$1,100 Centrelink Payment: If you’re hearing whispers about a $1,100 Centrelink payment landing in October 2025 and wondering what’s up with that, buckle up. Whether you’re keeping an eye on your finances, helping out someone who counts on these payments, or just curious, this breakdown brings you all the facts, practical tips, and insider info to make sense of it—talking straight, no fluff. Centrelink’s October 2025 payments are all about giving financial relief amid rising prices for everyday essentials: groceries, energy bills, rent—you name it. This payment package totals up to $1,100 for eligible Aussies, stacking a one-off $750 cost of living bonus alongside regular pension increases and some scheduled top-ups ranging from $250 to $1,300. The goal? Help those who need it most keep their heads above water in tough times. So let’s dive in and see if you or someone you know might be on the list—and how to get the most out of this boost.

$1,100 Centrelink Payment

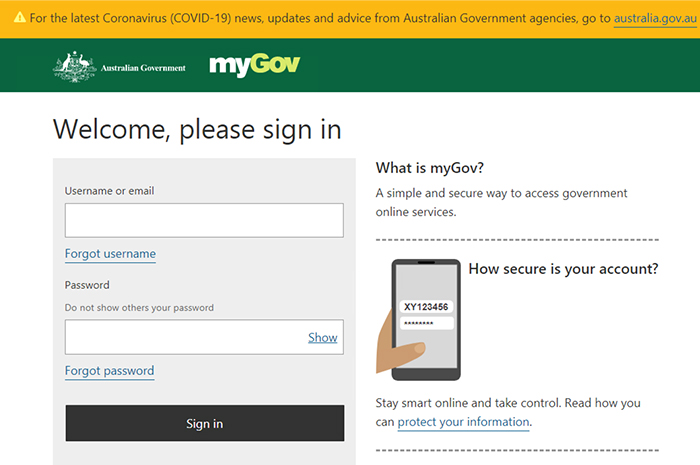

The $1,100 Centrelink payment in October 2025 is a crucial financial lifeline tailored for Aussies grappling with rising living costs. Through a one-off $750 bonus, regular indexed payment increases, and top-ups, this package safeguards the purchasing power of pensioners, job seekers, carers, and low-income families. The best part? It’s mostly automatic, but staying informed via the myGov portal and Express Plus app ensures you don’t miss a cent. Use this money wisely—budget, pay down debt, save, or cover urgent expenses—to soften today’s economic squeeze and build a stronger financial foundation.

| Topic | Details |

|---|---|

| Payment Range | $250 to $1,300 |

| Main Components | One-off $750 cost of living bonus, pension indexation increases, JobSeeker Payment boosts |

| Eligible Groups | Age Pensioners, Disability Support Pension recipients, JobSeekers, Carers, Low-income families |

| Automatic or Manual | Mostly automatic; manual application via myGov for some cases |

| Payment Dates (October) | 2nd, 16th, and 30th |

| Official Resource | Services Australia Centrelink |

What’s the $1,100 Centrelink Payment All About?

You might be wondering, is this a new payment? A bonus? Straight-up cash? Well, it’s actually a mix of multiple payments rolled into one total to tackle the hot topic of inflation and cost pressures in Australia.

Here’s the deal: The $1,100 figure refers to a bundle of payments aimed at easing the pinch felt by families, pensioners, job seekers, carers, and low-income households. It includes:

- A one-off $750 cost of living bonus: Cash straight into pockets of those meeting eligibility, with no hoops to jump through.

- Regular pension and allowance indexation increases: Done twice a year, to keep up with inflation so your Centrelink payments don’t lose buying power.

- Additional $250 top-ups and JobSeeker payment boosts for specific groups, spread across the year.

This isn’t handout season; it’s part of Australia’s broader social security strategy, making sure payment amounts match current economic realities.

Why $1,100 Centrelink Payment Matter Right Now?

You don’t have to be a math geek to notice that bills, food, and rent are shooting up faster than ever. For millions, keeping up can feel like a battle. These payments are the government’s way of saying, “We got you” — giving financial muscle to help make ends meet, cover the essentials, and get through unexpected expenses.

For example, in 2025:

- The Age Pension received a boost of about $29.70 more per fortnight for singles, bumping the fortnightly payment to roughly $1,178.70.

- JobSeeker payments also got increased by around $12.50 per fortnight.

- The one-off $750 bonus can tackle that surprise electricity bill or even help stock the fridge when money is tight.

These payments not only ease immediate strain but also help protect mental health by reducing financial stress for vulnerable Australians.

Are You on The List of Beneficiaries?

If you’re scratching your head about eligibility, here’s the rundown:

Qualifying Groups

- Age Pensioners (single or couples)

- Disability Support Pension recipients

- JobSeeker Payment recipients

- Carers and Parenting Payment recipients

- Low-income families receiving Centrelink support

What You Need to Qualify

- Be an Australian resident.

