Do This One Crucial Thing Before Starting Their Christmas Shopping: The festive season is coming fast, and UK households are being urged to set a clear budget before starting their Christmas shopping. Experts say 2025’s Christmas could be one of the most financially stressful yet—thanks to stubborn inflation, higher living costs, and the ever-growing pressure to make the holidays “perfect.” But while holiday ads and social media scream “buy now”, financial experts from the UK’s top consumer organizations are saying the opposite: “Pause. Plan. Budget.” Whether you’re a busy parent, a first-time renter, or a professional trying to stay on top of your finances, budgeting early can be the difference between a joyful December and a regret-filled January.

Table of Contents

Do This One Crucial Thing Before Starting Their Christmas Shopping

Budgeting for Christmas isn’t about cutting joy—it’s about protecting peace of mind. With the cost of living still high and consumer spending slowing, planning early and spending intentionally is the smartest move any household—or professional—can make. The message is clear: Start now, plan smart, spend wisely. A stress-free January is the best gift you can give yourself this year.

| Topic | Why it matters | Key Data / Insights |

|---|---|---|

| UK households urged to budget early | Avoid debt, overspending, and stress | Average UK household spends £748 at Christmas, with 1 in 5 using credit. |

| Weekly saving target | Builds a safe festive fund | Save ~£34.54/week from Oct–Dec to reach £345 by Christmas (Always Finance). |

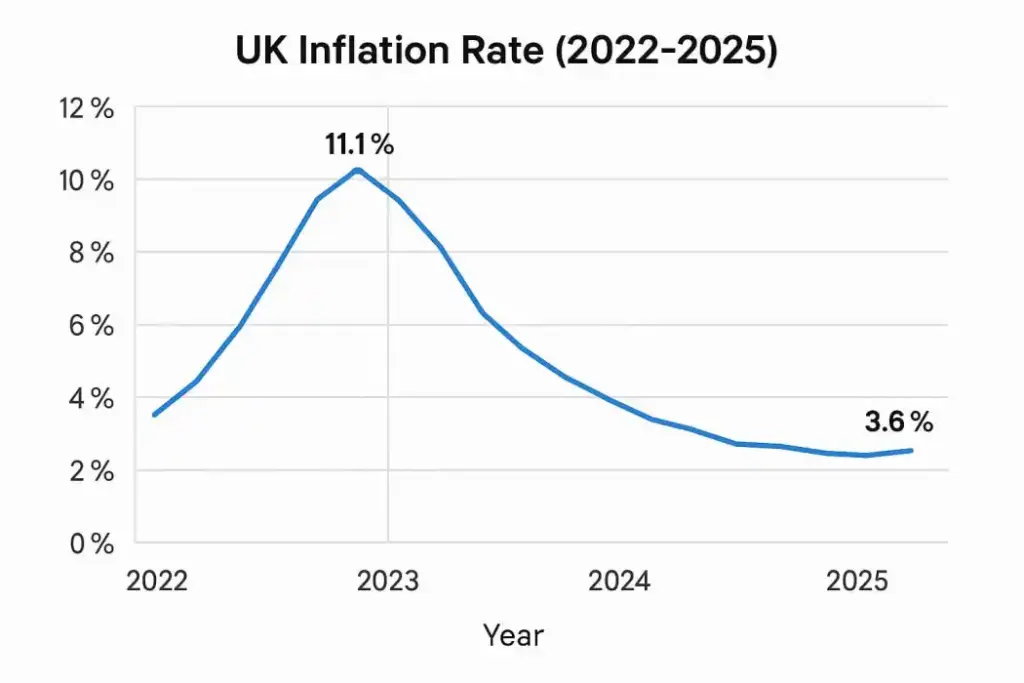

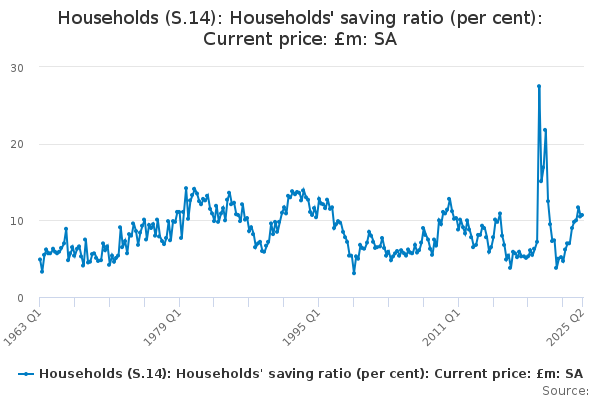

| Economic backdrop | Inflation still squeezing wallets | Inflation averaged 3.4% in 2025, while wage growth stagnated. |

