State Pension Set to Hit £12,548: If you’re wondering what the fuss is all about with the State Pension heading into April 2026, here’s the lowdown: the UK State Pension is set to jump to around £12,548 per year thanks to a policy that’s been making sure pensioners get a fair shake called the “triple lock.” Whether you’re just starting to think about retirement or keeping an eye on your financial planning, this boost is a big deal. Now, before you get lost in numbers and jargon, let’s break down what this means and how it happens—all in a way that’s simple to follow for everyone, from kids to pros working in finance. Plus, it’s packed with practical tips and solid facts you can trust.

Table of Contents

State Pension Set to Hit £12,548

The State Pension hitting £12,548 a year in April 2026 shines a spotlight on the government’s commitment to protecting pensioners’ income through the triple lock system. This increase reflects real wage growth and helps pensioners stay ahead of inflation. However, the rise also brings tax implications for many retirees, making it vital to plan well in advance. Whether you’re nearing retirement or already enjoying your pension, understanding these changes can help you manage your finances smartly and confidently.

| Aspect | Details |

|---|---|

| Annual State Pension | £12,548 (from April 2026) |

| Weekly Payment | Approx. £241.30 |

| Increase Rate | 4.8% (highest of earnings growth, inflation, or 2.5%) |

| Previous Annual Income | £11,973 |

| Basic State Pension Rise | To approx. £9,615 annually |

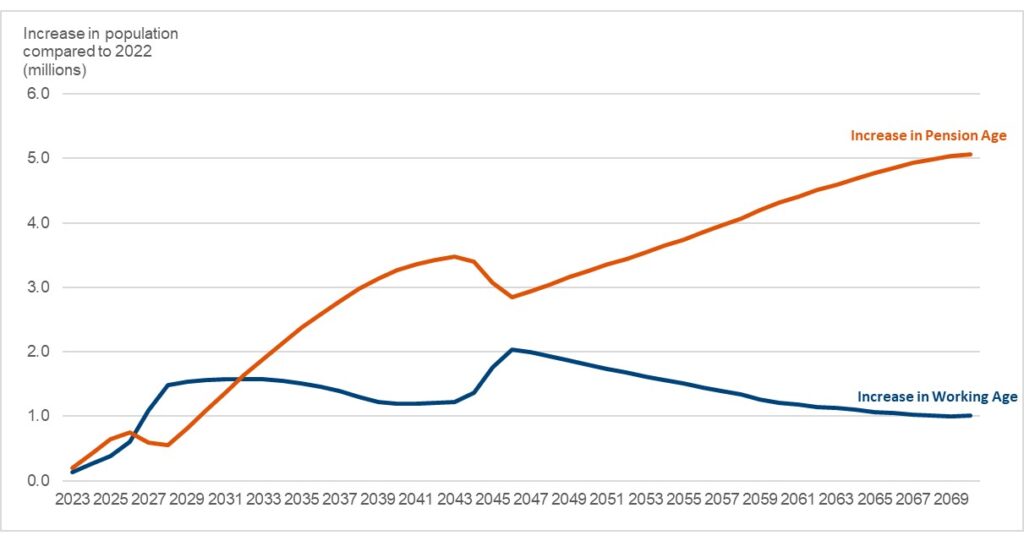

| Pension Age Change | State pension age rising from 66 to 67 starting April 2026 |

| Tax Impact | ~200,000 extra pensioners may pay income tax due to freeze on personal allowance near pension amount |

| Official Info Link | Gov.uk New State Pension |

What’s the Triple Lock and Why Should You Care?

