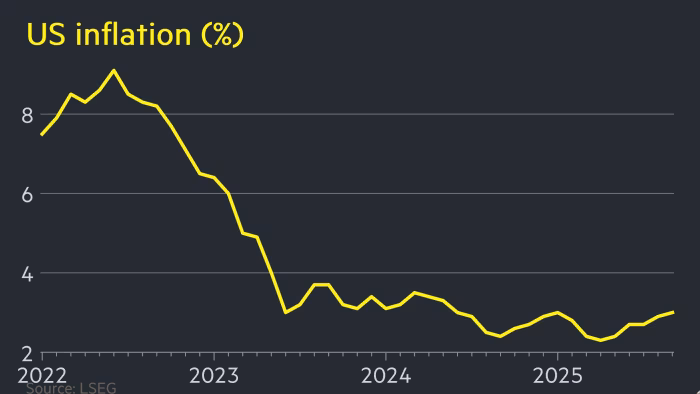

Inflation in the United States has climbed for the third consecutive month, reigniting concerns about household spending power and the long-term adequacy of Social Security benefits. According to the latest Consumer Price Index (CPI) report from the U.S. Bureau of Labor Statistics (BLS), prices rose 3.0% in the year ending September 2025. Economists say the increase is being driven by persistent costs in food, housing, and healthcare—categories that weigh heavily on older Americans.

Table of Contents

Inflation Is Rising Again

| Key Fact | Detail / Statistic |

|---|---|

| Latest U.S. inflation rate | 3.0% year-over-year as of September 2025 |

| Social Security COLA increase (2026) | 2.8% |

| Medicare Part B premium projection | 6.2% increase |

| Share of retirees relying on SS | 66 million beneficiaries |

As prices rise and Social Security adjustments lag, the purchasing power of millions of retirees is being tested. Policymakers, economists, and households face a delicate balancing act between safeguarding income and ensuring fiscal sustainability.

“This is not just an economic issue,” said Dr. Anya Sharma of Georgetown University. “It’s a social contract issue. How we address inflation’s impact on older Americans will define the retirement landscape for decades.”

A Renewed Inflation Wave

After steadily declining through much of 2024, inflation began to rise again in mid-2025, ending a brief period of price stability. The Federal Reserve attributes the resurgence to rising global energy costs, increased consumer demand, and higher service-sector prices.

“The inflation data show price pressures returning in areas that matter most to households — shelter, groceries, and healthcare,” said Dr. Maria Evans, senior economist at the Brookings Institution. “This trend could hit retirees particularly hard.”

According to the BLS, grocery prices rose 4.3% in the last year, rents climbed 5.1%, and healthcare services increased by 6.2%. These figures outpace the broader CPI average.

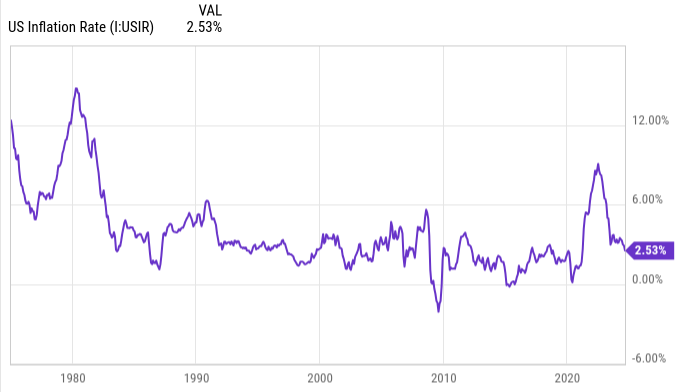

A Historical Pattern

The United States has experienced several inflation surges since the 1970s, but few have had as direct an impact on retirees as those tied to energy and healthcare costs. During the inflation crisis of the early 1980s, Social Security recipients saw real purchasing power erode despite sharp COLA increases. A similar pattern emerged during the post-pandemic spike in 2022.

“The lesson from history is clear,” said Dr. William Harper, economic historian at the University of Chicago. “When inflation is concentrated in essential goods, retirees feel it first and hardest.”

How Social Security COLA Works — and Why It May Fall Short

The Social Security Administration (SSA) announced a 2.8% cost-of-living adjustment (COLA) for 2026. The COLA is tied to the CPI-W, a measure of urban wage earners’ spending, which does not fully reflect retirees’ expenses.

“For many retirees, the COLA won’t be enough,” said Nancy Altman, president of Social Security Works. “Healthcare and housing costs are rising faster than overall inflation, so their real purchasing power may decline.”

Social Security provides benefits to roughly 66 million Americans, and for about half of them, it makes up more than 50% of their income, according to SSA data. The mismatch between COLA and real costs has become a recurring challenge.

Policy Debates Intensify

Lawmakers are debating whether to adopt the Consumer Price Index for the Elderly (CPI-E) to calculate COLA, which better reflects seniors’ spending on healthcare and housing. Supporters argue this change would help retirees keep up with real costs. Critics warn it could strain the Social Security Trust Fund more quickly.

“There is broad agreement that the CPI-W doesn’t reflect older Americans’ lives,” said Sen. Sherrod Brown (D-Ohio) during a recent Senate hearing. “The question is how to fix it responsibly.”

Others, including Sen. Chuck Grassley (R-Iowa), argue that broader entitlement reform is needed to keep the program solvent for future generations.

