Centrelink Indexation Payment Increase: If you’ve been wondering about the Centrelink indexation payment increase in October 2025, here’s the truth: there is no separate “October” increase. But there is a significant adjustment happening from 20 September 2025, which most Australians will see reflected in their October payments. This increase affects millions of Australians who rely on Age Pension, JobSeeker, Disability Support Pension, Carer Payment, and other welfare programs. In this guide, I’ll explain exactly what’s changing, why it’s happening, and how it impacts you — whether you’re a retiree, job seeker, financial adviser, or policymaker. Let’s dig in, clearly and practically.

Table of Contents

Centrelink Indexation Payment Increase

In short, there’s no separate “October 2025 increase.” The September 2025 indexation is the one that matters — bringing modest but important boosts to millions of Australians.

- Age Pension (single): + $29.70

- Age Pension (couple, each): + $22.40

- JobSeeker: + $15.40

- Deeming rates: Up to 2.75%

While the increases help ease cost pressures, rising living costs continue to challenge those on fixed incomes. For most Australians, staying informed, reviewing finances, and planning ahead remain the smartest moves.

| Category | Details |

|---|---|

| Effective Date | 20 September 2025 |

| Single Age Pension Increase | + $29.70 per fortnight (now $1,178.70 total) |

| Couple (each) Pension Increase | + $22.40 per person (now $888.50 each) |

| JobSeeker (single, no kids) | + $15.40 → $793.60 total |

| Deeming Rates (from Sept 2025) | 0.75% (lower) / 2.75% (upper) |

| Asset Cutoff (Single homeowner) | $714,500 |

| Income Free Area (Single) | $218 per fortnight |

| Next Indexation Date | 20 March 2026 |

| Official Source | Services Australia |

What Is Centrelink Indexation Payment and How It Works?

“Indexation” sounds like bureaucratic jargon, but it’s simply how the government keeps welfare payments in line with living costs. It ensures that people on Centrelink payments don’t fall behind when inflation or wages rise.

Here’s how it works:

- Centrelink (part of Services Australia) adjusts payments every March and September.

- The adjustment is based on three measures:

- Consumer Price Index (CPI) – measures overall price inflation.

- Pensioner and Beneficiary Living Cost Index (PBLCI) – tracks inflation for households on welfare.

- Average Weekly Earnings (AWE) – reflects wage growth across the economy.

Whichever measure is highest is used to increase the rate. That’s how payments keep their real purchasing power.

So, when someone says “October increase,” they’re referring to the September 2025 indexation, which flows into payments received in October.

What’s Actually Changing in September 2025?

1. Higher Pension and Payment Rates

From 20 September 2025, pensions and benefits rise automatically for millions of Australians.

- Age Pension (single) – up $29.70, to $1,178.70 per fortnight (includes supplements).

- Age Pension (couple, each) – up $22.40, to $888.50 each.

- Disability Support Pension – mirrors the same rate change for those over 21.

- Carer Payment – same as Age Pension.

- JobSeeker Payment (single, no children) – up $15.40, to $793.60 per fortnight.

- Rent Assistance and Energy Supplements – also adjusted slightly upward.

For someone on a full Age Pension, that’s roughly $772 extra per year for singles, or $584 per person for couples.

2. Deeming Rate Changes

After nearly five years of being frozen during the pandemic, deeming rates are increasing again — and this matters a lot for retirees with savings.

Here’s how it works:

- If you have financial assets (savings, term deposits, shares, etc.), Centrelink assumes you earn a certain “deemed” return.

- This “deemed income” counts toward your income test, even if your actual earnings are lower.

As of 20 September 2025:

- Lower deeming rate: 0.75% (up from 0.25%)

- Upper deeming rate: 2.75% (up from 2.25%)

Thresholds:

- Singles: First $64,200 → 0.75%; the rest → 2.75%

- Couples: First $106,200 (combined) → 0.75%; the rest → 2.75%

While this may seem small, it could reduce payments for part-pensioners with larger investments. In fact, government analysis suggests around 70,000 pensioners will receive slightly lower payments due to deeming increases.

