DWP Confirms £2,500 Pensioner Bonus: Lately, social media has been buzzing with claims that the Department for Work and Pensions (DWP) is about to pay every pensioner a £2,500 bonus in October 2025. Sounds amazing, right? But before you start planning that trip to Blackpool, here’s the truth: there’s no official confirmation of such a payment. Not a single statement from the UK government, DWP, or Parliament supports this rumor. Still, that doesn’t mean pensioners are left out in the cold. In fact, there are plenty of real payments and benefits that can add up to hundreds — sometimes thousands — of pounds each year. This article breaks it all down in plain English: what’s real, what’s rumor, and how to claim every penny you’re entitled to.

DWP Confirms £2,500 Pensioner Bonus

Let’s wrap this up clearly. The £2,500 DWP Pensioner Bonus making the rounds online isn’t real — at least not according to any official UK source. What is real are tried-and-true support systems like the State Pension, Pension Credit, Winter Fuel Payments, and potential cost-of-living supplements. Instead of chasing viral headlines, pensioners should focus on verifying their entitlements. The combined value of these legitimate supports can easily exceed £2,000 a year — and unlike rumors, this money is guaranteed, safe, and fully backed by the government.

| Topic | Details | Figures / Data | Source |

|---|---|---|---|

| £2,500 Bonus | No confirmation from DWP or Parliament | — | None |

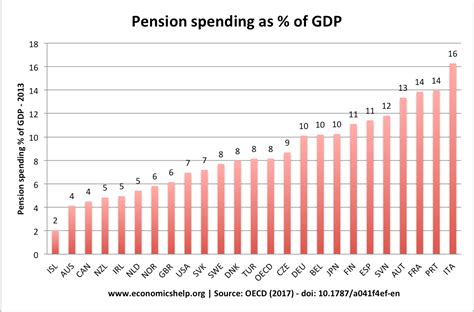

| Total Pension Spending (2024/25) | Pensioner-related DWP spend | ~£166 billion (58% of all benefits) | House of Commons Library |

| State Pension Rate (2025) | Maximum “new” weekly payment | £230.25 | Age UK |

| Pension Credit Top-Up | Support for low-income pensioners | ~£3,900 per year | GOV.UK |

| Winter Fuel Payment | Confirmed for 2025/26 | Up to £300 | MoneyWeek |

Understanding the Background: Why This Claim Spread Like Wildfire

Let’s face it — everyone’s felt the pinch these last few years. Prices have jumped, grocery bills have soared, and heating costs keep creeping higher. In 2023, the UK inflation rate hit an eye-watering 11%, the highest in 40 years. Even though it cooled in 2024, pensioners on fixed incomes are still playing catch-up.

So when people saw headlines or Facebook posts about a “DWP £2,500 bonus,” it sounded like a lifeline. Unfortunately, this “bonus” doesn’t appear anywhere in official records. What is happening is that the government continues to offer targeted support — smaller, focused payments to those who need it most.

Why the DWP Confirms £2,500 Pensioner Bonus Doesn’t Add Up?

Here’s why this rumor doesn’t stand on solid ground:

- No official DWP or Treasury documentation.

Every confirmed benefit scheme is published on GOV.UK or in Parliament’s Hansard records. There’s no sign of a £2,500 pensioner payment. - Unprecedented scale.

The DWP has issued one-off payments before — £300 or £900 during the 2022 cost-of-living crisis — but never anything close to £2,500 in a single round. - Timing mismatch.

Major benefits are reviewed each April (new fiscal year) or paid between November and December. October doesn’t align with any official DWP payment cycle. - Lack of media confirmation.

Major outlets like the BBC, The Guardian, or The Independent would be all over such a story if it were real. None have reported it.

In short, it’s misinformation — but the real benefits available are still worth understanding.

Real Financial Support for Pensioners in 2025

Even without a mega-bonus, pensioners can access several layers of financial help — from guaranteed income support to energy cost relief.

