Home Loan Shake-Up: this phrase has been making headlines lately. But what’s really happening? Why would a big bank cut mortgage rates even when the central bank holds steady? And, more importantly, what does that mean for borrowers both in Australia and the United States? Let’s break it down clearly, with facts, real-world examples, and step-by-step guidance. Whether you’re a homeowner, a first-time buyer, or a financial professional, you’ll walk away with a solid understanding of how this shake-up affects you — and what smart moves you can make.

Home Loan Shake-Up

The Home Loan Shake-Up triggered by a major bank adjusting rates following the RBA hold is more than just financial news — it’s a lesson in how modern lending works.

Banks aren’t simply reacting to central banks anymore; they’re competing in real time, anticipating moves, and using pricing strategy to gain customers. For borrowers, it’s both an opportunity and a challenge. You can save money — but only if you pay attention, shop around, and understand the terms. For professionals, it’s a glimpse into how monetary trends, competition, and consumer behavior intertwine. As the U.S. market watches, the message is clear: stay alert, stay informed, and act strategically when rates start moving — because sometimes, the smartest move comes before the central bank makes one.

| Topic | Key Data / Stats | Why It Matters |

|---|---|---|

| RBA Cash Rate | 3.60% (held steady in September 2025) (RBA.gov.au) | Sets the base cost of borrowing in Australia |

| Westpac Rate Cuts | 10 bps cut for owner-occupier loans; 20 bps for investor loans | Shows lenders can act independently of the central bank |

