UK Homeowners Could Save £123 Every Month on Their Mortgage: If your mortgage payments feel like a second rent check every month, you’re not alone. Across the UK, thousands of homeowners are realizing they could save an average of £123 each month simply by making one smart move: remortgaging their home.

This isn’t a get-rich-quick scheme or financial trick. It’s about being smart with your money—and understanding that mortgage rates aren’t carved in stone. By switching your existing loan to a new deal with a better rate, you can cut costs dramatically, all without moving houses or changing your lifestyle. Let’s break it down clearly—what remortgaging means, why it matters now, and how to actually do it the right way.

Table of Contents

UK Homeowners Could Save £123 Every Month on Their Mortgage

If you’re paying more than 5% interest on your mortgage, now is the moment to act. Remortgaging can free up over £123 every month—that’s your grocery budget, your savings contribution, or your next holiday. By checking your deal, comparing offers, and consulting a reputable broker, you could transform your finances with one straightforward change. Don’t leave money on the table. A few hours of research today could mean thousands of pounds saved tomorrow.

| Topic | Details |

|---|---|

| Average Monthly Savings | £123/month on a £200,000 mortgage (switching from 5.25% to 4.25%) |

| Lifetime Savings Potential | £36,000+ over 25 years |

| Simple Change | Remortgaging (refinancing to a lower interest rate) |

| Best Time to Switch | 3–6 months before your fixed term ends |

| Risks | Early repayment charges (ERCs) and arrangement fees |

| Sources | MoneyHelper UK, Bank of England |

| Average UK Mortgage Rate (Oct 2025) | ~4.3% fixed for two years, ~4.1% for five years |

What Is Remortgaging and Why Does It Matter?

In plain English, remortgaging means switching from your current mortgage deal to a new one—either with the same lender or a new one—to get a better interest rate or terms.

If you’re paying a 5.25% rate on your home loan and a lender offers you 4.25%, that 1% cut could translate into a saving of around £123 every month. Over time, that’s £36,000 or more that stays in your pocket instead of the bank’s.

Remortgaging isn’t only about lowering your payments. It can also let you:

- Consolidate debts into your mortgage at a lower rate.

- Borrow extra cash for renovations or repairs.

- Change your mortgage type, for example from variable to fixed.

- Reduce your mortgage term and become debt-free sooner.

In short, it’s about making your mortgage work for you—not the other way around.

Why Many Homeowners Are Still Overpaying?

Surprisingly, millions of homeowners are still paying the wrong rates. When your initial mortgage deal ends—usually after two to five years—you automatically move to the Standard Variable Rate (SVR).

The SVR is your lender’s default interest rate, and it’s typically 1.5 to 3 percentage points higher than most fixed-rate deals. As of 2025, the average SVR hovers around 7%—a costly place to be.

According to UK Finance, more than 800,000 households are stuck paying these high SVR rates. That’s money essentially being burned every month. The main reasons?

- Lack of awareness about deal expirations.

- Fear that switching is complicated or expensive.

- Misconceptions about eligibility or credit requirements.

In reality, the remortgaging process has never been easier. Online lenders and brokers can now compare hundreds of deals in minutes, handling nearly everything digitally.

How Much Can You Save? The Numbers Tell the Story

| Loan Amount | Old Rate (5.25%) | New Rate (4.25%) | Monthly Savings | 25-Year Savings |

|---|---|---|---|---|

| £150,000 | £898 | £832 | £66 | £19,800 |

| £200,000 | £1,197 | £1,074 | £123 | £36,900 |

| £250,000 | £1,496 | £1,342 | £154 | £46,200 |

Even a half-percent difference can save hundreds each year. If your balance is larger, the gains multiply quickly. These figures are based on a 25-year fixed-rate mortgage and were calculated.

