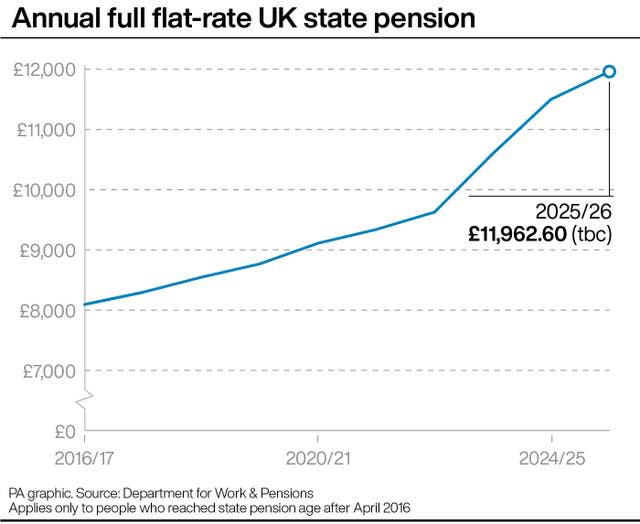

DWP Confirms Unexpected £230 Boost for State Pensioners: The Department for Work and Pensions (DWP) has announced one of the most impactful pension upgrades in recent UK history—the unexpected £230 boost for State Pensioners. Effective from September 2025, the full new State Pension rockets to £230.25 per week. In a year defined by inflation and rising bills, this change promises to help millions feel a little more secure. Whether gearing up for retirement, helping family, or advising clients, this guide ensures everyone understands the ins and outs—from base eligibility and top-ups to tax rules and special global scenarios.

Table of Contents

DWP Confirms Unexpected £230 Boost for State Pensioners

The DWP’s £230 boost transforms the retirement outlook for UK pensioners in 2025/26—offering more financial stability in a tough year. By understanding eligibility, maximizing your NI record, coordinating global entitlements, and claiming every pound of extra support, you can ensure a comfortable and rewarding retirement. Regular review, quick action on gaps, and smart coordination make all the difference. Don’t let any of these opportunities slip by—secure the maximum income, peace-of-mind, and benefits your hard work deserves.

| Feature | Details & Data |

|---|---|

| State Pension Boost | £230.25/week full new pension (2025/26) |

| Boost Start Date | September 2025 (applies automatically) |

| Triple Lock Increase | 4.1% for 2025/26 (wages, inflation, or 2.5% – whichever higher) |

| Eligibility Criteria | Age 66+, 10+ NI years minimum, 35 years for max payout |

| Payment Frequency | Every week/four weeks, NI number-based schedule |

| Tax Treatment | Income tax due above £12,570/year |

| Extra Support | Pension Credit, Winter Fuel, Carer’s Allowance, etc. |

| Checklist | Check NI record, fill gaps, claim extras, coordinate private/expat |

| Official Website | Gov.uk |

The 2025/26 State Pension Boost: What’s Changing and Why?

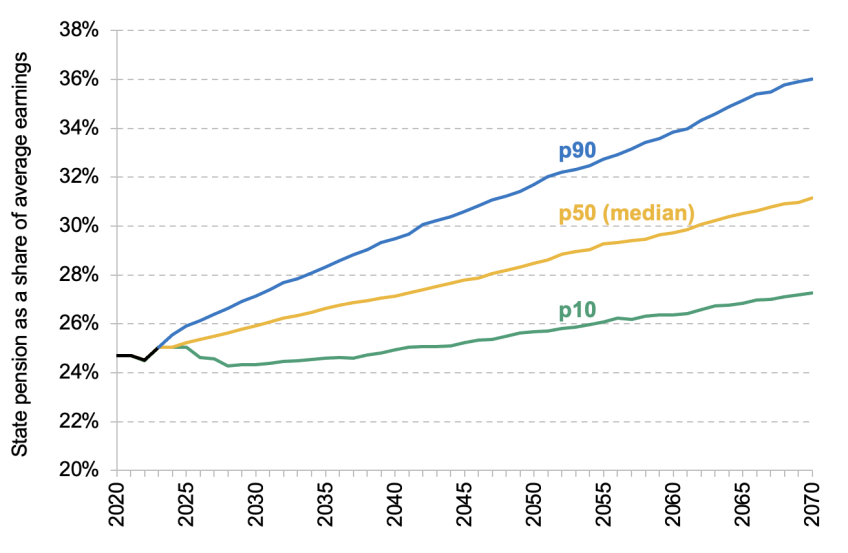

The “triple lock” system—guaranteeing that pension increases match wage growth, inflation, or never drop below 2.5%—helped deliver the biggest bump in years. With the cost-of-living crisis biting, this £230.25 weekly payment (over £11,973 annually) is a well-timed intervention. About a third of UK households claim DWP benefits; for many, this money replaces earnings, covers rent, or funds prescription medicine.

The higher payments mean:

- Less pressure from utility bills, rising groceries, and extra expenses.

- Improved financial security for seniors and disabled pensioners.

This boost, automatically applied for all eligible recipients, can be the difference between just getting by—and enjoying retirement with a little extra comfort.

Deep-Dive: Who Is Eligible for the Full State Pension?

Getting the new State Pension is about more than just hitting a birthday—your National Insurance (NI) record determines your payout.

Age Requirement

- Men: Born on or after April 6, 1951

- Women: Born on or after April 6, 1953

- Reach State Pension age (66 as of 2025; set to rise to 67 by 2028)

NI Years and Contribution Rules

- 10 Qualifying NI Years: Needed to get any new State Pension.

- 35 Qualifying NI Years: Unlocks the maximum State Pension (£230.25/week).

- Work, NI credits (for unemployment, illness, or caregiving), or voluntary NI payments all count.

