Social Security 2026 COLA Update: The Social Security 2026 COLA update — the much-anticipated Cost-of-Living Adjustment that determines how much bigger (or smaller) your benefit check will be — has officially been pushed back. And no, it’s not because inflation disappeared or someone in Washington forgot to crunch the numbers. This time, it’s politics: the U.S. government shutdown has thrown a wrench into the usual timeline, leaving millions of Americans waiting longer to find out what their 2026 Social Security raise will be.

Social Security 2026 COLA Update

The Social Security 2026 COLA update delay is an inconvenience, not a crisis. Your benefits are secure, your checks will keep coming, and the eventual increase — though modest — will still arrive in January 2026. For retirees and workers alike, this moment serves as a reminder: while Washington politics may stall the headlines, the safety net of Social Security remains strong. Stay patient, stay informed, and use the time to fine-tune your financial plan for the year ahead.

| Topic | Details |

|---|---|

| Reason for Delay | U.S. government shutdown halting BLS inflation data releases |

| Typical Announcement Date | Mid-October |

| Possible New Date | Late October or early November 2025 |

| Projected 2026 COLA | Estimated 2.7% – 2.8% (based on current inflation data) |

| Impact on Benefit Payments | None – benefits will still arrive on time |

| Affected Agencies | Bureau of Labor Statistics (BLS), Social Security Administration (SSA) |

| SSA Official Website | ssa.gov |

| Number of People Affected | About 72 million Americans |

Why the Social Security 2026 COLA Update Got Delayed?

Each fall, the Social Security Administration (SSA) calculates the annual COLA to help benefits keep pace with inflation. It’s based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) — specifically, the average inflation data for July, August, and September of the current year.

That final September number comes from the Bureau of Labor Statistics (BLS). But here’s the snag: when the government shuts down, the BLS temporarily stops releasing data — including the all-important CPI report.

Without it, the SSA can’t finalize the COLA. So, instead of the usual mid-October announcement, the 2026 update will likely be delayed until late October or early November 2025, depending on how long the shutdown drags on.

This isn’t the first time government gridlock has caused trouble. Similar issues cropped up in previous shutdowns — most notably in 2013 and 2018-2019 — when agencies paused essential economic reporting.

How the Shutdown Impacts Social Security?

The good news first: Social Security checks are still going out on time.

That’s because the program is funded through its own trust funds, not through annual Congressional appropriations. Those trust funds — fueled by payroll taxes — continue operating even during a government shutdown.

So retirees, survivors, and people receiving disability benefits don’t need to worry about missing payments.

However, the shutdown does slow down other operations. The SSA still runs, but with reduced staffing. Here’s what you might notice:

- Longer wait times for phone and in-person assistance.

- Delays in processing new retirement, disability, or survivor claims.

- Slower issuance of replacement Social Security cards or updates to records.

In short, the money keeps flowing, but the machinery behind the scenes moves slower.

According to Kiplinger, about 15,000 SSA employees could be furloughed during an extended shutdown, leaving only essential operations running.

Understanding the COLA — and Why It Matters

The Cost-of-Living Adjustment (COLA) is designed to ensure that inflation doesn’t erode the value of Social Security benefits. Each year, the SSA adjusts payments based on inflation data to help recipients maintain their purchasing power.

Think of it this way: if milk, gas, and rent cost more than they did last year, your Social Security benefit should increase too — ideally enough to cover those extra costs.

For 2026, early estimates peg the COLA at around 2.7% — a smaller bump than recent years but roughly aligned with pre-pandemic averages.

