Free £175 from Nationwide: So, you’ve heard the buzz — Nationwide is offering a free £175 cash bonus just for switching your bank account over to them in 2025. Sounds like a sweet deal, right? Before you start imagining what you’ll spend your bonus on, it’s crucial to understand exactly what you’re signing up for. This isn’t just handing out money like it’s candy. There’s some important fine print that could trip you up if you’re not paying attention. This guide will break down everything you need to know, talk through the nitty-gritty details, share practical steps to help you get that bonus without a hitch—and even explore why this offer might or might not be the right move for you. Whether you’re a newbie just curious about switching banks or a seasoned pro looking for a solid side hustle strategy, this article has you covered.

Table of Contents

Free £175 from Nationwide

The Nationwide £175 switching bonus is a genuine, achievable offer for those ready to change their banking relationship in 2025. Following the small-print conditions carefully—like transferring two direct debits, depositing £1,000, making a debit card payment, and completing the switch within deadlines—is essential to avoid disappointment. Nationwide’s FlexDirect, FlexAccount, and FlexPlus accounts all offer different benefits tailored to various customer needs; knowing these helps you choose the best fit beyond just chasing the bonus. Using the robust and secure Current Account Switch Service ensures your payments and balances transfer smoothly without disruptions. With this detailed guide, you have the knowledge and practical steps to confidently switch and pocket that bonus in style.

| Feature | Details |

|---|---|

| Bonus Amount | £175 |

| Eligible Accounts | FlexDirect, FlexAccount, FlexPlus |

| Minimum Direct Debits to Switch | 2 |

| Deposit Requirement | £1,000 within 31 days |

| Debit Card Payment Requirement | At least 1 transaction within 31 days |

| Switch Service Used | Current Account Switch Service (CASS) |

| Time Limit for Switch Completion | 28 days |

| Restrictions | Cannot have received similar bonus since 2021 (exceptions for sole-joint switches) |

| Bonus Payment Timeline | Within 10 days of fulfilling conditions |

| Official Details and Terms | Nationwide Official Switch Offer |

Why Is There a Free £175 from Nationwide?

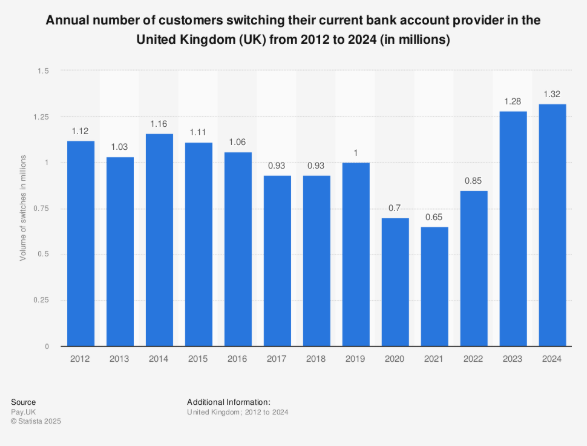

Before unpacking all the conditions, here’s the tea: Nationwide wants your business. Banks and building societies shell out cash incentives like these to attract new customers because your banking relationship means steady fees, interest margin, and cross-selling opportunities on products like mortgages, loans, and insurance.

But it’s not just a giveaway — the process has built-in hurdles to make sure only genuine switchers benefit, and to discourage folks from “churning” (switching accounts back and forth just to grab free cash). So while you stand to gain, you gotta play by their rules. Understanding this helps you approach the offer strategically, knowing what behavior is rewarded and what will get you disqualified.

Step-by-Step: How to Get That Free £175 from Nationwide

Pick the Right Account

Don’t just sign up for the first Nationwide account you find. The bonus applies only if you switch to one of these:

- FlexDirect: Offers decent perks alongside no monthly fees for the first year and some good interest rates on balances. It’s a strong choice if you’re looking for a solid all-around account with the potential to earn some interest, which is increasingly rare in current accounts.

- FlexAccount: Basic current account with no monthly fees, geared towards everyday banking without fuss. It doesn’t offer interest or perks but is a straightforward choice for those wanting simplicity.

- FlexPlus: Packed with extras (travel insurance, mobile phone cover, breakdown cover), but carries a monthly fee. This account is ideal if you value these bundled benefits and spend enough to justify the fee.

Each account suits different needs. For example, if you often travel, FlexPlus’s insurance benefits could save you money elsewhere. However, if you’re just after the bonus and low-cost banking, FlexDirect might be best.

Use the Current Account Switch Service (CASS)

This is the official UK banking switch system that guarantees your payments and banking history transfer smoothly within 7 working days, and your old account closes automatically. Without CASS, your switch won’t count for the bonus.

The CASS process helps you switch without the hassle of manually moving payments—which can be risky and lead to missed bills or bounced payments. It transfers all regular payments, including salary, benefits, bills, standing orders, and most importantly for the offer, Direct Debits.

Pro tip: Double-check that your old bank account has at least two active direct debits set up because those have to move over successfully. Standing orders or recurring card payments don’t count. Getting this wrong is one of the most common reasons people miss out on the bonus.

To start the process, you apply for your chosen Nationwide account online or via app. You’ll agree a switch date that must allow at least 7 working days for completion and cannot fall on a weekend or Bank Holiday. Your old bank will close your account on your switch date.

