£200 Cost of Living Payment: November 2025 is here, and with it comes the usual questions looming large: Is the UK government releasing a £200 Cost of Living Payment this November? If so, who qualifies? When will the money land in bank accounts? And how can you claim it if you’re eligible? There’s a lot of chatter online, some of it confusing or flat-out wrong. Let’s break down the facts and clear the air with a detailed, friendly guide that’s easy to understand whether you’re chatting with your neighbors or making professional financial decisions.

Table of Contents

£200 Cost of Living Payment

While there is no nationwide £200 Cost of Living Payment dropping this November 2025, many avenues of vital support exist to protect vulnerable households. From Winter Fuel Payments to local grants, ongoing benefits, charitable funds, and energy company assistance, the network of help remains solid. The best defense against the cost crunch is to stay informed, apply early for all eligible programs, and adopt smart budgeting habits. Whether you’re managing your family’s finances or helping clients, knowing where and how to get support makes a real difference.

| Key Fact | Data / Detail | Career / Professional Info |

|---|---|---|

| Nationwide £200 Payment | Not announced for Nov 2025 | No automatic payment for most |

| Last Major Payment | £299 in Feb 2024 | Required qualifying benefits |

| Winter Fuel Payments | Up to £300 for pensioners | Claim if born before Sep 1957 |

| Household Support Fund | Up to £300 local grants | Apply via local council |

| Charitable & Energy Grants | Varies (case-by-case) | Use Turn2Us grants finder |

| UK Inflation Rate (Sept 2025) | 3.8% annual CPI increase | Transport and housing major factors |

What is the £200 Cost of Living Payment (and is it really happening)?

The short answer is: No, there is no national £200 Cost of Living Payment for November 2025 across the UK. The previous program of Cost of Living Payments ran from 2022 through early 2024, with the last major payment of £299 distributed between January and February 2024 to qualifying households receiving means-tested benefits or tax credits.

The government has confirmed there are no plans for further national Cost of Living Payments in 2025. So the widely circulated rumors or social media posts promising new £200 or even larger lump sums from the Department for Work and Pensions (DWP) are not accurate.

However, there is some good news: targeted supports continue in the form of local council grants, pensions-related payments, and energy bill help, which may feel like a lifeline for many. Let’s explore what’s available.

The Economic Context Behind the Payment

Understanding why the £200 Cost of Living Payment is not happening nationwide this November requires a look at the UK’s economic landscape.

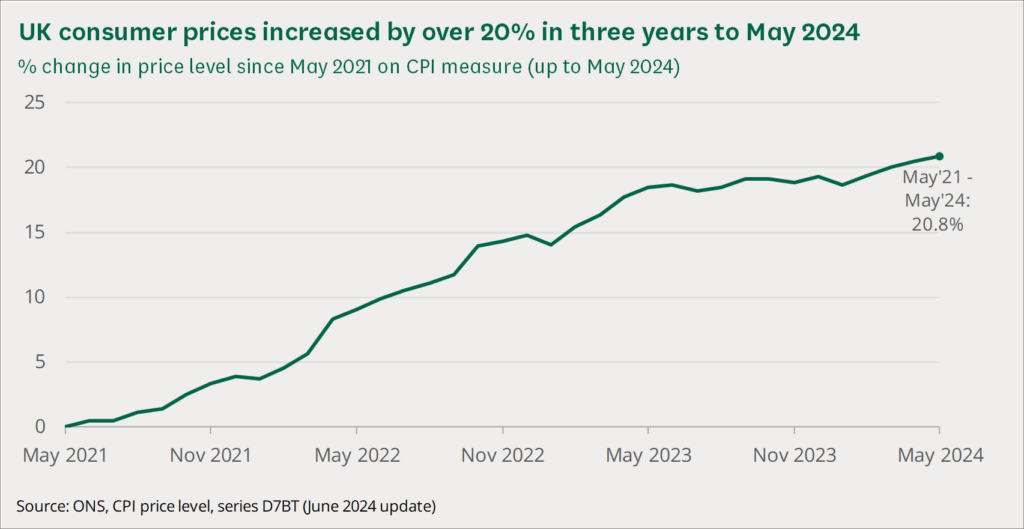

Inflation remains a real issue for many people. According to the Office for National Statistics (ONS) September 2025 report, the UK’s consumer price inflation rate was 3.8%, steady with previous months but still above the Bank of England’s 2% target for price stability. Key contributors to this inflation are housing costs and transport prices, which keep rising and weigh heavily on household budgets.

