You Could Lose £787 from Your Bank Account This December: The festive season is upon us, and for many UK households, that means increased spending, holiday shopping, and an uptick in transactions. However, alongside the excitement of the season comes a serious warning: you could lose £787 (or more) from your bank account this December if you’re not vigilant. As fraudsters take advantage of increased online activity and the holiday rush, the risk of scams has never been higher. Let’s break down why this warning is so crucial, how scammers operate, and how you can protect your hard-earned money.

Table of Contents

You Could Lose £787 from Your Bank Account This December

The risk of fraud is high in the UK, particularly as we approach December. While £787 is an average estimate of the financial loss from scams, it could be even higher for some victims. By staying vigilant, using strong security practices, and monitoring your accounts regularly, you can drastically reduce your chances of falling victim to fraud. Stay informed, stay secure, and enjoy a worry-free holiday season.

| Item | Detail |

|---|---|

| Total fraud losses in UK (2024) | ~ £1.17 billion stolen through authorised + unauthorised fraud. (ukfinance.org.uk) |

| Fraud cases in 2024 | Over 3.3 million reported incidents. |

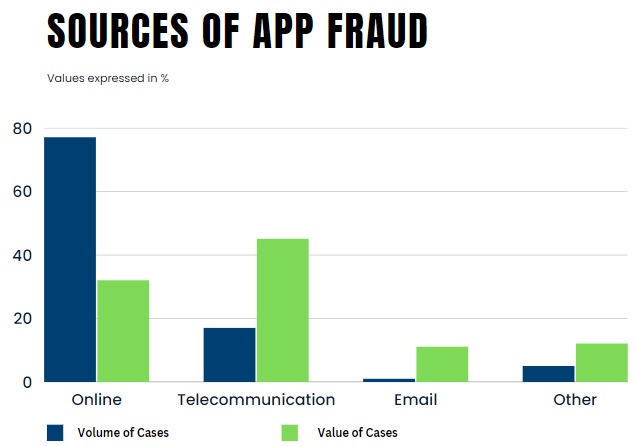

| Percentage of fraud that’s cyber‑enabled | ~ 67% of UK fraud involves online/cyber methods. |

