$1,725 Australia Age Pension: The $1,725 Australia Age Pension has everyone talking. If you’ve seen headlines about the government giving pensioners a bump this month, you might be asking: Who’s actually getting it? How much will it be? When will I see it in my account? Let’s unpack this in plain English. Whether you’re retired, planning to retire, or helping your parents navigate Centrelink, this guide breaks everything down step-by-step—with verified facts, examples, and tips from trusted sources.

Table of Contents

$1,725 Australia Age Pension

The $1,725 Australia Age Pension increase is a much-needed boost for millions of retirees. Singles now receive $1,178.70 per fortnight, while couples get $1,777 combined. Eligibility depends on your age (67+), residency, income, and assets. For most pensioners, this increase means a bit more breathing room—especially amid rising living costs. Stay informed and regularly review your situation to keep every dollar you’re entitled to. This isn’t just about getting paid—it’s about securing the comfort and dignity you’ve earned.

| Topic | Details / Data |

|---|---|

| Effective Date | 20 September 2025 |

| Full Pension – Single | $1,178.70 per fortnight |

| Full Pension – Couple (each) | $888.50 per fortnight |

| Increase Amount (Sept 2025) | $29.70 (single) / $44.80 (couple combined) |

| Residency Requirement | 10 years total (5 continuous) |

| Age Pension Age | 67 years (born after 1 Jan 1957) |

| Income Test (full pension) | $218 (single) / $380 (couple combined) |

| Assets Test (full pension) | $321,500 (single homeowner) / $481,500 (couple homeowner) |

| Part Pension Cutoff | $714,500 (single homeowner) / $1,074,000 (couple homeowner) |

| Payment Frequency | Fortnightly (or 4-weekly if overseas) |

| Official Reference | Services Australia – Age Pension |

Understanding the “$1,725 Australia Age Pension” Figure

Let’s clear one thing up first — no one is getting exactly $1,725 as a single lump-sum bonus. That number is shorthand used in media headlines to refer to the new total fortnightly amount for couples, which sits close to $1,777 combined after the September 2025 indexation.

So what actually happened?

- From 20 September 2025, the government increased Age Pension rates to keep up with inflation and wage growth.

- Singles saw a $29.70 increase per fortnight, while couples combined received a $44.80 bump.

- The change helps offset rising living costs for older Australians, especially amid ongoing housing and healthcare cost increases.

These adjustments are part of Australia’s twice-yearly pension indexation process, which takes place every March and September. The goal? To ensure the pension remains fair, sustainable, and aligned with current living standards.

Why the Age Pension Was Increased?

This bump isn’t a random giveaway—it’s based on indexation, a legal process that automatically adjusts pension rates according to:

- Consumer Price Index (CPI): Measures the cost of goods and services.

- Pensioner and Beneficiary Living Cost Index (PBLCI): Reflects the specific inflation pressures pensioners face.

- Male Total Average Weekly Earnings (MTAWE): Ensures pensions grow with wages, not just inflation.

Whichever is highest among these indicators determines the size of the pension increase.

In 2025, inflation hovered around 3.5%, pushing the CPI and PBLCI higher than wage growth. As a result, pensions saw the largest boost since 2022, helping older Australians keep up with costs like groceries, rent, and electricity.

Who Is Eligible for the $1,725 Australia Age Pension?

The pension bump applies only to people who already qualify for the Age Pension. If you’re not eligible yet, don’t worry—once you meet the requirements, you’ll automatically get the updated rates.

1. Age Requirement

You must be 67 years or older to qualify (for anyone born on or after 1 January 1957). You can apply up to 13 weeks before your 67th birthday through MyGov or Centrelink.

2. Residency Requirement

- Must have lived in Australia for at least 10 years, with 5 years continuously.

- Some exceptions exist for refugees or people covered under international social security agreements.

3. Income Test

Your income (from work, investments, or super) affects how much pension you receive.

- Singles: Full pension if income ≤ $218/fortnight

- Couples (combined): Full pension if income ≤ $380/fortnight

- If income exceeds these thresholds, your pension gradually reduces by 50 cents for every extra dollar.

4. Assets Test

Your assets (excluding your primary home) are assessed.

- Single homeowner: Full pension if assets ≤ $321,500

- Couple homeowners: Full pension if combined assets ≤ $481,500

- Beyond that, your payment reduces progressively until it cuts off entirely at around $714,500 (single) and $1.07 million (couples).

These tests ensure the Age Pension goes to those who truly need it.

What’s New for September 2025?

