$496 GST/HST Credit Coming: As the leaves start to turn this October, many Canadians are preparing to receive a welcome financial boost from the government—the $496 GST/HST credit payment. This tax-free quarterly payment aims to ease the burden of the Goods and Services Tax (GST) and Harmonized Sales Tax (HST) that Canadians pay on everyday purchases like groceries, gas, and clothing. This article is a comprehensive guide to help you fully understand the credit, ensure your eligibility, and maximize the benefit in 2025. Whether you’re a casual taxpayer or a financial pro, this will bring clear insights and actionable advice.

Table of Contents

$496 GST/HST Credit Coming

The $496 GST/HST credit arriving in October 2025 provides a vital financial cushion to millions of Canadians, especially those with limited resources. This tax-free quarterly benefit helps offset the everyday GST and HST paid on essential goods and services. By understanding eligibility rules, filing taxes promptly, and you can ensure you receive your full credit. Whether you are single, married, or raising children, the GST/HST credit is a dependable financial ally helping you manage rising living costs.

| Feature | Details |

|---|---|

| Payment Amounts | Up to $496 in October 2025; up to $533 annually for single individuals; $698 for couples |

| Eligibility Criteria | Canadian resident, age 19+, income thresholds met, filed 2024 tax return on time |

| Payment Schedule | Quarterly: January 3, April 4, July 4, October 3, 2025 |

| Additional Benefits | Provincial top-ups, extra amounts for each child under 19 |

| How to Check Eligibility | Through CRA’s secure online portal My Account |

| Official Information Source | Canada Revenue Agency GST/HST Credit page |

What Is the GST/HST Credit?

The Goods and Services Tax (GST) and Harmonized Sales Tax (HST) are federal and combined federal-provincial taxes charged on most goods and services in Canada. Recognizing the financial impact of these taxes on low- and moderate-income households, the Canadian government offers the GST/HST credit, a tax-free quarterly payment designed to help offset the GST/HST you pay throughout the year.

This credit is administered by the Canada Revenue Agency (CRA) and is recalculated annually. It is based primarily on your family’s net income reported on your tax return and your family size. The idea is to reduce the financial load, improving your budget flexibility for essential expenses.

A Detailed Breakdown of How the GST/HST Credit Works

Step 1: File Your Taxes Accurately and On Time

Your 2024 income tax return forms the basis for your 2025 GST/HST credit payments. The CRA uses the data from this return each year to determine your eligibility and the amount you will receive.

Even if you had little income or no income, filing a tax return is essential to receive the credit. Failing to file or late filing can cause delays or disqualification. So, always file your taxes on time to avoid missing out.

Step 2: Understanding the Payment Period

The credit payments are made over a 12-month payment period, starting July 1, 2025, and ending June 30, 2026. The payment you receive this October falls within this period and is calculated based on your 2024 tax return.

You’ll receive four quarterly payments during this time: in January, April, July, and October.