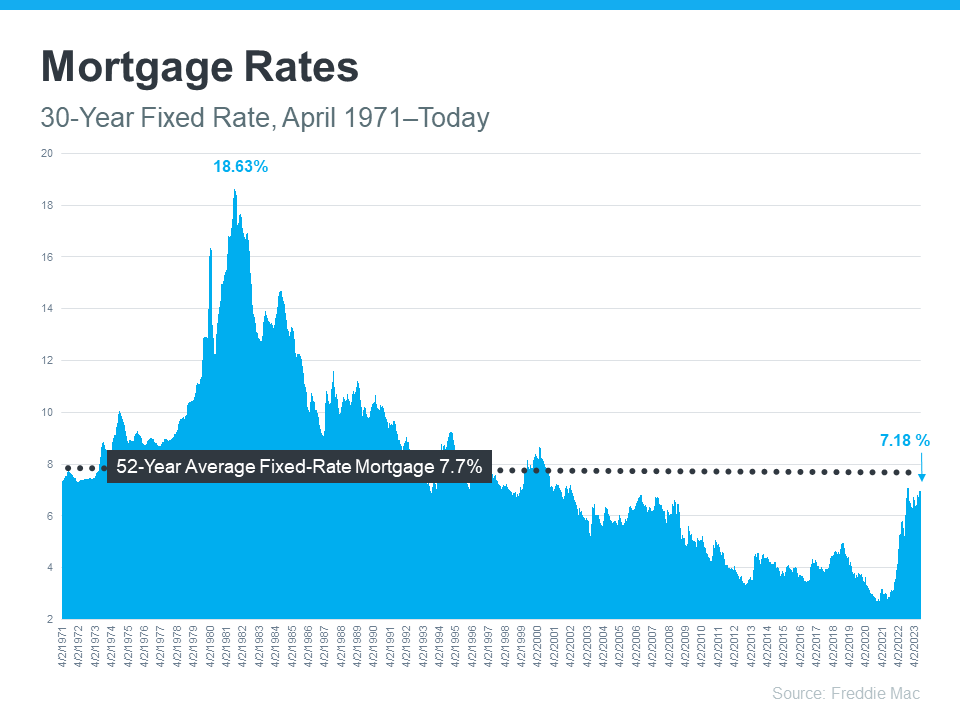

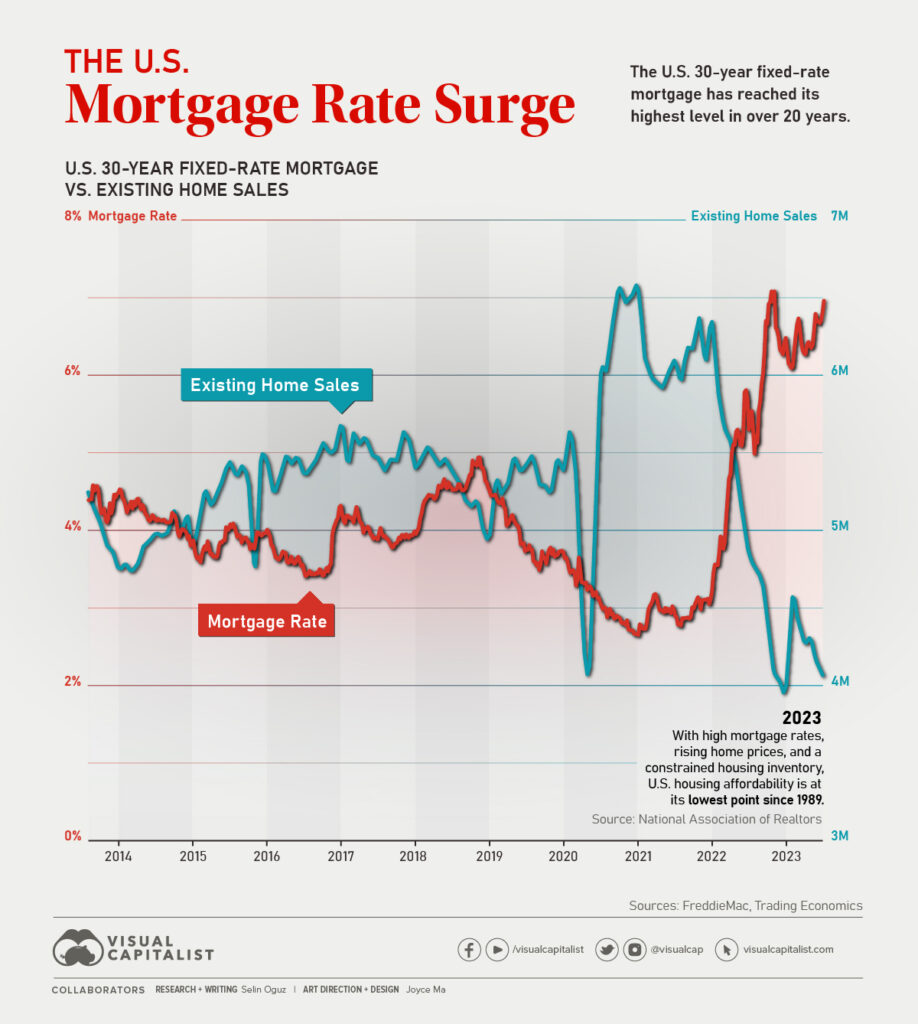

| U.S. 30-Year Fixed Mortgage Rate | 6.34% as of October 2025 | Benchmarks most American home loans |