| Retail trends | Cautious consumers ahead of holidays | UK retail spending rose only 2.3% year-on-year in September (Reuters). |

| Professional relevance | Applies to individuals, financial advisors, and retail pros | Includes 6-step budgeting guide, expert insights, and resource links. |

Why To Do This One Crucial Thing Before Starting Their Christmas Shopping Matter in 2025?

Let’s be real: 2025 hasn’t been an easy year for anyone’s wallet. Even though inflation has slowed, prices are still higher than they were before the pandemic. Groceries cost around 25% more than in 2019, and average energy bills remain above £1,800 a year. Add in rent or mortgage hikes, and most families are juggling tight margins.

According to Barclays’ Consumer Spending Report (2025), nearly 70% of UK shoppers say they plan to “spend less” or “look for deals” this Christmas. Retailers like Tesco and Aldi are responding with “price-locked essentials,” but household budgets are still under pressure.

So when experts say “budget first,” it’s not about being stingy—it’s about being in control.

“A Christmas budget isn’t about restriction—it’s about freedom,” says Sarah Penn, a financial coach with MoneyHelper UK. “When people plan early, they enjoy the holidays more because they aren’t stressing about the bills later.”

The Psychology Behind Overspending

Why do so many people overspend—even when they know better?

The answer is simple: emotion. Christmas triggers feelings of nostalgia, guilt, and generosity, all mixed together. We buy gifts to show love or to match what others are doing, and before we know it, we’ve hit the credit limit.

Here’s what drives it:

- FOMO: The fear of missing out—especially when stores push “limited time” deals.

- Guilt: Parents often spend more on kids to “make up” for a tough year.

- Social Pressure: Seeing everyone’s “perfect” Christmas on Instagram makes us spend more trying to match it.

The fix?

- Shop with a list.

- Wait 24 hours before impulse buys.

- Ask, “Would I still buy this if it wasn’t on sale?”

It’s about intentional spending, not deprivation.

The Do This One Crucial Thing Before Starting Their Christmas Shopping Plan (Simple & Proven)

Step 1: Know Your Total Spending Limit

Calculate how much you can realistically spend without touching rent, bills, or emergency savings.

If your monthly disposable income is £300, that’s your total holiday pot—stick to it.

Step 2: Split the Budget

Break your budget into categories:

- Gifts: 50%

- Food & Drink: 25%

- Decorations/Events: 15%

- Travel: 5%

- Emergency/Buffer: 5%

For example, if you have £600 total, that’s £300 gifts, £150 food, £90 events, £30 travel, £30 buffer.

Step 3: Save Weekly

Starting in October, saving £34.50 per week gives you £345 by mid-December. Use a dedicated savings account or “Christmas Pot” through banks like Monzo or Starling.

Step 4: Track Everything

Apps like Emma, Money Dashboard, or YNAB (You Need a Budget) sync with your bank and auto-categorize spending.

The rule: If you can’t track it, you can’t control it.

Step 5: Shop Smart

- Start early—prices rise in December.

- Compare prices using PriceSpy or CamelCamelCamel.

- Avoid “Buy Now Pay Later” unless it’s 0% and you can repay.

- Collect loyalty rewards and cashback.

- Shop second-hand for sustainable, cheaper options (Facebook Marketplace, Vinted, eBay).

Step 6: Review and Adjust

Midway through the season, check your progress. Overspent on gifts? Cut back elsewhere.

After Christmas, analyse what worked—so next year’s budget gets even smarter.

Real-Life Example: The Smith Family

Emma and Jake Smith, a family from Manchester with two kids, started budgeting in September.

They decided on a £500 Christmas limit, saved £40 weekly, and tracked every purchase in Monzo’s budgeting feature.

