DWP £470 Pension Bonus: If you’ve been hearing buzz about a “DWP £470 Pension Bonus in October 2025”, you’re not alone. Many retirees, working families, and financial planners are talking about this figure like it’s an extra payday coming this fall. Here’s the real story: this so-called “bonus” isn’t a random one-time payment, but an annual increase to State Pension payments under the U.K.’s Triple Lock system. It means more money in pensioners’ pockets starting in October 2025, designed to protect incomes from inflation and keep up with the rising cost of living. This article breaks it all down — eligibility, payment dates, real numbers, tax implications, and what it means for everyday people. It’s a straight-talking, professional guide that’s as easy to follow as a conversation over coffee.

Table of Contents

DWP £470 Pension Bonus

The DWP £470 Pension Bonus in October 2025 isn’t a one-time check—it’s a structured annual increase designed to help pensioners keep up with rising costs. For millions of retirees, this extra £470 per year can make a tangible difference in daily life, from paying bills to increasing financial security. By understanding how the Triple Lock works, who’s eligible, and how to plan ahead, pensioners can make sure they get every pound they’re entitled to.

| Topic | Details |

|---|---|

| Bonus Amount | Up to £470 per year increase in State Pension |

| Payment Start Date | October 2025 (on regular pension schedule) |

| Eligibility | State Pension recipients meeting National Insurance and residency rules |

| Triple Lock Increase | Based on highest of inflation, earnings growth, or 2.5% |

| Expected Weekly Increase | £9.05 per week |

| Number of Beneficiaries | Around 12.6 million |

| Official Source | GOV.UK |

| Next Review Date | April 2026 |

What Is the DWP £470 Pension Bonus?

The £470 Pension Bonus is not a special lump sum. It refers to the projected annual increase in pension income for State Pension recipients starting in October 2025.

This increase is the result of the Triple Lock Guarantee—a U.K. government commitment to raise pensions annually by whichever is highest:

- The inflation rate (measured by CPI),

- The average earnings growth, or

- A flat minimum of 2.5%.

For 2025, the full new State Pension is expected to increase from £221.20 per week to approximately £230.25 per week, resulting in an annual increase of about £470.

That extra £470 a year may seem modest, but for many retirees, it helps cover essential household expenses, provides a cushion against rising energy costs, or allows a little extra for personal spending.

