Canada CRA $2,600 Payment Arriving: If you’re living in Canada, you’ve probably caught wind of the buzz: a $2,600 payment from the Canada Revenue Agency (CRA) arriving this October 2025. While it sounds like a single jackpot, the truth is this is a combined total from several different government benefit programs designed to help Canadians through the pressures of rising living costs. Whether you’re a parent, a worker, a senior, or just curious to make sure you’re not missing out, this detailed guide breaks down exactly what you need to know—with clear, friendly explanations plus expert insights.

Table of Contents

Canada CRA $2,600 Payment Arriving

The Canada Revenue Agency’s $2,600 payment arriving in October 2025 is a combined set of critical benefits designed to support Canadians facing rising costs. These payments—ranging from child support to grocery rebates—offer relief to families, low-income workers, and seniors alike. By understanding eligibility, pay schedules, and keeping your tax filings current, you ensure these important funds reach you without delay.

| Benefit Program | Payment Date(s) | Who Qualifies | Typical Payment Amounts |

|---|---|---|---|

| Canada Child Benefit (CCB) | October 20 | Families raising children under 18 | $550 – $720/month per child |

| GST/HST Credit | October 3 | Low/moderate income Canadians | $250 – $600 annually |

| Ontario Trillium Benefit | October 10 | Ontario residents with income limits | Varies; support for property & energy taxes |

| Advanced Canada Workers Benefit | October 10 | Low-income workers 19+ years old | $400 – $2,461 annually + disability supplements |

| Canada Grocery Rebate | October 15 | Family incomes under thresholds | $234 – $412 one-time |

| $300 Federal Payment | October 28 | Eligible low to moderate income | $300 one-time payment |

What Exactly Is the Canada CRA $2,600 Payment Arriving?

Let’s clear the fog: the $2,600 isn’t a lump-sum deposit or a brand-new payment. Instead, it is the combined total of multiple benefits and credits paid out across October. These benefits provide financial support to millions by helping with things like groceries, rent, childcare, and utility bills, especially when inflation makes day-to-day expenses skyrocket.

Here are the key programs that contribute to this total:

- Canada Child Benefit (CCB) – Monthly support for families with kids.

- GST/HST Credit – Quarterly tax-free credit to help with sales tax expenses.

- Ontario Trillium Benefit (OTB) – Helps eligible Ontario residents with energy and property taxes.

- Advanced Canada Workers Benefit (ACWB) – Aimed at low-income workers to boost earnings.

- Canada Grocery Rebate (new in 2025) – Offset rising grocery prices.

- One-time federal relief payments and other provincial supplements.

Each comes with its own eligibility, payment schedules, and amounts, but together, they total roughly $2,600 for those who qualify for all or most benefits.

Who Qualifies for These Benefits?

Every benefit program has rules and income thresholds, but here’s a more detailed rundown of who benefits:

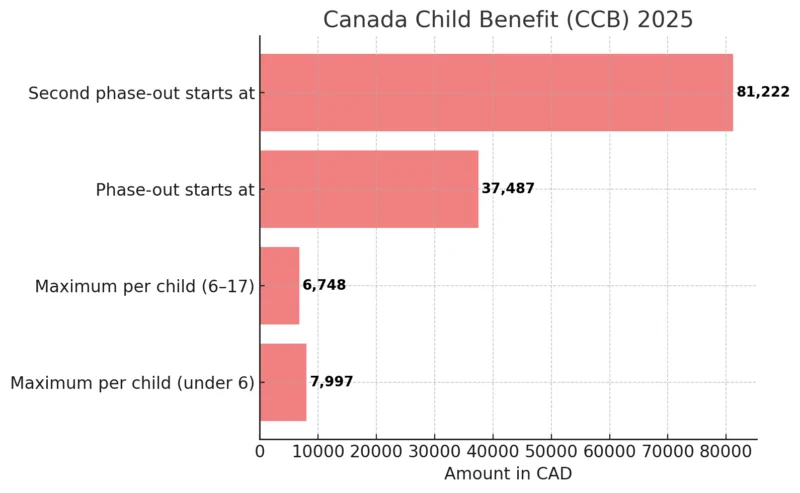

Canada Child Benefit (CCB)

This is a monthly tax-free benefit designed for families raising kids under 18. Payments are income-tested, so lower-income families get larger monthly amounts. Your 2024 tax return determines eligibility and the amount you receive for the 2025-26 benefit year.

