The Canada Revenue Agency (CRA) has officially denied claims circulating online that it is issuing a $3900 one-time payment to Canadians. The agency called the reports false and warned that the misinformation is likely part of coordinated fraud attempts.

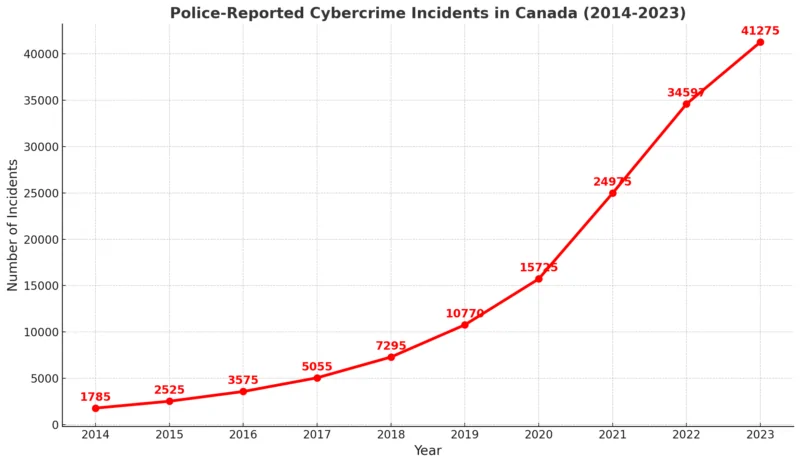

The claim, which has spread widely on social media and through misleading websites, has raised concerns among cybersecurity experts and government officials about the growing sophistication of digital scams targeting Canadians.

Table of Contents

$3900 One-Time Payment

| Key Fact | Detail / Statistic |

|---|---|

| Alleged payment amount | $3,900 |

| CRA official confirmation | No such payment exists |

| Real upcoming payments | Regular GST/HST credit, Canada Child Benefit |

| Fraud losses in 2023 | CAD $554 million |

| Common scam tactic | Fake benefit payments mimicking government announcements |

| Official Website | Canada Revenue Agency |

CRA Responds to the $3900 Payment Claim

The CRA issued a statement this week clarifying that no such $3900 payment program exists. The statement came after several unverified blogs and social media accounts began sharing links claiming Canadians could “apply” for a new relief payment.

“There is no $3900 one-time payment program. Messages claiming otherwise are fraudulent and should be ignored,” the agency said in its public fraud advisory.

The agency also warned Canadians not to click suspicious links or provide personal information through unofficial channels.

The Anatomy of the Hoax

The $3,900 payment hoax typically appears as a message shared on Facebook, TikTok, or Instagram, often with a headline resembling a government press release. These posts include official-looking logos, AI-generated graphics, and urgent language such as “Apply Now” or “Final Deadline.”

These elements are designed to trigger quick reactions before individuals verify the information. Similar scam tactics have been documented during the Canada Emergency Response Benefit (CERB) period in 2020, when fraudulent websites imitated official government portals.

“These scams often mimic government communication styles to appear credible,” said Dr. Marie Beaulieu, cybersecurity researcher at the University of Ottawa. “They are becoming increasingly polished, making it harder for people to distinguish fake from real.”

