New Pension Tax Rules Could Hit Millions: If you’ve been following the headlines about pensions lately, you’ve probably noticed one phrase popping up everywhere: New Pension Tax Rules Could Hit Millions; Reeves May Cut HMRC Relief. It’s a serious topic that’s got everyone from everyday savers to financial planners paying close attention. Why? Because these proposed changes could impact how millions of Brits save for retirement — and how much money they actually keep.

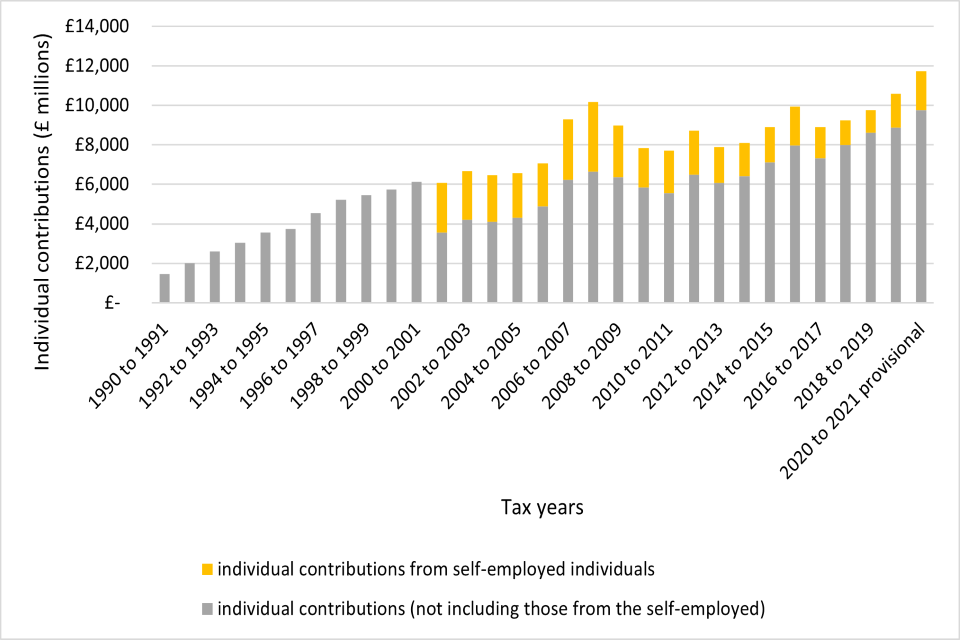

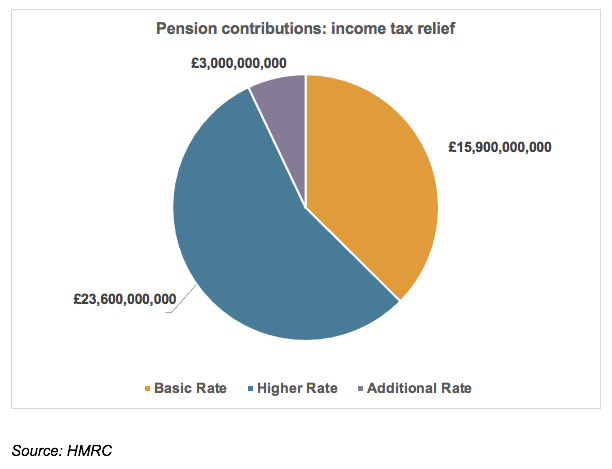

The new government under Chancellor Rachel Reeves is reportedly reviewing how much the UK spends on pension tax relief, and let’s just say the numbers are eye-watering. According to official HMRC data, the cost of tax relief on pensions has soared past £48 billion per year, making it one of the single largest tax expenditures in the country. That’s bigger than what the UK spends on policing or defense equipment in some years. Now, Reeves and her team are considering ways to “rebalance” pension tax relief, possibly turning the current tiered system into a flat-rate model. While the government says the goal is fairness and simplicity, critics argue it could end up being a stealth tax on middle and higher-income earners.

Table of Contents

New Pension Tax Rules Could Hit Millions

In short, the proposed new pension tax rules could reshape how millions of Brits save for retirement. While the government insists the aim is fairness, critics warn it’s effectively a tax grab that may discourage saving and investment. Whether you’re a young worker just starting to build your pension, or a near-retiree with a large pot, the key takeaway is simple: plan early, diversify your savings, and keep an eye on official updates. Financial stability in retirement is still within reach — you just have to be proactive about how you get there.

| Aspect | Details |

|---|---|

| Policy Name | New Pension Tax Rules (Proposed under Chancellor Rachel Reeves) |

| Who’s Affected | Potentially 20–25 million UK workers and retirees |

| Proposed Change | Flat-rate HMRC pension tax relief (likely 25%–30%) |

| Estimated Annual Savings for Government | Around £10 billion |

| Major Impacts | High earners lose 40%–45% relief; lump-sum caps could shrink; employer NI charges may rise |

| Related Issues | Inheritance tax expansion, frozen thresholds, inflation drag |

| Timeline | Expected announcement in the Autumn Budget 2025 |

| Official Resource | HMRC Pension Tax Relief Guidance |

Why Pension Tax Relief Is Being Reconsidered?

Pension tax relief is a cornerstone of the UK’s retirement system. It’s designed to encourage people to save for their later years by giving them a tax break on pension contributions. The idea is simple: you don’t pay income tax on the money you put away.

However, over time, this system has tilted heavily in favor of the wealthier segment of society. Data from the Institute for Fiscal Studies (IFS) shows that over 50% of all pension tax relief goes to individuals earning more than £60,000 a year.