1. Winter Fuel Payment — Up to £300

This payment is real, recurring, and meant to help pensioners heat their homes during cold months. Most people get it automatically.

Who qualifies?

- Born before 22 September 1959

- Lived in the UK during qualifying week (15–21 September 2025)

- Income typically under £35,000 for full eligibility

Payment window: November to December 2025

Deadline to claim manually: March 31, 2026

For many, it arrives automatically, but if you’ve deferred your State Pension or moved recently, you may need to apply by phone or mail.

2. Pension Credit — The Hidden Lifeline

This is one of the most underused benefits in the UK. About 880,000 eligible households aren’t claiming it, even though it can add nearly £3,900 a year to their income.

Eligibility basics:

- You must be over State Pension age.

- Your weekly income is below £218.15 (single) or £332.95 (couple).

Why it matters:

It not only tops up income but unlocks other support — like free TV licenses, NHS dental care, and Council Tax reduction.

Apply online via GOV.UK or call 0800 99 1234. Claims can be backdated up to three months.

3. State Pension and Annual Uplift

The “new” State Pension currently pays up to £230.25 per week, while older systems (pre-2016) vary based on contribution history.

Under the triple lock, pensions rise by whichever is highest — inflation, average earnings growth, or 2.5%. In 2025, that’s expected to be around 7%, adding roughly £900 a year for a full-rate pensioner.

4. Cost-of-Living Support (Pending Confirmation)

While not yet finalized for 2025, analysts predict further targeted cost-of-living payments if inflation remains above 4%.

These would likely mirror the 2022-2024 structure:

- £900 for low-income households

- £150 for disability claimants

- £300 for pensioners

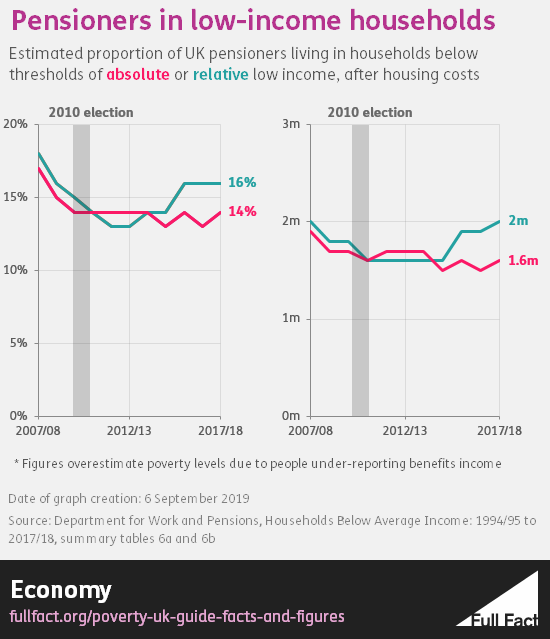

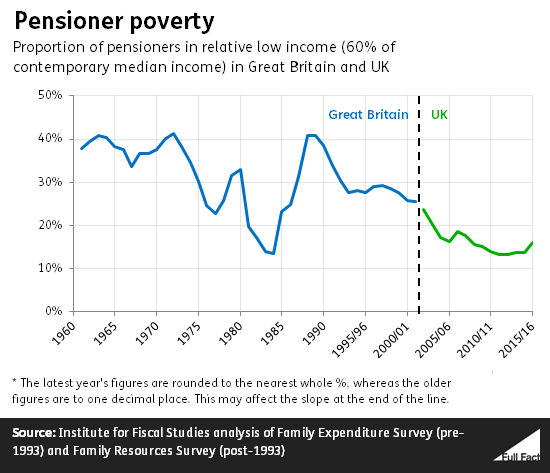

The Bigger Economic Picture

To really understand these benefits, you have to look at the economy.

According to the Office for National Statistics (ONS), the average pensioner household spent £26,900 in 2024 — up 12% from two years earlier. The biggest cost increases? Heating, rent, and food.

