Centrelink $1100 Direct Depositb: If you’re keeping tabs on your finances and wondering about the Centrelink $1100 direct deposit in November 2025, you’re in the right spot for the latest, clearest scoop. This payment is part of the government’s ongoing commitment to cushion Australians from rising living costs. This guide breaks down everything you need to know—when the payment hits your bank, who qualifies, its impact on your budget, and practical tips for making it work best for you. It’s clear and detailed enough for anyone to grasp yet packed with expert insights valuable for professionals too.

Table of Contents

Centrelink $1100 Direct Deposit

The Centrelink $1100 direct deposit in November 2025 is a timely and vital help for many Australians feeling the pinch of increased living costs. Knowing when to expect it, who qualifies, and how to use it wisely can ease financial stress and support you through challenging times. Beyond the payment itself, understanding income and asset thresholds and keeping your Centrelink information updated ensures smooth, continuous support. This payment is part of a broader government commitment combining lump-sum relief payments with regular indexation increases to keep pace with inflation, helping everyday Australians stay afloat as the economy evolves. Stay informed, plan carefully, and use this support to keep your finances steady.

| Topic | Details |

|---|---|

| Payment Amount | $1100 direct deposit |

| Payment Date (November 2025) | Around November 20, 2025 |

| Eligibility Criteria | Qualifying Centrelink payments or concession cards, income & asset tests |

| Automatic Payment | No application needed; deposited automatically |

| Payment Impact | Helps cover groceries, rent, utilities, fuel |

| Financial Tips | Budget planning, monitoring payments, avoiding penalties |

| Contact and Support | myGov account, Centrelink customer service |

| Reference & Links | Services Australia |

What Is the Centrelink $1100 Direct Deposit for November 2025?

The $1100 payment isn’t just a random bonus; it’s part of a carefully crafted Australian Government measure to help Australian households handle rising inflation and living expenses. Core costs like food, rent, power bills, and fuel have been hitting budgets hard, especially for seniors, carers, and people with disabilities.

This payment builds on previous cost-of-living boosts such as the $750 and $250 one-offs from 2023-2024 and ongoing indexation increases to Centrelink benefits. It is a direct deposit, meaning it will be deposited straight into your bank account on your usual payment schedule, with no action needed from you.

The idea behind this payment is simple: put extra cash into the hands of those who rely on Centrelink to prevent financial hardship and help maintain living standards amid tough economic times.

When Can You Expect the Payment?

Payment timing matters. For November 2025, Centrelink payments—including this extra $1100—are expected to be deposited around November 20th. Deposits usually show up within 2 to 6 business days after processing, so you might see the payment anytime between the 20th and 26th, depending on your bank and any public holidays or weekends in between.

The $1100 will accompany your usual Centrelink payment cycle—whether fortnightly or monthly. If your normal payday is on the 12th or 25th, expect to see the extra money in that same deposit, just reflected as a larger amount.

To stay in the loop, regularly check your myGov account where Centrelink posts payment schedules and alerts. Centrelink also sends letters or messages before major changes to keep you updated.

Who Qualifies for the Centrelink $1100 Direct Deposit?

Eligibility follows existing Centrelink payment rules with some important specifics:

