$1,390 IRS Relief Payment: 2025 has seen widespread speculation about a $1,390 IRS Relief Payment allegedly being sent to eligible Americans via direct deposit. Many people are wondering if they qualify, if the payment is real, or whether it’s just another rumor circulating online. This article presents a comprehensive, clear, and authoritative breakdown of everything you need to know about this claimed payment. It’s designed to be easy for anyone to understand, while still offering detailed insights valuable to professionals and financial experts.

Table of Contents

$1,390 IRS Relief Payment

The $1,390 IRS Relief Payment for 2025 remains a rumor without any official backing. While the IRS continues to offer tax refunds, credits, and targeted relief, no new mass stimulus payments are planned or scheduled. To protect yourself, file your taxes promptly, and verify payment statuses. Knowledge and caution are your best tools to avoid scams and secure your rightful refunds.

| Topic | Details |

|---|---|

| Payment Amount | $1,390 (Rumored, not confirmed by IRS) |

| Payment Type | Direct deposit (Alleged IRS stimulus/relief payment) |

| Official IRS Confirmation | No current IRS confirmation or authorization for $1,390 payment |

| Last Stimulus Payment | Ended officially in 2021 |

| How to Check Payment Status | IRS tools like Where’s My Refund? |

| Rumored Eligibility Criteria | Income caps around $75,000 (unverified and unofficial) |

| Official IRS Resources | irs.gov/newsroom |

| IRS Scam Alerts | IRS does not call or email asking for payment info; be wary of phishing attempts |

| Practical Tax Filing Tips | File early, use direct deposit, keep documents ready |

What Exactly Is the $1,390 IRS Relief Payment?

There’s been plenty of buzz about the IRS sending out $1,390 payments as a form of relief in 2025. While it’s easy to wish there was an extra cash boost available, this payment has not been officially announced or authorized by the IRS or any legislative body. The last federal stimulus payments came during the COVID-19 pandemic, with the IRS distributing Economic Impact Payments (EIPs) in 2020 and 2021 to millions of Americans.

The rumor of a $1,390 payment is mostly fueled by social media, unverified online stories, and sometimes even efforts by scammers trying to capitalize on confusion. No evidence supports that such a payment program is underway or planned.

The IRS’s Official Stance: No Payment Confirmed

Here’s the straight talk:

- No $1,390 relief payment has been authorized or scheduled by the IRS or U.S. Treasury for 2025.

- IRS official announcements about payments or tax relief are always posted publicly on their newsroom site.

- The IRS encourages taxpayers to watch for official communications mailed directly or posted on their website.

- Ignore viral claims if they are not accompanied by official IRS confirmation.

How to Verify if You’re on the $1,390 IRS Relief Payment List?

If you want to check for legitimate IRS payments or refunds:

- Use the IRS “Where’s My Refund?” Tool: This can be found at irs.gov/refunds. It’s the best real-time resource to see if you are due a refund or payment. You just need your Social Security Number, your filing status, and the exact amount of your expected refund or payment.

- Create an IRS Online Account: This portal lets you view your payment and tax history and receive messages from the IRS.

- Check IRS Official Mail: The IRS always sends a letter to confirm any payments.

- Monitor Your Bank Statements: Legitimate IRS payments appear detailed on your bank records.

- Avoid Unofficial Sources: Never trust or give your information to unknown callers or emails claiming you will receive payments.

IRS Scam Warnings: Protect Yourself

Because of the rumors about this $1,390 payment, scammers are stepping up their schemes:

- The IRS will never call, text, or email asking for your bank details or Social Security number.

- Don’t fall for fraudulent phone calls or emails that demand personal info to receive this “payment.”

- Always verify IRS notifications by visiting irs.gov directly.

- Report scams to the Treasury Inspector General for Tax Administration (TIGTA) or local enforcement.

IRS Stimulus Payment History: A Detailed Look (2020-2021)

Understanding the background of stimulus payments gives us clearer insight:

