£575 Bonus Boost: If you’ve seen headlines about a “£575 Bonus Boost for 4 million state pensioners,” you’re not alone. Thousands of retirees across the UK have been buzzing about a supposed cash windfall from the government. But is it true? And if so, are you one of the lucky ones? Let’s clear up the confusion right now: there is no separate £575 one-time payout coming to pensioners. The figure that’s been making waves online is linked to the State Pension triple lock increase — a legitimate, built-in policy that raises pensions annually in line with inflation or wage growth. The 2025 rise will be a significant one, and for many pensioners, it could mean hundreds of pounds more each year.

Table of Contents

£575 Bonus Boost

The “£575 Bonus Boost” might be a myth, but it’s rooted in a real and meaningful State Pension increase. Thanks to the triple lock, more than 12 million pensioners will see their incomes rise by up to 8.5% from April 2025. For most, that’s between £575 and £1,200 extra per year — a welcome relief as living costs stay high. There’s nothing to claim, no forms to fill out, and no bonus check in the mail — just a steady, reliable pay rise built into your pension.

To ensure you’re getting everything you’re entitled to:

- Check your State Pension forecast.

- Review your National Insurance record.

- Explore Pension Credit if your income is low.

| Topic | Details |

|---|---|

| Headline Claim | “£575 Bonus Boost for 4 million pensioners” |

| Reality | No official one-off payment; reflects annual triple lock increase |

| Triple Lock Rate for 2025 | 8.5% rise announced |

| Average Pension Increase | Between £575 and £1,243 per year |

| Beneficiaries | Around 12 million pensioners; 4 million on full new pension |

| Official Source | UK Government: State Pension Information |

| Key Factors | Wage growth, inflation, and government policy |

The Truth Behind the £575 Bonus Boost

The viral “bonus” rumor began spreading online in late 2024, with claims that millions of pensioners would receive a government-funded windfall. Some websites even implied that payments were automatic, while others linked to suspicious “claim forms.”

In reality, there’s no such government scheme. The Department for Work and Pensions (DWP) has confirmed that no separate £575 bonus exists. However, the figure roughly reflects the average annual increase most pensioners will receive in April 2025 due to the State Pension triple lock.

This system guarantees that pensions rise each year by whichever is highest:

- 2.5%

- The rate of inflation (Consumer Prices Index)

- Average wage growth

For 2025, wage growth was the highest of the three — 8.5% — meaning all qualifying State Pensions will increase by that amount.

The Economic Background: Why a Boost Now?

To understand why pensions are rising so sharply, it helps to look at the broader economic picture. The UK has been dealing with persistent inflation, fueled by global energy prices, supply chain issues, and higher public sector wages.

While inflation has eased from its 2022 high of over 11%, everyday costs — food, rent, and energy bills — remain steep. To help pensioners keep pace, the triple lock mechanism automatically triggers the largest increase when wages surge or prices soar.

According to the Office for Budget Responsibility (OBR), this year’s 8.5% uplift will cost the Treasury roughly £11 billion, but it’s seen as a fair trade-off to protect retirees from falling living standards.

Sarah Coles, Head of Personal Finance at Hargreaves Lansdown, summed it up perfectly:

“The triple lock ensures older people share in the country’s economic growth, not just its struggles. For millions, it’s the difference between getting by and falling behind.”

How Much More Will You Get?

Let’s look at what this means in real money.

If you’re on the full new State Pension, currently £221.20 per week, the 8.5% increase will lift your payment to about £239.00 per week. That’s around £12,428 a year, compared to £11,502 previously — an extra £926 annually.

For those on the basic State Pension (retirees who reached State Pension age before April 2016), the rate will rise from £169.50 to £184.00 per week — an increase of about £754 per year.

These numbers are averages, so your personal gain might differ based on your National Insurance record and whether you have additional pension entitlements.

So, while the “£575 bonus” headline isn’t accurate, the spirit of it is — millions of pensioners will enjoy a substantial income boost in 2025.

