IRS Confirms $1,390 Relief Deposit: If you’ve been online recently, chances are you’ve seen people talking about a $1,390 IRS relief deposit supposedly being sent out in October 2025. Some headlines make it sound official, with bold promises like “Americans to receive $1,390 in days” or “IRS launches new stimulus check.” For many folks, especially in a year of rising costs, this kind of news feels like a light at the end of the tunnel. But here’s the truth: the IRS has not confirmed any such payment. No bill has been passed in Congress. No official announcement exists.

This article breaks down where the rumor started, how real relief programs actually work, what legitimate aid you can apply for, and how to avoid scams. Whether you’re a retiree, a parent, or a working professional trying to stay ahead, this guide will give you a clear, fact-based picture of what’s really going on.

Table of Contents

IRS Confirms $1,390 Relief Deposit

The claim that the IRS will send a $1,390 relief deposit in October 2025 is not backed by any official announcement, legislation, or credible source. It’s a rumor — one that could lead to scams if people aren’t careful. However, there are real programs that can provide meaningful support, from tax credits to state rebates. Staying informed, verifying information, and filing taxes on time are the smartest steps you can take.

| Detail | Information |

|---|---|

| Claim | “IRS to issue $1,390 relief deposits in October 2025” |

| IRS Confirmation | No official announcement from IRS as of October 2025 |

| Legislation Status | No new federal relief bill passed |

| Source of Rumor | Viral TikTok videos, Facebook posts, and non-official blogs |

| Official Website | IRS.gov |

| Last Federal Stimulus | March 2021 (American Rescue Plan) |

| Legitimate Alternatives | Tax credits, state rebates, benefits |

| Recommended Action | Verify on IRS.gov, avoid scams, keep tax info updated |

Understanding Where the IRS Confirms $1,390 Relief Deposit Claim Came From

This rumor started when several unverified news websites and TikTok creators began spreading posts that claimed the IRS was “rolling out” a one-time payment of $1,390. These posts included fake eligibility charts, misleading timelines, and non-official links.

Many of these websites mimic the design of real government pages, but if you look closely, their URLs end with “.com” or “.net” — not “.gov.” None of these sources cite official IRS press releases or Congressional legislation.

The IRS newsroom is where all official payment programs are announced. As of mid-October 2025, no such announcement exists. This claim has also been flagged as misleading or false by USA Today, Hindustan Times, and Finger Lakes 1.

The spread of this misinformation reflects how quickly stimulus rumors can gain traction — especially in tough economic times when people are looking for financial help.

A Look Back at Real U.S. Stimulus Payments

To understand why so many believe these kinds of claims, it helps to look back at actual stimulus programs from recent years.

| Year | Program | Amount |

|---|---|---|

| 2020 | CARES Act | $1,200 per adult |

| 2020–2021 | Consolidated Appropriations Act | $600 per adult |

| 2021 | American Rescue Plan (ARP) | $1,400 per adult |

| 2022–2023 | Various State Rebates | $100–$1,500 |

These payments were backed by Congressional approval and signed into law by the President. Once the legislation passed, the IRS distributed funds directly through direct deposit, paper checks, or debit cards.

That’s why a figure like $1,390 seems believable — it’s similar to past amounts. But belief isn’t proof. Without legislation, no payment will go out.

Federal vs. State-Level Payments in 2025

While there’s no new federal stimulus program, some states are offering their own rebates and refunds to help residents deal with inflation and rising living costs.

Here are a few examples of recent or ongoing state relief programs:

- California: Previously issued up to $1,050 in “Middle Class Tax Refunds.”

- New Mexico: Offered $500–$1,000 rebates for eligible taxpayers.

- Colorado and Massachusetts: Sent surplus tax rebates to qualifying residents.

This is where a lot of confusion begins. Someone in California might receive a legitimate state rebate, post about it on social media, and people in other states assume it’s a federal program. The rumor then spreads with a new number, like $1,390, attached to it.

How IRS Confirms $1,390 Relief Deposit Actually Work: A Step-by-Step Guide

Even though there’s no $1,390 federal payment now, it’s important to know how real relief programs are created and distributed. Here’s how it typically happens:

1. Legislation Is Passed

No payment is issued without Congress passing a bill and the President signing it into law. This is the foundation for every federal stimulus payment in the past.

2. IRS Makes an Official Announcement

The IRS updates its newsroom, adds program details to IRS.gov, and issues press releases. This is the only legitimate source of IRS stimulus information.

3. Eligibility Is Based on Tax Returns

Payments are usually determined by:

- Adjusted Gross Income (AGI)

- Filing status (single, married filing jointly, head of household)

- Number of dependents

For example, during the 2021 stimulus:

- Individuals earning under $75,000 got the full amount.

- Couples earning under $150,000 received full payments.

- Partial payments were phased out for higher earners.

4. Distribution Happens Automatically

- Those with direct deposit on file receive payments first.

- Those without it receive paper checks or debit cards in the mail.

