The Canada Pension Plan (CPP) payments for October 2025 are set to be deposited nationwide on October 29, reaching millions of Canadians. The payments, part of a structured monthly schedule, provide critical financial support to retirees, people with disabilities, survivors, and dependants. While some online posts have described the upcoming transfer as a “new” benefit, officials emphasize it is a regular monthly payment, not a special top-up.

Table of Contents

New CPP Payments

| Key Fact | Detail |

|---|---|

| Payment date | October 29, 2025 |

| Eligible recipients | Retirees, disability benefit recipients, survivors, children |

| Maximum monthly pension (age 65) | $1,433 |

| Nature of payment | Regular monthly CPP deposit, not a special one-time payment |

| Official Website | Government of Canada |

A Pillar of Canadian Retirement: What the CPP Payment Covers

The Canada Pension Plan is a mandatory public pension program designed to provide income replacement during retirement. It also offers disability benefits and survivor benefits to eligible family members. According to Service Canada, more than 6.7 million Canadians receive CPP payments monthly.

The payment amount depends on each individual’s contribution history, age at benefit commencement, and type of benefit. Those who contributed the maximum amount throughout their careers and began receiving payments at age 65 may receive up to $1,433 per month in 2025. The average monthly amount is typically much lower, reflecting varied contribution histories.

Who Will Receive the October 29 Payment

The payment will be issued on October 29 to Canadians already enrolled in the CPP program, including:

- Retirement pensioners who have contributed during their working lives.

- Disability benefit recipients eligible under CPP Disability.

- Surviving spouses or common-law partners receiving survivor benefits.

- Children of deceased or disabled contributors who qualify for the children’s benefit.

Recipients who use direct deposit can expect funds to arrive on the scheduled date. Those receiving paper cheques may experience postal delays of several days.

A Look Back: The History and Evolution of CPP

The Canada Pension Plan was created in 1965 and began operating in 1966, during a period of significant social policy expansion. The goal was to ensure Canadians had a reliable source of income after retirement, supplementing personal savings and workplace pensions.

Since then, CPP has undergone multiple reforms. One of the most significant changes was the CPP enhancement program, introduced in 2019, aimed at gradually increasing benefits for future retirees by raising contribution rates and the maximum pensionable earnings ceiling.

“CPP is a cornerstone of Canada’s retirement system,” said Dr. Rachel Morin, a pension policy expert at the University of British Columbia. “Its design reflects decades of policy evolution, ensuring it can meet the needs of a changing workforce and aging population.”

How CPP Is Funded

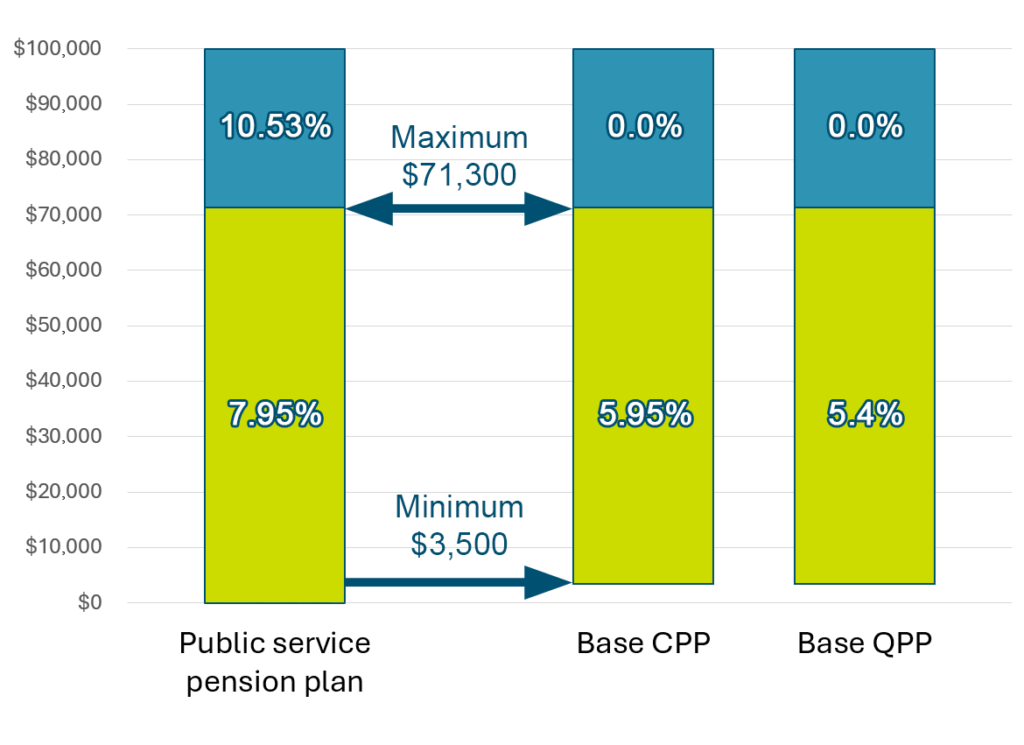

CPP is funded through mandatory contributions from employees, employers, and self-employed workers. In 2025, the contribution rate stands at 5.95% for employees and 11.9% for self-employed individuals, applied to earnings between the basic exemption of $3,500 and the year’s maximum pensionable earnings (YMPE) of $68,500.