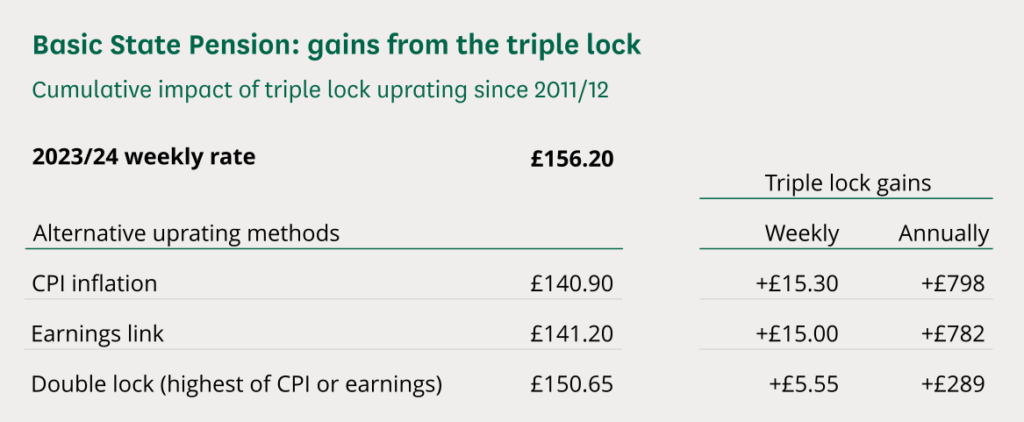

Imagine your paycheck going up every year so you can keep up with the cost of living and not lose buying power—that’s what the “triple lock” does for pensioners. It guarantees your State Pension increases annually by the highest of these three:

- Wage growth (how much paychecks are growing in general)

- Inflation (how much prices for everyday stuff like groceries and gas have increased)

- 2.5% minimum boost (a safety net, so it’s never less than this)

For April 2026, wage growth came out as the biggest winner at 4.8%, pushing up pension payments more than inflation (3.8%) or the default 2.5%. Pretty neat for those relying on this income!

This system was set up back in 2011 to make sure pensioners don’t fall behind financially—and it’s still doing its job strong.

The History: How Did We Get Here?

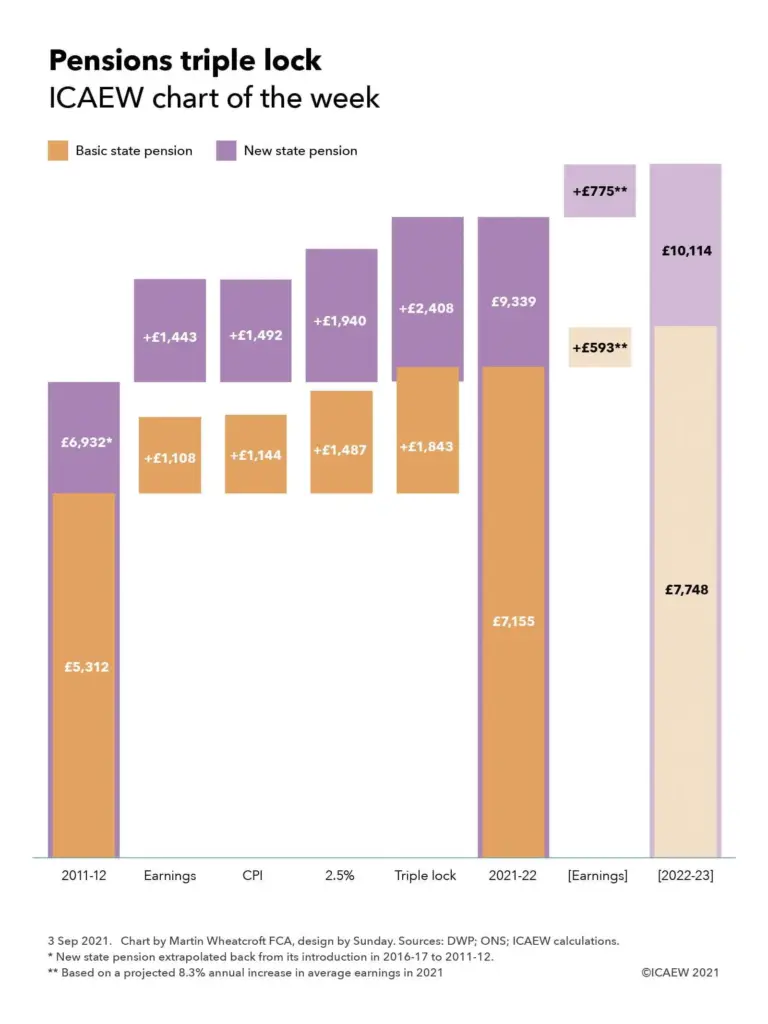

The State Pension in the UK has undergone significant evolution since its inception in 1948 as a basic safety net. Over the decades, the government has adapted it to changing economic realities and demographic trends. The triple lock was introduced in 2011 following a political pledge to safeguard pensioners’ incomes. Before that, stagnant or frozen pensions left many retirees vulnerable to inflation.