5. Recovery Claim Option

If you qualify but didn’t receive the payment, you can claim it as a Recovery Rebate Credit on your tax return.

Why Stimulus Rumors Spread So Fast?

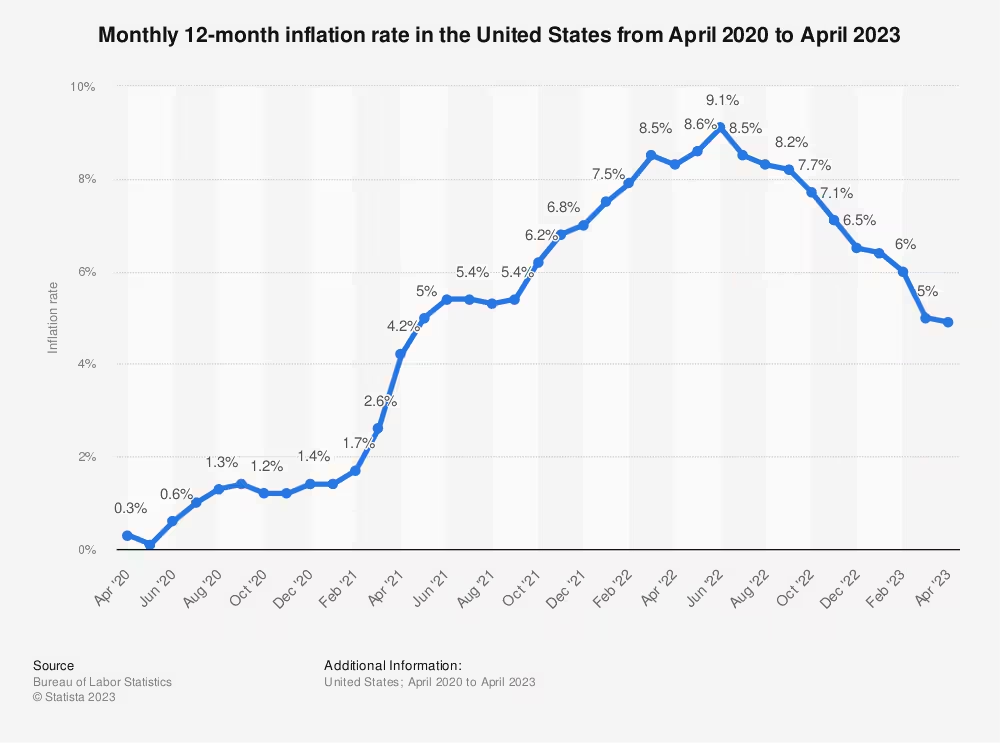

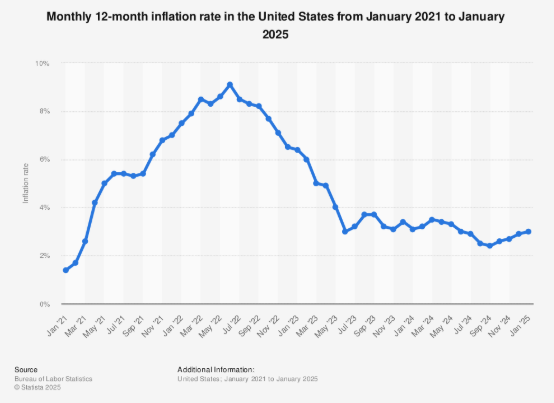

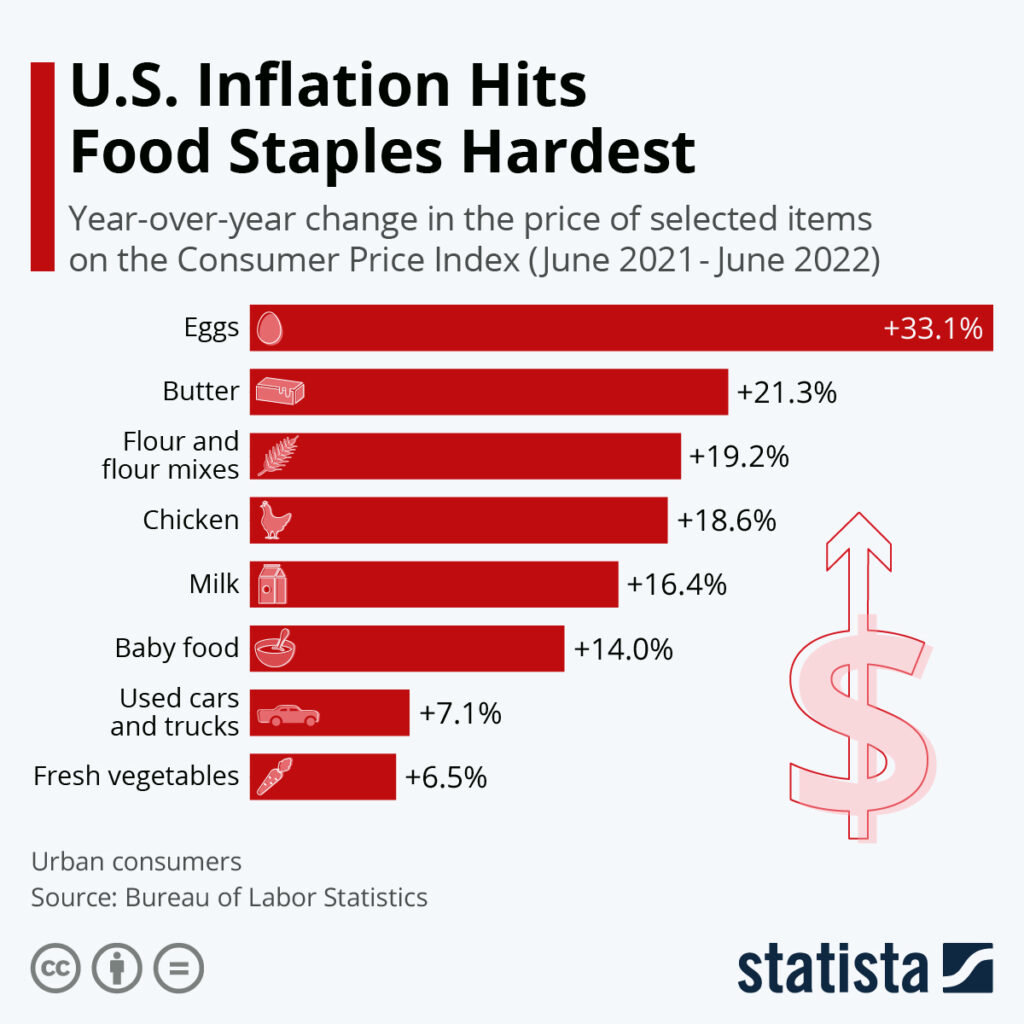

A major reason misinformation like this thrives is because people are facing real financial pressure. According to the Bureau of Labor Statistics, inflation is currently at 3.2% year-over-year as of fall 2025. Housing and groceries have seen some of the biggest spikes — with average rent increasing by 5% in many cities.

In a climate like this, a promised check of $1,390 sounds like a lifeline. Social media platforms also amplify posts that get high engagement, so a single viral video can spread across millions of feeds overnight.

How to Spot and Report a Fake IRS Payment Offer?

Scammers have gotten more sophisticated over the years, especially after the real stimulus checks of 2020 and 2021. Here are some red flags:

- Fake websites: Look out for URLs that resemble IRS.gov but end with “.com,” “.org,” or “.net.”

- Emails or texts asking for personal info: The IRS will never contact you through unsolicited messages.

- “Claim now” language: Real IRS programs don’t require signing up through third-party sites.

- Requests for payment to release funds: Legitimate stimulus payments are free.

Special Notes for Seniors, Veterans, and Low-Income Americans

Many scammers target older adults, veterans, and low-income households because they’re more likely to have fixed incomes and may rely on benefits. Here’s what’s important to remember:

- If you receive Social Security or VA benefits, any legitimate stimulus would be deposited directly into the same account.

- You don’t need to “apply” through a separate website.

- Do not share personal information with anyone over email or text.

Real Programs You Can Actually Use in 2025