Even with State Pension increases, many retirees are still below the Minimum Income Standard, which research by the Joseph Rowntree Foundation pegs at roughly £12,800 per year for singles and £19,700 for couples.

That’s why smaller, targeted payments — not sweeping bonuses — are the government’s main approach to helping older citizens manage rising costs.

Expert Commentary and Public Reaction

Charities and think-tanks have responded swiftly to debunk the £2,500 rumor.

An Age UK spokesperson said:

“We’ve seen this claim circulate on social media, but there’s no evidence it’s true. Pensioners should check official GOV.UK pages before believing or sharing such posts.”

Citizens Advice added that unclaimed benefits remain a bigger issue than missing bonuses.

“Each year, over a billion pounds in Pension Credit goes unclaimed. That’s real money pensioners could be using on essentials.”

Even the Resolution Foundation, a respected economic think-tank, noted that tackling under-claiming is “the fastest route to boosting pensioner income sustainably.”

Step-by-Step: How to Claim What You’re Actually Owed

Step 1: Check Your Pension Forecast

Use the free tool on GOV.UK to see your projected pension and National Insurance record.

Step 2: Claim Pension Credit

Even if you’re slightly above the threshold, apply — certain savings and circumstances are excluded. You can apply online, by phone, or through a trusted family member acting as a representative.

Step 3: Confirm Winter Fuel Payment

If you received it before, it’s automatic. If not, call the Winter Fuel helpline at 0800 731 0160.

Have your National Insurance number and bank details ready.

Step 4: Check for Other Linked Benefits

Once you get Pension Credit, you can often qualify for:

- Free NHS dental care and glasses

- Housing Benefit (if renting)

- Council Tax Reduction

- Cold Weather Payments

- Warm Home Discount

Step 5: Monitor Payments & Keep Records

DWP payments usually appear with the reference “DWP WFP” or “DWP PENSION.” If you think something’s missing, contact the Pension Service or Citizens Advice before 31 March 2026.

Common Scams and How to Stay Safe

Unfortunately, scammers love rumors like this. Here’s how to stay safe:

- Ignore texts or emails promising a “£2,500 DWP payment.”

- The DWP will never ask for your bank details via text.

- Always type official addresses manually — never click links.

- Report suspicious emails at gov.uk/report-suspicious-emails-and-texts.

If you suspect fraud, call Action Fraud (0300 123 2040) immediately.

Practical Money-Saving Tips for Pensioners

Even without mythical bonuses, there are plenty of legitimate ways to stretch your income:

- Energy savings:

Apply for energy-provider hardship funds and the Priority Services Register. - Transportation:

Get your free bus pass (or Freedom Pass if in London). - Water bills:

Ask your water company about social tariffs — many reduce bills for low-income households. - Healthcare:

Over-60s automatically qualify for free prescriptions and eye tests. - Local council aid:

Search online for your Household Support Fund or Council Welfare Assistance Scheme for one-off grants. - Budget advice:

Use MoneySavingExpert and Turn2Us to find tailored help.

These may not sound flashy, but together they can make a huge difference.

Are You Missing £8,300? DWP Urges Pensioners to Check for Back Payments Now

DWP WASPI £2,950 Compensation News – Only these will get it in October 2025

£4,200 Income Boost for Pensioners in Oct 2025: Check DWP’s New Updates and How to Claim Yours!

Example: Mr. and Mrs. Turner’s Case

The Turners, both 72, live in Manchester. They saw the £2,500 rumor on Facebook and felt hopeful — but skeptical. They earn £220 per week combined from pensions.

After checking GOV.UK, they learned they qualify for Pension Credit, worth £70 per week. They also got Winter Fuel Payment (£300) and a Council Tax reduction.

Total annual gain: about £4,000 — all genuine, government-backed support.

Moral of the story: the real help is out there if you know where to look.