State Pension Soars to £12,548 a Year: Big news for Britain’s retirees: the UK State Pension is set to soar to £12,548 a year from April 2026, boosted by a 4.8% increase under the government’s “Triple Lock” policy. This is great news for millions who rely on this income in retirement. But with the boost comes new tax challenges and bigger questions about the future of pensions in the UK. Whether you are nearing retirement or already enjoying it, this massive increase demands your attention—and your planning. Here’s everything you need to know—broken down into bite-size chunks.

Table of Contents

State Pension Soars to £12,548 a Year

The £12,548 State Pension boost heralds a welcome improvement for Britain’s retirees, promising more robust income in tough times. However, it also highlights emerging tax considerations and growing fiscal pressures threatening the triple lock’s long-term survival. Savvy planning, understanding your entitlements, and proactive financial management remain key as the pension landscape evolves. Ultimately, the best retirement is one built on solid state support and smart personal savings.

| Info | Details |

|---|---|

| New State Pension Amount (2026) | £12,547.60 per year (£241.30/week) |

| Basic (Old) State Pension Amount | £9,614.80 per year (£184.75/week) |

| Increase Percentage | 4.8% (driven by wage growth) |

| Effective Date | April 2026 |

| Approximate Additional Pensioners Paying Tax | Around 200,000 pensioners |

| Personal Income Tax Allowance (Frozen) | £12,570 |

| Estimated Cost of Triple Lock by 2030 | £15.5 billion annually |

| Official Reference | GOV.UK New State Pension |

What Is the UK State Pension?

The State Pension is essentially your government-guaranteed retirement income, funded by years of National Insurance contributions. To qualify for the full new State Pension, you need at least 35 qualifying years of contributions or credits. Those retiring before 2016 receive the Basic State Pension, which is lower but also increasing. Millions of Britons depend on this reliable income every month. It’s your financial safety net after decades in the workforce.

The Triple Lock: What Is It Exactly?

The “Triple Lock” is a government guarantee introduced in 2011. It promises the State Pension increases annually by the highest of the following:

- Average wage growth

- Inflation (measured by CPI)

- A guaranteed 2.5% increase

For 2026, the deciding factor was wage growth of 4.8%, which beat out inflation at 3.8%. This system protects retirees’ income from losing value and helps pensions keep pace with the rising cost of living and general wage increases.

The Numbers: How Much More Are You Getting?

| Pension Type | 2025 Amount | 2026 Amount | Annual Increase |

|---|---|---|---|

| New State Pension | £11,973 | £12,547.60 | £574.60 |

| Basic State Pension | £9,175.40 | £9,614.80 | £439.40 |

The uplift might sound modest, but for pensioners on a fixed income, this is meaningful extra money going into household budgets.

Why State Pension Soars to £12,548 a Year Matters?

Amid rising inflation and living costs, this extra pension income provides much-needed relief. Especially now, with costs for essentials such as food, fuel, and healthcare climbing, this bump enables retirees to maintain their living standards.

However, the catch is a frozen personal tax allowance at £12,570. This means the new pension of £12,548 barely skirts under the threshold, pushing many retirees into the tax net for the first time if they have any additional income.

Tax Implications: A Bump and a Bite

Financial experts warn that as many as 200,000 pensioners will now pay tax on their State Pension due to the freeze in the tax allowance. For instance, if a retiree receives the full new pension plus additional income (from dividends, savings interest, or private pensions), they could owe income tax.

This phenomenon means the government gains more revenue, but for pensioners, it can feel like one step forward, one step back.

Expert Opinions and Fiscal Challenges

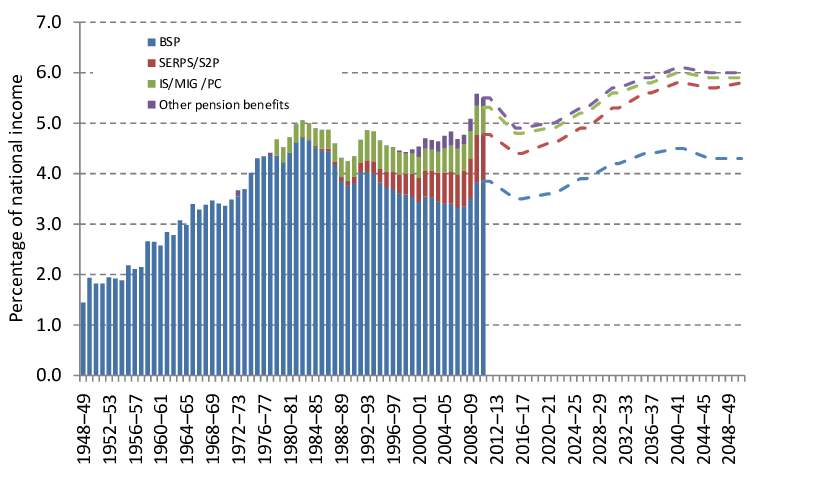

- The Office for Budget Responsibility (OBR) projects that the triple lock will cost taxpayers £15.5 billion annually by 2030.