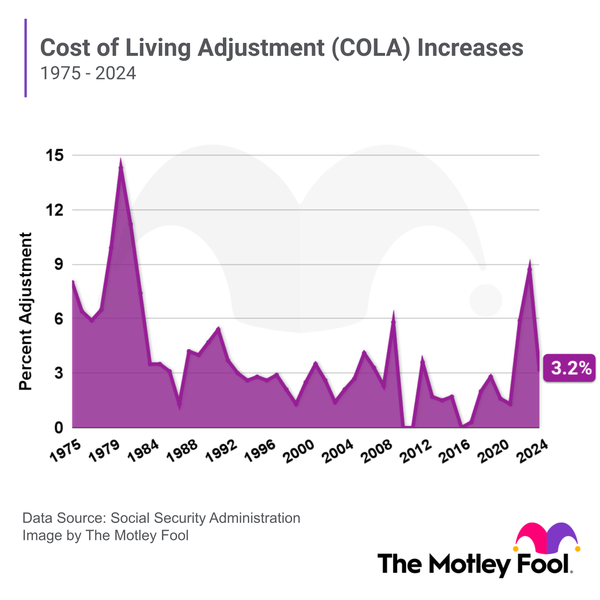

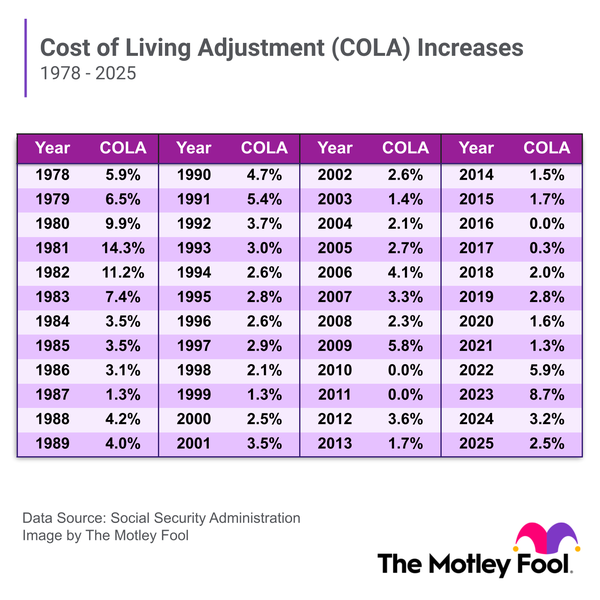

Here’s some perspective:

- 2023: 8.7% (highest since 1981)

- 2024: 3.2%

- 2025: 3.0%

- 2026 (projected): 2.7%

Even though inflation has cooled, the rising costs of healthcare, housing, and food continue to bite into seniors’ fixed incomes — making every decimal of the COLA count.

Example: How Much More You Might Get

Let’s do some quick math.

If you currently receive $2,000 per month in Social Security, a 2.7% increase would raise your payment by about $54 per month.

That might not sound like much, but across an entire year, it adds up to $648 extra — enough to help offset increases in utilities or medication costs.

Here’s how that stacks up across different benefit levels:

| Current Monthly Benefit | 2026 Increase (2.7%) | New Monthly Benefit |

|---|---|---|

| $1,500 | +$40.50 | $1,540.50 |

| $2,000 | +$54.00 | $2,054.00 |

| $2,500 | +$67.50 | $2,567.50 |

How COLA Is Calculated: A Simple Breakdown

To understand the delay, it helps to know how the SSA actually determines COLA.

- Collect Data: The BLS tracks inflation using the CPI-W index.

- Average Three Months: SSA averages the CPI-W for July, August, and September.

- Compare to Last Year: They compare this year’s average with last year’s average.

- Apply the Difference: Whatever the percentage increase is becomes the COLA.

If prices stay flat or drop, the COLA could technically be 0%. That’s rare but has happened — in 2009, 2010, and 2015.

This formula ensures benefits rise automatically with inflation, without needing Congress to pass a new law each year.

