You Could Be Owed £700 in Compensation: If you’ve ever financed a car in the UK between April 2007 and November 2024, there’s a chance you could receive compensation averaging around £700. That’s right—millions of drivers who were misled or treated unfairly in motor finance deals have a pathway to reclaim money through a major redress scheme announced by the UK’s Financial Conduct Authority (FCA). This article offers a clear, comprehensive guide to this motor finance compensation scheme, simplifying the complexities, sharing practical advice, and helping you understand how to protect your rights and claim what you deserve.

Table of Contents

You Could Be Owed £700 in Compensation

If you financed a car in the UK between April 2007 and November 2024, you might be owed compensation. The FCA’s massive motor finance redress scheme aims to repay millions of drivers an average of about £700 for unfairly hidden fees and commissions. The claims process is designed to be straightforward, transparent, and free, ensuring that consumers get their fair share without hassle. Stay alert, check your finance agreements, and watch for communication from your lender—money that belongs to you could soon be headed your way.

| Key Info | Details |

|---|---|

| Eligibility Period | April 6, 2007 — November 1, 2024 |

| Average Payout | Around £700 per agreement |

| Total Estimated Payout | £8.2 billion |

| Potential Beneficiaries | Approximately 14 million consumers |

| Claim Process | Initiated by lenders/brokers contacting customers or customers contacting providers |

| Expected Payments Start | Early 2026 |

| Complaints Deadline | Extended until July 31, 2026 |

| Official FCA Scheme Info | FCA Motor Finance Compensation Scheme |

What’s You Could Be Owed £700 in Compensation About?

