Millions of UK homeowners could reduce long-term borrowing costs through targeted UK mortgage savings strategies, according to new financial analyses released in early October. Experts say that redirecting cashback rewards and making small but consistent overpayments could cut total interest payments by as much as £9,700 over the life of a typical mortgage.

Table of Contents

UK Homeowners Could Save £9,700 This November

| Key Fact | Detail |

|---|---|

| Potential interest savings | Up to £9,700 on a standard 30-year mortgage of £250,000 |

| Typical mortgage interest rate | 5% average fixed rate in Q4 2025 |

| Overpayment flexibility | Many lenders allow up to 10% of the outstanding balance annually without penalty |

| Official Website | Bank of England |

Rising Interest Rates Drive Demand for Savings Strategies

UK mortgage costs have risen sharply over the past two years as the Bank of England increased its base rate to 5.25%, the highest level since 2008. Many homeowners have faced substantial increases in their monthly repayments following the end of fixed-rate deals.

Financial analysts say this environment has made overpayments a powerful tool for reducing total interest. “Every pound you pay early works harder in a high-interest environment,” said Laura Suter, head of personal finance at AJ Bell. “Even small amounts can significantly reduce how much interest you pay overall.”

How Cashback Schemes Are Being Used to Reduce Debt

The £9,700 figure stems from calculations involving cashback schemes that allow consumers to direct rewards from everyday spending—such as groceries, utilities, and retail—straight to their mortgage account. Platforms like Sprive and Santander Boosts have promoted similar features in recent months.

“This approach uses cashback as a micro-overpayment mechanism,” said Sarah Coles, personal finance expert at Hargreaves Lansdown. “For households already under pressure from higher bills, it can be an easy, low-effort way to chip away at their balance.”

These overpayments are compounded over time. For example, applying £50 a month in additional payments to a £250,000 mortgage at 5% interest over 30 years could save approximately £9,700 in interest and reduce the loan term by nearly three years, according to calculations by Moneyfacts.

Rules and Limits: What Homeowners Need to Check First

Before making overpayments, financial advisers urge borrowers to review their mortgage terms. Many lenders allow annual overpayments of up to 10% of the outstanding balance without penalty, but exceeding that limit can result in fees.

Homeowners should also clarify whether their lender uses term reduction or payment reduction for overpayments. In most cases, term reduction offers greater savings over time because the loan is repaid faster, lowering total interest costs.

“Understanding your lender’s policy is crucial,” said David Hollingworth, associate director at L&C Mortgages. “You want every pound to go towards reducing your balance, not just lowering monthly instalments.”

Broader Options to Cut Mortgage Costs

While cashback-driven overpayments are gaining traction, they are only one strategy among several. Other common options include:

- Remortgaging to a lower interest rate

- Lump-sum payments from bonuses or savings

- Offset mortgages, which reduce interest by linking savings accounts to the loan

- Shortening the mortgage term to cut total interest despite higher monthly payments.

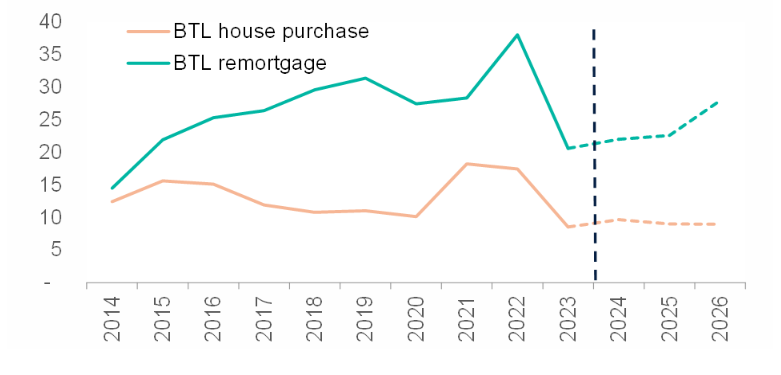

According to UK Finance, remortgaging applications rose 12% year-on-year in Q3 2025 as borrowers sought relief from high rates. The average monthly repayment on a new mortgage has climbed by over £400 compared with 2021.

Expert Caution: Overpayments Are Not a Universal Solution

While overpayments can provide substantial UK mortgage savings, they may not suit everyone. Households with high-interest unsecured debts, such as credit cards, may achieve greater savings by paying those down first. Others may need to prioritise building emergency savings.

Looking Ahead

The Bank of England has signalled that rates may remain elevated for several months, though markets expect a gradual decline in 2026. In the meantime, mortgage overpayments and cashback strategies are likely to remain attractive for homeowners seeking to protect their finances.

“Interest rates may ease eventually,” said Hollingworth. “But homeowners who act now can get ahead of the curve and save thousands over time.”

New DVLA Law Hits Over-62s from October 9: What Every Older UK Driver Must Know Now

DWP Confirms Universal Credit Changes: How Much More Will You Get in October 2025?

£200 Cost of Living Boost in 2025 – Who Qualifies & When Will You Get Paid?

FAQ

Q: Can I overpay any type of mortgage?

A: Most standard residential mortgages allow overpayments, but some fixed-rate products may restrict or charge for excess amounts.

Q: How much can I overpay without a penalty?

A: Typically up to 10% of the outstanding balance annually. Always check your specific lender’s terms.

Q: Do small overpayments really make a difference?

A: Yes. Even £25–£50 per month can reduce total interest and shorten the loan term significantly when compounded over time.