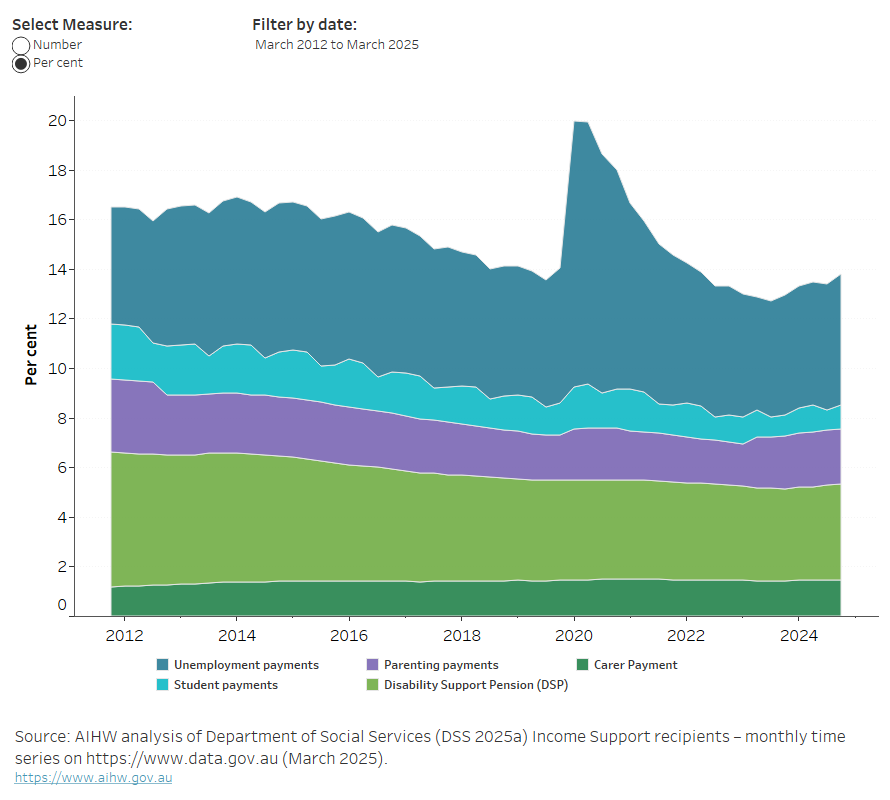

- You must currently receive eligible Centrelink payments such as Age Pension, Disability Support Pension, JobSeeker Payment, Parenting Payment, Carer Payment, or Veteran’s Service Pension.

- You hold a valid concession or pension card like the Pensioner Concession Card or Health Care Card.

- You meet the income and asset tests. These tests are designed to ensure support goes to those who need it most:

- Income Test: Total taxable income including earnings, investments, and some government benefits, below certain thresholds.

- Asset Test: All assets counted except usually your primary home, with limits specific to whether you own or rent your home and your family status.

- Example asset limit for single homeowners is roughly $321,500, while couples with a home have limits around $480,500. Non-homeowners may have higher ceilings.youtube

- This payment will be automatically deposited—no forms or separate applications necessary for qualifying recipients.

Centrelink has also slightly raised asset thresholds for eligibility this year to help seniors and pensioners who have some savings or owned property keep qualifying for support without losing benefits.youtube

What Does This Payment Mean for Your Budget?

Prices for essentials have been surging. Whether it’s the cost of groceries, rent, heating bills, or fuel, many families and individuals feel stretched. The $1100 payment is designed as a timely cushion for these bumps.

Here’s what it can help you cover:

- Energy bills: A rise in electricity and gas prices means your usual $150 bill might jump to $200. This payment can cover that increase for several months.

- Groceries: With food prices rising, this extra money can help put fresh produce and essentials in your cart without cutting corners.

- Rent or Mortgage: If housing costs have tightened your budget, the payment can help cover a rent hike or offset some mortgage repayments.

- Unexpected expenses: It can create a buffer to handle urgent repairs, medical costs, or transportation needs.

For example, Margaret from Adelaide, who receives the Age Pension, said the extra cash helps her buy healthier groceries and keeps her electricity on during winter without stress.

Practical Advice to Make the Most of Your Centrelink $1100 Direct Deposit

Adding strategy to how you use this payment can make a big difference:

1. Budget Wisely

Map out bills due in the upcoming months and allocate portions of this payment accordingly. Don’t rush to spend it all; treat it partly as a buffer for unplanned costs.

2. Monitor Your myGov Account

Regularly check your payment history and messages from Centrelink on myGov so you catch updates or requests for information early.

3. Report Life Changes Immediately

If you have changes in income, address, family status, or bank details, report them ASAP to avoid overpayments or underpayments.

