$400 Stimulus Payment Coming: If you’ve been scrolling through Facebook, watching the evening news, or chatting with your neighbors over coffee, you’ve probably heard about a “$400 stimulus payment” that’s supposed to hit American bank accounts in 2025. It sounds like free money, right? But before you start planning how to spend it, let’s set the record straight: this is not a new federal stimulus check. Instead, this is state-level financial relief, often called a rebate, inflation refund, or stimulus supplement. That means only some states are participating, and not everyone will qualify. If you want to know whether you’re eligible and when the payment might hit your account, this detailed guide will walk you through everything clearly.

Table of Contents

$400 Stimulus Payment Coming

The $400 stimulus payment is not a federal check but a state-level rebate program designed to ease the burden of inflation. Whether or not you qualify depends on where you live, your income, and your tax filing status. If your state is participating, take the time to:

- Check your eligibility on official government websites

- Make sure your personal information is up to date

- Protect yourself from scams

- Use the funds wisely once received

For many households, an extra $400 can help cover groceries, bills, or savings. While it won’t solve inflation, it can offer meaningful relief and boost local economies.

| Category | Details |

|---|---|

| Payment Amount | Up to $400 (state-level stimulus, not federal) |

| Eligibility | Income and residency-based; varies by state |

| States Involved | NY, CO, CA, MN, OR, and others |

| Payment Timeline | Fall–Winter 2025, depending on the state |

| Official Sources | IRS.gov, USA.gov, state revenue sites |

| Tax Status | Usually not federally taxable; state tax rules vary |

| Scam Warning | No official agency will call or text to offer stimulus |

| Application Requirements | Most payments are automatic; some states require filing or applications |

What Is the $400 Stimulus Payment Coming?

The $400 stimulus payment making headlines is a one-time state rebate meant to help residents deal with ongoing inflation and cost-of-living increases. It is not a federal program, so don’t expect the IRS to issue a national check to everyone this time.

Instead, states like New York, California, Colorado, Minnesota, and Oregon are using budget surpluses and special programs to distribute direct cash relief to eligible residents.

This approach mirrors smaller, state-driven stimulus efforts that began after the main federal stimulus programs ended in 2021. While the federal checks were universal (with income limits), state checks are targeted toward middle- and lower-income households.

A Brief History of Stimulus Checks in the U.S.

Understanding how we got here makes the current situation clearer.

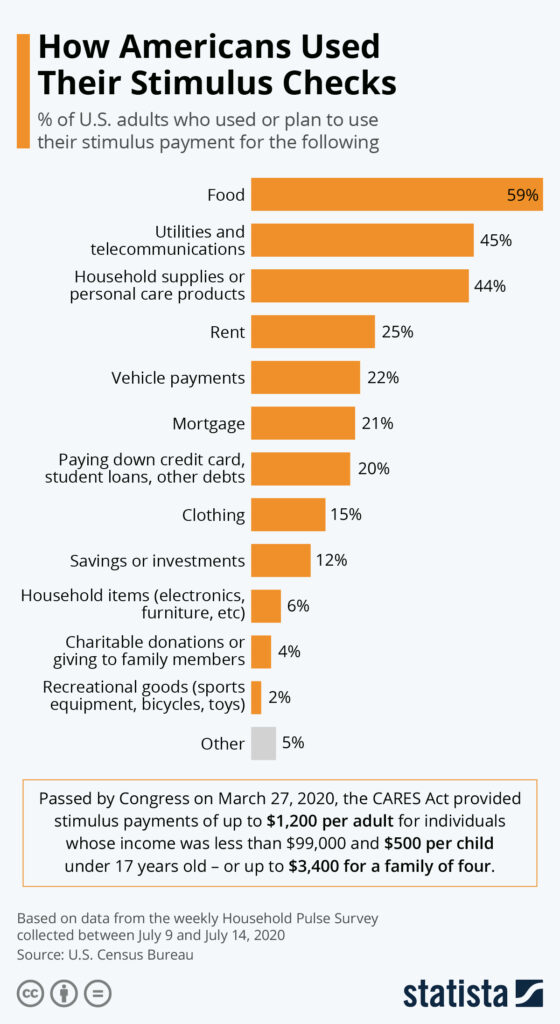

- 2020–2021: The federal government sent out three rounds of stimulus checks totaling up to $3,200 per eligible person through the CARES Act and the American Rescue Plan Act.