Real Benefits vs. Fake Promises

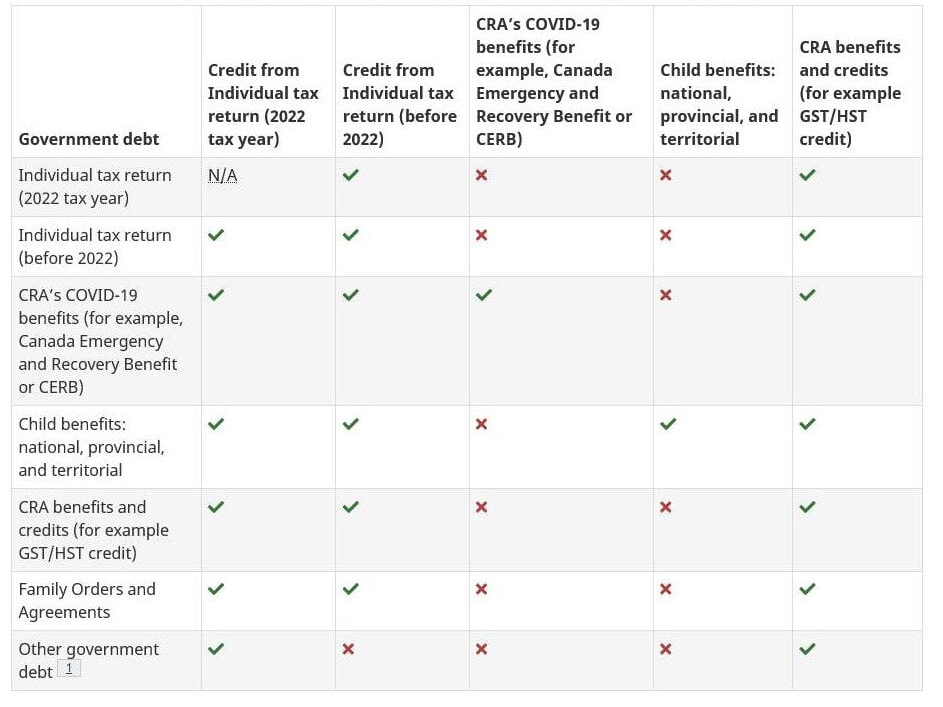

Canada currently offers several legitimate benefit programs, including:

- Goods and Services Tax/Harmonized Sales Tax (GST/HST) Credit

- Canada Child Benefit (CCB)

- Canada Workers Benefit (CWB)

- Old Age Security (OAS)

All these programs have clear eligibility rules and publicly available payment schedules, which can be verified directly through the CRA website or the “My Account” portal.

No such structure exists for the supposed $3,900 payment, a key sign of inauthenticity.

How Scammers Exploit Economic Anxiety

The timing of this scam is not coincidental. Canada has experienced persistent inflationary pressures over the last two years, increasing costs for essentials such as housing, food, and energy.

“Scammers understand that when Canadians are financially stressed, they’re more likely to act quickly on the promise of relief,” said Dr. Navdeep Parmar, an economist at Simon Fraser University. “These kinds of scams exploit hope as much as they exploit trust.”

The Canadian Anti-Fraud Centre (CAFC) reported that losses to scams reached $554 million in 2023, nearly double pre-pandemic levels. Phishing scams and fake government benefit programs ranked among the most common methods used.

Case Study: When Scams Become Personal

Earlier this month, 64-year-old Mary Thompson from Mississauga received a message promising the $3,900 payment. The message appeared to come from an official CRA email address and included a QR code.

“It looked real — it even had the CRA logo,” she told CBC News. “I almost clicked, but my son told me to check the CRA site first.”

Mary reported the incident to the CAFC, helping prevent what could have been a potential identity theft.

Such stories are increasingly common. Experts say these scams can lead to compromised personal data, emptied bank accounts, and long-term credit damage.

How the CRA Verifies and Announces Real Payments

Legitimate CRA benefit programs go through a formal approval and communication process. This involves:

- Cabinet or parliamentary approval of the program and funding.

- Public announcement through official channels, often accompanied by a press conference.

- Press release and media coverage from reputable outlets.

- Listing on the CRA website with detailed eligibility criteria and payment schedules.

- Notifications through My Account or physical letters — never through unsolicited texts or DMs.

This multi-step process ensures Canadians have multiple, verifiable points of contact.

“If a payment isn’t on the CRA website, it doesn’t exist,” said Julie Savard-Shaw, CRA spokesperson.

How to Protect Yourself from Payment Scams

The CRA advises Canadians to follow these steps:

- Verify information only on official domains (canada.ca).

- Ignore unsolicited payment offers received through text, email, or social media.

- Never share banking information or Social Insurance Numbers in response to unexpected messages.

- Report suspicious activity to the Canadian Anti-Fraud Centre.

