The Canada Revenue Agency (CRA) has officially confirmed an increase in the Canada Child Benefit (CCB) for the 2025–2026 benefit year, providing up to $7,997 annually for families with children under 6 years old. This marked improvement aims to help families cope with rising costs and strengthen the social safety net.

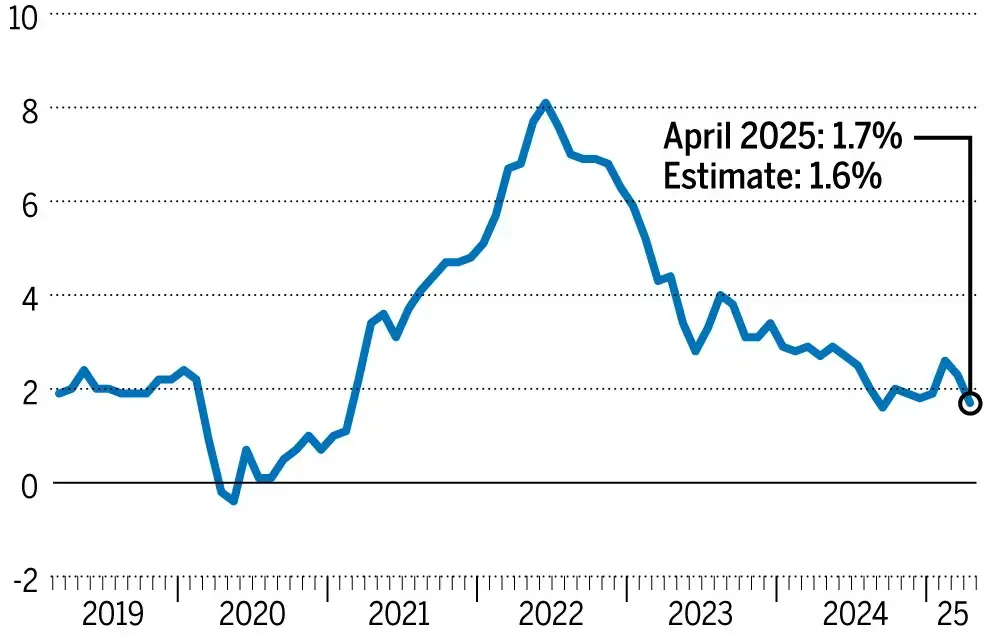

The updated CCB will now be paid in monthly installments, with eligible families receiving as much as $666.41 per month for each child under 6 and $562.33 for each child aged 6 to 17. This increase follows the government’s ongoing efforts to ensure families receive adequate support, especially as inflation continues to impact household budgets.

Table of Contents

Canada Child Benefit 2025

| Key Fact | Detail/Statistic |

|---|---|

| Maximum Benefit for Children Under 6 | $7,997 annually ($666.41/month) |

| Maximum Benefit for Children Aged 6-17 | $6,748 annually ($562.33/month) |

| Monthly Payment Dates | Typically 20th of each month |

| Additional Benefit for Children with Disabilities | Up to $3,411 annually ($284.25/month) |

| Official Website | Canada Revenue Agency (CRA) |

With the 2025 increase, the government continues to strengthen its social safety net, providing critical financial relief to millions of Canadian families. As economic pressures mount, initiatives like the CCB serve as an essential tool in fostering equitable growth and supporting the most vulnerable segments of society.

By ensuring that families receive the assistance they need when raising children, the Canada Child Benefit not only improves financial stability but also ensures that Canadian children grow up in a supportive environment. This ongoing commitment to children’s welfare is a testament to Canada’s dedication to building a strong, resilient future.

Understanding the Increased Canada Child Benefit

The CCB serves as a direct transfer to Canadian families, aimed at reducing child poverty and improving the overall well-being of children across the country. The 2025 increase comes as part of a broader government strategy to support families with young children, especially in the face of economic challenges such as inflation.

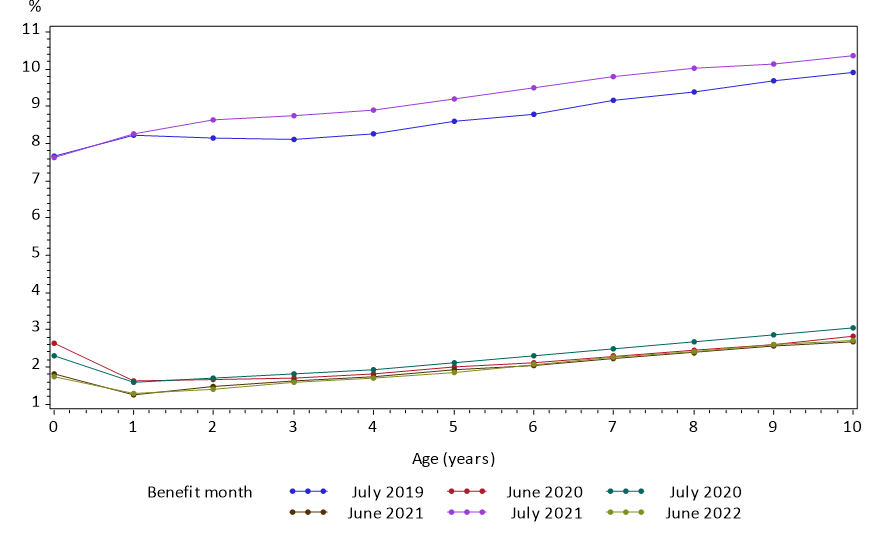

Eligible families with an Adjusted Family Net Income (AFNI) under $37,487 will receive the maximum amount. For those with higher incomes, the benefit is gradually reduced based on income levels. For example, families with an AFNI of $45,000 may receive approximately $7,471.09 annually for one child under 6, or about $622.59 per month.

