£9,700 in Potential Mortgage Savings: If you’re a UK homeowner or planning on buying a home, you’ve probably heard the buzz about £9,700 potential mortgage savings this November. That’s a serious chunk of change, and it’s not just smoke and mirrors. This opportunity ties directly to the Bank of England’s upcoming interest rate decision, which could dramatically affect your mortgage payments. Whether you’re new to homeownership or a seasoned borrower, knowing how to navigate this moment can save you thousands in interest over your mortgage term. Let’s dive into the details, break it down clearly, and equip you to make the best moves.

Table of Contents

£9,700 in Potential Mortgage Savings

November 2025 offers a rare chance for UK homeowners to save money during the Bank of England’s anticipated interest rate cut. With potential savings north of £9,700, it pays to be prepared. Study your mortgage, shop smart, consult experts, and strike fast when the timing’s right. Whether you’re stepping into the market or holding steady, making informed moves can make a world of difference to your wallet.

| Aspect | Details |

|---|---|

| Bank of England Base Rate | 4.00% in Oct 2025, anticipated cut to 3.75% on Nov 6 |

| Estimated Savings | Up to £9,700 over the mortgage life through strategic refinancing |

| Monthly Savings Example | Approximately £123 saved monthly on £200,000 mortgage |

| Mortgage Types Most Benefited | Tracker, variable rate, and fixed-rate mortgages nearing the end of their deals |

| Market Context | Steady housing market; moderate house price growth; cautious buyer behavior pre-budget |

| Extra Money-Saving Strategies | Overpayments, credit improvement, timely rate locking |

The Big Picture: Why November 2025 Is a Pivotal Month for Mortgages

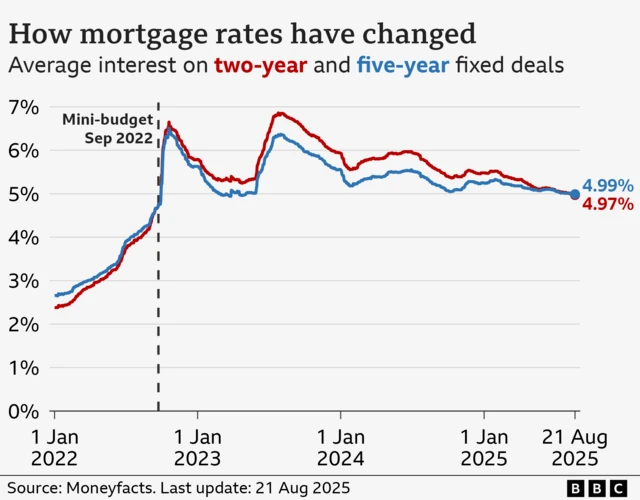

The UK’s financial gears turn around the Bank of England’s base interest rate, which influences the costs lenders charge borrowers. As of October 2025, this base rate stands at 4.00%, but widespread expert speculation has the Bank leaning towards cutting it to 3.75% on November 6, 2025.

This cut would trigger a chain reaction in the mortgage market: lenders generally react by lowering their mortgage interest rates, reflecting the base rate drop. For homeowners, especially those on tracker or variable-rate mortgages, this can mean immediate payment reductions. For others nearing the end of fixed-rate deals, it’s a golden opportunity to remortgage onto better terms, slashing monthly costs.

So, where does the £9,700 figure come from? It’s an estimate of how much some UK borrowers could save over the life of their mortgage by locking in lower rates or refinancing during this favorable window. Monthly savings of around £123 on a typical £200,000 mortgage can easily accumulate to this impressive total.

What Is Remortgaging and Why Should You Care?

Remortgaging is basically changing the terms of your mortgage deal—usually by moving from your current lender or deal to a new one with better interest rates or conditions. Imagine switching your phone plan to a better one with lower monthly fees but keeping your phone.

For example, if you have a mortgage charging 5.25% interest on £200,000, switching to a deal at 4.25% could cut your payments by about £123 each month. Over the typical 25-30 year mortgage term, that’s a serious amount to tuck away—enough for holidays, home improvements, or building an emergency fund.

Plus, in November 2025, these kinds of savings might be more accessible than usual because lenders are expected to adjust rates thanks to the upcoming BoE decision.