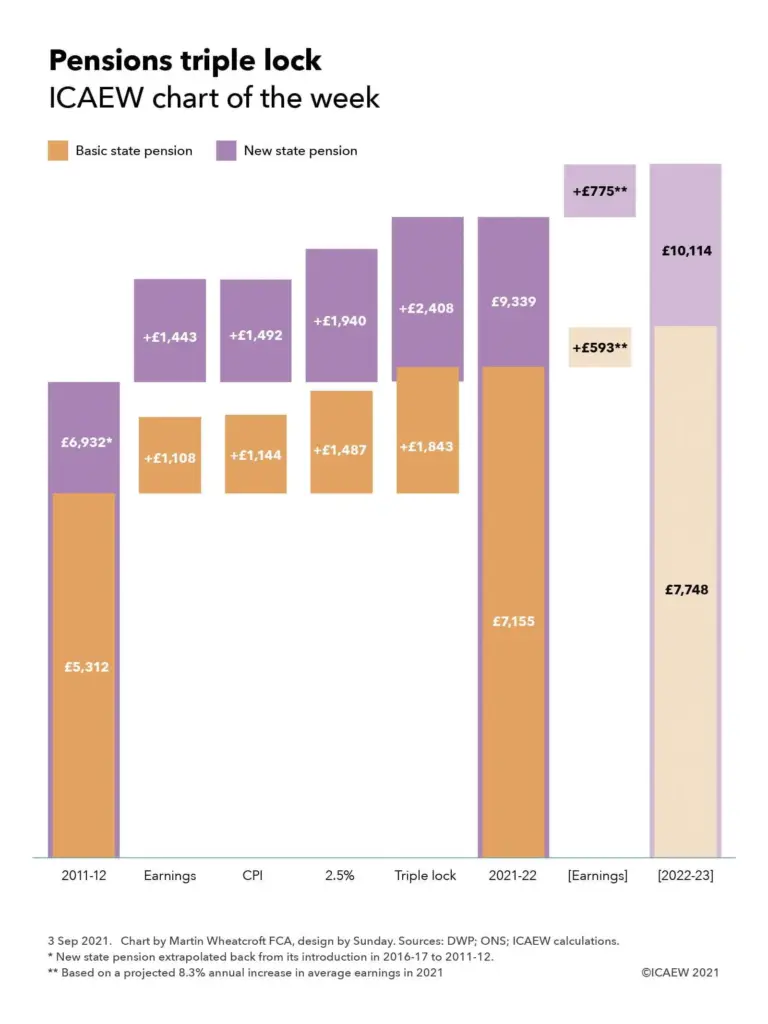

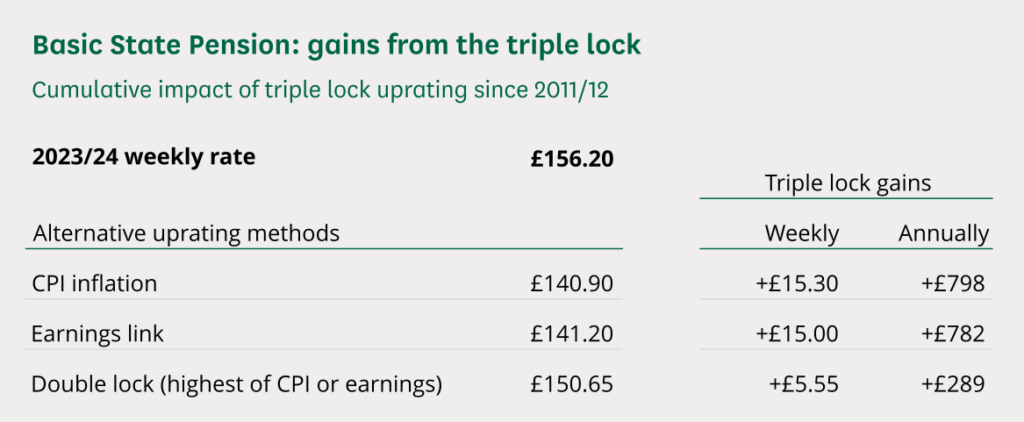

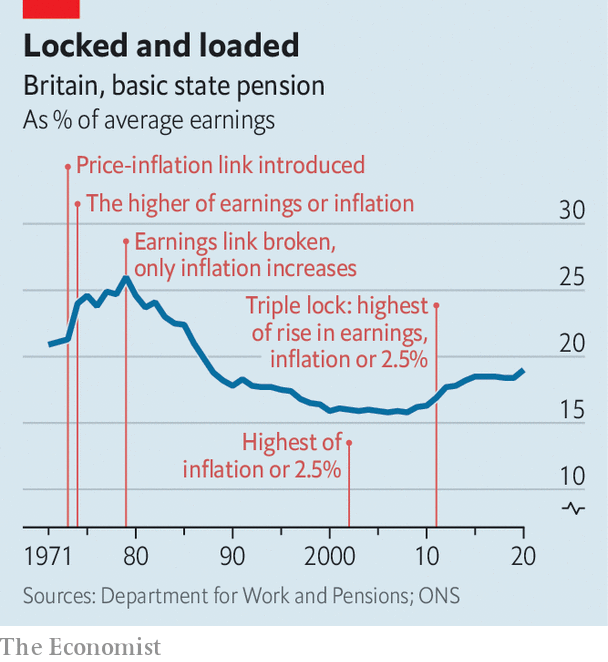

How the Triple Lock System Works?

Introduced in 2010, the Triple Lock is one of the most important protections for pensioners in the U.K. It guarantees that the State Pension increases each year by the largest of:

- Inflation rate (CPI),

- Average wage growth, or

- 2.5% minimum.

This ensures that the value of pension income doesn’t erode over time. In years when inflation or wages rise sharply, pensioners benefit from a more significant increase. When both are low, they still get at least 2.5%.

For 2025, official data shows inflation stabilizing after several years of volatility. Average earnings growth remains steady at around 5.1% year-on-year, according to the Office for National Statistics (ONS), which is a key driver behind the £470 figure.

This policy is critical because many retirees rely almost entirely on State Pension income to meet everyday living costs.

Historical Pension Increases

| Year | Weekly Pension | Annual Increase | Main Driver |

|---|---|---|---|

| 2021 | £179.60 | £228 | 2.5% floor |

| 2022 | £185.15 | £288 | High inflation |

| 2023 | £203.85 | £972 | Wage growth surge |

| 2024 | £221.20 | £906 | Inflation and earnings |

| 2025 (est.) | £230.25 | £470 | Moderate earnings growth |

This historical context shows that while 2025’s increase is smaller than 2023 and 2024, it still provides a real and meaningful boost. The 2023 spike was exceptional due to post-pandemic wage and inflation surges. The current figure reflects a more stable economic environment.

Who Is Eligible for the DWP £470 Pension Bonus?

The pension increase is not universal in the sense of being a flat cash handout. It applies to those who meet the eligibility criteria:

- Receiving the full new State Pension or basic State Pension (pre-2016),

- Having sufficient National Insurance (NI) contributions,

- Residing in the U.K. or a country with uprating agreements,

- Pensioners living abroad in qualifying countries (such as the U.S. and most of the EU) may also receive the increase.