Apart from the higher rates, a few policy tweaks are worth noting:

- Deeming Rate Increase: The government lifted deeming rates by 0.5%, impacting how income from savings and investments is calculated. This may slightly reduce payments for some part-pensioners.

- Energy Supplement Remains: The small energy supplement stays in place, even for overseas recipients, as part of the total pension package.

- Payment Frequency Flexibility: Australians living overseas long-term may now choose 4-weekly payments, simplifying budgeting.

- Updated Asset Thresholds: Asset limits were raised to reflect rising property and investment values, giving more people access to part-pensions.

How to Check or Apply for $1,725 Australia Age Pension?

Here’s your roadmap for checking or claiming your entitlement.

Step 1: Check Basic Eligibility

Confirm you meet the age and residency criteria. If you’re approaching eligibility, you can start preparing early.

Step 2: Calculate Your Income and Assets

Use the official Services Australia calculators to estimate your entitlement. These tools factor in your income, super, investments, and property ownership.

Step 3: Gather Your Documents

Before applying, prepare these:

- Identification (passport, birth certificate)

- Proof of Australian residency

- Details of income & investments

- Asset records (property, savings, vehicles, super)

Step 4: Apply Online or In Person

- Log in to MyGov and connect to Centrelink.

- Or apply at your nearest Centrelink Service Centre.

- You can apply 13 weeks before reaching pension age to avoid delays.

Step 5: Stay Updated

Once approved, review your circumstances every few months. If your income, living arrangements, or assets change, report them immediately to avoid overpayments or suspensions.

Real-Life Scenarios

Let’s make this practical with real examples:

Case 1: Sarah, Single, Homeowner

Sarah is 68 and lives in her own home. She has modest savings of $100,000 and earns $150 per fortnight from part-time tutoring.

Her total assets and income are well below thresholds, so she qualifies for the full $1,178.70 per fortnight pension.

Case 2: Peter and Judy, Couple Renters

Peter (70) and Judy (67) rent an apartment in Brisbane. Their combined assets are $720,000.

They’re above the full pension threshold but below the part-pension cutoff. So they receive a part-pension of around $1,300 per fortnight combined.

Case 3: Leon, Overseas Retiree

Leon moved to Portugal but had already received the Age Pension for five years.

He continues receiving payments every 4 weeks, but only proportionate to his Australian working-life residence, as per Services Australia’s overseas rules.

What Could Reduce Your Pension?

Even with the increase, some retirees may see less-than-expected results. Reasons include:

- Deeming Rate Rise: Higher rates mean higher “deemed income” from your savings, which may reduce payments.

- Asset Growth: Selling property or investments can temporarily push your assets above the threshold.

- Unreported Income: Failing to report changes (like rent from a second home) can cause overpayment debts or suspension.

- Living Overseas Too Long: Staying abroad for over 26 weeks may affect how much you receive or how it’s calculated.