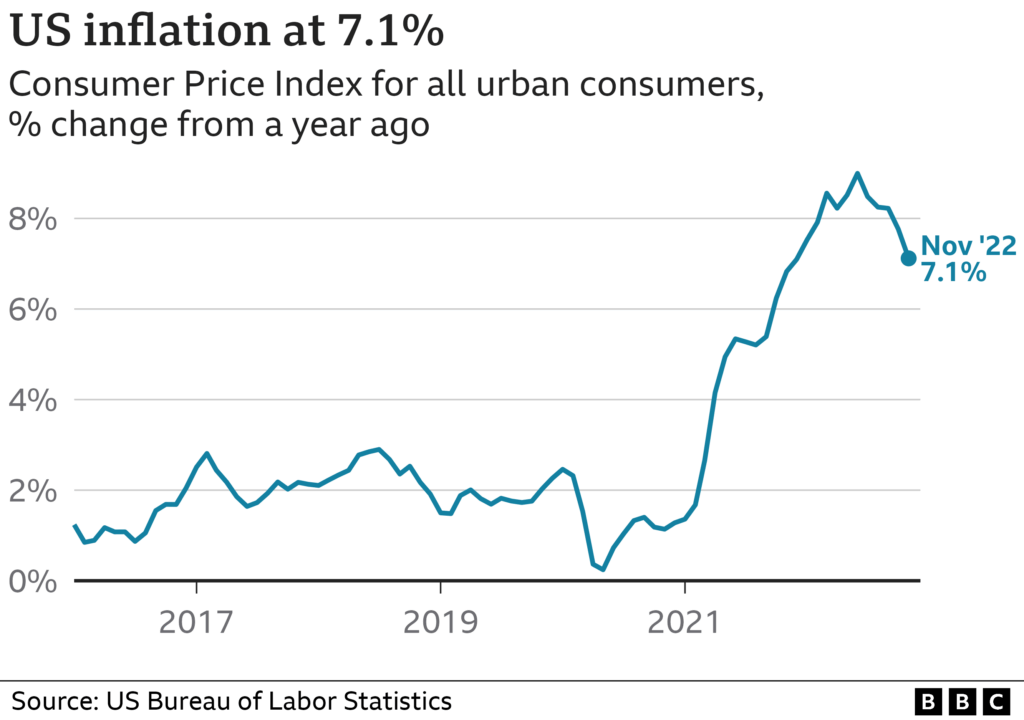

- 2022: As inflation surged to its highest point in 40 years, some states decided to provide additional aid on their own.

- 2023–2024: Multiple states, including California, Colorado, and New Mexico, distributed tax rebates to help residents manage rising costs.

- 2025: With inflation still elevated and some states enjoying budget surpluses, a new round of state-level rebates has emerged, often referred to informally as “$400 stimulus checks.”

Unlike federal programs, these payments are not guaranteed nationwide. Each state decides if, when, and how much to give out.

Why States Are Offering $400 Stimulus Payment?

According to data from Moody’s Analytics, American households spent approximately $11,434 more between 2021 and 2024 on basic goods and services due to inflation. Rent, gas, and grocery prices have remained stubbornly high, and even though inflation has cooled slightly, it is still above the Federal Reserve’s 2% target.

The U.S. Bureau of Labor Statistics reported that inflation hovered around 3.5% in September 2025. Many states have healthy budget surpluses because of pandemic-era federal funding, higher tax revenues, and economic growth. By returning some of this money to taxpayers, states are:

- Helping residents offset living costs

- Encouraging consumer spending in local economies

- Reducing financial pressure on low- and middle-income households

In short, these payments are a state-level solution to a national problem.

States Currently Issuing or Approving $400 Stimulus Payment Coming

The list of participating states may expand, but as of now, here’s where programs are active or planned:

| State | Payment Amount | Eligibility Criteria | Payment Method | Timeline |

|---|---|---|---|---|

| New York | Up to $400 | 2023 tax filers with qualifying income | Mailed check | Fall 2025 |

| Colorado | $400 individual / $800 joint | 2023 tax filers or PTC applicants | Direct deposit / check | Fall–Winter 2025 |

| California | $200–$1,050 | Income-based, 2023 tax return required | Debit card / direct deposit | Ongoing |

| Minnesota | $260–$1,300 | Based on adjusted gross income and dependents | Check or deposit | Rolling distribution |

| Oregon | Variable | Tax rebate recipients; targeted low/middle-income groups | Check or deposit | Late 2025 |

Each state uses its own rules and income thresholds. Some programs are automatic if you filed your state taxes, while others require an application or updated information.