Expats living in countries without such agreements, such as Canada or Australia, may see their pensions remain “frozen” at the original amount.

Payment Dates and Schedule

The increase takes effect from October 2025 and is paid through regular pension payments, which are typically made every four weeks.

Payment dates are determined by the last two digits of your National Insurance (NI) number:

| NI Number Ending | Payment Day |

|---|---|

| 00–19 | Monday |

| 20–39 | Tuesday |

| 40–59 | Wednesday |

| 60–79 | Thursday |

| 80–99 | Friday |

There is no separate “bonus payment date.” The increased amount is automatically added to your existing pension payments.

Timeline of Key Events

| Event | Date | Details |

|---|---|---|

| Triple Lock announcement | September 2025 | Official CPI and wage data released |

| Increase effective | October 2025 | Pension payments adjusted |

| Next review | April 2026 | New Triple Lock assessment |

This timeline helps retirees plan ahead—especially those relying on the pension as their main source of income.

Tax Implications of the Pension Increase

A pension increase, even a modest one, can affect your tax liability.

- If your total annual income exceeds the Personal Allowance (currently £12,570 for the 2025/26 tax year), you may have to pay income tax on the amount above the threshold.

- State Pension is taxable income, but tax is not deducted at source. HMRC may adjust your tax code or collect the tax through other income sources.

- For retirees with private pensions or part-time work, this increase could shift them into a higher tax bracket.

It’s wise to check your tax code after the increase.

Real-Life Example: Mary’s Story

Mary, a 68-year-old retiree from Manchester, currently receives £221.20 per week. Under the new rate, she will receive £230.25 per week, which is an extra £9.05 weekly.

Over a year, that equals £470.60 more income.

Mary uses this extra amount to help with energy bills during the colder months. For someone on a fixed income, even a small increase can bring greater financial stability and peace of mind.

Impact on U.S. Residents and Expats

For British pensioners living in the United States, the uprating agreement ensures they receive the same pension increases as those living in the U.K.

Payments are typically made via direct deposit in U.S. dollars. Currency exchange rates can affect the actual amount received, but the increase itself still applies.

Retirees in the U.S. should also review the Windfall Elimination Provision (WEP) under Social Security rules, which can affect how foreign pensions interact with U.S. benefits. More details are available at SSA.gov WEP.

Policy Debate Around the Triple Lock

The Triple Lock system has been a hot topic in U.K. politics. Supporters argue that it:

- Protects pensioners from poverty,

- Ensures dignity in retirement,

- Keeps up with cost-of-living increases.

Critics, however, say it places long-term financial pressure on public budgets, especially as the population ages.

In recent years, debates have emerged about whether to modify or replace the Triple Lock with a “Double Lock” (linking pensions only to inflation or earnings).

While no changes have been confirmed for 2025, it’s wise for retirees and future pensioners to stay informed about potential policy shifts.

How to Ensure You Receive the Full Increase?

Many pensioners miss out on benefits because of outdated personal information or administrative delays. Here’s how to make sure you don’t:

- Check your NI contribution record.

Missing years may reduce your pension entitlement. You can make voluntary contributions to fill gaps. - Update personal details.

Log into your GOV.UK account to ensure your address and bank information are correct. - Review your eligibility early.

Don’t wait until payment day. Review your pension forecast months in advance. - Avoid scams.

DWP will never ask for personal or bank details by email or phone. If in doubt, contact DWP directly. - For expats:

Confirm your country’s uprating agreement to ensure the increase applies.

How Retirees Can Make the Most of the DWP £470 Pension Bonus?

While £470 a year may not sound like a windfall, it can be used strategically to improve financial security:

- Covering heating or energy bills during winter.

- Allocating toward medical costs or dental appointments.

- Paying down small debts to reduce financial stress.

- Contributing to an emergency savings fund.

- Making small but meaningful lifestyle upgrades, like travel to see family.

Financial advisors often recommend treating the increase as predictable income, not as extra cash to spend impulsively.

Common Misconceptions About the £470 Pension Bonus

| Myth | Reality |

|---|---|

| “I’ll get a £470 check in October.” | It’s not a lump sum; the increase is spread across your regular payments. |

| “Everyone gets it automatically.” | Eligibility depends on NI contributions and residency. |

| “It’s a one-time bonus.” | It’s an annual uprating under the Triple Lock. |

| “I need to apply for it.” | No application is required; it’s automatic if eligible. |

| “Expats can’t get the increase.” | Many expats do, depending on their country of residence. |

DWP Confirms State Pension Changes in 2026 – 5 Crucial Rule Changes Every UK Retiree Must Check

£4,200 Pension Credit Boost in 2025: Check Eligibility Criteria and Application Process

DWP WASPI £2,950 Compensation News – Only these will get it in October 2025