$967 SSI Direct Deposit: If you’re waiting on your $967 SSI direct deposit in October 2025, you’re part of millions of Americans who depend on Supplemental Security Income (SSI) every single month. This isn’t just another payment; for many seniors, people with disabilities, and low-income individuals, it’s the backbone of their financial stability.

The October 2025 SSI schedule comes with a twist — recipients will get their regular payment on October 1 and an early payment on October 31 because November 1 falls on a Saturday. That’s why it’s important to understand not just the dates, but the rules, eligibility, and smart ways to manage the funds so you stay financially steady throughout the month. This guide provides a complete breakdown of the $967 SSI payment, eligibility requirements, state supplements, COLA adjustments, tax implications, application steps, and practical budgeting advice.

Table of Contents

$967 SSI Direct Deposit

The $967 SSI direct deposit in October 2025 is more than a line on a calendar — it’s essential support for millions of Americans. With two payments this month (October 1 and October 31), understanding how to manage and plan around these dates is key. Eligibility rules, COLA adjustments, and state supplements can influence the total amount you receive. Proper reporting helps prevent overpayment problems, and smart budgeting can make those dollars go further. Whether you’re just starting your SSI journey or have received benefits for years, being informed gives you financial control.

| Topic | Details |

|---|---|

| Maximum SSI Payment (2025) | $967 for individuals (federal base rate) |

| Primary Payment Date | October 1, 2025 |

| Early Payment Date (November) | October 31, 2025 |

| Eligibility Factors | Income, resources, disability/age, residency, citizenship |

| State Supplements | Up to $200+ extra in some states |

| COLA Adjustment | Annual increase based on inflation |

| Taxation | SSI is not taxable |

| Application Options | Online, phone, or local SSA office |

| Official Website | SSA.gov |

A Brief History of SSI and Why It Matters

The SSI program was established in 1972 as part of a major overhaul of the federal welfare system under President Richard Nixon. Before that, individual states had their own programs for elderly and disabled residents, but they were inconsistent and left many people without adequate support.

In January 1974, SSI made its first payments. It became the nationwide standard for basic income support for people who are older, blind, or disabled with little to no income. Unlike Social Security Retirement, which is earned through payroll taxes and work history, SSI is needs-based — meaning it is meant to help people with limited resources, even if they’ve never worked.

In 1974, the maximum federal payment was $140 per month for individuals. In 2025, it stands at $967, a reflection of nearly five decades of cost-of-living adjustments and program expansion. But despite these increases, many recipients still live on the edge of poverty — which is why every payment and every dollar matters.

What $967 SSI Direct Deposit 2025 Really Means?

The $967 per month amount is the maximum federal benefit for individuals in 2025. Couples can receive up to $1,450. Some states add additional money on top of this, called state supplements, which can raise the total monthly payment.

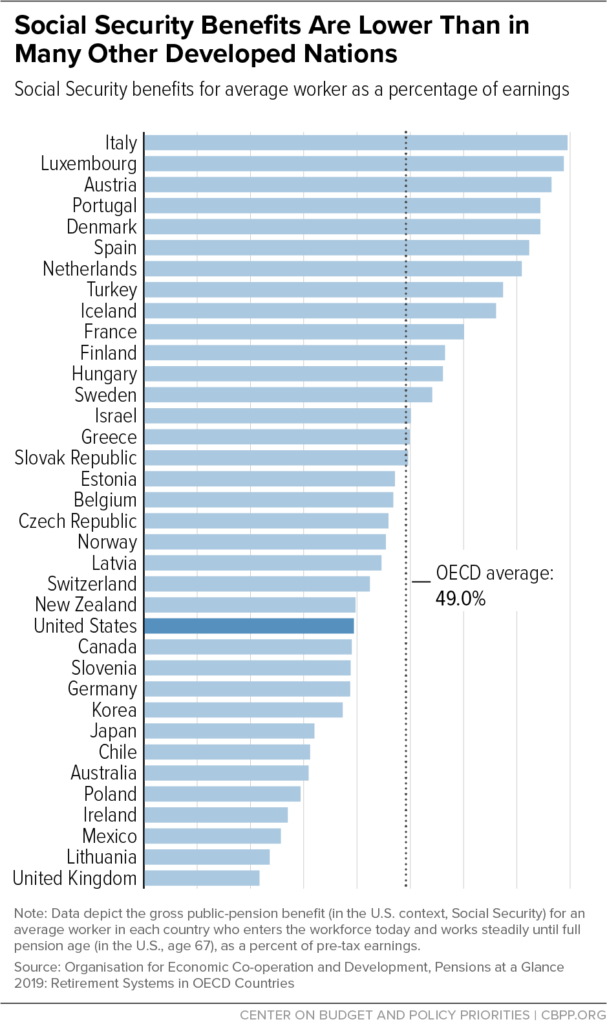

This amount is based on federal standards and may increase slightly each January with the Cost-of-Living Adjustment (COLA). COLA ensures that people receiving SSI don’t fall behind due to inflation. For many people, it’s the difference between barely getting by and covering essential expenses.

