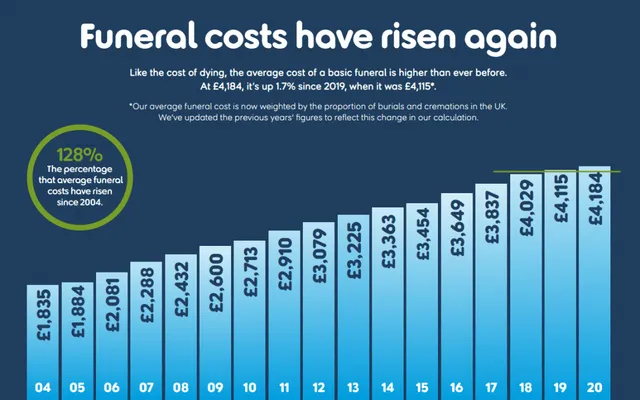

Why UK Families Are Being Pushed to Fork Out £1,700 More: Losing a loved one is one of life’s most painful experiences. While families face emotional pain, they also grapple with financial burdens that often catch them off guard. In the UK today, after paying an average £4,285 for a simple funeral, families must also find an extra £1,700 or more to cover hidden, unexpected costs. These costs come from legal fees, catering for wakes, travel, flowers, and other miscellaneous charges that add up quickly. This article unpacks why these costs are rising, what the funeral industry looks like in 2025, and how families can plan better to avoid overwhelming financial stress during tough times.

Table of Contents

Why UK Families Are Being Pushed to Fork Out £1,700 More

The cost of funerals in the UK has soared with hidden costs adding on average £1,700 or more beyond the expected bill. This financial squeeze, driven by inflation, changing social customs, and an ageing population, places real strain on bereaved families. Planning ahead with comprehensive cost knowledge, prepaid plans, insurance, and government benefits can safeguard families during these difficult times. Transparent communication and support for emotional health are equally vital. Facing the financial realities clearly means families can focus on what truly matters — honoring their loved ones with dignity and peace of mind.

| Aspect | Details |

|---|---|

| Average simple funeral cost | £4,285 (2025 UK average) |

| Average total cost of dying | £9,797 (includes funeral + added fees) |

| Additional hidden expenses | £1,700+ (legal administration, catering, transport, memorials) |

| Leading funeral market size | £3.1 billion in revenues (2025), growing at CAGR 3.3% |

| Regional cost differences | London funeral median at £5,449; Northern Ireland £3,441 |

| Government financial support | Funeral Expenses Payment (£1,000+ aid for eligible families) GOV.UK Funeral Payments |

| Uptick in funerals and market | 522,733 cremations in 2024; industry rapidly adapting to changing socio-cultural trends |

Why UK Families Are Being Pushed to Fork Out £1,700 More?

Most UK families expect funeral director fees and coffin costs. But beyond this, many face large, hidden expenses that push the total cost much higher:

- Legal and estate-related fees: Probate, wills, and asset administration typically cost over £2,500, yet many families don’t anticipate these charges when arranging the funeral.

- Catering for wakes: Hosting family and friends after a funeral can cost upwards of £2,500 for food and drinks.

- Floral tributes and memorial stationery: These items, while seen as essential by many, can add several hundred pounds.

- Transport and travel: Particularly for families arranging funerals away from their home area, travel expenses for themselves and the deceased’s body can be significant.

- Home clearance and related services: Sorting through and clearing the deceased’s home often incurs unexpected costs.

While these costs may seem secondary at first, they can nearly double the financial burden on families grieving a loved one in the current economic climate.

