$1,750 Payouts in 2025: If you’ve been feeling the squeeze of soaring property taxes or rent hikes in 2025, you’re definitely not alone. Across the United States, homeowners and renters alike find themselves wrestling with rising housing costs that stretch budgets thin. But here’s some welcome news — the $1,750 tax rebate for 2025 is here to offer major relief, putting important money back into the pockets of millions, especially seniors, disabled veterans, and low-to-moderate income families. Whether you own your home or rent, this rebate is designed to ease the burden and help manage those sky-high bills.

Let’s break this down in straightforward terms. The $1,750 tax rebate is a state-level program aimed at offsetting the rising property tax and rent costs many Americans face. And here’s a little secret: some folks may be eligible to double that amount—up to $3,500! Ready to see if you qualify? Want to know how to apply? This guide covers everything you need to know, from eligibility to step-by-step application instructions, along with tips to maximize your rebate.

Table of Contents

$1,750 Payouts in 2025

The $1,750 tax rebate in 2025 is a powerful relief measure for countless Americans facing steep housing costs. Seniors, disabled veterans, and income-qualified homeowners and renters can benefit greatly. By staying informed, preparing your paperwork early, and submitting your application before the deadline, you can take full advantage of this program and ease your financial pressures. This rebate isn’t just a tax break—it’s a vital support helping people keep roofs over their heads and cash in their wallets.