The 2025 Housing Market: What You Need to Know

The UK housing market in 2025 shows remarkable resilience despite economic headwinds. The average home value currently hovers around £305,680, reflecting a slow but steady increase of about 2.3% year-over-year. Growth has moderated this year, mainly due to cautious buyer behavior stemming from uncertainty around the upcoming November Budget and mortgage rate changes.

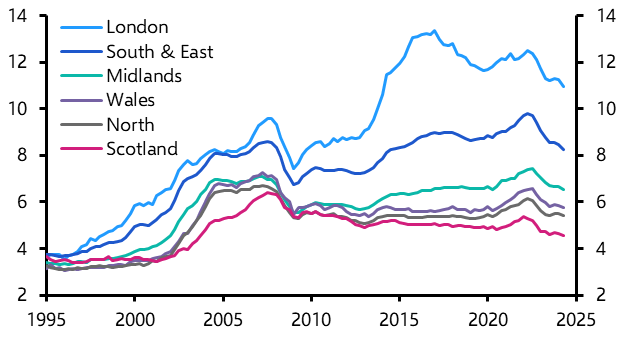

In some regions, especially London, there’s a notable gap between what sellers want and what buyers can afford. For example, London asking prices average nearly £700,000, while mortgage-approved sale prices hover around £530,000, showing buyer budget constraints.

This gap means buyers are becoming more pragmatic, adjusting expectations or focusing on areas with better affordability. Limited housing supply continues pushing prices up, but affordability pressures from higher borrowing costs keep a check on how fast prices grow.

For potential buyers and homeowners, understanding this balance of supply, demand, and interest rates is key to navigating the market effectively.

How to Maximize £9,700 in Potential Mortgage Savings This November: Step-by-Step Guide

Step 1: Dive into Your Mortgage Details

Start by reviewing your mortgage paperwork:

- What interest rate are you paying now?

- How much do you still owe?

- When does your current fixed deal (if any) end?

- What are the penalties or fees if you repay early?

Understanding your current deal is essential before making changes.

Step 2: Scout the Market for the Best Deals

Use comparison tools such as MoneySuperMarket, Compare the Market, and MoneySavingExpert to find competitive mortgages. Don’t just look at rates—consider the whole package including fees and flexibility.

Step 3: Talk to a Mortgage Broker

A good broker has access to a wide range of deals and can help you navigate the terms, fees, and conditions without the hassle of hunting yourself. Brokers like Habito, Trussle, and London & Country are well known for their transparency and fee-free advice.

Step 4: Calculate Your True Costs and Savings

Look beyond just the headline rate. Add up fees for arrangement, valuation, legal work, and any early repayment charges. Doing this math helps weigh if switching mortgages is worth it in your case.

Step 5: Improve Your Borrowing Position

Boosting your credit score, paying down debts, and getting your property revalued can help you secure better interest rates and mortgage terms.

Extra Tips to Stretch Your Savings Even Further

- Make Overpayments: If your lender allows, paying extra off your principal loan balance can shave years off your mortgage and reduce interest paid.

- Lock in Fixed Rates If You Prefer Security: Fixing your rate protects you from future hikes but may limit immediate savings from drops.

- Stay Up to Date: Mortgage and market conditions are fluid—keep an eye on economic news and lender rate movements.

- Plan Your Timing: Acting promptly after the BoE rate decision maximizes your chances to lock in deals before rates adjust broadly.

What Risks Should You Be Ready For?

- Early Repayment Charges (ERCs): Exiting a fixed deal early often incurs penalties that can offset savings.

- Longer Loan Terms: Lower monthly payments might mean repaying over a longer period, increasing total interest paid.

- Rate Volatility: Not all lenders cut rates equally or immediately after a BoE move.

- Missing Your Window: Hesitation could mean losing out as markets stabilize or rates start rising.

Why Do £9,700 in Potential Mortgage Savings Matter So Much?

Mortgage payments are typically the biggest monthly expense for UK families. Reducing those payments translates into real financial breathing room. Over a decade, switching deals smartly can save tens of thousands of pounds—money you could put toward retirement, education, or quality of life improvements.

Homeowners who stay informed and proactive tend to secure the best deals and build stronger financial futures.

UK Homeowners Could Save £123 Every Month on Their Mortgage; With Just One Simple Change

How to Save £9,700 on Your Mortgage in November; The Secret UK Lenders Don’t Want You to Know

Huge Mortgage Savings in November? UK Households Could Cut £9,700 in Interest—Don’t Miss Out