- Partial Pension: If you have between 10 and 34 years, payment scales up proportionally.

How to Build Qualifying Years?

- Most people accrue qualifying years through full-time work and NI payments.

- Credits granted for those receiving certain benefits, sick leave, unemployment, or looking after family.

- Carers, parents, or those on Universal Credit can accumulate years without traditional work.

Special Cases

- International Agreements: Time living/working in EEA countries, Switzerland, or select nations can combine with UK records to meet eligibility.

- “Contracted out” employees (pre-2016): May need extra years; calculation blends old and new systems for protected payments.

- Spousal/Civil Partnership: Most pensions are individual, but some can inherit protected payments under special rules.

Payment Dates and Frequencies: How Money Lands

Don’t wait for a paper check—almost all payments are direct deposit!

Payment Cycle:

- Weekly or Four-Weekly: Choice depends on personal preference and NI number.

- NI Number Rut: Payment dates based on last two digits—Monday-Friday rolling schedule.

- Bank Holiday? If due on a holiday or weekend, the money lands early.

New claimants usually receive their first payment four weeks after being approved; existing recipients get the boost automatically with no paperwork needed.

Maximizing Unexpected £230 Boost for State Pensioners: Advanced Tips

1. Fill National Insurance Gaps

- Gaps hurt payouts—often caused by career breaks, self-employment, or time abroad.

- Backfill with Class 3 Voluntary Contributions: Available for gaps in the previous six tax years, costing approx £923/year, generating up to £342 extra annually.

2. Consider Deferral

- If you delay claiming your State Pension, you can boost payouts by nearly 5.8% per deferred year.

- Works best for those still working or those who don’t need funds immediately.

- Note: If collecting certain welfare benefits, deferral may not apply.

3. Trace and Combine Workplace/Private Pensions

- Use the Pension Tracing Service to reclaim lost pension pots from previous employers.

- Coordinating private pensions and State Pension can dramatically increase retirement income.

4. Working Beyond Pension Age

- No NI contributions due after reaching pension age.

- State Pension is not means-tested—extra earnings don’t reduce your entitlement.

- However, total income can trigger tax obligations.

Government Extras: The DWP Safety Net

Pension Credit

- Income guaranteed: At least £227.10/week for singles. Opens the door to housing benefits, council tax relief, free TV licenses, and more.

- Over 2 million pensioners eligible—yet around 800,000 still don’t claim.

Attendance Allowance/Disability Payments

- Up to £92/week for those needing regular care because of sickness/disability.

- Not means-tested: Eligibility based on care needs.

Winter Fuel Payment

- Automatic for most pensioners and disabled claimants.

- Ranges from £100 to £300; paid in Nov/Dec annually.

Cold Weather Payment

- £25 per eligible seven-day freeze period (between Nov and Mar).

Carer’s Allowance and Grants

- Increase of £164/year from 2026 for full-time carers.

- Applies even if the recipient is a pensioner looking after a loved one.

Warm Home Discount

- £150 credit for qualifying pensioners—often applied automatically on utility bills.

Special Support

- Low-income pensioners may get support for rent, healthcare, and council tax via local schemes.

- Free NHS prescriptions and travel for many at State Pension age.

Taxation, Expats, and Global Pension Issues

Is State Pension Taxable?

- Yes, if total annual income exceeds £12,570 (personal allowance for 2025/26).legalandgeneral

- DWP does not withhold tax; retirees must coordinate with HMRC and file returns if above the threshold.

- Combine with private pension or part-time work? You may enter a higher bracket.

Retiring Abroad

- Some countries recognize UK State Pension increases during foreign residency (e.g., EEA).

- In certain places—e.g., Australia, Canada—the UK State Pension is “frozen” from the date you move.

- Many nations have double tax treaties to avoid paying tax twice; check local rules.

U.S.-UK Social Security Crossovers

- Pensioners with mixed work history navigate both UK State Pension and U.S. Social Security.

- Recent Social Security reforms in the U.S. may help some avoid “windfall elimination”.

Extended Examples and Case Studies

Case #1: Carers & Credits

Lisa quit work at 56 to care for her husband full-time. Over eight years, she earned NI credits, bumped up her record to 37 years, and now collects the full pension rate.

Case #2: International Pensions

Alan worked in Germany for seven years. These, combined with six years in the UK, make him eligible for UK State Pension (based on six UK years), but he also claims German pension.

Case #3: Deferral in Action

Tom, still working at 66, postponed his claim for two years. Now he enjoys nearly £670/year extra, with his private pension supplementing the higher State Pension.

Case #4: Forgotten Pensions

Mary used the tracing service to recover three lost pension pots, adding £5,000/year atop her State Pension.

Common Pitfalls and Solutions

- Missing out on claiming Pension Credit, Attendance Allowance, or Winter Fuel grants.

- Failing to check your NI record or fill gaps early enough for retirement.

- Incorrect assumptions about international entitlements—always double-check.

- Assuming all benefits come automatically—some require annual applications.

Comprehensive Checklist for UK Pensioners

- Check your NI record online.

- Fill any gaps with voluntary contributions or NI credits.

- Consider deferral for a higher future payout if working.

- Locate all workplace/private pensions with tracing services.

- Annually review eligibility for support schemes.

- Monitor tax position if income is high.

- Know which international agreements affect your entitlement.

- Prepare for benefit changes and new regulations.

£300 Pension Blow for UK Retirees – HMRC’s October 9 Rule Change Sparks Outrage

DWP Confirms State Pension Changes in 2026 – 5 Crucial Rule Changes Every UK Retiree Must Check

HMRC Confirms £300 Pension Cut from October 9; Every UK Pensioner Needs to Know this, Check Details