| Eligibility Group | Max Rebate Amount | Bonus Condition |

|---|---|---|

| Seniors (65+) | $1,750 | Up to $3,500 with “dual eligibility” |

| Disabled Veterans | $1,750 | Extra 50% bonus with VA benefits |

| Low-Income Homeowners | $1,200 | Additional $300 if filing early |

| Renters (Select States) | $500 | Varies depending on state |

The Backstory: Why This Rebate Exists

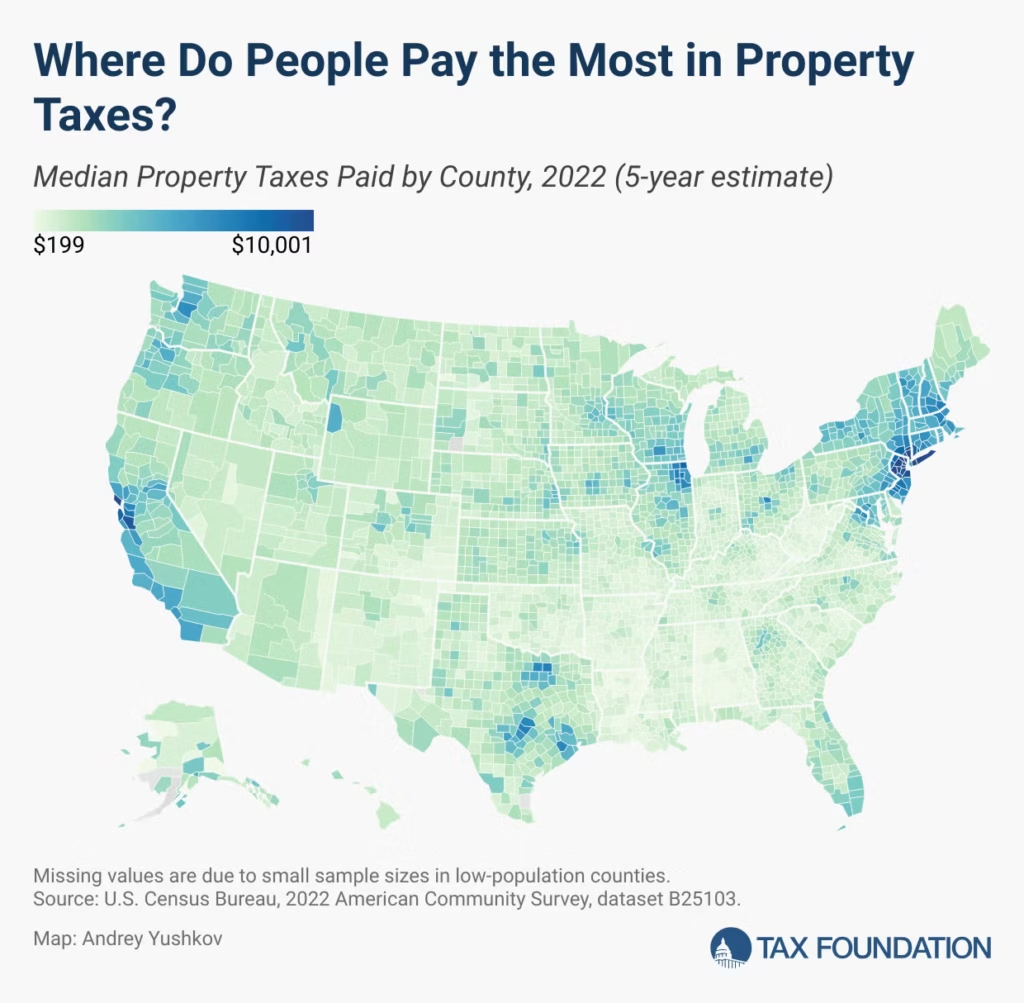

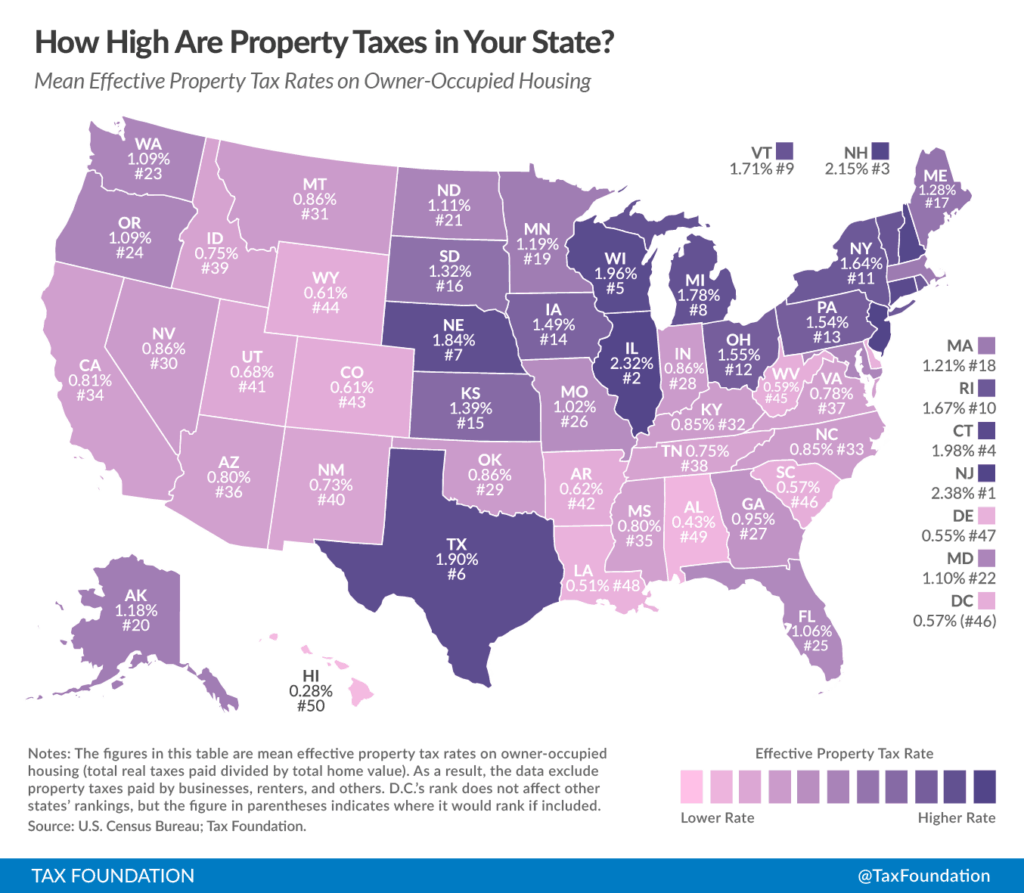

In recent years, property taxes have been climbing rapidly due to inflation and increasing home valuations. According to the Tax Foundation, the average property tax rate is approximately 1.1% nationwide, but states like New Jersey hit much higher rates — sometimes near double the national average. At the same time, rent has skyrocketed in many urban and suburban areas. Seniors and lower-income families on fixed budgets have been hit particularly hard by these increases.