- Economists argue the policy disproportionately benefits wealthier retirees compared to lower earners.

- The Institute for Fiscal Studies (IFS) warns about future generations bearing heavier tax burdens and facing later retirement ages due to rising pension costs.

While the triple lock preserves dignity and purchasing power for millions, its long-term affordability is a hot political topic.

Could Retirement Age Rise Again?

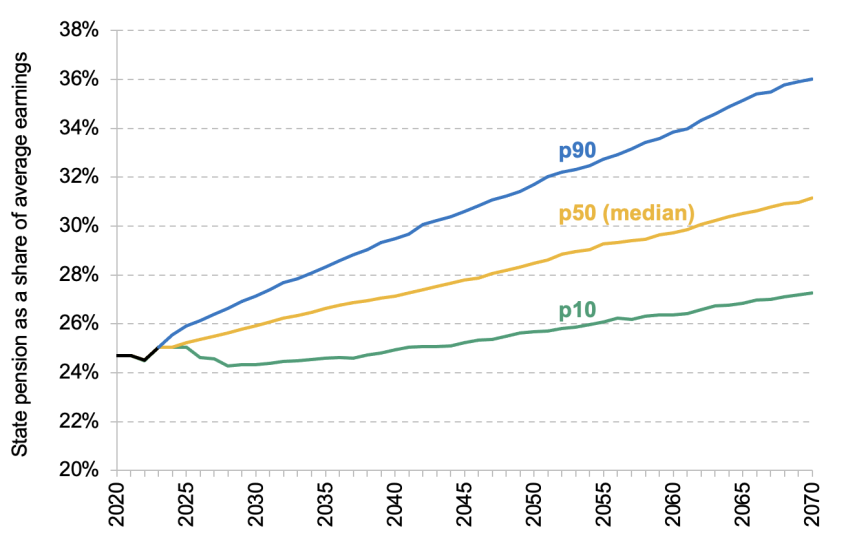

With people living longer and pension payouts lasting longer, the government is considering raising the State Pension age. It’s already legislated to increase to 67 by 2028, and discussions are underway to raise it further to 68 between 2036 and 2038, and potentially to 74 by 2070.

This reflects demographic realities but requires individuals to plan for longer working lives.

Historical Context: The Evolution of the UK State Pension

Understanding today’s pension boost means knowing its roots:

- The Old Age Pension Act of 1908 started it all, paying a small non‑contributory pension of 5 shillings/week to those over 70 who met strict income and character criteria.

- The Widows, Orphans, and Old Age Contributory Pensions Act 1925 introduced a contributory system where both employers and employees contributed.

- The Beveridge Report in 1942 laid the foundation for a universal state pension paid from 1948 under the National Insurance Act 1946, funded by mandatory contributions.

- Over decades, pensions were linked to earnings through schemes like SERPS (1978) and later the State Second Pension (S2P) (2002).

- The Triple Lock was introduced in 2011 to stop pensions losing value in real terms.

- A major reform came in 2016 introducing the New State Pension, simplifying the system for those reaching retirement age after April 2016.

This history reveals a steady evolution from minimal social assistance to a robust, earnings-linked safety net.

Real-Life Example: Linda and John

Linda, a retired nurse in Manchester, qualifies for the full new State Pension and earns £12,548 annually. She also gets £2,000 a year from a workplace pension—her taxable income surpasses the tax-free allowance by nearly £2,000. She ends up paying about £180 per year in tax but appreciates the pension rise helps her manage everyday expenses.

John, a retiree from Leeds with no extra income beyond the State Pension, benefits fully from the boost without paying a penny in tax. Yet, he remains concerned about future changes that might reduce these benefits or raise his pension age.

How to Make the Most of Your State Pension Boost?

Here’s a practical roadmap:

- Check your State Pension forecast at the official GOV.UK website to understand your entitlements.

- Review and fill National Insurance gaps with voluntary contributions to boost your pension.

- Plan your taxes smartly using ISAs and personal savings allowances.

- Consider applying for Pension Credit if your income is below thresholds—it can top up your income.

- Diversify your retirement income by investing in personal pensions or other savings vehicles.

- Stay updated with changes to pension policies by following trusted sources.

Looking Forward: What Comes Next?

- The Triple Lock remains guaranteed through the current Parliament but faces intense scrutiny and possible reform discussions post-2028.

- Pension age increases and means-testing are likely topics in upcoming debates.

- Growing costs challenge politicians balancing fiscal responsibility with social fairness.

- Personal financial planning will become even more critical to ensure a secure retirement.

UK Two-Child Benefit Cap Changes – Check How It Affects You & Eligibility Rules

£300 Pension Blow for UK Retirees – HMRC’s October 9 Rule Change Sparks Outrage

New DWP Rule Triggers £416 Monthly Cut – UK Families Urged to Check Payments Immediately