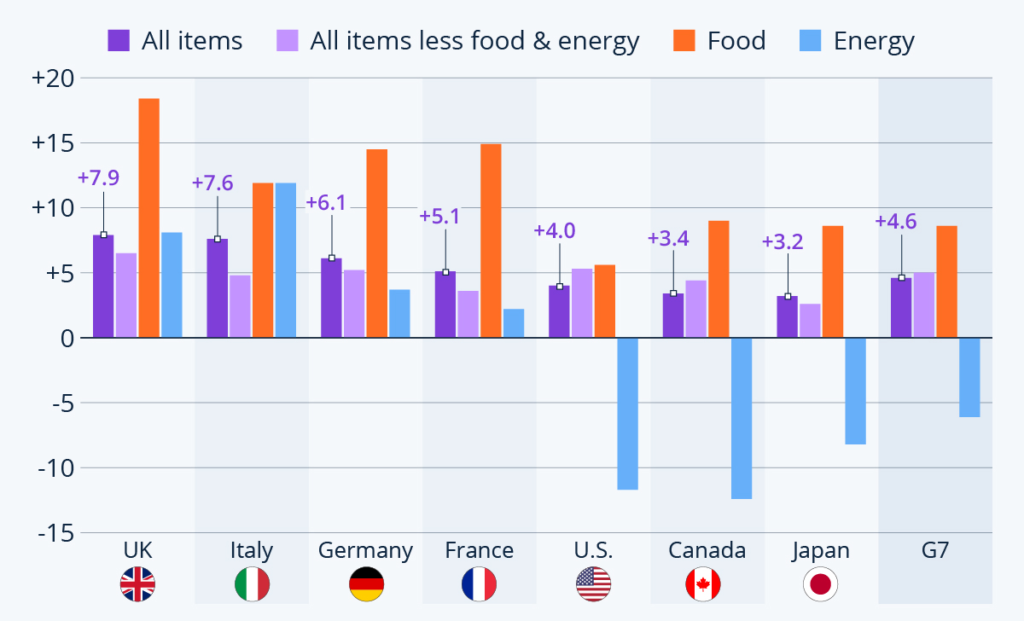

Global Perspective: How Other Nations Adjust

The U.S. is not alone in grappling with inflation and aging populations.

- In the European Union, pensions are automatically indexed to inflation in most member states, though some governments have capped increases.

- Japan, facing long-term low inflation, uses a wage-price index to adjust benefits.

- In Canada, Old Age Security benefits are adjusted quarterly based on CPI.

“Compared to other advanced economies, the U.S. has a relatively rigid and delayed adjustment mechanism,” said Dr. Hiroshi Tanaka, a senior fellow at the OECD. “This can leave retirees more exposed during inflationary spikes.”

Real-Life Stories Behind the Numbers

For many older Americans, inflation isn’t an abstract statistic. It’s a daily budgeting challenge.

Linda Harris, 72, of Ohio, has already cut back on fresh produce and household repairs. “Even with the COLA increase, it won’t cover the rent hike and my Medicare premium,” she said.

In Arizona, David Ortega, 67, relies on both Social Security and part-time income as a bus driver. “I thought retirement would mean slowing down. Instead, I’ve had to pick up extra shifts just to keep up.”

These stories echo national trends. A Pew Research Center survey found that 71% of retirees say inflation has significantly impacted their standard of living in 2025, up from 58% a year earlier.

Economic Outlook: What Lies Ahead

The Congressional Budget Office (CBO) forecasts that inflation may average around 2.6% in 2026, but warns of volatility due to energy prices and global supply chain shifts. The International Monetary Fund (IMF) projects similar figures, noting that U.S. inflation could remain “elevated relative to pre-pandemic norms” for several years.

The Federal Reserve has not ruled out further interest rate increases to stabilize prices. “We remain committed to returning inflation to target,” said Fed Chair Jerome Powell in a recent press briefing.

Expert Tips: Adapting to Inflationary Pressures

While no single strategy fits all, financial experts recommend several approaches to help households adjust:

- Budgeting with inflation in mind: Reassess recurring expenses annually.

- Understanding fixed-income vulnerability: Retirees relying solely on Social Security are more exposed to inflationary shocks.

- Exploring supplemental income: Part-time work, annuities, or investments can help build resilience.

- Monitoring Medicare premiums: Rising healthcare costs can erode COLA gains.

“Planning around inflation is not about predicting the future perfectly,” said Erin Jacobson, a certified financial planner in New York. “It’s about building flexibility into your retirement income.”

Legislative Outlook

Several bills under consideration in Congress could shape how the U.S. responds to inflation’s impact on Social Security:

- The Fair COLA for Seniors Act, which proposes using the CPI-E index.

- The Social Security 2100 Act, which aims to expand benefits while raising payroll tax caps.

- A bipartisan proposal to create an automatic COLA reserve fund.

While none have advanced to a floor vote yet, analysts say rising inflation may accelerate negotiations.

Florida’s Minimum Wage Gets a Boost – Here’s How Much You’ll Earn in October 2025

$1,750 Payouts in 2025: The Tax Rebate Giving Major Relief to Homeowners and Renters Nationwide

FAQ About Inflation is Rising Again

Q: How does inflation directly impact Social Security benefits?

Social Security benefits are adjusted through an annual COLA, but if inflation outpaces the adjustment, real purchasing power declines.

Q: What is CPI-E and why does it matter?

The CPI-E measures inflation based on seniors’ spending patterns. Advocates argue it would provide more accurate adjustments for retirees.

Q: How do other countries handle inflation for pensioners?

Many countries, including Canada and Germany, index pensions directly to inflation, often more frequently than the U.S.

Q: Will Medicare premiums affect the COLA increase?

Yes. Medicare Part B premiums are deducted from Social Security payments, potentially reducing net monthly benefits.