Rising Costs and Industry Trends Driving These Expenses

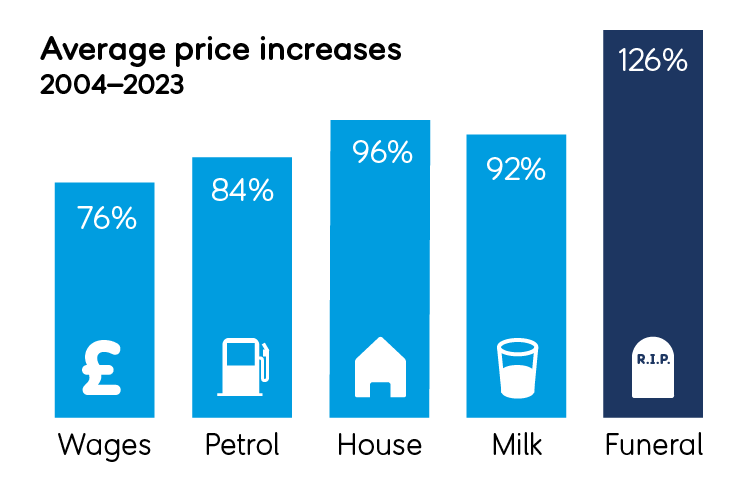

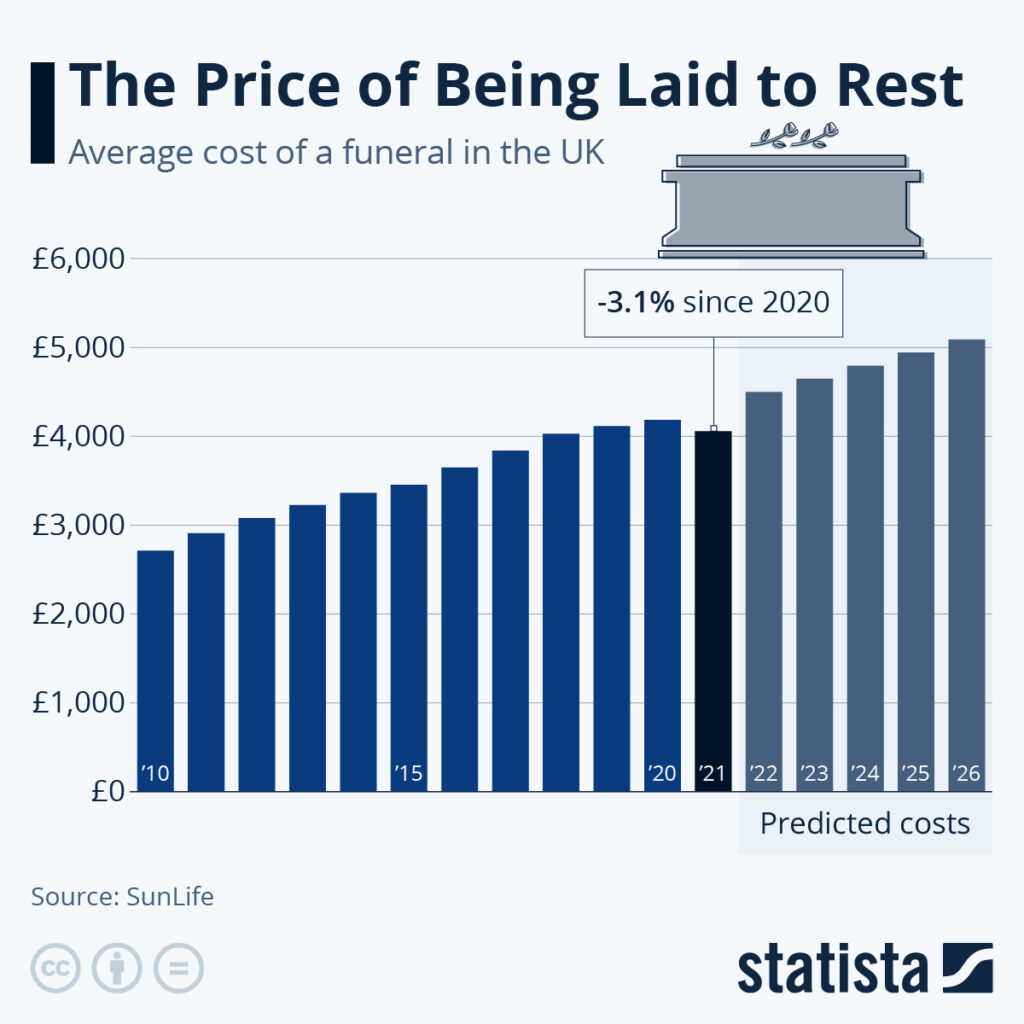

The increase in funeral costs reflects wider economic and social trends:

Inflation’s Impact

As with all sectors, inflation has pushed up wages, fuel, utilities, and material costs, affecting funeral homes, crematorium charges, and third-party providers.