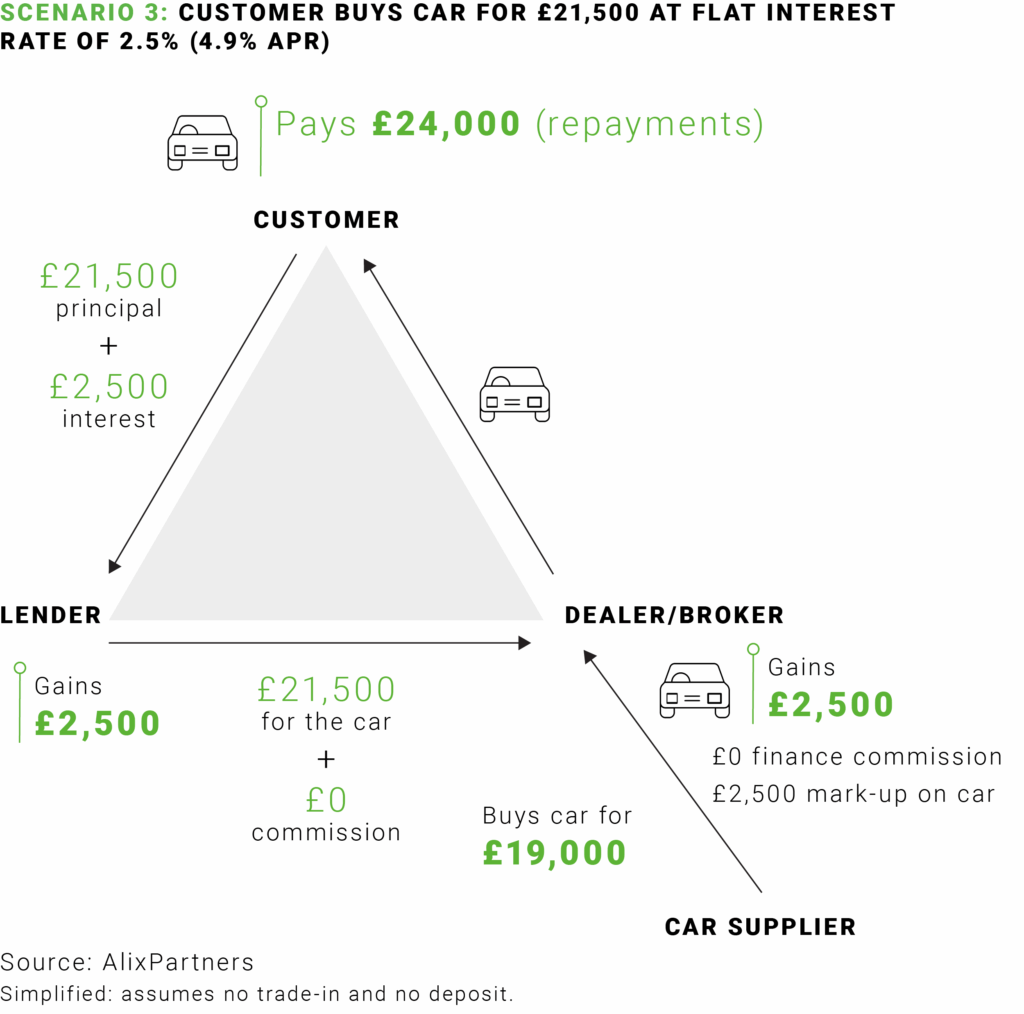

Buying a car often means taking a loan or hire purchase agreement. Many consumers in the UK have done this over recent years through brokers or dealers. However, the FCA found that numerous finance firms didn’t properly disclose commissions to brokers or dealers, which caused consumers to pay more than necessary.

The FCA’s redress scheme targets these unfair motor finance agreements, providing compensation to eligible customers for overpayments linked to hidden or high commissions. An estimated 14 million agreements are affected, meaning a potential payout of roughly £8.2 billion overall. The average individual payout—about £700—can mean a significant refund for many consumers, making this one of the most impactful redress programs in UK financial history.

The Root Cause: Understanding Motor Finance Mis-Selling

Here’s why this compensation is necessary:

- When financing a car, brokers or dealers often receive commissions from lenders for arranging loans.

- Regulations mandate full disclosure of such commissions to the consumer.

- Many firms failed to transparently disclose these fees or involved discretionary commissions and high commission rates which were not made clear.

- This lack of transparency meant that consumers paid higher interest rates or fees unknowingly, resulting in unfair borrowing costs.

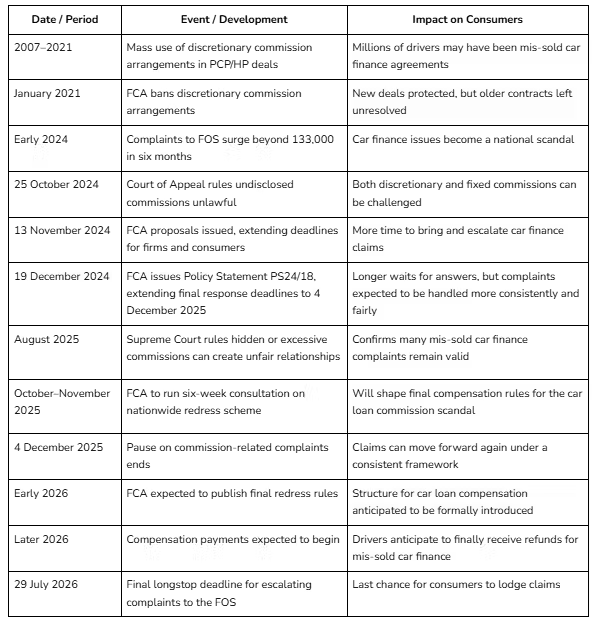

- The FCA stepped in following a landmark Supreme Court ruling that reinforced consumer rights in this area.

Who’s Eligible for £700 in Compensation?

- Consumers who signed regulated motor finance agreements between April 6, 2007, and November 1, 2024.

- The finance agreement involved commissions paid to brokers or dealers.

- Agreements where commission was inadequately disclosed, or the commission was above 35% of the total credit cost and at least 10% of the loan.

- Includes consumers, sole traders, small partnerships, and unincorporated bodies.