By buying early and using supermarket loyalty points, they spent £495—no credit cards, no stress.

Jake says, “It was the first January we didn’t dread checking our bank balance.”

Expert Insights and Data

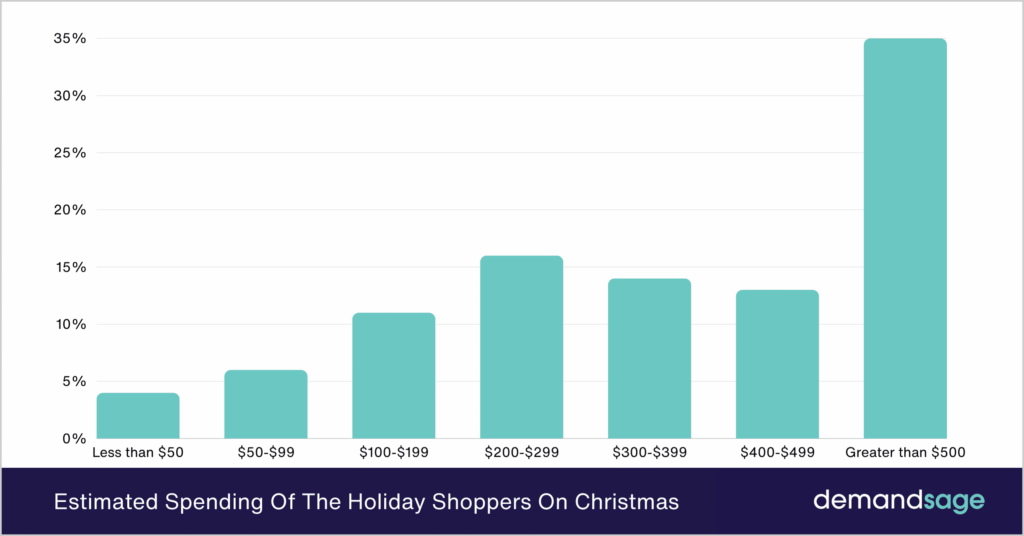

According to The Guardian, many UK consumers are shifting from impulse shopping to “value-based spending.” Retailers are seeing demand for budget-friendly bundles, smaller gifts, and practical items.

Barclays Consumer Research (Oct 2025) found:

- 61% of Brits plan to buy fewer gifts this year.

- 43% say they’ll use “cash only” for presents.

- 29% will rely on credit cards or BNPL services.

These numbers paint a clear picture: shoppers are cautious, but temptation is still high.

“Even £10 a week can make a difference. The earlier you plan, the less likely you are to fall into debt traps,” says Mark Hodson from StepChange.

Professional & Economic Relevance

This isn’t just about personal finances—it’s also about how professionals and retailers adapt.

For retailers, understanding that shoppers are more price-conscious means offering transparent pricing and early promotions. For financial advisors, helping clients plan seasonal budgets adds real value to their year-end reviews.

Budgeting skills are now part of financial literacy training in many UK workplaces. Employees with better financial wellbeing are more productive and less stressed—something HR professionals are paying attention to.

Tools & Resources

| Resource | Purpose |

|---|---|

| MoneyHelper Budget Planner | Free UK government budgeting tool |

| Emma App | Bank syncing and spending insights |

| Monzo Pots | Automatically saves spare change |

| Which? Christmas Spending Guide | Expert advice on saving |

| Citizens Advice | Free debt support |

Beyond the Budget: Emotional & Social Value

Budgeting doesn’t make Christmas less joyful—it can actually make it better. When money stress is off your shoulders, you can focus on what matters: connection, gratitude, and peace of mind.

Financial therapist Dr. Laura Hunt says:

“We equate spending with love, but love doesn’t come with a receipt. Children remember the feeling, not the price tag.”

So, instead of spending £500 on gifts, consider shared experiences—like baking days, board games, or volunteering. These moments cost little but mean everything.

$500 Christmas Bonus from DWP – Check If You’re Eligible Before It’s Too Late!

Banks Slash Rates? UK Families Could Save £9,700 in Mortgage Interest This November Alone

UK Homeowners Could Save £9,700 This November; Here’s How to Slash Your Mortgage Interest Fast