Funds are invested by the Canada Pension Plan Investment Board (CPPIB), a Crown corporation operating at arm’s length from the federal government. The CPPIB manages over $630 billion in assets, investing globally in equities, bonds, infrastructure, and other sectors to ensure the plan’s sustainability.

“The CPP is actuarially sound and sustainable for at least the next 75 years,” said John Graham, President and CEO of CPPIB. “We invest with a long-term horizon to provide stable and secure benefits.”

How CPP Fits into Canada’s Retirement Income System

CPP is one of the three pillars of Canada’s retirement income system:

- Old Age Security (OAS) – A universal program for seniors aged 65 and older.

- Canada Pension Plan (CPP) – Earnings-based, contributory pension.

- Private savings – Including Registered Retirement Savings Plans (RRSPs), workplace pensions, and personal investments.

Unlike OAS, which is funded through general revenues, CPP is funded through contributions and investment returns.

What the Numbers Say: Demographics and Dependence on CPP

According to Statistics Canada, more than 96% of Canadian seniors receive CPP or Quebec Pension Plan (QPP) benefits. For roughly 37% of recipients, CPP represents their primary source of income in retirement. The program is especially critical for low- to middle-income Canadians without substantial private savings.

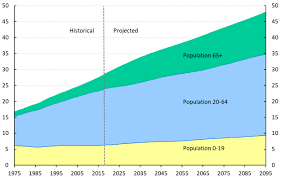

Canada’s population is aging rapidly. By 2035, one in four Canadians will be aged 65 or older. This demographic shift makes CPP’s role in supporting financial security more important than ever.

Real-Life Impact: How CPP Fits into a Retirement Budget

For many retirees, CPP is one component of a broader income mix. Mary Desrosiers, a 72-year-old retiree in Montreal, says CPP covers about half of her monthly expenses.

“I worked for 35 years and contributed regularly,” she said. “CPP gives me the security of knowing there’s money coming in every month. It’s not everything, but it’s a foundation.”

According to Service Canada, delaying CPP benefits beyond age 65 can increase monthly payments by 0.7% per month, or up to 42% more by age 70.

How to Apply and Manage Your CPP Benefits

Canadians can check their contribution records, apply for benefits, and update payment information through their My Service Canada Account (MSCA).

Steps to apply for CPP:

- Confirm your eligibility and contribution history.

- Decide on a start date (early at 60, standard at 65, or late up to 70).

- Apply online or by mail at least six months before your chosen start date.

- Receive payments via direct deposit for faster access.

Those who are already receiving payments do not need to reapply to receive the October 29 deposit.

Common Misconceptions About CPP

“CPP will run out of money”

This is false. Actuarial reports confirm CPP is fully funded for at least 75 years, thanks to mandatory contributions and CPPIB’s investment strategy.

“Everyone gets the same amount”

Benefit amounts vary significantly. Payments depend on how much and how long an individual has contributed, and the age at which they start receiving benefits.

“CPP covers all retirement needs”

CPP is designed to replace only a portion of pre-retirement income. Canadians are encouraged to save through OAS, RRSPs, or workplace pensions to maintain their standard of living.

How Canada Compares Internationally

Canada’s CPP ranks among the most stable public pension systems globally. According to the Mercer CFA Institute Global Pension Index, Canada scores high on sustainability and integrity, though lower on adequacy, reflecting modest replacement rates compared to some European systems.

For example:

- Netherlands and Denmark have higher replacement rates but face sustainability challenges.

- United States Social Security provides lower average benefits and faces funding concerns by 2035.

Future Outlook: Sustainability and Policy Direction

Federal officials project that CPP contribution rates will remain stable over the next decade, even as benefit levels rise gradually under the enhancement plan. Cost-of-living adjustments are applied annually based on the Consumer Price Index (CPI), ensuring benefits keep pace with inflation.

“The CPP is built to endure,” said Dr. Morin. “Its design makes it resilient to demographic shifts that are challenging other pension systems around the world.”

The next scheduled CPP payment after October 29 is set for November 27, followed by December 22, marking the final disbursement of 2025.

$300 Federal Payment in Canada on 25 October – Who Qualifies and How Much You’ll Get

CRA Update: $496 GST/HST Credit Coming in October 2025 – How to Check If You’re Eligible

Canada CRA $2,600 Payment Arriving in October – Who Qualifies and When You’ll Get Paid

FAQ About New CPP Payments

Q: Is the October 29 CPP payment a bonus or special payment?

A: No. It is part of the regular monthly schedule.

Q: Do I need to reapply to receive this payment?

A: No. If you are already receiving CPP benefits, the payment will be issued automatically.

Q: How can I check the exact amount of my CPP payment?

A: Log in to your My Service Canada Account or contact Service Canada directly.

Q: Does CPP adjust for inflation?

A: Yes. Payments are indexed annually to the Consumer Price Index.

Q: Can I increase my CPP benefit amount?

A: Yes. Delaying the start of CPP beyond age 65 can increase your monthly payments.