For a single senior on a fixed income, $967 might be used for rent, utilities, groceries, and transportation. The way this money is stretched varies by region. In states with lower living costs, it can cover a modest lifestyle. In higher-cost states like California or New York, state supplements play a big role in helping recipients manage expenses.

Payment Dates in October 2025

October 2025 has an unusual SSI schedule:

- October 1, 2025 – Regular October SSI payment.

- October 31, 2025 – Early payment for November because November 1 falls on a Saturday.

This means two deposits in the same month, but it’s important to remember that the October 31 payment is not a bonus. It simply arrives early. Many people make the mistake of treating it as extra money, then face cash flow gaps in November.

If your payments are made through direct deposit, they usually appear in your account early in the morning on the scheduled day. Some banks process payments at different times, so it might appear later in the day for some recipients.

Eligibility Criteria for SSI in 2025

To receive SSI, you must meet several federal eligibility standards. These include:

Income and Resource Limits

- Income must be below a set threshold. Countable income reduces SSI benefits.

- Resources must be below:

- $2,000 for individuals

- $3,000 for couples

- Certain assets do not count — like your primary home, personal belongings, or one vehicle.

Age or Disability

- Age 65 or older, or

- Blind, or

- Disabled under SSA’s strict definition of disability.

Citizenship and Residency

- Must be a U.S. citizen or a qualified noncitizen.

- Must reside in the 50 states, D.C., or approved U.S. territories.

Other Rules

- Cannot be confined to a public institution (with exceptions).

- Must apply and comply with reporting requirements.

Example: If you’re 70 years old, live in your own home, and have $1,500 in savings, you’ll likely qualify. If you inherit $10,000 and do not report it, you could lose eligibility or face repayment demands.

How to Apply for $967 SSI Direct Deposit?

Applying for SSI can be done three ways:

- Online at ssa.gov/ssi

- By phone at 1-800-772-1213

- In person at your local SSA office.

The process involves:

- Checking your eligibility using the SSA’s Benefit Eligibility Screening Tool.

- Collecting documents such as identification, proof of income, medical records, and proof of residency.

- Completing the application and attending an interview.

- Waiting for the decision. If approved, payments usually begin the month after your application is processed.

Applying early is critical. Many people experience delays simply because they didn’t have their documents ready or didn’t submit everything at once.

Direct Deposit and Payment Processing

The U.S. Treasury requires most SSI recipients to receive their payments electronically. Direct deposit is faster, safer, and more reliable than paper checks.

Most recipients see their payments by 9 a.m. Eastern Time on the scheduled day. If your bank processes payments slowly, it may appear later that day. Those using the Direct Express card can also receive funds electronically.

If your payment doesn’t arrive, SSA recommends waiting three business days before calling. Delays are usually caused by bank processing or technical issues.

State Supplements: An Extra Boost

Not all states offer state supplements, but many do. These are additional payments on top of the federal SSI benefit.

For example:

- California adds an average of $200+ per month.

- New York provides supplemental payments depending on living arrangements.

- Some states, like Texas, do not offer state supplements.

Whether the supplement is paid by the state or the SSA depends on the state. In some states, you’ll receive a single payment combining both amounts. In others, you might receive a separate state payment.

State supplements are a major lifeline for those living in high-cost-of-living areas.