Energy bills, although slightly eased since previous years, still consume a considerable portion of incomes, particularly for pensioners and low-income families. Food prices have spiked over the last few years with staples costing notably more than before.

Because of these factors, the government has stepped back from universal cost of living cash payments, instead investing in long-term benefit improvements and localised funding schemes aimed at targeting vulnerable households more precisely.

What Support Is Actually Available in November 2025?

While a fresh national £200 payment is off the table, the government and local authorities still offer several vital supports to ease financial stress.

Winter Fuel Payment: A Vital Help for Pensioners

If you’re born on or before September 25, 1957, you are likely eligible for the Winter Fuel Payment. This annual tax-free lump sum of up to £300 helps pensioners pay heating bills during the colder months.

This payment is generally automatic. You’ll receive a letter or email from the DWP around October or November, and the money typically arrives in your bank by December.

Household Support Fund: One-Off Help from Your Local Council

Local councils administer the Household Support Fund, which offers one-off cash grants to families struggling with essentials like food, fuel, clothing, and household goods.

The size, eligibility criteria, and application process for these grants differ from council to council. Some may offer payments similar to the rumored £200, others smaller or slightly higher.

Apply directly through your council’s website or office, providing proof of income, residency, and financial hardship. With budgets limited, it’s wise to apply early and keep an eye out for announcements.

Ongoing Benefits and Disabled Support

Universal Credit, Pension Credit, Income-related Jobseeker’s Allowance (JSA), Employment and Support Allowance (ESA), Disability Living Allowance (DLA), and Personal Independence Payment (PIP) continue as the core financial support pillars.

These benefits support millions of households monthly and sometimes unlock additional help such as:

- Warm Home Discount (£150 off winter electricity bills)

- Local council Tax Reduction schemes

- Free prescriptions or dental care for eligible recipients

Understanding which benefits you receive and keeping your details up to date is essential to avoid missing out.

Charitable Grants and Energy Company Help

Charities like Turn2Us offer emergency grants for food, utilities, and digital connectivity. Their fast online survey tool helps you discover eligibility for thousands of funds nationwide.

Energy providers also feature hardship programs, including social tariffs offering cheaper electricity or gas rates for vulnerable customers, and emergency discounts.

Budgeting Advance Loans: Interest-Free Emergency Funds for Universal Credit Claimants

If you’re receiving Universal Credit and face an urgent unexpected expense—such as appliance breakdown, medical costs, or urgent repair—you can apply for a budgeting advance loan.

The loan is interest-free and repaid by monthly deductions from your future benefit payments, capped at 15% to keep repayments affordable. The maximum loan amount depends on your household size but can be up to £812 in families with children.

Managing Your Budget in Challenging Times: Practical Tips

Money management is key to weathering ongoing cost pressures. Here are some commonsense ways to stretch your income:

- Track spending: Write down or app-record all expenses over a week to spot patterns and unnecessary costs.

- Shop with lists and use discounts: Plan grocery shopping with a list, use loyalty cards, and hunt for sales or bulk buys on essentials.

- Switch energy providers: Look for the best tariff for you, considering fixed vs. variable rates. Providers sometimes offer cheaper “social tariffs” to low-income customers.

- Use energy wisely: Turn off electronics, use hot-water bottles before heating, dress warmly indoors, and insulate windows with draft-proofing products.

- Review subscriptions: Cancel or pause memberships that aren’t essential to free up cash.

- Explore community support: Food banks, local charities, and faith groups often have resources available confidentially.

How Professionals and Community Organizations Can Help

If you’re a social worker, healthcare professional, or community advocate, you play a big role in helping people access available support:

- Provide clear, up-to-date information about eligibility for benefits and local grants.

- Assist with understanding and filling out complex applications—many struggle with the digital system.

- Collaborate with local charities and councils for coordinated support, avoiding duplicated efforts.

- Offer or refer clients to financial literacy workshops focused on budgeting, debt reduction, and saving strategies.

- Monitor signs of hardship like fuel poverty and housing insecurity, offering advocacy or referrals as needed.

£300 Pension Blow for UK Retirees – HMRC’s October 9 Rule Change Sparks Outrage

DWP Confirms State Pension Changes in 2026 – 5 Crucial Rule Changes Every UK Retiree Must Check

HMRC Confirms £300 Pension Cut from October 9; Every UK Pensioner Needs to Know this, Check Details