- Bonus payments for children under 6.

- Includes provincial/territorial top-ups in some areas.

- Filing taxes on time is critical to continue receiving payments without delays.

GST/HST Credit

This quarterly benefit helps offset sales tax costs for lower- and middle-income Canadians. The October payment is the last installment for the 2025 benefit year.

- Eligibility is automatic when you file taxes, no application needed.

- Payments consider your marital status, family size, and income reported on your 2024 tax return.

- The credit has increased by 2.7% for the 2025-26 period due to inflation adjustments.

Ontario Trillium Benefit (OTB)

Available only to Ontario residents, this benefit combines several credits to assist with electricity, property, and sales taxes.

- Paid quarterly and tailored specifically to household income and energy use.

- Also includes Northern Ontario Energy Credit for eligible northern residents.

- Supports families and seniors facing higher utility costs amid rising prices.

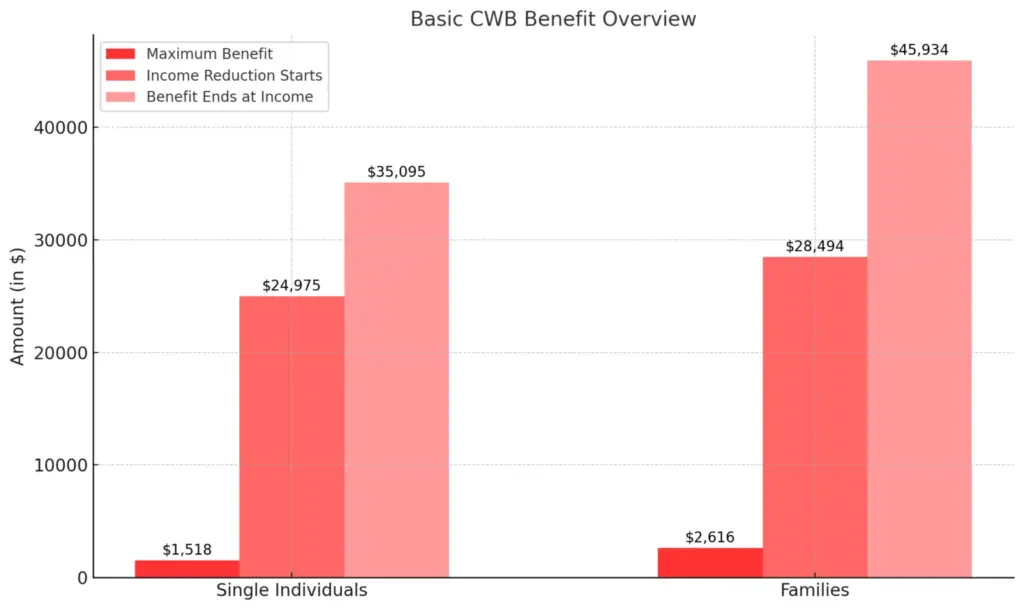

Advanced Canada Workers Benefit (ACWB)

The ACWB acts as a financial boost for low-income workers by providing an advance on the Canada Workers Benefit, which is based on the previous year’s reported income.

- Workers 19 years or older qualify if income falls under thresholds.

- Disability supplements are available for eligible individuals.

- Payments are made in installments; October is the first installment for many in 2025.