Future Outlook

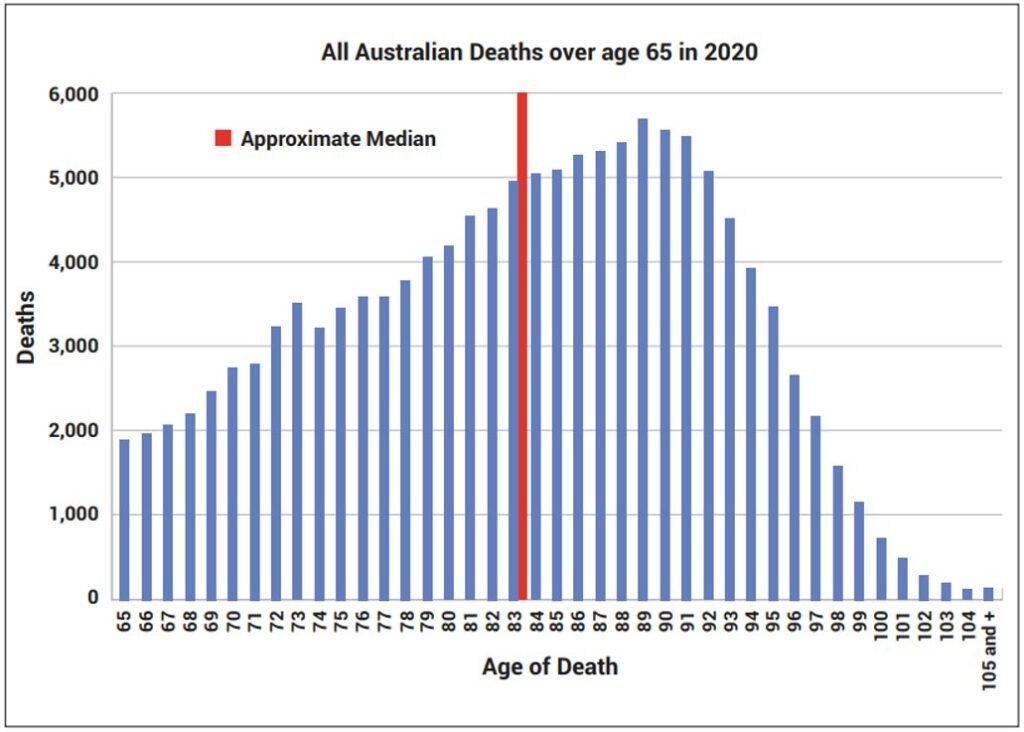

The next adjustment comes on 20 March 2026, when rates will again be reviewed. Experts predict another moderate increase depending on inflation trends.

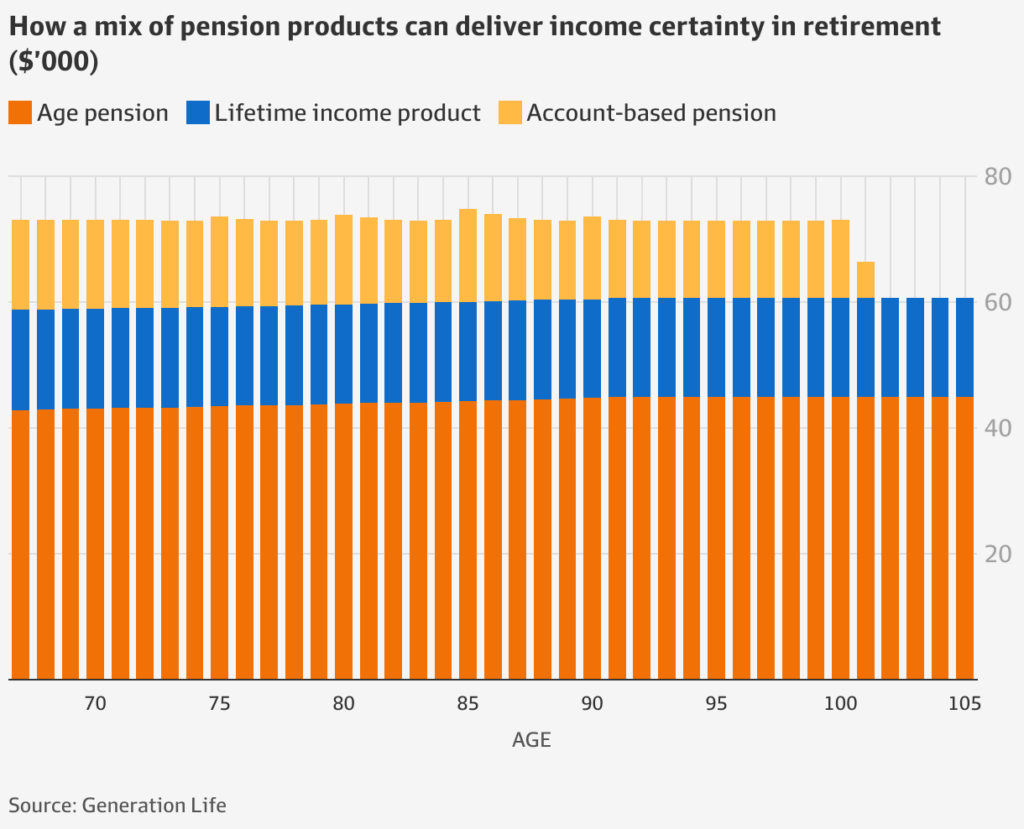

Long-term, discussions are underway about:

- Possibly raising the pension age further (beyond 67)

- Simplifying the income and asset tests

- Better integrating superannuation and pension systems

With an ageing population, these reforms will continue to shape how retirement income works for Australians.

Practical Tips to Maximize Your Pension

- Take Advantage of the Work Bonus: You can earn up to $300 per fortnight from work without it counting toward your income test.

- Reinvest Smartly: Keep savings in low-deeming accounts to reduce assessed income.

- Seek Advice: A licensed financial adviser can help legally structure your assets to maximize eligibility.

- Apply Early: Starting your claim before turning 67 helps avoid payment gaps.

- Check State Benefits: Many states offer extra rebates (energy, travel, healthcare) for pensioners.

Australia Centrelink Age Pension Rates After October 2025: Check Revised Rate, Payment Date