Understanding the Current Mortgage Landscape

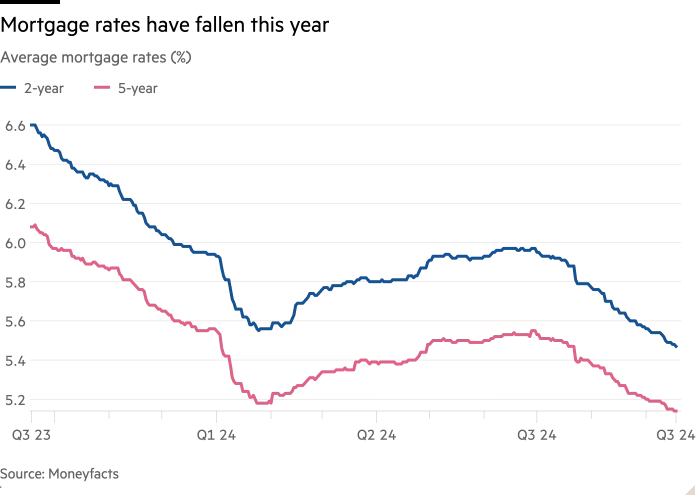

The mortgage market in the UK has seen wild shifts over the past three years. After the economic shock of 2022–23, interest rates climbed sharply. The Bank of England pushed its base rate to 5.25% to combat inflation.

In 2025, things are stabilizing. The average two-year fixed rate sits at roughly 4.3%, and five-year rates hover around 4.1%. Many analysts predict moderate stability through 2026.

This means now may be the perfect time for homeowners to lock in lower rates before another market swing.

As Sarah Coles, Head of Personal Finance at Hargreaves Lansdown, notes:

“Even a one-percent drop can make the difference between struggling and breathing easier. Remortgaging remains one of the simplest cost-saving options for UK households.”

The Best Time to Remortgage?

Timing your remortgage correctly can maximize your benefits. Generally, you should start looking three to six months before your current deal ends. This allows enough time to compare options and avoid slipping onto the SVR.

You might also consider remortgaging if:

- Your rate is significantly above current averages.

- Your credit score or income has improved since you first borrowed.

- Your property value has risen, lowering your loan-to-value (LTV) ratio.

- You want to shorten or extend your loan term for flexibility.

Even if you’re mid-deal, you can sometimes remortgage early if the savings outweigh the early repayment charges (ERCs). A mortgage broker can calculate whether it’s worth it.

Step-by-Step Guide to Save £123 Every Month on Their Mortgage

Step 1: Review Your Current Deal

Gather your latest mortgage statement. Check your:

- Current balance and interest rate

- End date of your fixed term

- Remaining term

- Any early repayment charges

Knowing these details helps you understand what savings are possible and whether it’s worth switching now or waiting a few months.

Step 2: Compare Market Rates

Use trusted comparison platforms like:

- MoneySuperMarket

- Compare the Market

- MoneySavingExpert

Look for fixed-rate options for stability or tracker rates if you expect interest rates to fall further.

Step 3: Consult a Mortgage Broker

Mortgage brokers are the middlemen who do the heavy lifting for you. A whole-of-market broker can access lenders the public can’t. Recommended firms include:

- Habito

- Trussle

- London & Country (L&C)

Most brokers are free for borrowers because they’re paid by the lender once your mortgage completes.

Step 4: Calculate the Total Cost

Don’t get blinded by a low rate. Check the arrangement fees, valuation costs, and legal charges. Sometimes a slightly higher rate with low fees can save more in the long run.

Step 5: Apply and Finalize

Once you’ve found your deal, the process usually involves:

- Getting a Mortgage in Principle (MIP)

- Submitting documents like ID, payslips, and bank statements

- Awaiting valuation and approval

- Signing and completing

Most remortgages wrap up in six to eight weeks, often with minimal disruption.

Real-World Examples

Sarah from Manchester

A 35-year-old teacher, Sarah had a £200,000 loan at 5.39%. When her fixed term expired, her lender moved her to 7.49% SVR. She remortgaged to 4.29% fixed, cutting her payments by £219 per month—over £13,000 saved in five years.

James and Emily from Bristol

The couple had £180,000 left on their mortgage at 5.6%. Their new rate of 4.15% dropped their payment by £200 monthly. By using their deal’s 10% overpayment feature, they’re now set to finish their mortgage three years earlier.

These examples highlight how even modest rate changes can lead to significant long-term savings.