3. Updated Income and Asset Tests

Income and asset thresholds also rise:

- Asset limits for full pension:

- Single homeowner: $321,500

- Couple homeowner: $481,500

- Cutoff for part pension:

- Single homeowner: $714,500

- Couple homeowner: $1,074,000

- Income free area: $218 per fortnight (single), $380 (couple combined)

If your income or assets exceed these thresholds, your payment is gradually reduced.

Why Centrelink Indexation Payment Increase Matters — The Bigger Picture

Keeping Pace with the Cost of Living

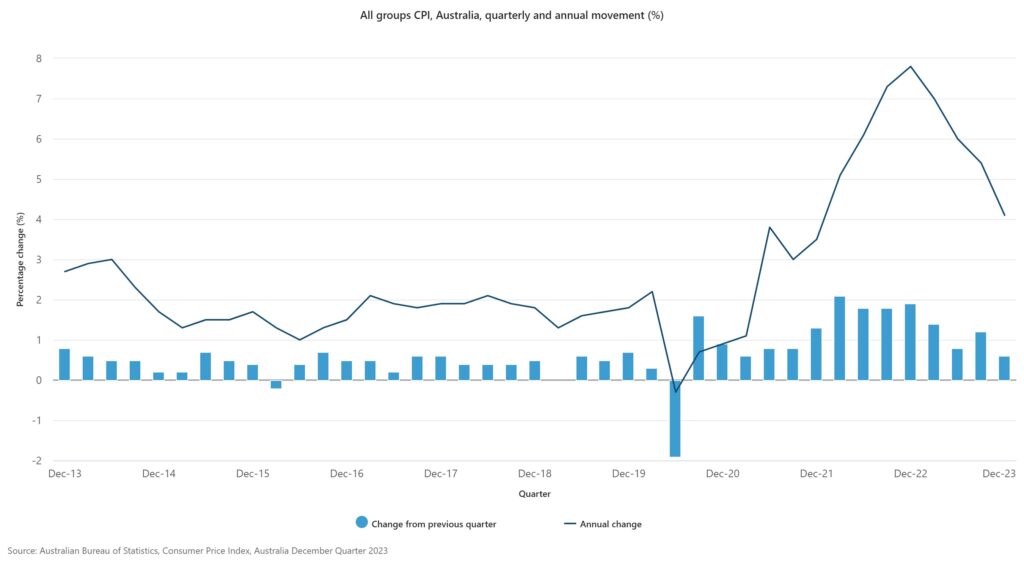

The September 2025 indexation comes amid stubbornly high inflation, particularly in essentials like rent, energy, and groceries.

According to the Australian Bureau of Statistics (ABS), the Pensioner and Beneficiary Living Cost Index (PBLCI) rose 1.1% in the June quarter of 2025 — faster than the general CPI.

So while the increase helps, it may still lag behind real-world price pressures.

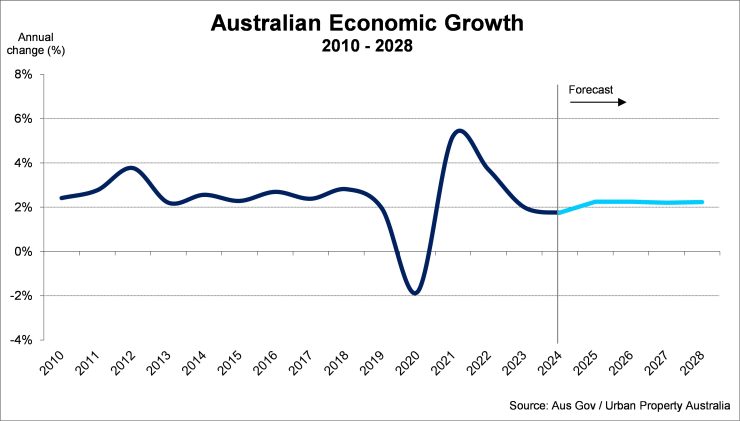

Economic and Political Context

This is the first major indexation round after the government lifted the JobSeeker base rate in 2024 and unfroze deeming rates. The Albanese government has emphasized “targeted relief without fueling inflation.”

