DWP Confirms State Pension Changes: If you were born in the early 1960s, this one’s for you. The Department for Work and Pensions (DWP) has confirmed a series of State Pension changes set to roll out in 2026, and they’re a big deal. From raising the pension age to tweaking National Insurance (NI) rules, these updates will reshape how millions of Britons plan for retirement. Now, don’t worry — this isn’t a doom-and-gloom story. But it is a wake-up call. The world’s changing, and so are retirement systems. Understanding what’s ahead means you can adjust your plans and keep your golden years golden.

DWP Confirms State Pension Changes

The 2026 State Pension changes mark a new chapter for British retirement. For most, the rise to 67 isn’t devastating — it’s a gentle nudge to plan smarter and think long-term. Start by checking your NI record, verifying your SPA, and updating your retirement plan. Build private savings early, stay informed, and treat the State Pension as a baseline — not the whole plan. Retirement isn’t just about stopping work. It’s about creating freedom — the freedom to live well, travel, and enjoy the life you worked so hard for. And that starts with staying one step ahead of the rulebook.

| Topic | What’s Changing / Projected Change | Who’s Affected / Why It Matters |

|---|---|---|

| State Pension Age rises to 67 | From April 2026 to March 2028, the pension age moves from 66 to 67. (gov.uk) | Affects people born after 6 April 1960, mainly early Gen X retirees. |

| Triple Lock continues | Forecasted ~5.3% increase in April 2026 (based on wage growth). | Boosts annual pension income but may push some retirees into taxable territory. |

| Tighter NI qualifying rules | Possible limits on credit-based qualifying years. | Caregivers, part-timers, and low-income earners might lose some credited years. |

| Third State Pension Age Review (2025) | Could accelerate the next age increase to 68. | Affects those born after 1977 — future retirees. |

| Protected Payments changes | Older pension components (SERPS, S2P) may increase only with inflation. | May reduce overall annual increases for mixed pensions. |

Why the DWP Confirms State Pension Changes?

Let’s call it like it is — the UK’s retirement system is under pressure.

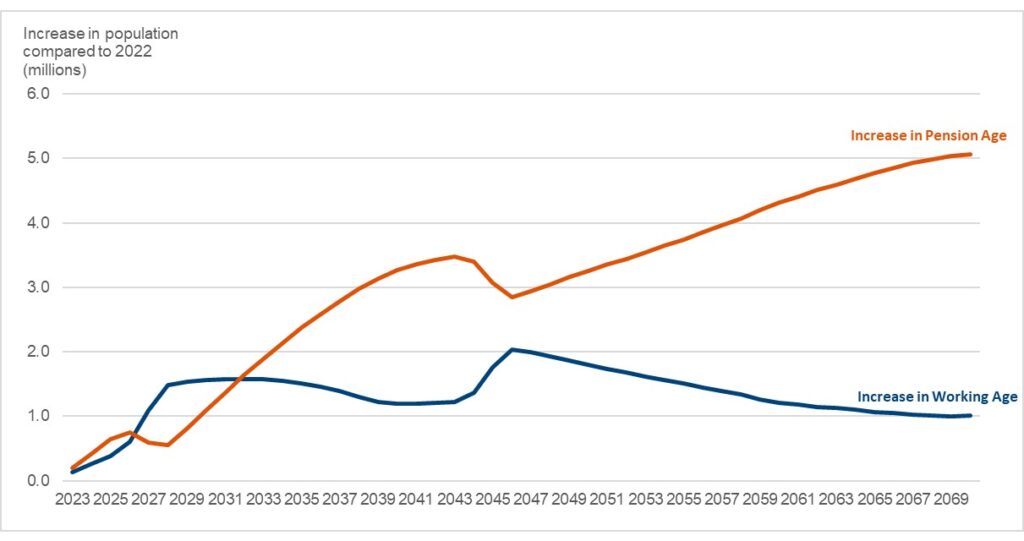

People are living longer, the population is aging fast, and public finances are stretched.

According to the Office for National Statistics (ONS), the average UK life expectancy is now around 81 years — up from 70 in the 1970s. That’s great news for longevity, but it also means pensions need to stretch further.