COLA Adjustments and Inflation Protection

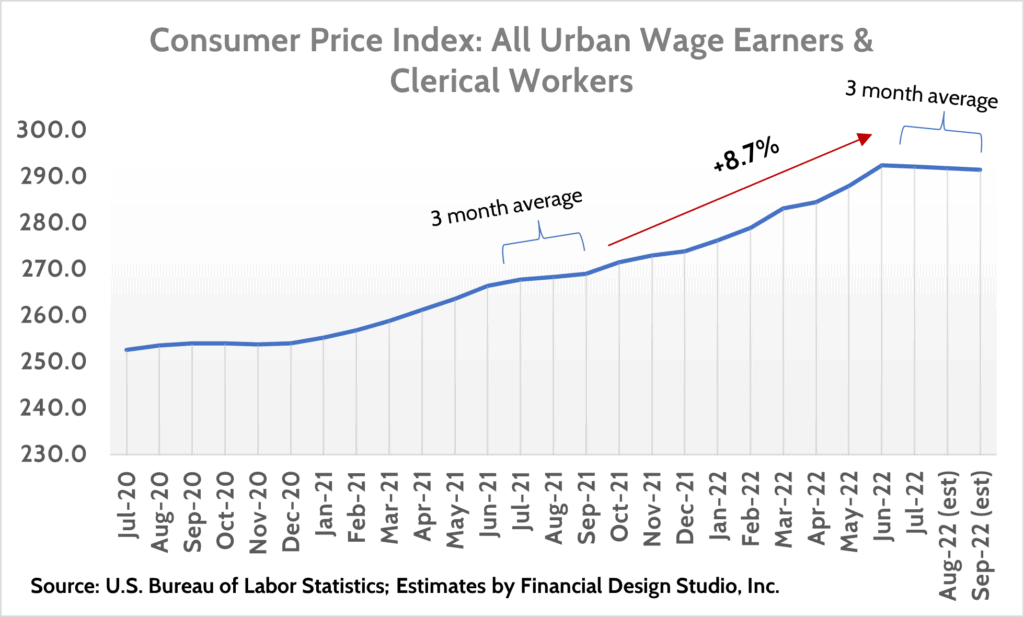

One of the most important aspects of SSI is the Cost-of-Living Adjustment (COLA). Each year, the Social Security Administration announces a new COLA based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

- 2023 COLA: 8.7%

- 2024 COLA: 3.2%

- 2025 COLA: Announcement expected October 2025

This annual increase is designed to offset inflation and ensure that beneficiaries don’t lose purchasing power over time. If inflation rises, the SSI payment may increase starting in January 2026.

While these increases help, many advocates argue they haven’t kept up with rising housing and medical costs. Nonetheless, they remain a key mechanism to preserve the value of SSI benefits.

Tax Implications

One big advantage of SSI is that it is not taxable.

Unlike Social Security retirement benefits, which may be taxable depending on income, SSI payments are fully exempt from federal income tax. Most states do not tax SSI either.

This means recipients get to keep the full amount of their benefit, which is especially important for those living on tight budgets.

Overpayments, Reporting, and Compliance

One of the biggest issues SSI recipients face is overpayment — when SSA sends more money than you were eligible to receive. This often happens when:

- A recipient fails to report income or resource changes.

- A change in living arrangements goes unreported.

- Inheritance, gifts, or marriage alters eligibility.

SSA can demand repayment of overpaid benefits, even if it was unintentional. To avoid this:

- Report all changes immediately using My Social Security online or by phone.

- Keep records of income and assets.

- Review notices from SSA carefully.

Failing to report can also lead to penalties or benefit suspension.

Special Considerations: Veterans, Students, and Noncitizens

- Veterans can receive SSI alongside VA benefits, but VA payments count as income and may reduce SSI amounts.

- Students under 22 may have part of their income excluded from SSI calculations, allowing them to work part-time without losing benefits.

- Noncitizens can qualify for SSI if they meet strict immigration status requirements. Certain refugees and asylees may receive SSI for a limited period.

SSI vs. Social Security Retirement

| SSI | Social Security Retirement |

|---|---|

| Needs-based | Based on work history |

| No work credits required | Requires work credits |

| Max $967 (2025) | Varies |

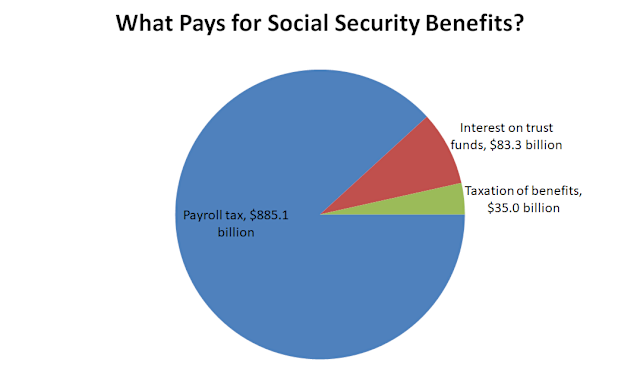

| Funded by general tax revenues | Funded by payroll taxes |

| Not taxable | May be taxable |

| Can be received alongside retirement | SSI may be reduced depending on income |

Budgeting Tips for SSI Recipients

Living on a fixed income isn’t easy, but smart planning can help make every dollar count:

- Create a detailed monthly budget listing fixed expenses like rent, utilities, and food first.

- Look for local programs for food assistance, energy assistance, and transportation discounts.

- Use SNAP (food stamps) if eligible to stretch your grocery budget.

- Avoid high-interest payday loans or credit traps.

- Consider community health clinics and Medicaid programs for medical care.

An individual with $967 can manage basic expenses by prioritizing housing and food, using assistance programs to supplement other needs.

$1,976 Social Security Payment Timeline for 62+ Recipients; Check Official Payout Dates

Social Security 2026 COLA Update Pushed Back Due to US Shutdown – What You Should Know