State governments recognized the growing financial strain and responded by launching these rebates as part of their 2023-2025 state budgets, with a goal to provide targeted relief to vulnerable populations. This rebate is designed to help residents keep more money in their wallets without affecting federal tax returns because it is a state-level benefit.

The legislative push behind this rebate reflects a growing acknowledgement among policymakers that housing costs represent the largest expense in most household budgets, often exceeding 30% of total income. By injecting relief directly through rebates, states hope to curb financial strain, prevent housing insecurity, and stimulate local economies through increased disposable income.

How the $1,750 Payouts in 2025 Compares to Previous Years?

The $1,750 rebate in 2025 is among the largest ever issued. In prior years, rebates ranged typically between $700 and $1,000, so this represents a significant increase reflecting governments’ recognition of the affordability crisis. This uptick shows the commitment to making housing costs manageable and protecting homeownership and rental stability across communities.

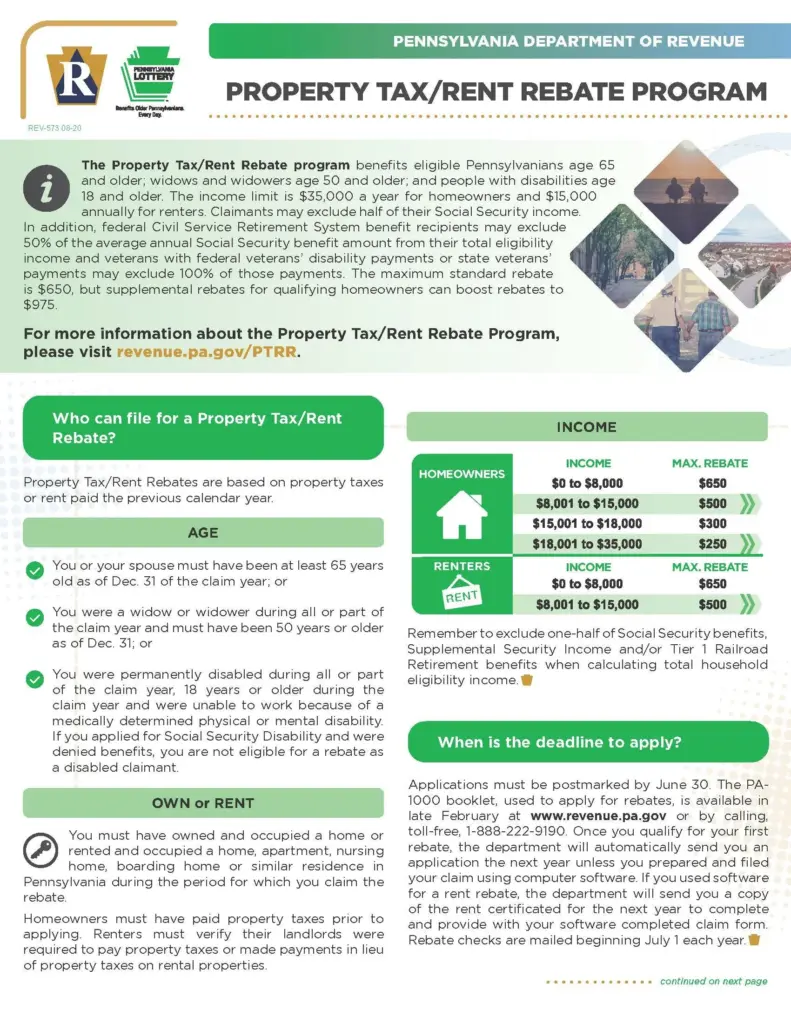

For example, in New Jersey, the rebate amount was roughly $1,000 in 2023; in 2025, it’s nearly doubled for eligible seniors. Similarly, Pennsylvania has increased its rent rebate caps to help renters cope with soaring rents. This growth in rebate sums is a strategic state response aligning with cost-of-living increases and targeted social support.

How the Rebate Stimulates the Economy?