Expert Advice and Financial Insight

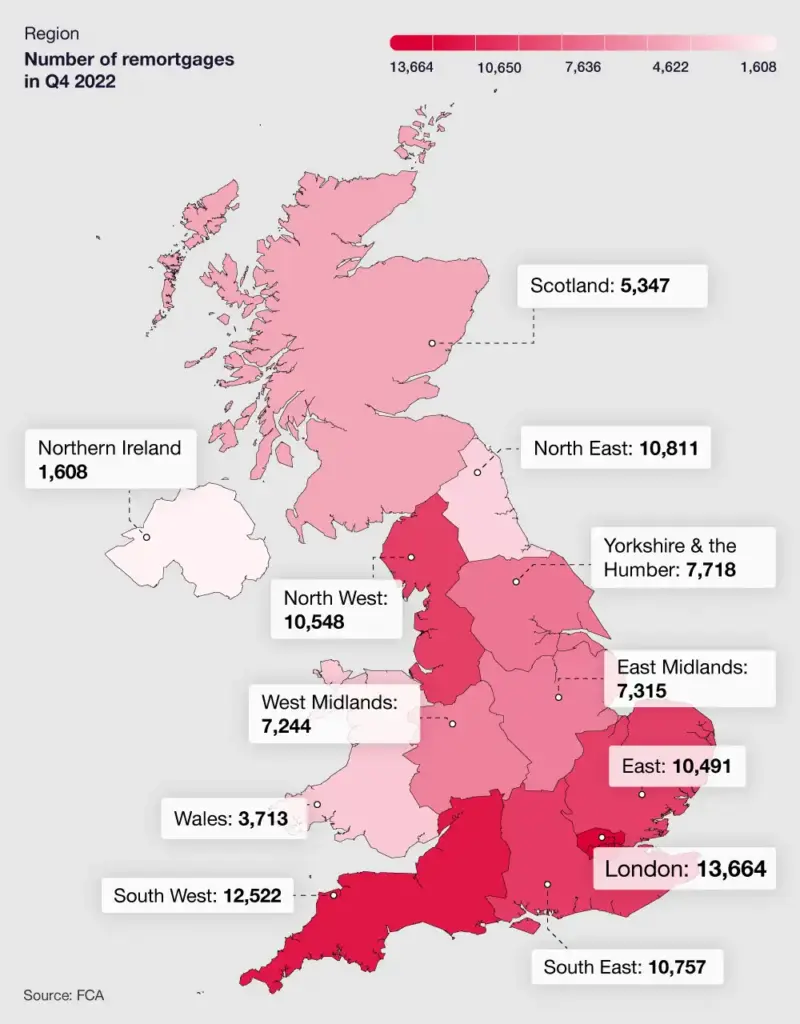

The Financial Conduct Authority (FCA) and MoneyHelper UK both recommend reviewing your mortgage regularly.

According to MoneyHelper, homeowners who remortgage every few years could save an average of £2,500 annually compared to staying on SVR.

Meanwhile, the Bank of England reports that around 45% of borrowers with fixed deals due to expire in 2025 could see their rates drop compared to last year.

In short, the window of opportunity is open, and it’s worth acting before economic conditions change again.

Pro Tips to Maximize Your Savings

- Improve Your Credit Score: Pay bills on time, reduce debts, and review your credit file.

- Lower Your LTV Ratio: If your home has appreciated in value, ask for a new valuation—it could unlock better rates.

- Use Overpayment Options: Many lenders let you pay up to 10% extra annually without penalties.

- Consider Shorter Terms: A 20-year mortgage may have higher monthly payments but can save thousands in interest.

- Lock Rates Early: If you find a good rate, many lenders let you secure it up to six months in advance.

Common Pitfalls to Avoid

- Waiting Too Long – Start comparing deals before your term ends; don’t roll onto the SVR.

- Ignoring Fees – Add up all costs to find the true saving.

- Extending Your Loan Too Far – It may lower payments but increases total interest.

- Skipping Credit Checks – One mistake on your report can delay or block approval.

- Failing to Re-evaluate Later – Mortgage markets shift. Recheck deals every few years.

Banks Slash Rates? UK Families Could Save £9,700 in Mortgage Interest This November Alone

UK Homeowners Could Save £9,700 This November; Here’s How to Slash Your Mortgage Interest Fast

The Bigger Picture: Why Remortgaging Matters in 2025

With inflation pressures still lingering and household budgets stretched, controlling recurring costs is crucial. Mortgage payments are often the single largest expense for most families.

Remortgaging isn’t just about saving cash—it’s about financial stability and planning ahead. By locking in a lower rate now, you shield yourself from future rate hikes and unpredictable market changes.

Experts from MoneySavingExpert note that homeowners who proactively switch deals every few years save, on average, £10,000–£15,000 per decade compared to those who don’t. That’s serious long-term value for minimal effort.