State Pension Set to Hit £12,548: Breaking Down the Numbers

So what does this bump actually mean for your wallet?

- The new State Pension (for folks hitting pension age since 2016) is going from about £11,973 to £12,548 a year, or roughly £241.30 per week.

- The old basic State Pension (for those retiring before 2016) will rise to around £9,615 annually.

- If you’re drawing the full pension, you’re looking at a raise of approximately £574.60 annually—not chump change!

Keep in mind, these numbers can vary depending on your full National Insurance record and any contracted-out periods from your working life.

State Pension Compared: UK vs. US Social Security

Wondering how the UK’s pension rise stacks up against the US? The US Social Security benefits get adjusted yearly based on inflation through a Cost-of-Living Adjustment (COLA). For 2026, the US is expecting about 3.2% COLA, which is lower than the UK’s 4.8% rise. Both systems aim to maintain retirees’ purchasing power, but the UK’s triple lock offers a slightly bigger boost by including wage growth, which ties pensions to broader economic prosperity.

Impact on Different Groups

The pension rise doesn’t affect every retiree equally:

- Women, who may have gaps in employment or lower lifetime earnings, might not qualify for the full pension without additional National Insurance credits.

- Private sector workers often have workplace pensions in addition to the State Pension, so they may view this increase as part of a larger retirement income.

- Working-class retirees relying heavily on the State Pension will feel this raise more directly in their day-to-day finances.

Government Debates and Sustainability Concerns

While popular among pensioners, the triple lock’s long-term sustainability has been questioned. The rising cost of pension payments—estimated to reach £15.5 billion annually by 2030—places pressure on government budgets. Debates have surfaced around possibly modifying or scrapping the triple lock in favor of a “double lock” or inflation-only model, due to the financial strain and demographic shifts, including an aging population.

Looking Ahead: What’s the Future of the State Pension?

Experts predict that if wage growth remains strong, pensions will continue to outpace inflation. However, policy changes could cap these increases post-2030. Pensioners and those planning retirement should stay informed about government announcements, especially during annual budgets.

How the Triple Lock Works: A Detailed Explanation

The triple lock mechanism is straightforward but powerful. Every April, the government reviews three figures:

- The Consumer Prices Index (CPI) inflation rate from the previous September.

- The average wage increase in the UK from May to July of the previous year.

- A guaranteed minimum rise of 2.5%.

Whichever number is highest becomes the percentage increase applied to the State Pension. This protects pensioners from inflation while allowing them to benefit from strong wage growth.

Planning Your Retirement: Practical Tips

Here’s what you can do now to make the most of your retirement:

- Check your National Insurance record regularly to confirm you qualify for the full pension.

- Start saving additional retirement funds in ISAs or private pensions to supplement your State Pension.

- Consider working longer if possible, especially with the State Pension age increasing.

- Use tools like the Gov.uk State Pension Planner to estimate your future pension.

How to Claim State Pension Set to Hit £12,548?

If you’re not yet receiving it, claiming is simple:

- The government usually writes to you about four months before you qualify.

- If you don’t get a letter, apply directly through the official Gov.uk portal.

- Payments typically start the week after your claim is processed.

Tax Implications: What You Need to Know

Because the personal tax-free allowance has been frozen near £12,570, just slightly above the new pension level, around 200,000 additional pensioners might become liable for income tax on their State Pension. This means pensioners need to carefully plan their finances and consider potential tax payments alongside their pension income.

State Pension Overhaul Coming in 2026 – DWP Reveals 5 New Rules That Could Impact Your Retirement

DWP Confirms State Pension Changes in 2026 – 5 Crucial Rule Changes Every UK Retiree Must Check

£11Bn Payout Ahead as Regulator Cracks Down on UK Car Finance Mis-Selling