Centrelink Cost Of Living Payment: Inflation’s biting hard in Australia for 2025, and government relief like the Centrelink Cost Of Living Payment in November 2025 arrives as a lifeline for millions. Seniors, carers, and disabled Australians—those most exposed to skyrocketing prices—now have extra financial muscle to help meet their daily needs. This article unpacks all the fine print, delivers historical context, and brings real-world advice, making it ideal for both everyday users and finance pros.

Table of Contents

Centrelink Cost Of Living Payment

Centrelink’s November 2025 Cost Of Living Payment stands as a powerful buffer against tough economic pressures. Combined with regular indexation, bonus payments, and fresh support programs for aged care, the system now delivers more robust protection for those who need it most. Staying safe from scams, budgeting payments wisely, and tapping local support networks will help families stretch every dollar and live with dignity.

| Feature | Details |

|---|---|

| Payment Name | Centrelink Cost Of Living Payment (November 2025) |

| One-off Payment Amount | $780 |

| Eligible Schemes | Age Pension, Disability Support Pension, Carer Payment |

| Payout Date (Expected) | November 28, 2025 |

| Indexation Increase (2025) | +$29.70/fortnight for singles; +$44.80 for couples (Age Pension) |

| Extra 2025 Payments | $380, $750, $1,550 depending on program and eligibility |

| Application Needed | None (Automatic), but myGov/account details must be current |

| Official Resources | Services Australia, SuperGuide |

| Impact | Protects seniors, carers, and vulnerable groups from inflation, rising rent, and medical costs |

What Is the Centrelink Cost Of Living Payment?

Centrelink’s Cost Of Living Payment in November is a one-off, $780 welfare supplement delivered automatically to eligible Australians. Unlike previous years, recipients don’t need to lodge forms, jump through hoops, or worry about getting lost in the process. Centrelink scrapes its own records, deposits the bonus straight to your registered account, and notifies you via myGov. This means more cash in your pocket exactly when you need it most.

Why now?

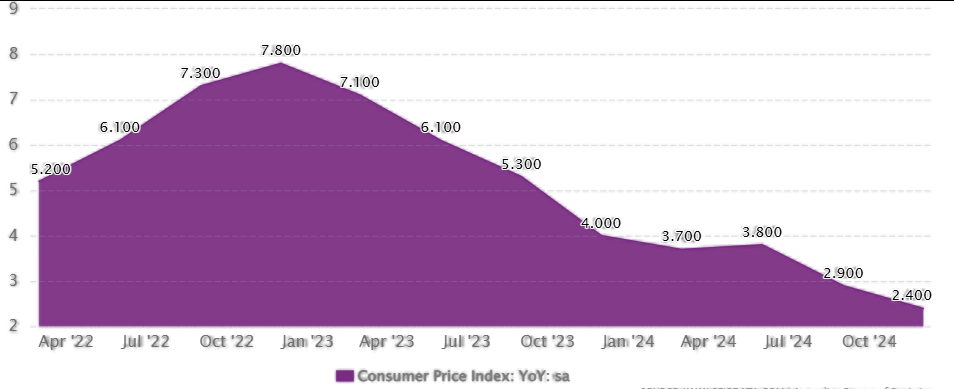

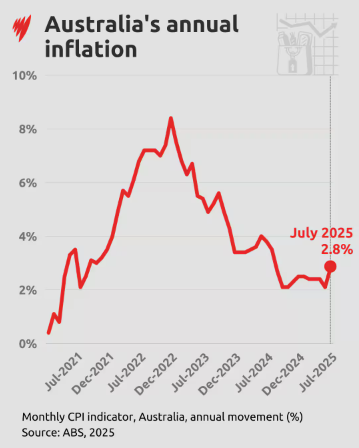

Over the past year, the Consumer Price Index (CPI) jumped by approximately 3.5%-4%. The cost of fresh food, rent, electricity, and medicines surged, with the average household spending about 15-18% more on essentials than in 2024. Centrelink responds by combining flat lump-sum relief with its regular “indexation” process, ensuring benefits keep pace with inflation.abc+1

Payment History & Australia’s Cost-of-Living Response

Australia’s welfare system has long responded to cost pressures with targeted payments:

- 2022: $250 payments went to Age Pensioners, jobseekers, concession card holders during COVID inflation surges.

- 2023: One-off payments ended, replaced by biannual indexation (automatic rate increases tied to inflation and wages).

- 2025: Crisis-level inflation triggered the return of one-off payments, including $780 (the central November payment), plus $380, $750, and $1,550 extras for specific programs.

- Means-tested fee changes: New hotelling contributions for aged care from 1 November 2025, indexed alongside other benefits.

Automatic indexation lifts age pension and disability support by $29.70/fortnight for singles, $44.80 combined for couples. Regular increases apply March and September, responding to movements in CPI, living costs, and wage rates.

Eligibility Explained in Depth

Eligibility isn’t just a tick-box process—Centrelink uses several filters:

- Active receipt of Age Pension, Disability Support Pension, or Carer Payment: Recipients must be currently on payment rolls.

- Residency requirement: You must be living in Australia with a verified address.

- Income/assets testing: Limits ensure help targets those who need it most.