Meanwhile, government figures show that State Pension spending hit £110 billion in 2023–24, making it one of the largest items in the national budget. The number of people over 66 is set to rise by more than 2 million by 2030. If the system doesn’t evolve, it risks becoming unsustainable.

So the DWP’s 2026 updates are designed to:

- Balance fairness between generations

- Reflect longer lifespans

- Encourage private retirement saving

- Keep the Triple Lock affordable

It’s not about cutting benefits — it’s about keeping the whole structure stable for decades to come.

1. The Big Shift: State Pension Age Rises to 67 (2026–2028)

This one’s written in stone. Between April 2026 and March 2028, the State Pension Age (SPA) will gradually rise from 66 to 67 for both men and women.

Example:

- Born 10 May 1960 → Eligible at 66 years + 1 month (June 2026)

- Born 2 September 1962 → Eligible at 67 years

That might not sound dramatic, but for people planning to retire at 66, it could mean waiting up to a full year longer before payments begin.

Why it matters:

If you rely solely on your State Pension, that one-year gap can mean the difference between financial comfort and short-term strain.

What to do:

- Use the State Pension age checker to find your date.

- Recalculate your retirement budget with that delay factored in.

- If possible, extend your working plan or boost private savings to bridge the gap.

2. Tougher National Insurance (NI) Qualifying Rules

Currently, you need 35 qualifying years of NI contributions to get the full State Pension, and 10 years minimum to receive any pension.

But starting in 2026, insiders expect stricter definitions for what counts as a qualifying year. Credits earned for time spent caring, claiming benefits, or studying might become more limited.

That means people who’ve taken time off for caregiving or illness could lose out on credited years unless they make voluntary contributions or prove eligibility more precisely.

Example:

Sarah, a part-time worker and caregiver, currently gets NI credits for caring for her elderly mother. Under new rules, she might need to provide formal evidence of her caregiving role or could lose those credits entirely.

What to do:

- Check your NI record now on gov.uk.

- Identify any “gaps” early — you can usually pay voluntary Class 3 contributions to fill missing years.

- Keep official records of caring or unemployment periods.

3. Triple Lock Still in Place — But It Could Push You Into Paying Tax

Good news first: the Triple Lock is staying (at least for now).

This system ensures your pension rises each April by the highest of:

- Average wage growth

- Consumer Price Index (CPI) inflation

- 2.5% minimum

With wage growth at around 5.3%, the DWP projects a similar ~5% rise in April 2026. That means the full new State Pension, currently £230.25 per week, could increase to roughly £242.45 per week, or £12,607 per year.

Sounds great, right? Well, maybe — because the personal tax-free allowance is still frozen at £12,570 until at least 2028. That means some retirees could find themselves paying tax for the first time, even without extra income sources.

Example:

Mary, receiving the full pension, crosses the £12,570 threshold by just £37.60. That small excess makes her technically taxable.

Smart move:

- Consider deferring your State Pension (it grows by roughly 5.8% for each year deferred).

- Use ISAs or private pensions for tax-efficient income.

- Review your income mix each year to stay under key thresholds.