- Enable two-factor authentication on CRA’s “My Account.”

The Royal Canadian Mounted Police (RCMP) has also launched joint operations with the CRA to investigate phishing networks behind similar scams.

Legal Ramifications for Fraudsters

Under Canada’s Criminal Code, online fraud carries penalties including fines and prison sentences of up to 14 years for large-scale schemes.

“Even sharing a fraudulent link knowingly can lead to legal consequences,” said RCMP Inspector Daniel Leclerc, who heads a cybercrime unit in Quebec. “These aren’t harmless rumours. They can enable serious financial crime.”

RCMP confirmed they are monitoring the spread of the $3,900 payment hoax and coordinating with international partners to trace its origin.

How to Spot a Fake Government Announcement

| Red Flag | Fake Payment Claim | Real CRA Announcement |

|---|---|---|

| Website URL | Misspelled domains (e.g., “canada-gov.net”) | canada.ca or cra-arc.gc.ca |

| Communication method | Texts, DMs, or WhatsApp messages | CRA portal, mail, or official press release |

| Language | Urgent, emotional, “act now” tone | Formal and neutral language |

| Personal information request | Banking, SIN, ID | CRA never asks for this through email or text |

| Timing | Sudden, with vague deadlines | Scheduled and announced weeks in advance |

Similar Scams Around the World

Canada is not alone. Similar fake benefit announcements have surfaced in the United States, United Kingdom, and Australia.

- In the U.S., scammers falsely claimed the IRS was issuing a $2,400 “inflation relief” cheque.

- In the U.K., fake “cost of living grants” circulated through text messages during the energy crisis.

- Australian authorities faced a surge in phishing attempts during pandemic-era stimulus programs.

This global pattern shows how fraudsters often adapt successful scams across borders.

Government and Industry Response

The Canadian government is increasing its investment in digital fraud prevention, including partnerships with major tech platforms. CRA officials are working with Meta, X (formerly Twitter), and Google to flag and remove fake ads or pages posing as government entities.

“We need both technology companies and citizens to act together,” said Mélanie Joly, Canada’s Minister of Foreign Affairs, who has been briefed on foreign interference through misinformation networks.

Ottawa is also reviewing new legislation to hold platforms accountable for hosting verified scam content, following models used in the European Union.

The Human Cost of Digital Scams

Cybersecurity experts warn that beyond financial loss, scams erode public trust in institutions. Once trust is undermined, legitimate government relief programs may face lower uptake — a challenge during emergencies like pandemics or natural disasters.

“Every scam like this doesn’t just take money,” said Dr. Anya Sharma, senior fellow at the Brookings Institution. “It chips away at the public’s confidence in the system.”

Looking Ahead: How Ottawa Plans to Tackle Misinformation

Federal agencies are expected to expand their public awareness campaigns this fall, focusing on:

- Education on how benefit programs are actually created.

- Improved security features for CRA accounts.

- Real-time alerts when fraudulent campaigns are detected.

- Partnerships with financial institutions to flag suspicious transfers.

Officials also plan to improve media literacy education, particularly for seniors and vulnerable populations, who are often targeted by scammers.

October 2025 Canada Carbon Rebate – How Much You Could Receive? Check Details

CRA $2700 Coming For Canadian Seniors In October 2025 – Is it true? Check Payment Date & Eligibility

$2100 Direct Deposit For Canadian Seniors 2025: Check Payment Date & Eligibility Criteria

FAQ

Q: Is the CRA really sending out a $3,900 payment?

No. CRA has confirmed no such program exists.

Q: How can I check if I’m eligible for real benefits?

Log in to CRA’s My Account or visit the benefits payment dates page.

Q: What should I do if I get a scam message?

Do not click any links. Report the message to the Canadian Anti-Fraud Centre at 1-888-495-8501 or antifraudcentre-centreantifraude.ca.

Q: Why $3900?

Fraudsters use specific amounts to make the scam seem more credible and urgent.

Q: Who is most at risk?

Seniors and low-income households are often targeted, though anyone can be affected.