That means a relatively small portion of taxpayers — roughly the top 10% — reap the lion’s share of a benefit that costs everyone billions in lost tax revenue. Reeves and her Treasury team argue that this imbalance needs fixing.

What the New Pension Tax Rules Could Hit Millions?

While no official policy paper has been released yet, multiple credible reports — including from MoneyWeek, The Guardian, and Financial Times — suggest that the government is considering a number of overlapping reforms.

1. Flat-Rate Tax Relief

At present, pension relief matches your marginal tax rate. That means:

- Basic rate taxpayers get 20%

- Higher rate taxpayers get 40%

- Additional rate taxpayers get 45%

The new proposal could replace all of this with a single flat rate of around 25–30% for everyone.

This would simplify the system but also redistribute benefits:

- Basic rate taxpayers could actually gain, moving from 20% to 25%.

- Higher and additional rate taxpayers would lose out, dropping from 40–45% to 25–30%.

A Treasury insider quoted in The Guardian said this change alone could raise £8–10 billion per year — a major boost for public finances.

2. Cap on Tax-Free Lump Sums

Currently, you can take 25% of your pension pot tax-free when you retire. This is often called the Pension Commencement Lump Sum (PCLS).

For someone with a £600,000 pension pot, that means £150,000 tax-free — a huge benefit. But under potential new rules, the government could:

- Cap that tax-free amount (e.g., at £100,000), or

- Limit the percentage (e.g., reduce to 20% of total pot)

The aim is to prevent large tax-free withdrawals that disproportionately favor wealthier retirees.

3. Employer Contributions and National Insurance

At the moment, employers don’t pay National Insurance on their pension contributions. This is a powerful incentive for companies to offer generous pensions.

However, this policy costs HMRC roughly £20 billion annually in forgone NI revenue. The new rules may propose that a small employer NI charge (2–3%) apply to pension contributions, which could nudge some firms to scale back their contributions or shift costs to employees.

4. Inheritance Tax on Pension Pots

Today, unused pension funds are usually passed on tax-free to beneficiaries if the policyholder dies before age 75. Even after 75, the beneficiary only pays income tax on withdrawals — no inheritance tax (IHT).

But the Financial Times recently reported that the Treasury is considering including large pension pots in the IHT system, especially those above £1 million.

This could bring thousands of wealthy estates into the tax net for the first time.

5. Carry-Forward Rule Adjustments

Under current law, you can “carry forward” unused pension allowances from the previous three tax years, allowing big one-off contributions.

New reforms could reduce the carry-forward window to one or two years, hitting older professionals and the self-employed who contribute irregularly.

Who Could Be Hit the Hardest?

Here’s a simplified look at who gains or loses if the reforms go through.

| Group | Impact Summary |

|---|---|

| High Earners (£60k+) | Major loss of higher-rate relief; could cost £2,000–£4,000 yearly |

| Middle Earners (£30k–£50k) | Could gain slightly from a flat-rate system |

| Retirees with Large Pots | Reduced tax-free lump sums and potential IHT exposure |

| Employers | Possible new NI contributions on pensions |

| Younger Savers | Neutral — benefit if relief becomes more equitable over time |

How It Affects the Broader Economy?

Critics of the proposed cuts argue that it could discourage long-term saving, especially among professionals and entrepreneurs who often rely heavily on private pensions for retirement security.

A survey by AJ Bell found that nearly 30% of higher earners would reduce their pension contributions if tax relief were cut to 25%. This could lead to lower investment in UK pension funds — which currently hold over £3 trillion in assets, much of which is invested in UK companies and bonds.

Economists warn that slashing relief could have a knock-on effect on capital markets, potentially shrinking liquidity and reducing pension fund growth over time.

What You Can Do to Prepare for the New Pension Tax Rules Could Hit Millions?

If these proposals make you nervous, don’t worry — there are concrete steps you can take right now.

1. Review Your Pension Contributions

If you’re in the 40% or 45% tax bracket, consider making extra contributions before the new Budget. Doing so locks in the current higher-rate relief.

2. Talk to Your Employer

Ask if your company plans to adjust its contribution policy if NI rules change. It’s better to know early than get surprised later.

3. Consider Diversification

Don’t rely solely on your pension for retirement. Explore ISAs, bonds, or real estate investments for more flexibility.

4. Update Your Estate Plan

If inheritance tax changes are approved, speak with a financial adviser about trusts or beneficiary nominations to protect your loved ones.

5. Stay Informed

The Autumn Budget 2025 will be crucial.

Practical Example: What It Means in Pounds

Let’s make it real with a few examples.

- Example 1:

Olivia earns £80,000 and contributes £10,000 to her pension.- Current system: £4,000 tax relief

- Flat-rate (25%): £2,500

- Annual loss: £1,500

- Example 2:

Tom earns £35,000 and contributes £5,000.- Current system: £1,000 relief

- Flat-rate (25%): £1,250

- Annual gain: £250

- Example 3:

Emma, aged 65, has £500,000 saved.- Current tax-free lump sum: £125,000

- Proposed cap: £100,000

- Taxable difference: £25,000, meaning £5,000–£10,000 extra tax depending on rate.

DWP £470 Pension Bonus In October 2025: Eligibility Criteria & Payment Dates

UK’s £200 Cost of Living Payment in October 2025 – Payment Schedule, Eligibility & Latest Updates!

UK Two-Child Benefit Cap Changes – Check How It Affects You & Eligibility Rules