Even though the $1,390 check isn’t real, there are several real, legally backed programs that provide financial support:

| Program | Benefit |

|---|---|

| Earned Income Tax Credit (EITC) | Up to $7,830 for eligible households |

| Child Tax Credit | Up to $2,000 per child |

| LIHEAP | Help with energy bills |

| SNAP | Food assistance |

| SSI / SSDI | Income support |

These programs don’t require you to pay to “claim” them, and applications are processed through official federal or state websites.

What Tax Professionals Are Saying

Tax preparers and financial planners around the country are issuing warnings about this $1,390 rumor. Many compare it to similar scams that appeared in 2020 and 2021 when criminals sent fake “IRS forms” to trick people into giving up personal information.

A certified tax preparer in Florida explained:

“Every time there’s economic stress, these scams pop up. People get desperate and want to believe it’s true. The best thing anyone can do is file their taxes early, keep their information updated, and never trust unofficial sources.”

Tax professionals recommend:

- Filing your 2024 tax return as soon as possible in 2026.

- Using IRS Direct Pay for secure transactions.

- Signing up for USPS Informed Delivery to track official mail.

How to Stay Prepared If a Real Relief Program Is Ever Announced?

Even though there isn’t one now, it’s wise to be prepared in case Congress does pass a relief bill in the future. Here’s what you can do:

- Make sure your direct deposit information is updated with the IRS.

- File your taxes on time so your eligibility can be automatically determined.

- Monitor official sources, not social media, for updates.

- Keep your mailing address current to avoid delays with paper checks.

- Educate family members, especially seniors, about spotting scams.

October SSDI and November SSI Payments Scheduled by Social Security for 2025: Check Payment Details!

$1450 SSI Double Payment In October 2025: Only these Americans will get it, Check Eligibility