4. Check for Additional Rebates and Concessions

Beyond this payment, you might be eligible for energy rebates, water concessions, rent assistance, or food support programs.

5. Avoid Debt By Prioritizing Payments

Use the money to cover overdue bills or pack away some to pay down any high-interest debts.

Income and Asset Tests in More Detail

The income test considers all forms of taxable income, which include wages, pensions, investment earnings, and some Centrelink payments. Different thresholds apply depending on whether you are single or in a couple.

The asset test examines your total assets except your main home, which is usually exempt. Assets include savings, second properties, investments, vehicles, and other valuables. Centrelink updates these limits periodically to reflect changes in the economy.

These tests ensure assistance targets low-income, low-asset Australians who need it most while protecting government sustainability.

How Does Centrelink Adjust Payments Over Time?

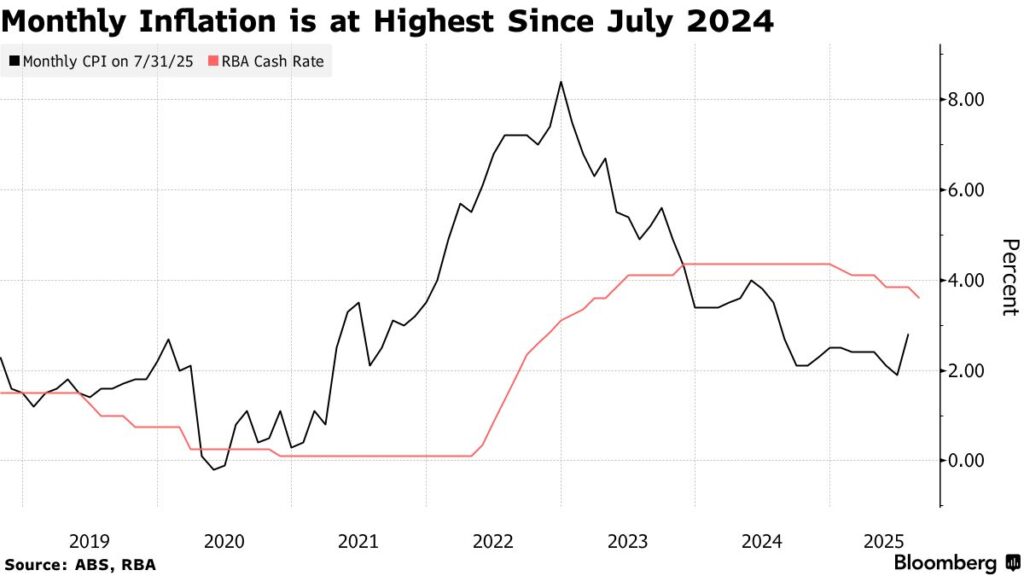

Besides lump-sum payments like this $1100 deposit, Centrelink benefit rates are regularly adjusted through indexation—usually biannually in March and September—linked to inflation and wage growth figures.

- For example, in July 2025, the Age Pension increased by about $19.60 per fortnight for singles.

- Other payments like JobSeeker and Disability Support also saw similar percentage adjustments to help prevent the erosion of purchasing power amid rising costs.

This ongoing adjustment, combined with targeted one-offs, aims to provide stable, predictable income while addressing short-term financial shocks.

How to Contact Centrelink for Assistance?

If you have questions about your payment or need help:

- Check your myGov account regularly for alerts, messages, and payment information.

- Call Centrelink’s dedicated helpline for personalized support and questions.

- Visit the official Services Australia website for comprehensive guides, payment schedules, calculators to check eligibility, and privacy information.

Stay vigilant against scams—Centrelink will never ask for your banking info via email or phone calls. Always confirm information using official channels.

Centrelink Indexation Payment Increase In October 2025 – How much? Check Here

Australia Centrelink Age Pension Rates After October 2025: Check Revised Rate, Payment Date