Step-by-Step: How to Check If You Qualify

- Check your state’s official website. Search “$400 stimulus check [Your State] 2025” and make sure the site ends in

.govto avoid scams. - Review income and residency rules. Most states use your 2023 or 2024 tax return to determine eligibility.

- Log in or create a tax account. Some states offer secure portals where you can check payment status and update information.

- See if payment is automatic. If you’ve filed taxes and qualify, no extra action may be required.

- Apply if needed. If your state requires an application, make sure to meet deadlines and provide accurate information.

- Update your mailing address. This helps avoid delays if your state sends paper checks.

How and When Payments Will Be Sent?

The delivery method depends on the state.

- Direct deposit: Fastest method, typically used for people who received their tax refunds electronically.

- Paper check: Common for those without direct deposit information on file.

- Debit card: Some states, such as California, issue preloaded debit cards to speed up distribution.

Many states are aiming to distribute payments within six to eight weeks after eligibility is determined. However, backlogs may occur during high-demand periods, so it’s wise to track your status through official channels.

Real-Life Experiences from Previous State Rebates

When states distributed similar rebates in 2022 and 2023, many families reported that the extra cash made a meaningful difference.

One Colorado resident said she used her $400 rebate to catch up on utility bills before winter. A single parent in New York shared that their check covered nearly a full week of groceries. For many working-class Americans, these checks provide temporary but real relief.

Even though $400 may not cover a full rent payment, it can help bridge gaps, reduce debt, or cover basic expenses without turning to high-interest credit cards.

Tax Implications of Receiving a State Rebate

One of the most common questions about stimulus or rebate checks is: “Do I have to pay taxes on this?”

For most people, the answer is no. The IRS clarified in 2023 and 2024 that most state-issued stimulus payments are not considered taxable federal income. However, state tax laws can differ:

- If you claim the State and Local Tax (SALT) deduction, part of the rebate could be taxable.

- Some high-income households may have reporting requirements.

- States can issue 1099-G forms for rebate payments, but not always.

How to Avoid Stimulus Scams?

Whenever there’s a government payment, scammers appear. Here are the most common tactics and how to avoid them:

- Fake texts or calls claiming to offer faster payment in exchange for personal info.

- Phishing emails pretending to be from IRS or state agencies.

- Fake websites with misspelled domains or unofficial URLs.

- Social media messages promising “extra stimulus.”

Legitimate agencies will never call, text, or DM you for your personal information.

Economic Impact of State Stimulus Programs

State-level rebates aren’t just handouts. They have measurable effects on the economy. According to estimates from the Congressional Budget Office (CBO), state stimulus programs can boost local economic activity by 0.2% to 0.4% during the quarter the payments are distributed.

This happens because:

- Households spend the money quickly, often on essentials like gas, food, and rent.

- Local businesses see increased demand, helping maintain jobs.

- Tax revenues may rise indirectly, partially offsetting the cost of the rebates.

Economists caution, however, that while these payments help individuals, they don’t address the root causes of inflation. They’re a temporary cushion, not a permanent fix.

Expert Tips to Make the Most of Your $400 Stimulus Payment Coming

- Use it for essentials first — groceries, bills, transportation.

- Pay off small debts to save on future interest charges.

- Set aside a portion for emergencies.

- Avoid spending on impulse purchases that don’t contribute to financial security.

- Track the payment to avoid delays or misplacement.

Common Mistakes to Avoid

- Failing to update your address or bank info, causing check delays.

- Ignoring legitimate notices from your state tax department.

- Assuming the payment is federal and waiting for IRS action.

- Missing application deadlines.

- Falling for fake social media posts or text message scams.

$1,702 Stimulus Payment For Everyone in Oct 2025 – Will you get it? Check Eligibility

$3,831, $4,018, $5,108 Social Security Payments in October 2025; How to Get it? Check Eligibility