Beyond individual relief, this rebate acts as a local economic booster. When families are less burdened by housing costs, they tend to spend more on healthcare, groceries, transportation, and other essentials. Economists note that programs like these stimulate consumer spending and strengthen community businesses, creating a positive ripple effect in the economy.

Moreover, stable housing facilitated by these rebates can reduce governmental expenditures on homelessness prevention and emergency social services. By preventing default on mortgages and avoiding evictions, the state saves on long-term social costs and helps maintain community stability.

Who Qualifies for the $1,750 Payouts in 2025?

The rebate eligibility revolves around:

- Homeowners aged 65 or older living in their primary residence with income below state-set thresholds (usually up to $250,000). Some states have sliding scales: for instance, income between $150,000 and $250,000 may receive reduced rebates.

- Disabled veterans who receive qualifying VA benefits.

- Low-to-moderate income families owning their homes.

- Renters in selected states (e.g., New Jersey, Pennsylvania), generally qualifying for smaller rebates.

Importantly, applicants must have paid property taxes on their primary residence for the tax year or be current renters. In some states, seniors under 65 can qualify if income qualifies but may receive slightly lower rebate amounts. Verification of residency and tax payments is strictly required.

The Hidden “Dual Eligibility” Rule: Double Your Rebate

One of the most talked-about features is the hidden “dual eligibility” rule. Seniors or disabled vets who both receive Social Security benefits and qualify for a Senior Homestead Exemption may get their rebate doubled, maxing out at $3,500. This rule applies if household income is below approximately $45,000 and the property value falls within state limits.

To take advantage, applicants should ensure their local tax assessor’s office has their updated income and Social Security benefit information. Often, this requires submission or verification ahead of rebate application deadlines.

Step-by-Step Guide to Claiming $1,750 Payouts in 2025

1. Verify Eligibility: Confirm your age, income, residence, and property/rent status against your state’s official criteria.

2. Gather Documents: These typically include:

- Proof of residency (utility bills, driver license)

- Last year’s property tax bill or rent receipts

- Income documentation (Social Security statements, W-2s, tax returns)

3. Submit Your Application:

Most states offer online portals for submissions, making the process quicker and easier. Paper applications are accepted but slow processing times apply.

4. Watch the Deadlines:

Each state sets its own deadlines, generally between June 30 and October 31, 2025. Missing this window may reduce or eliminate rebate eligibility.

5. Receive Your Rebate:

Payments roll out between July and September 2025, delivered via direct deposit or mailed check depending on your filing preference.

Avoid These Common Mistakes

- Missing the deadline: Late applications often mean smaller or no rebates. Mark your calendar and start early.

- Incomplete or inaccurate documentation: Double-check income and residency proofs to avoid delays.

- Application fraud risks: Use only official state websites or trusted government agencies to apply.

- Failing to update exemptions: Ensure your Senior Homestead Exemption and Social Security info are current with local tax assessors.

Maximizing Your Benefits: More Than Just the Rebate

Besides this rebate, check eligibility for other assistance programs that can stack with it, such as:

- Energy bill assistance programs that reduce household utility expenses

- Property tax deferrals or freezes for seniors and veterans

- Local housing vouchers or rent subsidies

Combining assistance can significantly reduce the financial pressure of housing costs.

Real Stories from People Like You

- Jane, 67, in New Jersey, got her rebate doubled to $3,500 by qualifying under the dual eligibility rule — enough to cover a sizable portion of her annual property tax.

- Marcus, a renter making $30,000 annually in Pennsylvania, claimed a $500 rent rebate that eased his paycheck-to-paycheck struggle.

- Linda, a disabled veteran, took home $2,625 with the base rebate plus VA benefit bonuses, allowing her to cover vital home repairs.

Why This Matters to Professionals?

For real estate agents, tax consultants, financial planners, and senior care managers, understanding this rebate program is vital. It helps advisors provide accurate guidance on budgeting, tax savings, and affordable housing options. Recognizing the availability and timing of rebates can shape more effective client engagement and financial advice.

USA Retirement Age Increase From October 2025 – Check New Retirement Age & Revised Eligibility

Social Security Payments Delayed: Here’s Why You Won’t Get Yours Today

October SSDI and November SSI Payments Scheduled by Social Security for 2025: Check Payment Details!