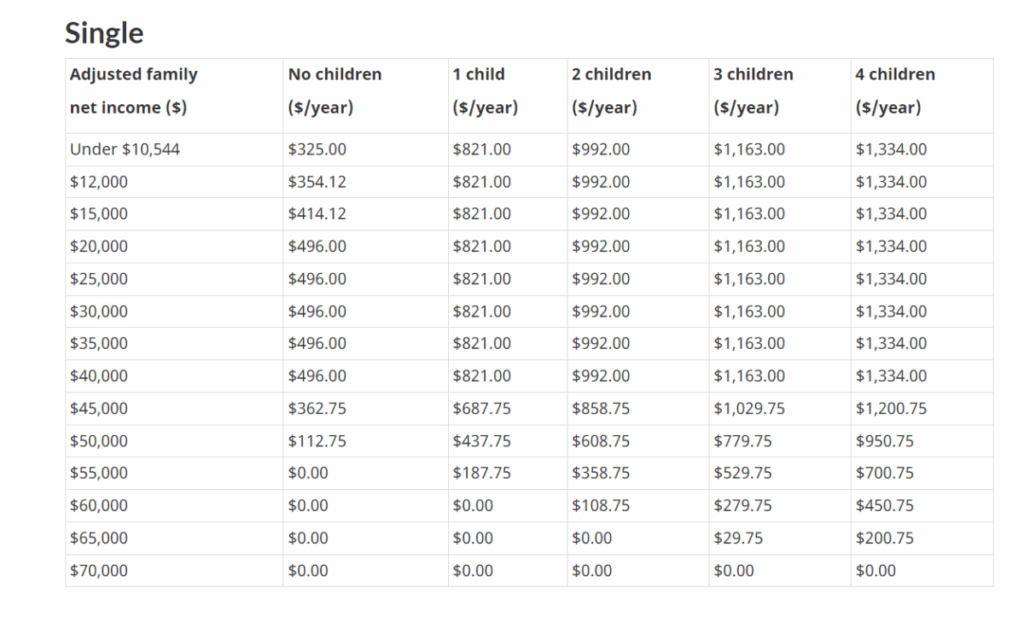

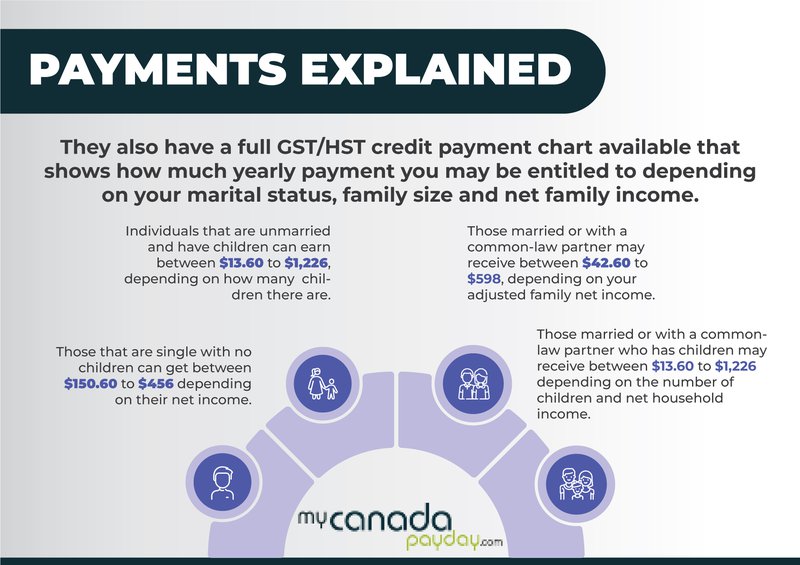

Step 3: How the CRA Calculates Your Credit Amount

The CRA factors in:

- Your adjusted family net income.

- Your marital status (single, married, or common-law).

- The number of children under 19 you have, who are registered for the credit.

For 2025:

- Single individuals with eligible income can receive up to $533 annually.

- Couples can receive up to $698 annually.

- You get an extra $184 for each child under 19.

However, this amount begins to decrement once your family’s income exceeds certain thresholds—roughly $45,000 for singles and higher for families depending on size. This phase-out prevents higher-income earners from receiving the benefit but supports those who need it most.

Step 4: Receiving Your Payment

Most Canadians receive their payments via direct deposit—which is the fastest and safest option. Payments usually show up with a note such as “GST/HST tax credit” on your bank statement.

If you don’t have direct deposit set up with the CRA, you will receive a cheque by mail, though this could take longer.

Who Is Eligible for the $496 GST/HST Credit Coming?

To qualify:

- You must be a Canadian resident for income tax purposes.

- You must be at least 19 years old. Younger applicants with spouses or children may qualify.

- You should have filed your 2024 tax return on time.

- Your adjusted family net income must be below CRA’s income thresholds.

- You must be registered or have eligible children under 19 for any dependent amounts.

Newcomers or immigrants may still be eligible but may need to submit additional forms and documents and ensure proper residency status is established.

It’s important to know that the credit is automatically assessed when you file your taxes—no separate application is necessary. However, accurate filing and timely submissions are crucial.

Provincial Top-Ups: What Extra Support Can You Expect?

Certain provinces provide top-up payments on top of the federal GST/HST credit, strengthening your benefit. Provinces like Quebec, Ontario, and Manitoba offer supplemental amounts, which boosts your total credit.

For example:

- Quebec residents could receive a provincial bump that increases the total credit beyond the federal maximum.

- Ontario and Manitoba also provide modest top-ups, mostly benefiting families with children or lower incomes.

These provincial contributions can elevate the total annual benefit, sometimes exceeding $1,000 for families, an important supplement to daily budgets.

How to Check Your $496 GST/HST Credit Status?

CRA My Account Portal

The quickest and most comprehensive method is the CRA My Account, an online portal where you can:

- View your exact GST/HST payment amounts.

- Check upcoming payment dates.

- Update your contact and banking details.

- Receive notifications about changes or issues.

If you haven’t registered yet, it’s a highly recommended, secure, and convenient way to keep tabs on your benefits.

Benefits Calculator Tool

Unsure about your expected credit? CRA provides a child and family benefits calculator on their website to give you a projected estimate of your credit.

Contact CRA Directly

If you prefer phone access or can’t use the online tools, you can contact CRA’s service line, but be prepared for possible wait times.

What Life Changes Affect Your Credit?

Your GST/HST credit can change if your situation does. It’s crucial to update your info with CRA when:

- You get married, separated, or divorced.

- You have children, lose custody, or children turn 19.

- Your adjusted family net income changes significantly.

- You move provinces.

Timely updates help avoid payment errors, underpayments, or overpayments.

CPP $1306 Payment Update in November 2025: Check Your Pension Eligibility, Payment Date

November $2600 Direct Deposit by CRA – Will you get this? Check Eligibility, Dates

Real-Life Example: How the Credit Helps Families

Consider Lisa and Mark, a couple with two kids living in Ontario, earning a combined adjusted net income of $48,000 in 2024. Alongside the federal GST/HST credit, they receive Ontario’s top-up, totaling approximately $1,000 a year or $250 per quarter. This additional income helps cover rising costs of groceries, childcare, and utilities, providing real, tangible relief in their monthly budget.

Recent Updates and Changes to the GST/HST Credit in 2025

The CRA has slightly increased the maximum credit amounts for 2025, reflecting inflation and rising living costs. They have also enhanced their online systems to streamline eligibility checks and direct deposit enrollments, making access easier and more secure.

Additionally, CRA has adjusted phase-out thresholds to gradually reduce credits for higher incomes, helping families plan their finances with predictability.

Tips to Maximize Your GST/HST Credit Benefit

- Always file your tax return on time, no matter your income level.

- Keep your banking and contact information current through the CRA My Account.

- Immediately report life changes like marriage, births, or moves to CRA.

- Use the CRA benefits calculator regularly to anticipate your payments.

- Pair your GST/HST credit with other programs such as Canada Child Benefit (CCB) for comprehensive support.