- Those who have already been compensated for these claims or currently have cases with the Financial Ombudsman Service are excluded.

How Does the Compensation Scheme Work?

- FCA Consultation & Launch

The FCA is consulting on the scheme design and expects to finalize policies by early 2026. The compensation scheme should launch shortly thereafter. - Lenders Contact Customers

Finance firms are required to contact eligible customers within specific timeframes—typically six months from scheme launch—to offer compensation details. - Claiming Compensation

Customers can accept and claim compensation without charge. The amount paid includes simple interest calculated from the date of overpayment (based on the Bank of England base rate plus 1%). - Escalating Complaints

If a claim is denied or delayed, consumers can escalate their complaint to the Financial Ombudsman Service for independent resolution.

Real-World Examples: How It Affects You

- Heather financed a compact car in 2012 via a dealer. She was never told how much commission was included in her finance agreement. Under the scheme, Heather could reclaim hundreds of pounds that were unfairly charged to her.

- John refinanced his SUV in 2019, with a fresh deal brokered independently. Despite refinancing, both his original and new finance agreements fall into the scheme, meaning John could receive payout for each qualifying agreement.

What This Means for You If You’re Buying a New Car?

The FCA scheme’s existence shines a light on past industry practices, but it also serves as a reminder to stay vigilant. When financing a car:

- Ask for full written disclosures on fees, commissions, and loan terms before signing.

- Shop around multiple lenders for competitive, transparent deals.

- Consider alternatives like personal loans or credit unions if they offer clearer terms.

- Always read all contract details carefully to avoid surprises.

Impact on the Motor Finance Industry

This compensation scheme is one of the most significant interventions into UK car finance in decades. The fallout includes:

- A projected payout liability for lenders between £8.2 billion and potentially £9.7 billion, depending on uptake.

- Estimated operational and compliance costs for firms are up to £2.8 billion, with total industry costs around £11 billion.

- Increased transparency and regulatory oversight moving forward.

- Changes to underwriting, disclosure, and broker compensation practices.

Preventing Fraud and Protecting Yourself

Given the scale of this scheme, watch out for scams:

- The FCA scheme does not charge fees; it’s free to claim.

- Avoid contacting unknown third-party “claims management” companies demanding upfront payments.

- Communicate only with your known lender or broker.

- Report suspicious schemes to UK Consumer Protection agencies or the FCA.

The Wider Impact on the UK Motor Finance Industry

The FCA’s motor finance compensation scheme is not just a big deal for consumers—it’s shaking up the entire car finance market. Lenders are facing potential liabilities estimated between £8.2 billion and £9.7 billion due to this redress program. While this might sound alarming, regulators predict the motor finance market will continue functioning well with strong competition and product availability. However, some smaller, non-prime lenders that serve higher-risk borrowers could face tougher funding challenges. The FCA is closely monitoring this to ensure consumers still have access to motor finance options without huge price hikes. Importantly, the scheme pushes the industry towards greater transparency and fairer practices, signaling a major shift in how car loans will be arranged in the future.

Staying Informed and Protecting Yourself from Scams

With such a vast compensation scheme unfolding, fraudsters may try to exploit consumers eager to claim. It’s crucial to protect yourself by only dealing directly with your known car finance lender or broker. Never pay any upfront fees for making a compensation claim—official FCA schemes are free. Avoid third-party “claims management” companies that promise faster payouts but often charge hefty commissions, potentially eating into your compensation. Always verify information through the FCA’s official website or reputable financial consumer organizations. Staying informed not only ensures you do not miss out on legitimate claims but also shields you from scams that could cost you money and personal data.

£11Bn Payout Ahead as Regulator Cracks Down on UK Car Finance Mis-Selling

New Car Tax Plan Could Hit All Rural UK Drivers This November – What You Need to Know

DWP Confirms £416 Monthly Benefit Cut – Urgent Action Required for Thousands of UK Families