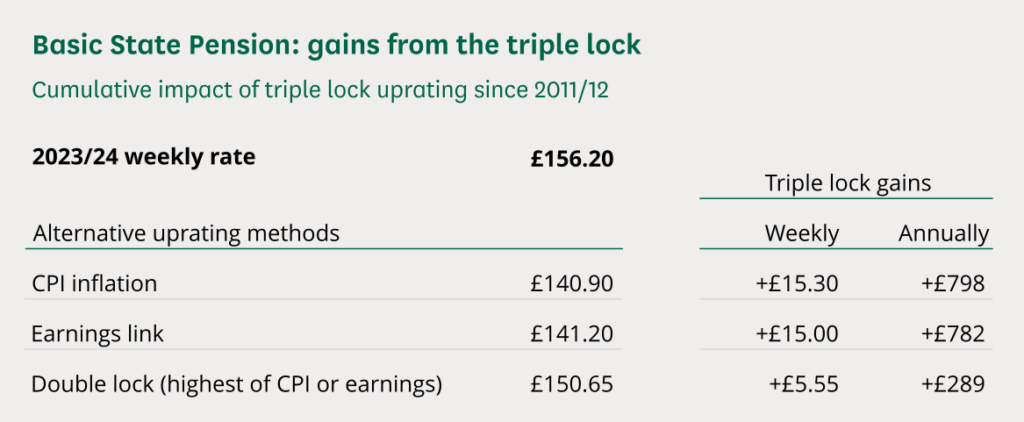

Understanding the Triple Lock System

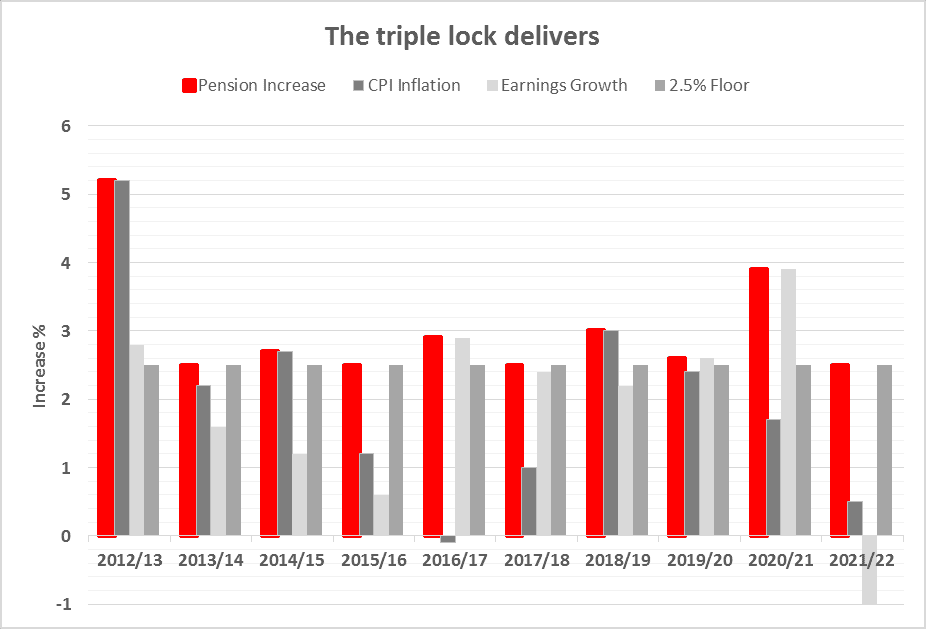

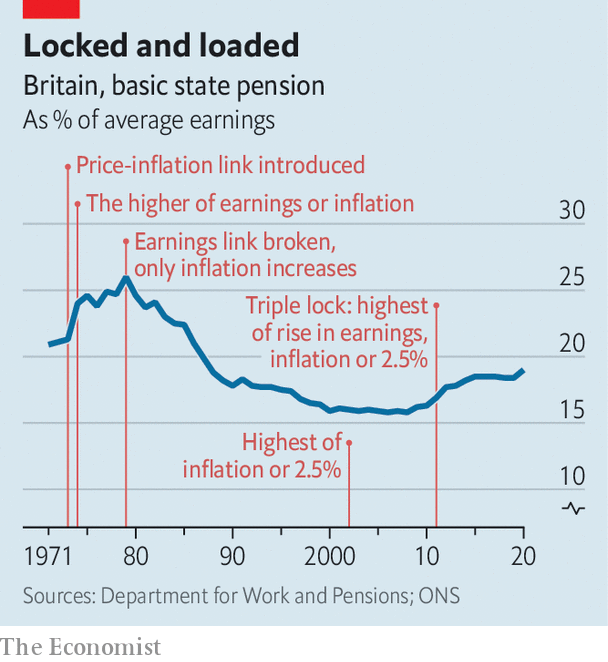

Introduced in 2010, the triple lock was designed to ensure pensioners’ incomes grow in real terms. Before that, pensions were often uprated only with inflation, which meant retirees fell behind when wages rose faster than prices.