- Account verification: Payments don’t go through if there’s a mismatch or outdated info in your records.

Example Case:

Daisy, age 73 from Sydney, receives Age Pension and has bank details on file. On November 28, Centrelink deposits $780 into her account automatically. She doesn’t fill out any claim—her eligibility was checked weeks earlier.

By contrast, Tom, 55, on Newstart Allowance, isn’t eligible unless he ticks all required boxes or shifts onto Disability Support.

Some payments (like the $380, $750, and $1,550 bonuses) serve different demographic slices—youths, unemployment claimants, recipients of Parenting Payment, and others with specific situations.

How and When Are Centrelink Cost Of Living Payments Made?

- Payment date: Anticipated for Friday, November 28, 2025. Adjust for weekends and public holidays—check myGov for confirmation.

- Depositing: Payouts are direct-deposited to registered bank accounts. It’s critical to keep details up to date to avoid payment errors.

- Extra rounds: Other bonus payments (e.g., $380, $1,550) for select categories drop earlier in November.

- Notifications: Centrelink updates your myGov inbox, sends email/text confirmations for payment credits.

Pro tip: Banks often take an extra business day to process Centrelink payments, especially on Fridays.

Indexation—How Benefits Keep Pace

Indexation means benefits increase in line with inflation, keeping welfare payments strong as living costs rise:

- Applied automatically March and September

- Singles (Age Pension, DSP, Carer payments): Up by $29.70/fortnight

- Couples (combined): Up by $44.80/fortnight

- Hotelling contributions for aged care: Introduced November 2025, means-tested and indexed for inflation

Centrelink’s process guarantees you don’t miss out as prices for everyday items rise. Recipients should check rate charts published by Services Australia, updated each quarter.

Step-by-step Recipient Guid for Centrelink Cost Of Living Payment

1. Log in to myGov:

Check your payment history, bank details, and active benefits.

2. Verify account info:

Update records for name, address, and bank account to avoid delayed payments.

3. Set budget priorities:

Plan how to use your payment—cover rent, medical bills, overdue utilities, or save for emergencies.

4. Beware of scams:

Ignore emails or texts demanding personal info. Only respond through myGov or official .gov.au addresses.

5. Join community support:

Local welfare groups, senior centers, and charities host cost-of-living workshops.

Inflation Trends & Living Cost Challenges

Inflation pushed the price of groceries, electricity, transport, and rent higher in nearly every capital city in 2025. Fresh food rose over 8%, electricity bills surged at least 12%, and average city rents climbed more than 18%.

Australian households now pay an average of $1,755/year—a $35 rise in energy price caps, with many experts recommending fixed tariff plans to lock in savings.

Such conditions highlight why targeted relief payments and indexation are vital to keeping vulnerable Aussies afloat.

Watch Out for Scams & Fraud

Scammers ramp up during government payout cycles. If you’re a Centrelink recipient:

- Never click links from emails, texts, or social media claiming to be Centrelink—go direct to myGov.

- Centrelink does NOT ask for payment or banking info via text.

- Australians lost over $300 million to scams in 2024; most fraud starts with fake welfare or banking messages.

- Report any suspicious communication to Services Australia’s scam watch team.

Keep your myGov login details secure. Change passwords if you suspect a breach. Request in-person Centrelink support for digital challenges.

Real-Life Success Stories

Sam, Brisbane: A carer for his disabled partner, Sam’s regular income wasn’t enough to cover a surge in power and rent bills. The $780 payment arrived just in time, allowing him to buy groceries for the month and catch up on overdue notices.

Leah, Bendigo: As a widow on Age Pension, Leah struggled to buy all her medications. She used bonus payments to cover medical costs and enrolled in local budgeting sessions offered by her council’s support team.

Zac, Perth: A youth allowance recipient, Zac was able to purchase a refurbished laptop for his studies and save the rest for future emergencies.

Financial & Career Advice

- Budget smart: Allocate one-off payments toward the most urgent expenses.

- Bulk buy if feasible: Essentials, especially medications and personal care, can be cheaper in large packs.

- Use professional help: Community financial counselors can provide free budgeting advice.

- Mental health services: Many local health departments offer phone support, free sessions, and online resources as bills rise.

- Avoid payday loans and high-interest credit: These erode payment benefits.

Professionals and social service providers should proactively share verified info, organize outreach, and warn clients against fraudulent offers.

Comparison Table: Cost Of Living Payment Data

| Year | Payment Type | Amount | Eligible Groups | Application Required | Impact |

|---|---|---|---|---|---|

| 2022 | Cost of Living (COVID) | $250 | Seniors, jobseekers, concession cards | No | Helped offset COVID-related inflation |

| 2023 | Indexation Only | Varies | All welfare recipients | No | Annual uplift tied to CPI; supplemental |

| 2025 | Cost of Living (Nov) | $780 | Age Pension, DSP, Carer Payment | No | Main November payout, rent/medical relief |

| 2025 | Bonus Payments | $380-$1,550 | Young, low-income, families | No | Staged support, emergencies |

Australia Age Pension Increase in October 2025 – Check Increased Payout Amount & Date

Centrelink Indexation Payment Increase In October 2025 – How much? Check Here