Strategies

Roth IRA as a Strategic Reserve

Because Roth IRA withdrawals are generally tax-free, these accounts can be powerful tools for managing tax brackets later in retirement. Many financial planners recommend using Roth accounts strategically in years when income might otherwise push a retiree into a higher bracket.

A study by the Tax Policy Center found that retirees who blended taxable, tax-deferred, and Roth withdrawals reduced lifetime taxes by an average of 20%.

Roth Conversions for Flexibility

Converting traditional 401(k) or IRA funds to a Roth IRA during lower-income years can help reduce future RMD obligations. However, conversions increase taxable income in the year they occur, requiring careful planning.

“Roth conversions are like paying your tax bill on your own terms,” said Ed Slott, a nationally recognized IRA expert. “Done right, they give retirees control over their future tax exposure.”

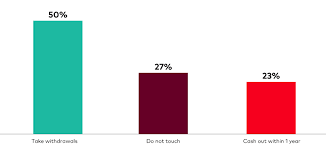

The Role of Behavioral Finance

Behavioral finance research shows that many retirees instinctively withdraw from their largest accounts first, often their 401(k). This “account size bias” can lead to higher tax burdens and faster depletion of savings.

“People are used to building up their 401(k) for decades. Tapping it first feels intuitive,” said Dr. Meir Statman, professor of finance at Santa Clara University. “But intuition is often at odds with optimal strategy.”

Experts also note that fear of running out of money often leads retirees to under-spend early in retirement, potentially sacrificing quality of life.

Real-World Example: Two Retirees, Two Strategies

Consider two hypothetical retirees, both with $1 million in retirement savings:

- Scenario A: Withdraws from 401(k) first, pays taxes on all withdrawals, and reaches higher tax brackets earlier.

- Scenario B: Withdraws from taxable brokerage first, defers 401(k) withdrawals until RMD age, and uses Roth for tax smoothing.

Result: Scenario B preserves $120,000 more after-tax income over 25 years, according to Morningstar’s retirement modeling tool.

This difference highlights why withdrawal strategy is as critical as investment strategy.

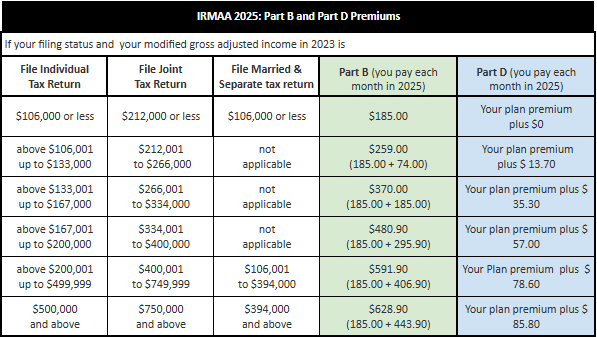

Social Security and Medicare: Hidden Tax Traps

Retirement withdrawals can affect more than income taxes. If total income crosses certain thresholds, up to 85% of Social Security benefits may become taxable, and Medicare premiums can increase under the Income-Related Monthly Adjustment Amount (IRMAA) rules.

Strategic 401(k) withdrawals can help retirees stay below those thresholds, avoiding these “stealth taxes.”

“The interaction between 401(k) withdrawals, Social Security, and Medicare is often overlooked,” said Alicia Munnell, director of the Center for Retirement Research at Boston College. “That’s a costly mistake.”

Legislative Landscape and Policy Outlook

How RMD Rules Have Evolved

The IRS has gradually increased the RMD age from 70½ to 73, with plans to raise it to 75 in 2033. Lawmakers argue that longer life expectancies and shifting retirement patterns justify the change.

“People are living longer, and their retirement savings need to last longer,” said Howard Gleckman, senior fellow at the Tax Policy Center.

Potential Future Changes

Lawmakers are exploring further reforms, including:

- Expanding Roth IRA incentives

- Simplifying RMD calculations

- Creating automatic in-plan annuity options for 401(k)s

Any of these could reshape how future retirees manage withdrawals.

Global Comparisons: How Other Countries Handle Withdrawals

While the U.S. relies heavily on 401(k) and IRA accounts, other countries take different approaches:

- Canada uses Registered Retirement Income Funds (RRIFs), which also have mandatory withdrawals but lower penalties for flexibility.

- United Kingdom pensioners can use flexible drawdowns without strict RMD-style rules.

- Australia offers superannuation accounts with tax advantages and age-based withdrawal guidelines.

These models offer alternative approaches policymakers may examine as America’s retirement system evolves.

Common Pitfalls Retirees Should Avoid

- Large Lump Sum Withdrawals: Can push retirees into higher tax brackets and increase Medicare premiums.

- Ignoring State Taxes: Some states fully tax retirement income, while others offer exemptions.

- Poor Timing with Market Volatility: Selling during downturns can lock in losses.

- Neglecting Beneficiary Planning: Tax consequences can extend to heirs if accounts are not structured properly.

“Withdrawal mistakes are often irreversible,” warned Christine Benz, director of personal finance at Morningstar. “The wrong sequence or timing can cost hundreds of thousands over a long retirement.”

Strategies for a More Resilient Retirement Plan

- Use a multi-bucket strategy: keep cash for near-term needs, fixed income for medium term, and equities for long-term growth.

- Coordinate withdrawals with tax-loss harvesting or Roth conversions during low-income years.

- Reassess withdrawal plans annually, especially after tax law changes or major life events.

- Consider professional advice from fiduciary planners, not product sales representatives.

“Retirement isn’t static,” said Ed Slott. “A good withdrawal strategy is flexible and adapts over time.”

Looking Ahead

As Americans live longer and rely more on personal savings, the 401(k) and IRA withdrawal decision will only grow more important. With potential policy changes on the horizon, experts urge retirees to stay informed and proactive.

“Retirement income planning is not just about what you have saved,” Blanchett said. “It’s about how smartly you use it.”

FDA Issues Urgent Warning: Popular Cookware Could Leak Dangerous Lead

SNAP & Food Supplement Aid to Expire Nov. 1 – What Families Should Know Before It’s Too Late

USDA Warns SNAP Benefits Could Run Out in November Amid Shutdown Concerns

FAQ About The Smartest Way to Tap Your 401(k)

Q: When can I start withdrawing from a 401(k) without penalty?

A: Generally at age 59½. The Rule of 55 may allow earlier withdrawals if you leave your job after age 55.

Q: How does RMD age work now?

A: The RMD age is 73, increasing to 75 by 2033.

Q: Are Roth IRA withdrawals always tax-free?

A: Yes, if the account is at least five years old and the owner is over 59½.

Q: Should I always delay withdrawing from my 401(k)?

A: Not always. The best sequence depends on your income, tax bracket, and financial goals.

Q: How can withdrawals affect Social Security and Medicare?

A: Large withdrawals may increase taxable income, triggering taxes on benefits and higher Medicare premiums.