Timing Is Everything: Switch Within 28 Days

After you open your Nationwide account and request a switch, you have 28 days to complete the process—including closing your old account and moving all payments. Missing this window voids the offer.

This deadline ensures the bank’s incentive isn’t exploited and encourages genuine new customers. Planning ahead helps—don’t wait until the last minute to initiate your application or switch.

Deposit at Least £1,000

You need to deposit a minimum of £1,000 into your new Nationwide account within 31 days of switching. This can be transferred over from your old account or come from salary or savings, but transfers from another Nationwide account or Visa credit card aren’t eligible.

Think of this as a sign of genuine use—you’re not just opening an account to grab the bonus but actually using it. It also offers flexibility in how you meet this, whether a lump sum or multiple small deposits adding up to £1,000.

Make a Debit Card Purchase

Make at least one purchase with your new Nationwide debit card within 31 days of the switch. This can be as small as buying a coffee or paying a bill online. The idea is to confirm you’re actively using the account.

Most debit card payments, including contactless payments, Apple Pay, and Google Pay, qualify. It’s a simple but important part of the offer’s conditions.

Get Your £175 Bonus

Once all conditions are fulfilled, Nationwide will credit you the £175 bonus within 10 days. It typically appears on your statement as “Switching Offer” or similar.

What Could Trip You Up? Avoid These Common Pitfalls

No Direct Debits = No Bonus:

If your old account lacks two active direct debits, or if they aren’t properly transferred through CASS, you’re out of luck. Many people assume standing orders count, but they don’t. Make sure your regular payments qualify beforehand.

Switch Process Not Fully Completed:

Partial switches or holding multiple accounts with the same bank during the process disqualify you. The CASS guarantees your old account closes and payments migrate, but you need to ensure this happens timely.

Missing Deadlines:

Both the full switch and deposit/debit card use have strict time frames (28 and 31 days). Late actions won’t be forgiven.

Previous Bonuses:

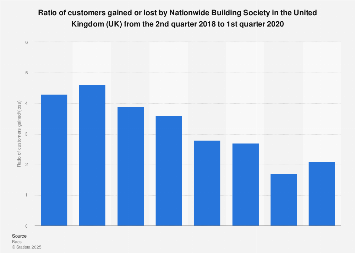

If you’ve collected a similar Nationwide switching bonus since August 2021, you generally won’t qualify again, except if you switch between sole and joint accounts.

Debit Card Use Forgotten:

Skipping the minimum one debit card transaction is an easy misstep—don’t forget this!

Beware of £275 Claim Rumors:

Some chatter online claims higher bonuses, but the official and confirmed offer is £175 as of 2025.

Why Consider Switching Your Bank Account?

Besides the obvious instant cash boost, switching bank accounts can improve your financial life in various ways:

- Higher Interest Rates: Nationwide’s FlexDirect account offers a competitive 5% AER on balances up to £1,500 for the first year, which beats many typical current accounts. This can effectively grow your savings while you bank.

- Better Perks and Services: FlexPlus includes things like worldwide travel insurance and mobile phone insurance, often saving you money if you’d buy similar coverage separately.

- Improved Customer Service: Nationwide’s reputation for strong service and trust can make everyday banking less stressful.

- Financial Organization: Moving to a new account can be a chance to review and eliminate unused direct debits and standing orders, improving budget control.

However, take care to weigh any fees (like FlexPlus’s monthly charge) against benefits and your spending habits.

Nationwide Account Comparison to Suit Your Needs

| Feature | FlexDirect | FlexAccount | FlexPlus |

|---|---|---|---|

| Monthly Fee | None | None | £18/month |

| Interest on Balances | 5% on up to £1,500 for 12 months | None | None |

| Cashback on Debit Card | 1% up to £5/month for 12 months | No | No |

| Overdraft Facility | Yes (Interest-free up to £50) | Yes | Yes |

| Travel Insurance | No | No | Yes (worldwide, including winter sports) |

| Mobile Phone Insurance | No | No | Yes |

| Fee-Free Spending Abroad | No | No | Yes |

| Best For | Interest earners & cashback seekers | Budget-conscious users | Insurance/perks lovers |

Nationwide Is Sending £275 to Customers; But Only If You Complete These Two Easy Steps

Banks Slash Rates? UK Families Could Save £9,700 in Mortgage Interest This November Alone

UK Families at Risk: The AI Scam That’s Silently Stealing £595 From Victims

Understanding the Current Account Switch Service (CASS) Process

The Current Account Switch Service (CASS) is the backbone of the Nationwide switch offer. It makes moving your bank account seamless, protecting you from payment disruptions.

Here’s how it works in detail:

- Apply for your new Nationwide account online or via app.

- Choose a switch date, allowing at least 7 working days for processing (no weekends or bank holidays).

- You’ll sign a Current Account Switch Agreement and Closure Instruction, authorizing automatic transfer.

- On your switch date, all your incoming (salary, benefits) and outgoing payments (Direct Debits, standing orders) move across.

- Your old account closes automatically; any payments mistakenly sent to your closed account are redirected for 36 months.

- You’re covered by the Current Account Switch Guarantee, which ensures any errors in the switching process are corrected and refunded if needed.

CASS is designed to safeguard you from hassles historically associated with switching banks, such as missed payments or account overlaps. Also, switching via CASS won’t affect your credit score negatively unless you apply for overdrafts or credit simultaneously.