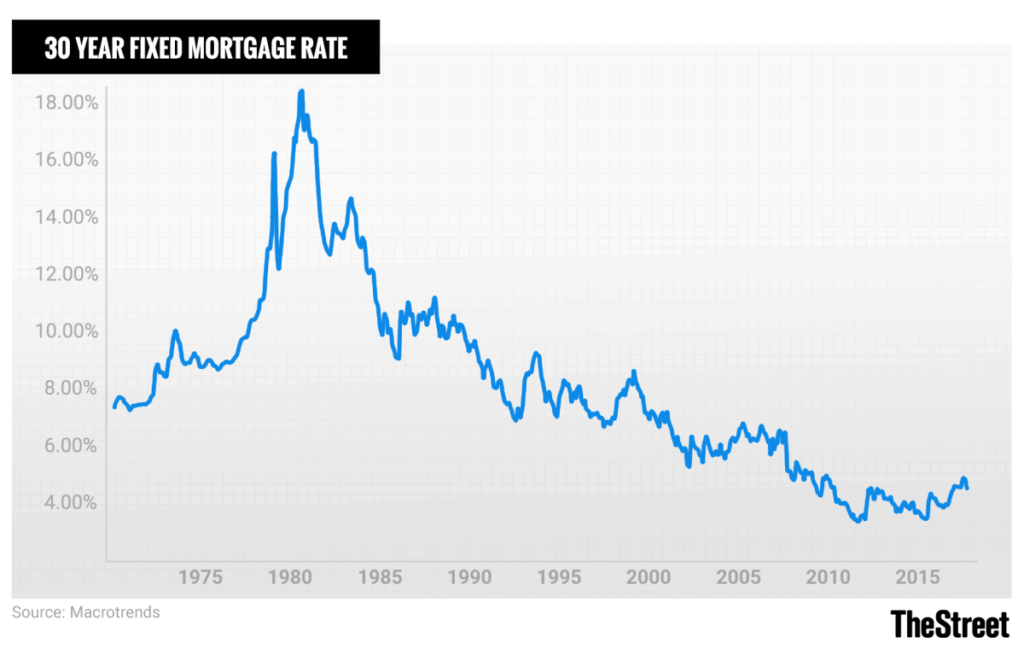

| Historical U.S. Average (1971–2024) | 7.70% | Shows today’s rates are still moderate historically |

| Average U.S. Mortgage Payment | $1,929/month (FHFA.gov) | Reflects household affordability pressure |

| Global Relevance | Lenders worldwide watch each other’s moves | Demonstrates how local banking shifts can affect global markets |

For context, the RBA (Reserve Bank of Australia) sets monetary policy for Australia — much like the Federal Reserve does in the U.S. When either holds or changes rates, it usually guides the entire lending industry. This time, though, one major bank didn’t wait for official permission.

What Happened — The Australian Home Loan Shake-Up

In late September 2025, the Reserve Bank of Australia (RBA) decided to hold its cash rate steady at 3.60%, signaling patience amid mixed inflation signals. But almost immediately after the decision, Westpac, one of Australia’s four largest banks, surprised the market by cutting its home loan rates.

Specifically:

- Owner-occupier variable loans with 70% Loan-to-Value Ratio (LVR) were cut by 10 basis points (0.10%).

- Investor loans saw an even deeper 20-basis-point cut.

These cuts applied primarily to new borrowers and refinancers, not necessarily existing customers. The bank essentially said, “We’re betting the market will cool and we’re moving early to capture demand.”

This is unusual because banks usually move after a central bank decision — not before or in opposition. But Westpac’s move was strategic: it wanted to get ahead of expected RBA cuts later in the year.

Why This Move Matters?

This might seem like a small adjustment — what’s a tenth of a percent, right? But in lending, those tiny numbers make a big difference.

- A 10-basis-point cut on a $500,000 mortgage saves roughly $500 per year in interest.

- Multiply that across hundreds of thousands of loans, and it’s a multi-million-dollar market move.

This decision also signals something bigger: competition in the lending market is heating up. Even when central banks stand still, lenders can maneuver independently to attract new business, reduce churn, and build brand trust.

For borrowers, it means you can’t just rely on the Fed or RBA news — you have to watch your own lender’s moves too.

The U.S. Angle — Mortgage Rates Still Holding High

In the U.S., the story feels similar but with its own twist.

According to Freddie Mac’s Primary Mortgage Market Survey, the average 30-year fixed rate was 6.34% as of the first week of October 2025. The 15-year fixed stood around 5.50%.

Compared with early 2022 — when rates hovered near 3% — borrowing costs have more than doubled. Yet, historically, they remain lower than long-term averages near 7.7%.

The Federal Reserve has paused rate hikes several times this year, suggesting inflation is cooling but not gone. Some banks are hinting they might lower mortgage rates ahead of any official cut to stay competitive — echoing Australia’s bold move.

Why Would a Bank Cut Rates Without the Central Bank?

There are a few reasons banks move ahead of policy makers:

- Competition for borrowers — Every borrower shopping for a mortgage today is a prize. A small rate advantage can win thousands of customers.

- Anticipation of future cuts — If the bank expects the Fed (or RBA) to cut rates soon, it might lower early to secure new customers now.

- Lower funding costs — Banks with cheaper access to capital (from deposits or bonds) can afford to lend at lower rates.

- Public relations and branding — Cutting rates creates a positive image: “We care about your wallet.”

- Portfolio balancing — Lenders sometimes need to boost certain loan types (like owner-occupier or investment loans) for internal risk balancing.

It’s part marketing, part economics, and part confidence.

How Home Loan Shake-Up Affects Borrowers?

If you’re a homeowner, first-time buyer, or refinancer, this kind of shake-up affects you in several ways.

