The 2025 Visa-Mastercard class action settlement is a significant development in the long-running legal battle between U.S. merchants and two of the world’s largest payment processors. This settlement, which has been in the works since 2005, offers affected businesses a chance to recover a portion of the fees they have paid for Visa and Mastercard transactions over the past two decades. The settlement’s size and its implications for the future of the payments industry are monumental.

Table of Contents

Background on the Lawsuit and Settlement

The roots of this case trace back to 2005, when a group of U.S. merchants filed a class action lawsuit accusing Visa and Mastercard of conspiring to set interchange fees at unfairly high levels. These fees, also known as swipe fees, are paid by merchants to banks every time a customer uses a credit or debit card. The merchants argued that the two companies worked together to inflate these fees, which negatively impacted businesses and consumers alike.

The lawsuit alleged that Visa and Mastercard’s actions violated U.S. antitrust law by making it more expensive for businesses to accept card payments. After nearly two decades of legal wrangling, the settlement was finally reached in 2024, providing a $5.54 billion fund to compensate affected businesses. Businesses that accepted Visa and Mastercard payments between January 1, 2004, and January 25, 2019, may be eligible for refunds as part of the settlement.

The settlement’s approval in 2024 was a major victory for the plaintiffs, and it marks one of the most significant antitrust settlements in U.S. history.

How Do Interchange Fees Work and Why Do They Matter to Merchants?

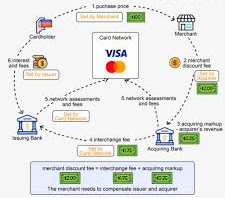

Interchange fees are central to understanding why this lawsuit was filed in the first place. These fees are charged by banks to businesses whenever a customer pays with a credit or debit card. They are set by card networks like Visa and Mastercard and are passed along to the merchant.

The fees are typically a percentage of the transaction amount, and they vary depending on several factors, including the type of card used and the nature of the transaction. For example, business owners who accept premium rewards cards, like those offering airline miles, may pay higher interchange fees compared to those accepting basic debit cards.

For small businesses, these fees can be a significant burden, often leading to higher prices for consumers or reduced profit margins. Larger businesses, with more transaction volume, can sometimes negotiate lower fees, but the disparity between large and small businesses remains a point of contention.

The settlement’s promise of refunds gives small businesses in particular an opportunity to recoup some of the costs they’ve borne over the years due to inflated fees. Many of these businesses have expressed frustration at the seemingly monopolistic nature of Visa and Mastercard’s fee-setting practices.

Eligibility: How to Check If Your Business Qualifies

To take part in the settlement, businesses need to check if they qualify based on the period of eligible transactions. Merchants who accepted Visa or Mastercard payments during the period from January 1, 2004, to January 25, 2019, are eligible to submit a claim. However, businesses that did not process transactions with either company during this period will not qualify.

The claims process itself is straightforward, though business owners must ensure they have accurate records of their payment transactions during the affected period. According to legal experts, it is essential for merchants to provide clear documentation to avoid delays in the claims process. Dr. Emily Johnson, an expert in antitrust law at Harvard University, emphasizes the importance of meticulous record-keeping for merchants, noting that “the success of your claim depends heavily on your ability to demonstrate that you were subject to these fees during the eligible period.”

To submit a claim, eligible merchants must visit the official settlement website and fill out the required forms by February 4, 2025. The settlement’s website also provides detailed instructions and FAQs to assist businesses with the process.

How Will Refunds Be Calculated?

The amount of money each eligible merchant will receive depends on several factors. The size of the refund is based on the merchant’s transaction volume during the period covered by the settlement. Smaller merchants may receive smaller amounts, but in general, businesses will be entitled to up to $2000 in compensation.

The refund amounts will be distributed based on the proportion of the total claims made by eligible businesses. For example, if a business processed a significant volume of Visa or Mastercard transactions during the settlement period, it could receive a larger refund than a smaller business with fewer transactions.