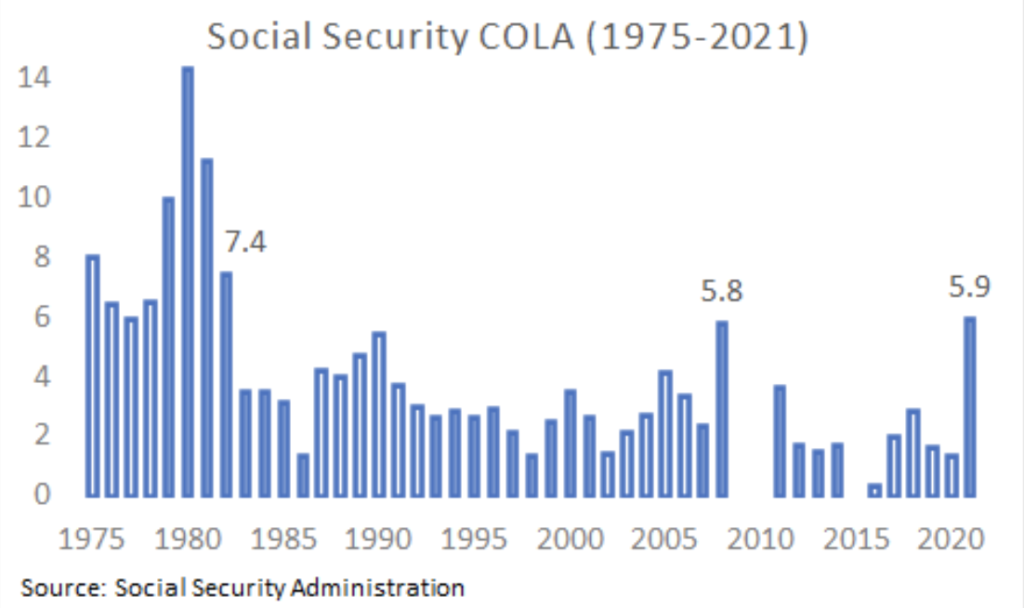

Historical Context: A Look Back at Past COLA Trends

Since automatic COLAs began in 1975, the average increase has been about 3.7% per year.

Some standout years include:

- 1980: 14.3% — the largest in history, during double-digit inflation.

- 2009 & 2010: 0% — due to the Great Recession’s deflation.

- 2023: 8.7% — the highest in four decades, following pandemic inflation.

The 2026 COLA, while smaller, reflects the stabilization of consumer prices after years of volatility. Economists point to declining energy prices, steady job growth, and slower wage gains as reasons for moderation.

The Real-World Impact on Retirees

The delay might seem minor — just a few weeks — but for millions of seniors living on fixed incomes, uncertainty is stressful. Many rely on the COLA announcement to plan next year’s housing, medical, and food budgets.

AARP data shows that half of seniors say Social Security is their primary or only source of income. When inflation rises faster than their benefits, they feel it immediately — at the grocery store, the pharmacy, and the gas pump.

Even a modest 2.7% increase can provide breathing room. For someone earning $24,000 per year in benefits, that’s about $650 more annually — enough to pay for a month’s worth of groceries or two months of utilities.

How to Prepare Financially While Waiting For Social Security 2026 COLA Update

If you’re waiting on the official COLA announcement, here’s what you can do in the meantime:

1. Estimate Your Increase

Use a conservative estimate (around 2.7%) to plan ahead.

Multiply your current benefit by 1.027 to get your expected 2026 payment.

2. Revisit Your Budget

If you’ve been relying heavily on savings to cover expenses, now’s the time to reassess. Inflation may be cooling, but costs for healthcare and housing remain stubbornly high.

3. Watch Medicare Premiums

The Medicare Part B premium is usually announced around the same time as the COLA — and sometimes, a higher premium can eat into your raise.

4. Check Your My Social Security Account

You can view your personalized benefits and projections at ssa.gov/myaccount. When the COLA is finalized, that’s where it’ll appear first.

5. Stay Calm and Stay Informed

Delays happen — but payments won’t stop.

What This Shutdown Reveals About Government Dependence

Beyond the delay itself, the shutdown highlights how much Americans depend on federal data systems. A single missing inflation report can stall billions in financial planning, from Social Security to tax brackets and even private pensions.

Economists warn that prolonged shutdowns could undermine confidence in public institutions. Financial planners also note that uncertainty can make retirees more conservative with spending — indirectly slowing the economy.

Mary Johnson, a Social Security policy expert with The Senior Citizens League, told Investopedia that “even small delays ripple through households that live paycheck to paycheck — or check to check.”

$1,976 Social Security Payment Timeline for 62+ Recipients; Check Official Payout Dates

USA Retirement Age Increase From October 2025 – Check New Retirement Age & Revised Eligibility