1. Lower Potential Monthly Payments

Even a modest rate drop can trim your payment. For instance, on a $400,000 30-year loan:

- At 6.34%, your payment is about $2,486/month.

- At 6.14%, it drops to $2,435/month — about $600 a year saved.

That may not sound huge, but for families juggling costs, every bit helps.

2. Refinancing Opportunities

When one lender lowers rates, others often follow. That means better options for refinancing your existing mortgage and possibly reducing total interest paid.

3. Increased Market Activity

Lower borrowing costs can push more people into the housing market, raising demand (and sometimes home prices).

4. Uneven Eligibility

Banks often restrict lower rates to “prime” borrowers — those with excellent credit scores, low LVR/LTV ratios, and stable incomes.

5. Limited Duration Offers

Promotional cuts don’t always last. If rates fall further, lenders may roll back deals or tighten qualification criteria.

Step-by-Step Guide: What Borrowers Should Do Now

Step 1: Review Your Current Mortgage Terms

Know your interest rate, loan type (fixed/variable), and remaining term. Check your Loan-to-Value Ratio (LTV) — if your property value has risen, you might now qualify for better rates.

Step 2: Compare Across Multiple Lenders

Don’t rely on one offer. Use trusted comparison platforms such as Bankrate or NerdWallet.

Ask lenders for a Loan Estimate, which lists rate, APR, and fees.

Step 3: Run the Math

Calculate how long it takes to recover refinancing costs — typically called the break-even point. If you’ll stay in the home longer than that, refinancing usually makes sense.

Step 4: Watch Treasury Yields and Fed Announcements

Mortgage rates often move alongside 10-year U.S. Treasury yields. If yields drop, lenders may cut rates even without a Fed decision.

Step 5: Don’t Forget the Fine Print

Some “discount rates” are introductory. Always ask about:

- Adjustment periods

- Early exit fees

- Fixed-term penalties

Step 6: Get Professional Advice

If you’re unsure, talk to a mortgage broker or financial advisor. They can run scenarios and find deals that fit your situation.

Historical Context — Why This Isn’t New

Banks breaking ranks with central banks isn’t unprecedented.

- In 2008, several U.S. regional banks cut mortgage rates aggressively before the Fed’s emergency cuts to retain liquidity.

- In 2020, some Australian and Canadian banks offered pandemic-relief discounts even when their central banks paused policy.

These examples show lenders sometimes lead the market to anticipate or influence broader monetary trends.

Risks and Watchouts

- Short-Term Marketing Gimmicks

Some lenders use “headline” cuts that later reset higher. Always read the small print. - Inflation Uncertainty

If inflation spikes again, lenders may reverse cuts quickly. - Funding Costs

Banks rely on wholesale funding and deposits — if those costs rise, cuts may not last. - Credit Risk Exposure

Cutting rates too far may attract riskier borrowers, forcing future tightening. - Housing Market Pressure

Easier credit could push home prices up, eroding affordability again.

Regulatory Oversight and Legal Landscape

Recent developments in the U.S. mortgage sector highlight that regulation plays a big role.

In October 2025, Reuters reported a nationwide lawsuit accusing a mortgage tech firm and major lenders of price coordination using shared rate-setting software.

That means regulators like the Consumer Financial Protection Bureau (CFPB) and Department of Justice are watching lender behavior closely.

Banks must balance innovation and competition with compliance — another reason why bold rate cuts make headlines.

Global Ripple Effects

When a major lender in one country acts independently, global investors take notice.

International markets are interconnected through funding costs, bond yields, and investor sentiment.

- A rate cut in Australia can influence Asian bond markets.

- Lower Australian rates can affect U.S. mortgage-backed securities demand as investors rebalance portfolios.

It’s a reminder that interest rate changes aren’t isolated — they’re part of a larger financial web.

Glossary — Explained Simply

- Basis Point (bps): One hundredth of a percent (0.01%). So, 10 bps = 0.10%.

- LTV (Loan-to-Value): Your loan balance divided by your home’s value. Lower LTV = lower risk = better rates.

- Variable Rate: Changes with the market; can go up or down.

- Fixed Rate: Locked for the loan term — stable, predictable payments.

- APR (Annual Percentage Rate): Includes both interest and fees — the “true cost” of borrowing.

- Break-Even Point: How long until refinancing savings exceed costs.