Every September, the government compares three figures — inflation, average earnings, and 2.5% — and applies whichever is highest from the following April. This automatic mechanism has helped raise the new State Pension by over 60% since its introduction.

However, it’s also expensive. By 2030, it’s projected to add more than £45 billion annually to public spending if kept unchanged. Despite the cost, it remains extremely popular with voters and is considered politically untouchable — at least for now.

How to Check Your Eligibility and Pension Amount?

If you’re unsure what you’ll receive, you can verify it easily. Here’s how:

- Check your forecast – Visit the Check Your State Pension Forecast page. You’ll need your Government Gateway ID or HMRC login.

- Review your National Insurance record – Full pension entitlement requires 35 qualifying years of NI contributions. You can check your record and even pay voluntary contributions for missing years.

- Confirm your payment date – Pensions are paid every four weeks, directly into your bank account. The new rates apply automatically from April 2025.

This process takes less than 10 minutes and ensures there are no surprises when the new rates roll out.

Pension Credit: An Often-Overlooked Benefit

While the triple lock benefits everyone, Pension Credit remains one of the most underclaimed benefits in the UK.

It’s available to retirees on low incomes, topping up weekly earnings to £218.15 for singles or £332.95 for couples. Even more importantly, qualifying for Pension Credit opens doors to other benefits — including the Winter Fuel Payment, free NHS dental care, and TV license discounts for those over 75.

Beware of Pension Scams

Whenever there’s pension news, scammers aren’t far behind. Fraudsters exploit trending topics like “bonus payments” or “backdated pensions” to trick people into revealing personal details or transferring money.

Here are a few red flags to watch out for:

- You’re contacted unexpectedly by text, email, or phone.

- You’re asked to “confirm” your National Insurance or bank details.

- You’re promised quick cash or exclusive government schemes.

Remember: the government never contacts individuals directly about pension bonuses or refunds.

Could This Increase Affect Your Taxes?

This part often catches people off guard.

Because the Personal Allowance — the amount you can earn before paying income tax — is frozen at £12,570 until 2028, some retirees may find themselves paying tax for the first time.

If your total income (State Pension plus private or workplace pensions) exceeds that threshold, you’ll owe income tax on the excess.

For example:

If your pension income rises to £12,428, you have only £142 of tax-free space left. Add a small private pension, and you could owe tax at 20%.

How to Make the Most of Your Extra £575 Bonus Boost?

Even modest increases can make a big difference when used wisely. Here are practical ways to stretch your boost further:

- Rework your monthly budget. Update your spending to reflect the new income and identify areas for saving.

- Pay down high-interest debt. Clearing credit cards or overdrafts provides an instant return on investment.

- Top up your emergency fund. Aim to save at least three months of living expenses.

- Consider savings accounts or ISAs. High-interest savings accounts or Cash ISAs allow tax-free growth.

- Check eligibility for other support. Many councils offer Council Tax reductions and energy rebates for pensioners.

A small boost today can snowball into significant financial comfort tomorrow.

Political Outlook: Will the Triple Lock Survive?

Both the Labour and Conservative parties have publicly committed to maintaining the triple lock until at least the next election. However, the growing cost is sparking debate among economists and policymakers.

The Institute for Fiscal Studies (IFS) warns that if wage growth continues to outpace inflation, the triple lock could become unsustainable without tax increases or spending cuts elsewhere.

Still, few politicians want to risk alienating pensioners — one of the most consistent voting blocs in the UK. As a result, any reform will likely be gradual, such as adjusting the formula or raising the State Pension age.

Tom Selby, head of retirement policy at AJ Bell, explains:

“We’re heading for a showdown between affordability and fairness. The triple lock is vital for pensioners, but it’s a long-term fiscal challenge the government can’t ignore.”

DWP Confirms State Pension Changes in 2026 – 5 Crucial Rule Changes Every UK Retiree Must Check

HMRC Confirms £300 Pension Cut from October 9; Every UK Pensioner Needs to Know this, Check Details

£11Bn Payout Ahead as Regulator Cracks Down on UK Car Finance Mis-Selling