Australia Age Pension Increase: If you’re aiming to stay on top of your retirement income or helping an elder in your family, the Australia Age Pension increase in October 2025 is a game changer. Starting from September 20, 2025, the government upped the fortnightly payments, which you’ll see reflected in October pension payouts. Whether you already get the pension or plan to apply soon, understanding the bump, eligibility, and payment timing is essential — here’s the lowdown in friendly, clear terms.

Table of Contents

Australia Age Pension Increase

The Australia Age Pension increase in October 2025 is a vital boost to support seniors handling rising everyday costs. With higher fortnightly payments, important supplements, and clear eligibility rules, retirees can plan better and enjoy a more comfortable retirement. Staying informed, reporting income and assets honestly, and seizing all available benefits ensures you get the most out of your pension. It’s not just about money—it’s about respect, security, and quality of life for hardworking Australians.

| Topic | Key Data / Change | Why It Matters |

|---|---|---|

| Full Pension Rate | Single: $1,178.70/fortnight; Couple each: $888.50 | Updated max payments post-increase |

| Asset Test Thresholds | Single homeowner: $321,500 (full pension limit); single non-homeowner: $579,500 | Determines eligibility |

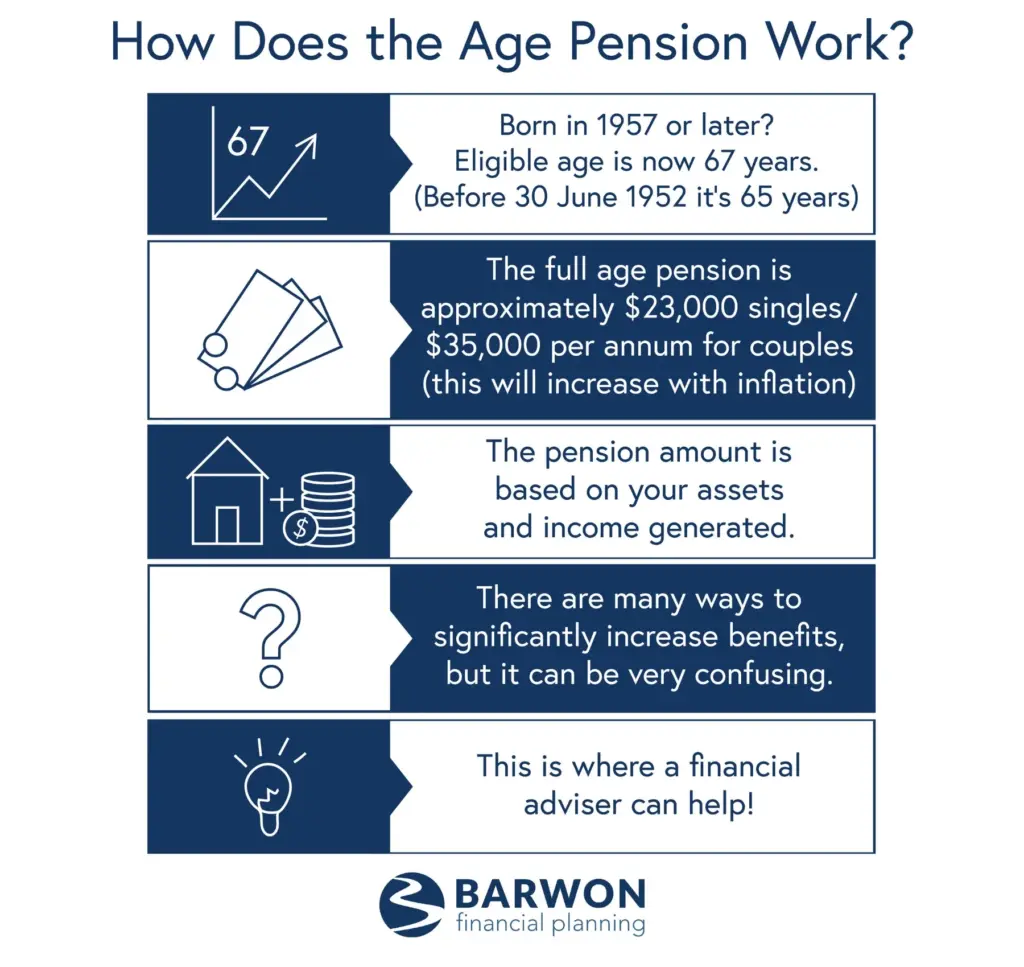

| Qualifying Age | 67 years (born after Jan 1, 1957) | Pension age threshold |

| Payment Frequency | Fortnightly | Helps with budget planning |

| Official Source | Services Australia |

What’s the Australia Age Pension and Why Should You Care?

The Age Pension is the government’s way of helping Aussies aged 67+ cover living costs like food, rent, utilities, and health bills. Think of it as a safety net that’s regularly adjusted so retirees don’t fall behind as prices rise. This year’s raise means an extra $29.70 per fortnight for singles and $44.80 combined for couples — a real boost to keep up with the rising cost of living.

It’s more than just dollars; it’s about respect for those who’ve contributed to society throughout their working lives, ensuring a more secure and dignified retirement.

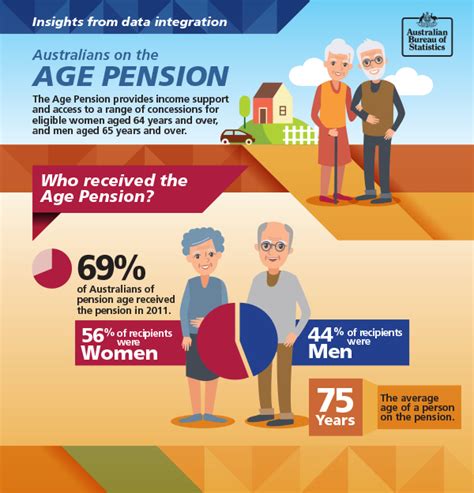

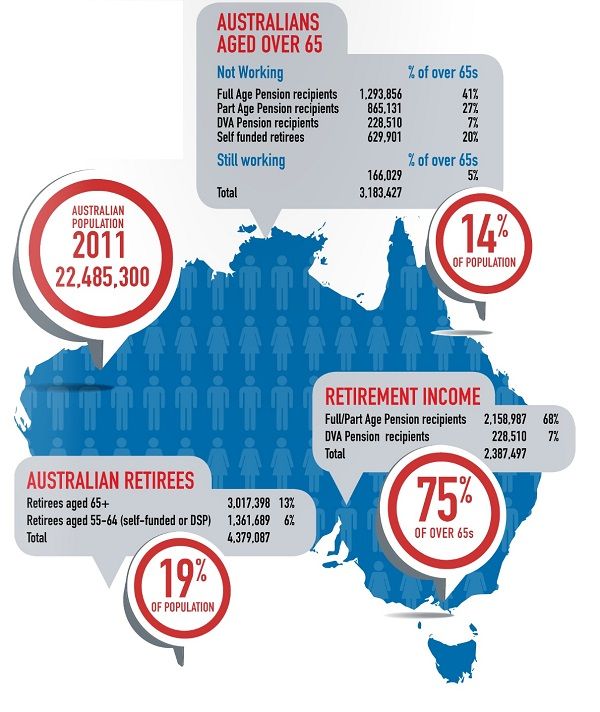

A Brief History & Context: The Age Pension Journey

The Age Pension kicked off in 1909, designed to help older Aussies with basic living costs. Initially provided at age 65, the qualifying age is now 67 to reflect longer life expectancies. The pension’s value is tweaked twice yearly — March and September — based on inflation, consumer prices, and wage growth. This increase in late 2025 is part of that system keeping pace with real world challenges faced by seniors.