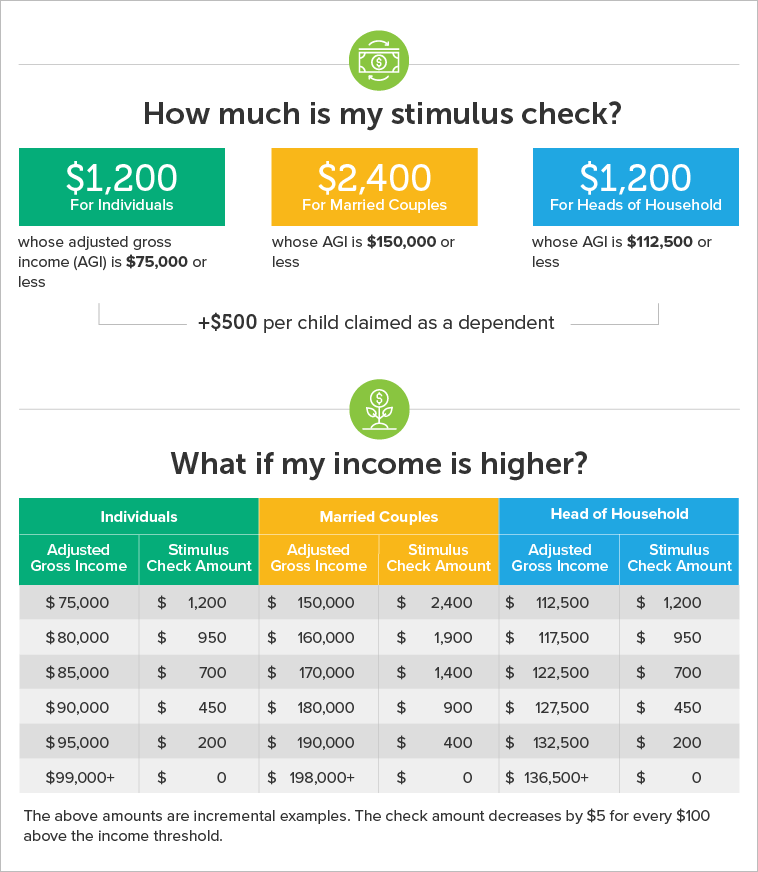

- First Round (2020): Authorized by the CARES Act; up to $1,200 for individuals, $2,400 for married couples, and $500 per qualifying child. The IRS issued about 162 million payments totaling approximately $271 billion.

- Second Round (Late 2020): Authorized under the Consolidated Appropriations Act; payments provided up to $600 per individual and $600 per child, phased out at income levels starting at $75,000 for singles.

- Third Round (2021): Authorized under the American Rescue Plan Act; payments of $1,400 per eligible individual and child or dependent, with similar income phase-outs. This was the last official economic impact payment.

These payments provided vital financial relief during the pandemic and were phased out after delivery concluded in 2021. Taxpayers missing payments could claim the Recovery Rebate Credit on their 2020 or 2021 tax returns but no further stimulus checks were authorized beyond that.

Delivery Timelines and Mechanisms

The IRS delivered stimulus payments efficiently using various methods:

- Direct Deposits: Delivered to bank accounts for taxpayers with up-to-date banking info on file.

- Paper Checks and Debit Cards: Mailed to those without direct deposit details.

- Payments were prioritized based on filing status, income, and dependency information.

The IRS used tools like the “Get My Payment” and later “Where’s My Refund?” website and mobile app to help taxpayers track their payments in real time.

Practical Tax Filing Tips to Maximize Your Refund and Speed

- File Your Taxes Early: Early filing helps you get your refund or credits sooner.

- Use Direct Deposit: This is the quickest way to receive refunds.

- Double-Check Your Information: Ensure there are no errors in your bank account or routing numbers and tax forms.

- Keep All Receipt and Income Records: Helps if you need to amend or clarify filings.

- Consider Trusted Tax Preparation Software: Many integrate Recovery Rebate Credit checks automatically.

- Check Your IRS Account Periodically: To see scheduled payments or notices.

Beware of IRS Tax Scams in 2025: Protect Yourself

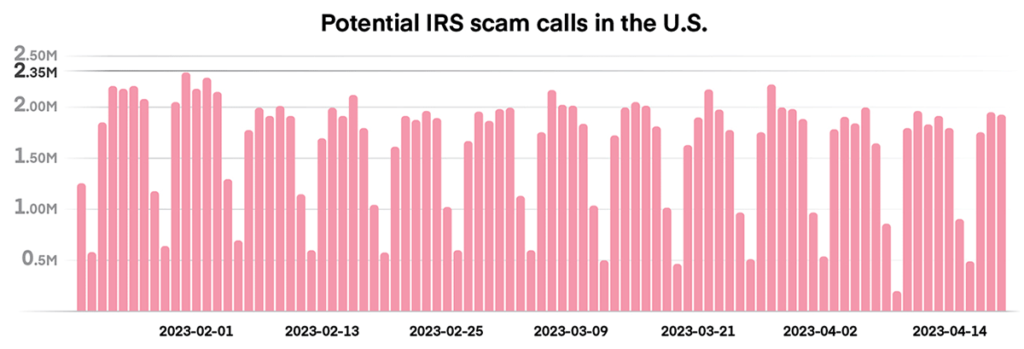

As the $1,390 IRS relief payment rumor spreads, scammers are ramping up their efforts to trick taxpayers with fake calls, emails, and texts claiming to offer quick cash or assistance. The IRS’s annual “Dirty Dozen” list of tax scams for 2025 warns everyone to stay alert against sophisticated schemes designed to steal your money and personal info.

Common tricks include phishing emails impersonating the IRS with fake refund guarantees or threats of legal action if you don’t pay immediately. Scammers also use “smishing” scams—fraudulent text messages with alarming language and malicious links—or poses as bogus tax preparers charging extortionate fees or submitting false returns.

To protect yourself, never share your Social Security number, bank details, or personal information over the phone or online unless you’ve verified the source. The IRS will only contact you through official mail and never demand payment via gift cards, wire transfers, or cryptocurrencies.

If you suspect a scam, hang up immediately and report the incident to the IRS or Treasury Inspector General for Tax Administration (TIGTA). Staying informed about these scams empowers you to guard your financial security and keep your identity safe in 2025 and beyond.

$5108 Stimulus Payment for Seniors: Full Schedule and Details for October 2025

$500 Relief Checks Coming to One State: Check Eligibility Criteria and Payment Dates