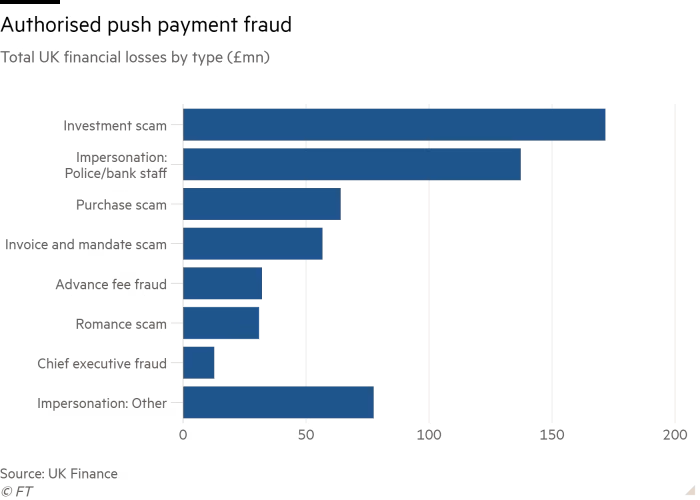

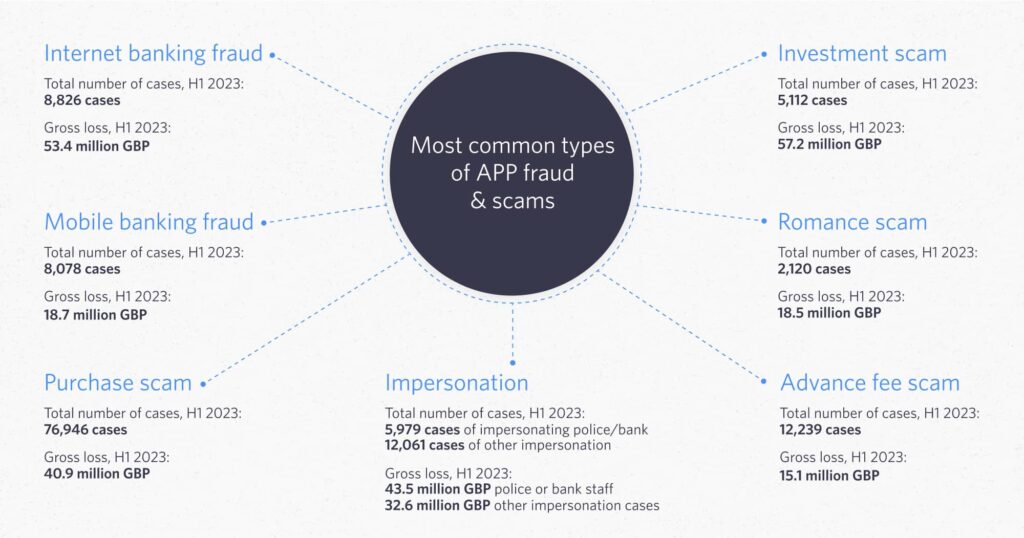

| Example scam type: APP (Authorised Push Payment) | Many victims tricked into “sending” money believing it’s to a trusted party. Latest figures show ~£340 million lost in 2023. |

| Why December is risky | More payments, higher volume of transactions, festive deals = more “opportunities” for fraudsters. |

What We’re Talking About?

When headlines mention that UK households are at risk of losing £787, it’s not about a one-size-fits-all fraud incident. Rather, it reflects the growing trend of fraud, scams, and unauthorised transactions that many consumers face, particularly around the busy holiday period. The £787 figure likely comes from estimates of average scam losses. The exact amount may vary from person to person, but the risk is real.

With the UK seeing over £1.17 billion in fraud losses in 2024 alone, the £787 warning serves as a reminder of just how easily fraud can hit. As online banking becomes more prevalent, fraudsters are getting savvier in their attempts to steal from unsuspecting individuals. Unfortunately, the average person often becomes a target at the most vulnerable time: during the holiday season when spending increases and people are distracted.

Why You Could Lose £787 from Your Bank Account This December Matters Now?

As we head into December, there’s a unique combination of factors that make the risk of fraud more prominent:

- Increased Spending: With Christmas shopping, end-of-year bonuses, and bills, the number of transactions increases substantially. Scammers know that people are more likely to make quick decisions during this time.

- Higher Volume of Online Transactions: Over the last decade, online shopping and digital payments have skyrocketed. This has given fraudsters ample opportunities to trick people into handing over their hard-earned cash.

- New Target Demographics: Older adults, younger people, and even those receiving holiday bonuses are prime targets for fraud schemes. Fraudsters know that these groups are often vulnerable or less aware of the latest scam tactics.

In 2024 alone, UK Finance reported that 3.3 million incidents of fraud were recorded, highlighting the scale of the issue. These fraudsters prey on vulnerability and often use tactics that seem legitimate — like fake bank alerts, urgent delivery requests, or phony payment demands.

The Anatomy of How the Loss Happens

Understanding how fraudsters work is crucial to protecting yourself. Here’s a breakdown of the typical steps involved in a scam that could lead to a loss of £787 or more:

1. Targeting the Vulnerable

Fraudsters often target groups that are more likely to let their guard down. This can include:

- Older Adults: Seniors are often less familiar with the latest online scams and more likely to fall for phone scams or phishing emails pretending to be from a bank.

- Holiday Shoppers: The busy shopping season creates a perfect storm for fraudsters. People are distracted by discounts, rushing to make purchases, and often not as careful about checking their bank details.

- People Awaiting Payments: Those expecting Christmas bonuses, government benefits, or end-of-year payments may be tricked into believing a scam email or text that asks them to verify their account details.

2. The Scam Execution

Fraud can take many forms, but Authorised Push Payment (APP) scams are among the most common. This involves fraudsters convincing victims to authorise payments to them, often by pretending to be someone the victim trusts.

- Phishing Emails and Texts: These are one of the most common ways fraudsters try to steal personal information. You might receive an email that looks like it’s from your bank or utility provider, asking you to click on a link and provide your bank details. These links often lead to fake websites that closely resemble the official ones.

- Fake Websites and Online Stores: Scammers set up fake online stores that look legitimate but are designed to steal payment details. For instance, if you’re searching for a holiday deal, scammers may lure you into making a purchase through a seemingly legitimate website, only to steal your credit card details when you check out.

- Social Engineering: Fraudsters may pretend to be a family member, friend, or colleague, contacting you through email or social media to ask for urgent financial assistance. They’ll often claim to be in an emergency situation and request that you send money immediately.