Understanding the Australia Age Pension Increase in Detail

Who Qualifies for the Age Pension?

- Age: You must be at least 67 years old (for those born on or after January 1, 1957). You can start your application up to 13 weeks before turning 67.

- Residency: You need to have lived in Australia for at least 10 years, with 5 years continuous. Some overseas work or residence may count if your country has reciprocal agreements with Australia.

- Income and Assets: The government tests your income and assets to decide if you get the full pension, part pension, or nothing at all.

What Are the New Payment Amounts?

Here’s what Aussies will be receiving fortnightly after the increase:

| Pension Type | Amount (AUD) |

|---|---|

| Single Person | $1,178.70 |

| Couple (each person) | $888.50 |

| Couple Combined | $1,777.00 |

Extras include the Pension Supplement for daily costs, the Energy Supplement to ease power bills, and Rent Assistance if you rent your home.

How Is the Pension Calculated?

Two tests decide your pension: the income test and the assets test. The government calculates which test gives you the lower pension amount, and that becomes your payment.

- Income Test: You get a free area ($2,575.40/fortnight for singles). Earnings above this reduce the pension by 50 cents per dollar.

- Assets Test: Your possessions (home, super, investments, cars) are valued. If your assets pass limits ($321,500 for single homeowners for full pension), payments reduce accordingly.

Payment Schedule: When Does the Cash Hit Your Account?

Payments land every two weeks, making it easier to budget. In October 2025, pension payments come through on:

- October 2,

- October 16,

- October 30.

Knowing dates means you can plan your bills and expenses without surprises.

How This Increase Helps Different Groups?

- Regional and Remote Seniors: Higher living expenses in the bush? The increase helps cover those.

- Women: Those who often have lower super balances rely more on the pension; this increase is significant.

- Indigenous Australians: Many live in remote or regional areas where costs are elevated; the boost aids financial stability.

- Couples Separated by Illness: Special combined pension payments ease the burden on families dealing with health issues.

Practical Advice: Tips to Make the Most of Your Australia Age Pension Increase

- Track your income and assets carefully: Reporting changes promptly lets you avoid overpayments or underpayments.

- Use online pension calculators: Tools like the SuperGuide Age Pension Calculator help estimate your payment.

- Check eligibility for supplements: Rent assistance and energy supplements can add extra support — don’t miss out.

- Plan for the long haul: Consider financial advice for superannuation and pension interactions.

Common Pitfalls to Avoid

- Failing to report income or asset changes can cause repayment debts.

- Misunderstanding pension eligibility could result in missed payments.

- Ignoring deadlines for supplement claims may reduce your total income.

- Not taking advantage of government concessions like the Pensioner Concession Card.

Personal Perspective: Real Impact for Retirees

Consider Mary from Melbourne, aged 70, who relies on the pension as her main income. The October 2025 increase puts an extra $59.40 a month into her wallet, enough to cover her groceries or a night out with friends. For Mary, this bump is not just money — it’s peace of mind, independence, and dignity.

Comparing the Age Pension to Other Australian Retirement Supports

Unlike private superannuation, the Age Pension is income-tested and asset-tested, ensuring those most in need get help. Other supports include:

- Disability Support Pension for people unable to work due to disability.

- Carer Payment for those caring for someone with severe disabilities.

- Newstart Allowance (now JobSeeker Payment), which supports unemployed people but is less generous than the Age Pension.

Understanding these differences can help retirees access the right help based on their situation.

How to Apply or Check Your Australia Age Pension Increase?

Applying is straightforward:

- Apply online with your myGov account linked to Centrelink.

- Prepare documents: age proof, residency, income, assets, and bank info.

- Applications can start 13 weeks before your eligibility date.

- Once approved, payments commence swiftly.

Keeping your details updated online helps avoid delays.

Australia Centrelink Age Pension Rates After October 2025: Check Revised Rate, Payment Date

Centrelink Indexation Payment Increase In October 2025 – How much? Check Here