Canada Grocery Rebate (New in 2025)

This one-time payment is designed to ease the financial burden caused by grocery inflation, aimed especially at families and moderate-income earners.

- Eligibility based on your 2024 tax return.

- Income caps approximately $45,000 for singles and $65,000 for families.

- Helps cover groceries and essentials in an unpredictable inflationary environment.

$300 Federal Payment

This is a separate one-time federal relief payment sent to lower- and moderate-income Canadians who meet specific criteria.

- Automatically issued if you qualify.

- Helps with general expenses like rent or utilities.

- Paid on October 28, 2025.

When Exactly Will These Payments Arrive?

Knowing when to expect your benefits lets you budget smarter and avoid financial hiccups. Here’s the confirmed schedule for CRA payments in October 2025:

- October 3: GST/HST Credit – The final quarterly installment for 2025.

- October 10: Ontario Trillium Benefit and Advanced Canada Workers Benefit.

- October 15: Canada Grocery Rebate.

- October 20: Canada Child Benefit and related provincial top-ups.

- October 28: $300 Federal Payment.

Payments via direct deposit usually hit early in the morning on these dates, which is why CRA urges everyone to sign up if they haven’t already. Cheques mailed via Canada Post may be delayed due to strikes or weather events, so direct deposit is the safest, fastest option.

How to Ensure You Receive Canada CRA $2,600 Payment Quickly and Safely?

- File your 2024 tax return on time! The CRA uses your tax info to verify eligibility — no filing, no payment.

- Sign up for direct deposit through your CRA My Account. It’s quick, secure, and avoids postal delays.

- Keep bank and address details current to prevent bounced or lost payments.

- Track payments via CRA My Account or mobile app, where you can view your benefit history and upcoming payments.

- Set reminders for tax deadlines and benefits enrollment to avoid surprises.

- Beware of scams and never share personal info outside official CRA channels.

Real-Life Scenarios to Understand the Impact

Example 1: Emily, Single Mom Supporting Two Kids

Emily relies on the Canada Child Benefit to help with kids’ daily expenses.

- Each month, she gets roughly $700 from CCB.

- October adds the GST/HST credit installment ($400).

- Ontario Trillium Benefit helps with her utility bills.

- The Grocery Rebate ($400 one-time) eases the supermarket shock.

Emily sees roughly $2,200 extra in October—critical aid to balance her family’s budget.

Example 2: Raj, Low-Income Worker Without Kids

Raj gets support mainly from the Workers Benefit and GST/HST credit.

- The Advanced Canada Workers Benefit deposits an installment ($1,200 approx.) in October.

- The GST/HST credit quarterly payment boosts cash flow.

- The $300 federal relief at month’s end helps with bills.

This financial boost helps Raj avoid costly credit options and pay essentials on time.

Why the Canada CRA $2,600 Payment Matters in Today’s Economy?

In 2025, inflation has hit grocery shelves, gas prices, and home energy bills hard—stretching household budgets thin. These combined CRA benefits act like a lifeline, providing predictable and direct financial support that helps millions cover essential costs while maintaining dignity and stability.

Beyond individual households, these payments also stimulate local economies by putting money into the hands of people more likely to spend it on everyday goods and services.

Additional CRA Programs Worth Knowing

While the October benefits are huge, CRA also administers:

- Canada Disability Benefit: Regular support payments for adults with disabilities.

- Old Age Security (OAS) & Canada Pension Plan (CPP): Monthly payments for seniors and contributors.

- Climate Action Incentive Payments: For residents in provinces without provincial carbon pricing—paid quarterly.

- Support for newcomers: Once eligible by residency and filing, newcomers receive many similar supports.

CPP $1306 Payment Update in November 2025: Check Your Pension Eligibility, Payment Date

CRA Confirms $3900 One-Time Payment – When It’s Coming and Who’s Eligible in Canada

CRA $2700 Coming For Canadian Seniors In October 2025 – Is it true? Check Payment Date & Eligibility