The CRA also offers additional financial assistance to families with children who qualify for the Disability Tax Credit. These families may be eligible for the Child Disability Benefit (CDB), which provides up to $3,411 per year ($284.25 per month) per eligible child.

The Canada Child Benefit: A Lifeline for Canadian Families

Launched in 2016, the Canada Child Benefit has become one of the cornerstones of Canada’s social welfare system. It was designed to replace previous child tax benefits and offer more direct and substantial support to families. Unlike its predecessors, the CCB is non-taxable and is aimed at families with children under 18 years of age.

One of the major goals of the CCB is to reduce child poverty. According to a 2020 report by the Canadian Centre for Policy Alternatives (CCPA), the CCB played a significant role in reducing child poverty by 20% in the first few years after its implementation. With its regular increases and the 2025 enhancements, the program continues to provide a critical cushion for families grappling with the challenges of raising children in an expensive, fast-evolving economic environment.

How the CCB Impacts Different Types of Families

- Low-Income Families

For families with lower incomes, the Canada Child Benefit provides crucial financial relief. These families often face the greatest challenges in covering the costs of housing, food, clothing, and childcare. The CCB reduces financial strain, ensuring families can meet their children’s basic needs. For example, a single parent with a child under 6 who has an income of around $25,000 will be eligible for the full $7,997 annual benefit. - Middle-Income Families

Even families with moderate incomes benefit from the CCB. While their payments will be lower than those for low-income families, the monthly payments provide significant assistance in managing everyday expenses. A dual-income household with an annual income of $60,000, for example, may still receive $5,000 annually for two children, which can be used for childcare, education expenses, and other necessities. - Families with Children with Disabilities

Families with children who qualify for the Disability Tax Credit (DTC) are eligible for additional financial assistance through the Child Disability Benefit (CDB). This targeted support helps parents address the unique costs associated with raising a child with a disability, including specialized care and medical expenses.

Payment Disbursement and Tracking: Everything You Need to Know

The Canada Child Benefit is disbursed on a monthly basis, with payments made on the 20th of each month. For those expecting the CCB for the first time, it’s important to register early to ensure no delay in the monthly payouts. Families can track their CCB payments through the CRA’s My Account online portal, which allows users to monitor payment schedules and amounts, as well as update any personal information.

The CRA also offers options for direct deposit, ensuring families receive their payments promptly without having to wait for paper cheques. If the 20th falls on a weekend or holiday, the payment is issued on the next business day.

Government’s Long-Term Vision for the CCB

While the Canada Child Benefit is a short-term financial lifeline, it also fits within a long-term strategy to combat poverty, improve educational outcomes, and enhance overall family well-being. The current increase is an acknowledgment that the cost of raising children is higher than ever. With inflationary pressures and rising housing and food costs, Canadian families are facing heightened financial strain.

The government has indicated that the CCB’s future increases will remain tied to inflation, ensuring it adapts to changing economic conditions. This adjustment ensures that families continue to receive a benefit that keeps pace with the actual costs of living.

In addition, there is growing political support for expanding the CCB to include more targeted programs for single-parent households and rural families, who may face unique challenges compared to urban families.

How Families Can Maximize Their Benefits

To ensure families are receiving the full CCB benefit, it’s essential to file tax returns every year, even for those with no income to report. The CRA bases CCB eligibility and the amount of payment on the most recent tax information. Failure to file may result in delays or missed benefits.

Families should also make sure to update their marital status, address changes, or any changes in the number of children, as these can impact the benefit calculation. CRA’s My Account is a crucial tool for ensuring benefits remain accurate and timely.

CRA $2700 Coming For Canadian Seniors In October 2025 – Is it true? Check Payment Date & Eligibility

Canada Revenue Agency Dodges Key Question: How Many Call Centre Workers Are Coming?

FAQ

1. What is the maximum amount a family can receive from the Canada Child Benefit in 2025?

A family can receive up to $7,997 annually for each child under 6 years of age, and $6,748 annually for children aged 6 to 17.

2. Can families with higher incomes still qualify for the CCB?

Yes, families with higher incomes can still qualify for the CCB, but the amount decreases as income rises. The benefit is reduced gradually based on the family’s adjusted net income.

3. How often are the Canada Child Benefit payments made?

The CCB payments are made monthly, typically on the 20th of each month, or the next business day if the 20th falls on a weekend or holiday.

4. What is the Child Disability Benefit?

The Child Disability Benefit (CDB) is an additional payment available to families whose child qualifies for the Disability Tax Credit. Families can receive up to $3,411 annually per eligible child.

5. How can I apply for the Canada Child Benefit?

You can apply for the CCB by registering your child at birth, applying online through CRA’s My Account, or mailing in Form RC66.