3. The Loss and Aftermath

Once the scammer has access to your account or has convinced you to send them money, the loss can be significant. The scam could take place over days or even weeks, and the fraudster may try to gain access to your online banking credentials.

- Immediate Transfers: Once they have your bank details, they can swiftly move funds from your account, often to an overseas location, making it difficult for you to recover the money.

- Emotional Impact: The financial loss is just one part of the story. Many people feel a deep sense of shame, guilt, or frustration after being scammed. Rebuilding trust in the system takes time, and in some cases, the loss may have a lasting impact on the victim’s confidence.

Why the You Could Lose £787 from Your Bank Account This December Figure?

The figure of £787 is not a random number; it likely reflects the average amount that people lose due to fraud. In many cases, victims of APP fraud lose between £500 and £1,000. This makes the £787 figure a median or rounded estimate of what the average victim might lose in such incidents. However, some individuals may lose far more than this amount, depending on the scale of the scam and the victim’s involvement.

What You Can Do — Practical Advice for Protecting Yourself

Fraud is a real threat, but the good news is there are steps you can take to protect your money. Follow these guidelines to avoid falling victim to fraud:

Step 1: Know the Risk

The first step to protecting yourself is to understand the risk. The rise of cyber-enabled fraud means that more than 67% of UK fraud involves online tactics. Be aware that you could be targeted at any time. Be particularly cautious around high-volume periods like the holidays.

Step 2: Secure Your Accounts

- Set Up Two-Factor Authentication (2FA): This adds an extra layer of security to your online banking. Even if someone knows your password, they won’t be able to access your account without your phone or other authentication method.

- Use Strong, Unique Passwords: Your bank account password should be something that is difficult for others to guess. Avoid using obvious choices like your birth date or “password123”.

- Separate Accounts for Spending and Saving: Consider keeping a separate account for daily spending and another for your savings. This can limit the amount of money fraudsters can access if they manage to infiltrate one of your accounts.

Step 3: Spot the Scams

Be on the lookout for warning signs of fraud:

- Urgent Requests for Payment: Fraudsters often create a sense of urgency — “act now or your account will be suspended!” If you receive an unexpected request for money, pause before reacting.

- Suspicious Links: If an email or text contains a link, hover your mouse over it to see the real URL. If it doesn’t match the official website of your bank or service provider, don’t click it.

- Impersonation Attempts: If you receive an unsolicited phone call or message claiming to be from your bank or utility company, hang up and call the official customer service number.

Step 4: Set Up Alerts and Monitor Your Accounts

Many banks allow you to set up alerts that notify you whenever a transaction occurs. This is especially helpful for spotting fraudulent transactions quickly.

- Transaction Alerts: Set up alerts for any transactions over a certain limit (e.g., £100). If you see a payment you didn’t make, you’ll be alerted immediately.

- Review Statements Regularly: Regularly check your bank and credit card statements to catch any suspicious activity.

Step 5: Report Fraud Immediately

If you believe you’ve been scammed, report it immediately to your bank. Many banks have dedicated fraud teams that can freeze transactions or assist in recovering stolen funds. Additionally, you can report fraud to Action Fraud, the UK’s national fraud and cybercrime reporting centre.

Step 6: Educate Others

Scammers often prey on people who aren’t aware of the latest scams. Make sure your family members, especially elderly relatives, understand the risks and know what to look out for.

How Professionals Can Protect Clients?

If you work in finance, it’s essential to help your clients protect their assets, too. Here are some steps you can take:

Financial Advisors and Accountants

- Educate Clients on Scams: Help your clients understand common scams and how to avoid them. Ensure that they know how to set up fraud alerts and use strong passwords.

- Review Security Practices: Encourage clients to use two-factor authentication and other advanced security measures for online banking.

FinTech Professionals

- Upgrade Security Features: If you work in the fintech industry, ensure that your platforms offer robust security measures like biometric logins and real-time fraud detection.

Customer Service Teams

- Spot Fraud Early: Train customer service teams to spot fraud early and be prepared to escalate issues quickly if they notice anything suspicious in a client’s banking activity.

Banks Slash Rates? UK Families Could Save £9,700 in Mortgage Interest This November Alone

UK Families at Risk: The AI Scam That’s Silently Stealing £595 From Victims