Demographic Shifts

The UK’s ageing population is leading to more deaths annually. In 2024 alone, there were over 522,000 cremations, up from years prior. With one in four Brits expected to be over 65 by 2040, demand for funeral services continues to rise steadily.

Industry Market Growth

The UK funeral sector generated £3.1 billion revenue in 2025, growing annually at about 3.3% CAGR. Top firms like Dignity Group Holdings and Funeral Services Ltd dominate but face increasing competition from innovative smaller providers.

Changing Preferences

Social shifts are transforming funeral customs:

- Secular and bespoke ceremonies have overtaken religious funerals for most.

- Funeral celebrants (non-religious officiants) now perform nearly 65% of funerals.

- Environmental concerns prompt more eco-friendly options, including natural burials and biodegradable caskets.

- Digital technology has introduced livestreamed funerals and online memorials.

Funeral Cost Breakdown: What Families Typically Pay

| Cost Element | Average UK Cost (2025) |

|---|---|

| Funeral director & service | £2,297 |

| Basic attended funeral | £4,285 |

| Legal and estate administration | £2,549 |

| Wake catering and refreshments | £2,581 |

| Funeral flowers and tributes | £400+ |

| Transport and travel | £450+ |

Invisible to many are hidden fees such as probate or paperwork costs and post-funeral gatherings, which can add another £1,700 on average, doubling what families tend to expect initially.

The Rise of Direct Cremations and Eco-Friendly Funerals

Funeral trends show:

- Direct cremations, where no formal ceremony occurs, now make up more than 20% of UK funerals due to affordability (~£1,597 average cost). While lower cost, some families find them less emotionally satisfying.

- Eco-friendly funerals are growing in popularity, featuring carbon-neutral options, biodegradable urns, and natural burials.

- These choices reflect rising environmental awareness and budget realities.

How Families Can Better Manage Funeral Costs?

Full Cost Transparency

Ask for detailed quotes upfront from funeral directors, listing all charges from coffin to transport to paperwork fees. This avoids surprises.

Prepaid Funeral Plans

Lock in current prices to protect against inflation and ease future family financial burdens. Prepaid plans are becoming increasingly popular in the UK.

Funeral or Life Insurance

Ensure policies specifically cover funeral expenses; these can save thousands in the long run.

Budget Buffer

Keep a contingency fund of at least £1,700 beyond the funeral estimate to cover extras like catering or travel.

Explore Government Aid

Low-income families can apply for the Funeral Expenses Payment, which covers burial or cremation fees plus up to £1,000 for other expenses.

Foster Family Conversations

Discuss end-of-life preferences and finances early to reduce stress and confusion for surviving relatives.

Emotional Well-being: Navigating Grief alongside Finances

Funerals take a massive emotional toll. Coupled with financial worries, the stress can become overwhelming.

- Reach out to grief counselors or support groups.

- Take periodic breaks from planning and paperwork.

- Practice simple self-care: adequate rest, nutrition, and social connection.

Many UK charities provide bereavement support which is essential during this time.

UK vs US Funeral Cost and Trends Comparison

The US funeral market parallels the UK’s challenges with high average costs—about $9,000 (£7,350)—and increasing preference for direct cremations. Both markets face:

- Rising average costs due to inflation and rising professional fees.

- Increased interest in environmental funeral options.

- Digital innovation like livestreaming and online memorializing.

- Growing demand for personalized ceremonies over traditional religious ones.

Personal Story: The Real Cost Burden of Hidden Fees

Sarah from London recently arranged her father’s funeral. The initial quoted funeral was £4,500. However, after legal fees (£2,300), catering (£2,400), flowers (£850), and travel (£450), the final spend exceeded £10,500. This shock financial impact is becoming common among UK families without thorough prior planning.

UK Two-Child Benefit Cap Changes – Check How It Affects You & Eligibility Rules

UK Families at Risk: The AI Scam That’s Silently Stealing £595 From Victims

New DWP Rule Triggers £416 Monthly Cut – UK Families Urged to Check Payments Immediately