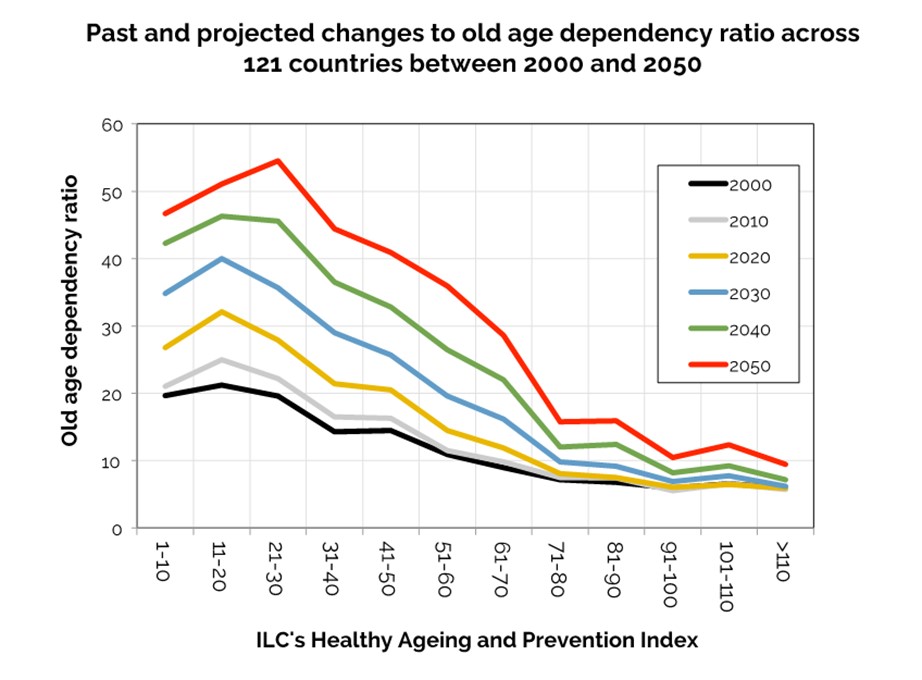

4. The 2025 Review Could Push the Pension Age to 68

As part of the Pensions Act 2014, the government must review the SPA regularly. The third review, due mid-2025, will evaluate whether the shift to age 68 should happen earlier than currently planned (2044–46).

Analysts at the Institute for Fiscal Studies (IFS) and the Office for Budget Responsibility (OBR) predict that, due to life expectancy trends, the government may consider advancing that rise to the late 2030s.

While this doesn’t affect those retiring around 2026, it’s vital for long-term planning — especially for anyone born after 1977.

Takeaway:

If you’re under 50, base your financial planning on a likely SPA 68 or even 69. It’s better to be prepared than surprised.

5. “Protected Payments” and Partial Inflation-Only Increases

If you built up Additional State Pension (SERPS or S2P) before 2016, part of your pension is considered a protected payment. Unlike the new State Pension, this portion doesn’t benefit from the Triple Lock — it only increases with CPI inflation.

Example:

Tom’s pension includes:

- £180/week (new pension, triple-locked)

- £40/week (protected, CPI-linked)

If inflation is 3% but wage growth is 5%, Tom’s total increase will be blended — 5% on £180 and 3% on £40.

What to do:

- Log into your pension forecast to identify protected components.

- Consider supplementing inflation-linked portions with private or occupational pensions.

How This Compares to U.S. Social Security?

For readers familiar with the U.S. system, here’s a simple comparison.

- U.K. State Pension: Flat rate, based on qualifying years; SPA currently 66–67.

- U.S. Social Security: Earnings-based; early claim allowed from 62 (with reductions).

- Both systems are funded by worker contributions and face demographic pressure from aging populations.

The key difference? In the U.S., delaying benefits until age 70 can earn higher payouts. In the U.K., deferring gives roughly 5.8% extra per year. The logic is similar — work longer, get more.

Financial Planning Tips to Stay Ahead

- Audit your NI record every year. You can only backfill missing years for a limited time.

- Start a private or workplace pension if you haven’t already. Employer contributions are essentially “free money.”

- Budget for the gap — if your SPA shifts to 67, plan how you’ll cover that extra year.

- Track inflation — higher inflation means future pensions rise faster, but so do living costs.

- Use trusted calculators like MoneyHelper’s retirement planner to model scenarios.

- Review annually with an adviser — legislation and thresholds change fast.

Expert Insights and Data

The Pensions Policy Institute (PPI) warns that 1 in 4 workers underestimate their State Pension age, leaving gaps in retirement planning. Meanwhile, Hargreaves Lansdown’s Sarah Coles advises, “Even six extra months of saving before retirement can mean thousands more in future pension income.”

The Institute for Fiscal Studies also cautions that the real-term value of pensions could fluctuate with inflation, suggesting retirees diversify income sources to cushion market or policy shifts.

Financial experts across the board agree on one principle: don’t rely on the State Pension alone. It’s a solid foundation, but the modern retiree needs layers — private savings, workplace pensions, and investments that hedge inflation.

£4,200 Income Boost for Pensioners in Oct 2025: Check DWP’s New Updates and How to Claim Yours!

DVLA Confirms Major Licence Rule Change for Drivers Aged 57+ Across the UK – What You Must Know Now

HMRC Confirms £300 Pension Cut from October 9; Every UK Pensioner Needs to Know this, Check Details