Treasurer Jim Chalmers noted in August 2025:

“Indexation ensures Australians on fixed incomes aren’t left behind as costs rise. But we also need to balance budget sustainability and inflation control.”

That’s code for: expect moderate, not massive, increases.

Real-Life Scenarios

Example 1: Full Pensioner

Margaret, 72, owns her home and has $15,000 in savings.

- She gets the full single Age Pension.

- Her fortnightly payment rises from $1,149.00 → $1,178.70.

- Over 12 months, she gains $772 extra.

Example 2: Part-Pensioner Couple

Frank and Helen have $220,000 in investments.

- They’re subject to deeming rates, so their deemed income rises from ~$4,000 → ~$5,500 annually.

- This slightly reduces their payment. Their net increase might be closer to $20–$30 per fortnight combined, instead of $44.80.

Example 3: JobSeeker Recipient

Jacob, 45, unemployed, receives JobSeeker.

- His payment rises from $778.20 → $793.60 per fortnight.

- That’s a 2% bump — welcome, but unlikely to offset full inflation.

Professional Insights: Financial and Policy Implications

For professionals, these changes mean:

- Financial Planners & Accountants

- Re-run client projections and Centrelink eligibility models.

- Update retirement cash flow assumptions based on new deeming thresholds.

- Social Workers & Community Advisors

- Explain why the “October” increase isn’t new—it’s September’s indexation.

- Help clients check MyGov for updated notices and report any income/asset changes.

- Policy Analysts & Advocates

- Track the balance between inflation adjustment and benefit adequacy.

- Prepare for debates on whether JobSeeker and Youth Allowance rates remain below poverty benchmarks.

- Everyday Australians

- Revisit household budgets.

- Monitor energy and rent costs.

- Stay informed on upcoming March 2026 adjustments.

Australia Centrelink Age Pension Rates After October 2025: Check Revised Rate, Payment Date

$1,725 Australia Age Pension Coming this month: Who will get it? Check Eligibility, Payout Schedule

Step-by-Step: What You Should Do Now

- Check Your MyGov Notifications

- Look for your updated payment rate from 20 September.

- Review Your Budget

- Update income and expense forecasts using your new payment amount.

- Reassess Financial Assets

- If you have savings, shares, or super, check how the new deeming rates affect your income test.

- Update Centrelink if Circumstances Changed

- Any change in living situation, income, or investments must be reported.

- Stay Informed for March 2026

- Next indexation and deeming review expected 20 March 2026.

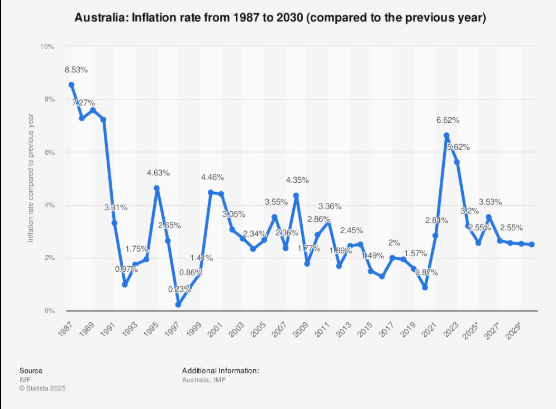

Historical Snapshot: How We Got Here

- 2019–2020: Deeming rates frozen during COVID to protect retirees’ payments.

- 2023–2024: Inflation surged to 7.8%, triggering the largest pension increases in decades.

- 2025: Inflation moderates (~3%), but living costs for retirees remain high, prompting steady indexation.

- 2026 onwards: Policy experts expect debates over whether the PBLCI should be replaced by a broader cost-of-living index.

Practical Tip for Americans or Expats

For U.S. expats or dual citizens living in Australia — Centrelink operates somewhat like Social Security in the U.S., but with means-testing. Your benefit depends not just on age, but also on your assets and income. This makes financial planning far more critical.