- Receive one of the eligible Centrelink payments listed above.

- Pass relevant income and assets tests based on your payment type.

For most folks already receiving these payments, no extra paperwork is needed—the money goes straight to your account automatically. If you’re new or need an advance, you’ll have to apply via official channels like myGov.

How to Check $1,100 Centrelink Payment Status?

Managing your benefits shouldn’t feel like a treasure hunt. The simplest, safest way to check your payments is through these official portals:

- myGov Portal: This is your all-in-one online government service hub. Link your Centrelink account here to check incoming payments, upcoming dates, and more.

- Express Plus Centrelink App: Handy for on-the-go checking, notifications, and updates.

Important October 2025 Payment Dates to Remember

Centrelink payments are dished out fortnightly, with October 2025 payment days set as follows:

- Thursday, October 2

- Thursday, October 16

- Thursday, October 30

Mark these dates on your calendar or phone to plan finances and avoid surprises.

Step-by-Step Guide to Accessing Your $1,100 Centrelink Payment

Want to make sure you get what’s yours without a hitch? Here’s how to stay on track:

Step 1: Sign Up or Log In to MyGov

- New to Centrelink? Head to my.gov.au to sign up for free.

- Link your Centrelink account using your Customer Reference Number (CRN).

Step 2: Check Your Payments Regularly

- Use the myGov portal or the Express Plus Centrelink app to view payment history, upcoming dates, and amounts.

Step 3: Keep Your Personal Details Updated

- Update your income, address, and banking info promptly to prevent delays or overpayment issues.

Step 4: Apply for Additional Support or Advances if Qualified

- If you face hardship or extra expenses, use myGov to request advances or extra payments.

Making the Most of Your Centrelink Payment: Practical Tips

Every dollar counts, so here are some strategies to stretch those funds:

- Budget smart: Prioritize rent, utilities, groceries, and essential bills. Tracking your expenses—even with a simple notebook or app—can reveal where you might be able to trim costs.

- Tackle Debt Early: The sooner you pay off high-interest debts like credit cards or pay-day loans, the more you free up cash.

- Build an Emergency Fund: Even small savings add up over time and can protect you if unexpected costs hit.

- Use Community Support: Many local organizations offer programs on budgeting, debt counseling, and even free essentials—never hesitate to reach out.

- Stay Alert Against Scams: Be cautious with unsolicited calls or emails claiming to be from Centrelink. Always verify via official websites to protect your info.

These practical habits combined with your Centrelink support can boost your financial security and peace of mind.

How Inflation Impacts Centrelink Payments and What You Should Know?

Inflation affects everyday life—from the price of bread to energy bills—and Centrelink payments are designed to help offset this impact. Payments are indexed twice yearly, in March and September, based on the Consumer Price Index (CPI), so your benefits keep pace with the cost of living.

However, inflation sometimes outpaces these adjustments, especially during rapid rises in energy or housing costs. That’s where one-off payments like the $750 cost of living bonus come in, providing a cash boost between indexation cycles.

Understanding this mechanism helps recipients plan better and realize this support is part of a bigger system responding to economic realities.

How Centrelink Supports Different Groups Specifically?

Age Pensioners

Age Pension recipients get regular indexation and the one-off cost of living payment, helping supplement their retirement income. Recent boosts have improved fortnightly payments by nearly $30, a meaningful increase when living on a fixed income.

JobSeekers

JobSeeker payment recipients benefit from modest boosts in their regular payment and any applicable top-ups. These payments help people get through tough job search periods while covering basics.

Disability Support Pension & Carers

This group often has additional living costs related to their circumstances. Centrelink payments reflect these needs with specific supplements, including concessions and extra payments alongside the cost of living supports.

Low-income Families & Parenting Payments

Additional assistance reaches families managing tight budgets with children, easing pressures from rising childcare, education, and household costs.

What to Do if Your Payment Is Cancelled or Stopped

Sometimes, payments might get cancelled or paused due to changes in circumstances, incomplete paperwork, or policy shifts. If that happens:

- Check your Centrelink online account for alerts or messages.

- Contact Centrelink promptly via official channels to sort issues.

- Provide any required documents quickly to avoid longer delays.

- Seek financial counseling if you face hardship.

Being proactive can help prevent interruptions and keep your benefits flowing smoothly.

Real Talk: How These Payments Help in Real Life

Meet Joan, a retired teacher from Sydney who relies on the Age Pension. She says the $750 one-off bonus was a lifesaver during an unexpected cold snap’s electricity bills. “It was like a breath of fresh air—helped me avoid stressing over money for once,” Joan shares.

Then there’s Mike, a single dad paddling through the job market. The JobSeeker increase plus the bonus gave him room to clear debts and stock up on groceries without sweating it. “It’s not just money, it’s peace of mind,” Mike explains.

Stories like these highlight how Centrelink payments not only help with bills but also support mental and emotional well-being during challenging times.