The settlement will not cover all the losses incurred by merchants but provides partial compensation for the inflated interchange fees they paid over the years. The final distribution of refunds will depend on the number of claims submitted and the overall claim volume.

The Bigger Picture: What Does This Settlement Mean for the Payments Industry?

This settlement marks a significant turning point in the regulation of interchange fees, which have been criticized for their lack of transparency and fairness. The case has drawn attention to how Visa and Mastercard, which dominate the payments industry, set their fees and how those fees affect merchants and consumers.

The outcome of this case could have long-lasting effects on the payment card industry, especially regarding how interchange fees are regulated. Legal and regulatory experts are already speculating that this settlement could be a catalyst for broader reforms in the financial services sector.

“The settlement might lead to new rules on how fees are set and whether card networks like Visa and Mastercard can continue to operate in the way they have in the past,” said Michael Sullivan, a legal analyst at the Financial Services Institute.

Moreover, businesses and merchants have been urging lawmakers to scrutinize payment processors more closely. Some are calling for legislation that would make the fee-setting process more transparent and reduce the influence Visa and Mastercard hold over merchant pricing.

What Other Antitrust Cases Have Set Precedents?

The Visa-Mastercard case is not the first time the U.S. government or private entities have taken action against large corporations over antitrust concerns. The Microsoft antitrust case, which resulted in a 2001 settlement with the U.S. Department of Justice, is often cited as a key example of how U.S. antitrust laws can hold major companies accountable for monopolistic practices.

Similarly, in 2020, the U.S. Department of Justice filed an antitrust lawsuit against Google, accusing the company of using its dominance in the search engine market to stifle competition. These high-profile cases highlight the growing tendency to challenge corporate power when it negatively impacts consumers and smaller competitors.

Comparing the Visa-Mastercard case with these previous legal battles reveals broader trends in how antitrust laws are evolving. The Visa-Mastercard case could pave the way for future actions against other financial service providers and large corporations that engage in questionable pricing or business practices.

Global Antitrust Cases: A Broader Perspective

While the Visa-Mastercard case is a significant milestone in U.S. antitrust law, similar actions have taken place around the world. The European Union (EU) has been actively pursuing antitrust investigations against Visa and Mastercard for years, claiming that their interchange fees violate European competition law. In 2019, the European Commission fined Mastercard €570 million for blocking merchants from accessing better payment services. Visa and Mastercard have also been scrutinized by regulators in other parts of the world, including Australia and Canada.

These cases illustrate that Visa and Mastercard are facing increasing scrutiny on a global scale, with regulators and business owners demanding more transparency and fairness in payment systems.

Millions of Californians Can Now Get Up to $1,789 in CalFresh; Here’s What Changed Overnight

$1450 SSI Double Payment In October 2025: Only these Americans will get it, Check Eligibility

Visa-Mastercard Class Action FAQ

How do I know if my business qualifies for the settlement?

Your business must have accepted Visa or Mastercard payments between January 1, 2004, and January 25, 2019. You must also submit your claim by February 4, 2025.

How much will my business receive from the settlement?

Refunds will vary, with eligible businesses receiving up to $2000. The exact amount depends on your transaction volume during the affected period.

What documents do I need to submit a claim?

You will need detailed records of your transactions with Visa and Mastercard during the eligible period. These documents will help verify your claim and determine your refund amount.

Will this settlement affect future interchange fees?

While the settlement addresses past fees, it may lead to increased scrutiny of Visa and Mastercard’s pricing practices in the future.

Concluding Paragraph:

As the deadline for filing claims approaches, eligible merchants should ensure they are prepared to submit their claims before the February 4, 2025, cutoff. This settlement provides a rare opportunity for businesses to recoup some of the costs incurred due to inflated interchange fees. The broader impact of the settlement may reshape how payment systems operate, making this a key moment in the ongoing fight for fairer business practices.