Canada Housing Benefit: If you’re living in Canada and feeling overwhelmed by soaring rent or mortgage payments, you’re not alone. The government’s new one-time $500 Housing Benefit payment coming in October 2025 aims to provide a crucial financial cushion for those struggling with the rising costs of housing. Whether you’re renting an apartment or paying off a mortgage, this benefit could be just what you need to manage your household expenses better during challenging times. Many Canadians are experiencing a significant squeeze on their wallets. From record-high housing prices to increasing interest rates, the financial stress of housing affordability is a real problem affecting millions. This article will walk you through everything you need to know about this $500 payment, including eligibility, application procedures, and practical tips for managing housing costs.

Canada Housing Benefit

The Canada Housing Benefit $500 payment in October 2025 offers a lifeline during a tough time in the housing market. If you meet the eligibility criteria, act early to apply through CRA and set up direct deposit for faster payout. Remember, this isn’t a permanent solution but a vital bridge to help you navigate rising housing costs. Stay proactive, manage your finances wisely, and make use of all available resources to safeguard your housing stability.

| Aspect | Details |

|---|---|

| Payment Amount | One-time $500, tax-free |

| Payment Timing | Starting late September, bulk payments in October 2025 |

| Eligibility Age | 18 years or older |

| Residency Status | Canadian citizens or permanent residents only |

| Income Limits | Low- to moderate-income households, varies by family size & region |

| Eligible Housing Costs | Rent or mortgage payments on primary residence |

| Application Period | Opens early September, closes late October 2025 |

| How to Apply | CRA My Account portal or mail |

| Payment Delivery | Direct deposit (preferred) or mailed cheque |

| Official Website | Canada Revenue Agency – Housing Benefit |

Understanding the Context: Why Is Housing Affordability a Major Issue in Canada?

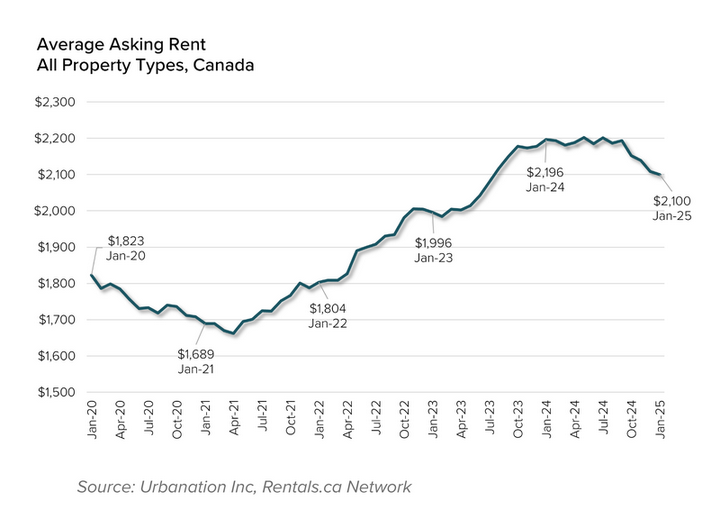

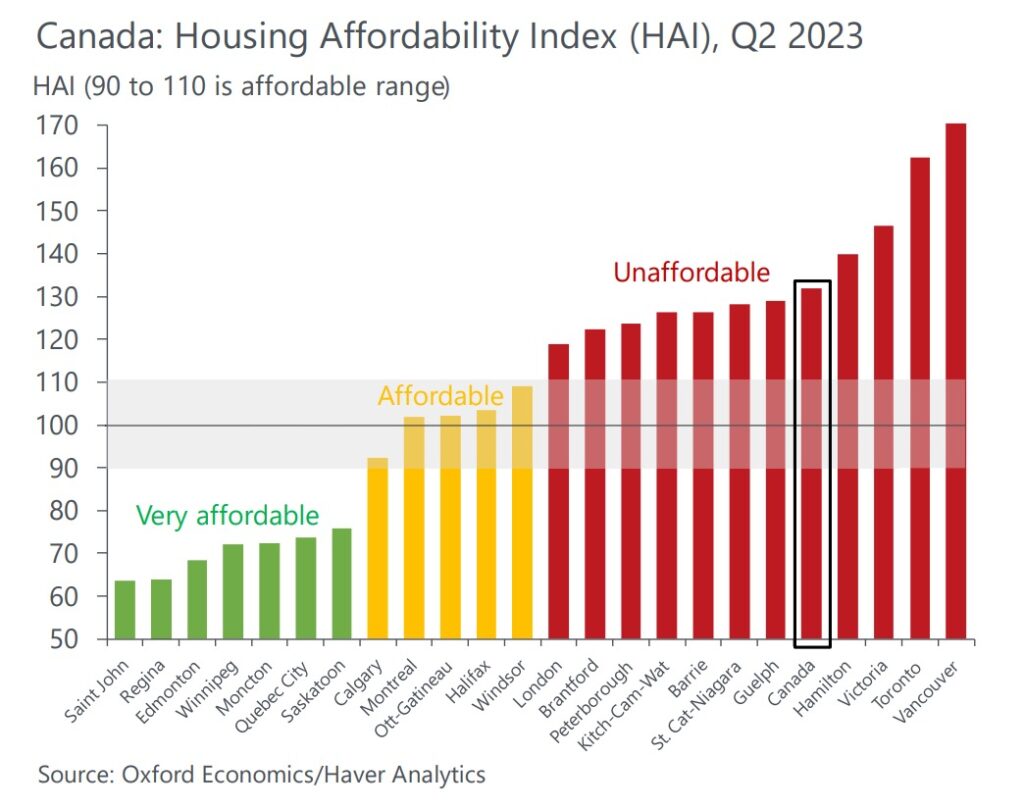

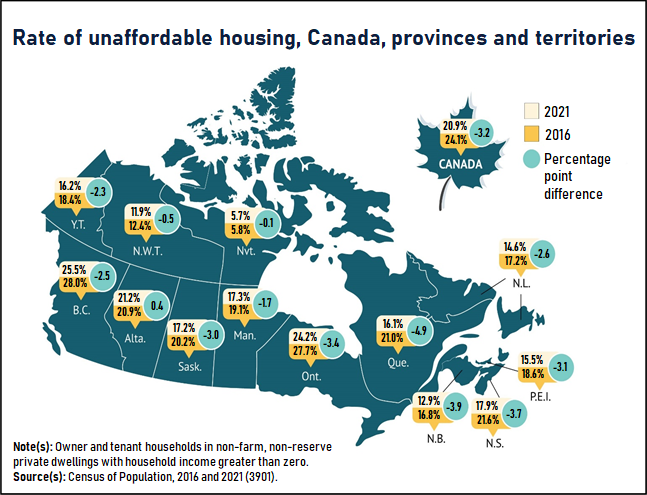

Canada’s housing market has been under immense pressure for several years. Over the past decade, housing prices in major cities like Toronto, Vancouver, and Montreal have skyrocketed, making homeownership a distant dream for many young families. According to the Canada Mortgage and Housing Corporation’s (CMHC) latest report from Fall 2025, housing affordability remains a crisis, with over 30% of household income spent on housing costs in several urban areas.

This trend is fueled by multiple factors:

- Supply and demand imbalance: Despite high construction levels, demand for housing outpaces supply in many regions, pushing prices higher.

- Rising mortgage rates: Inflationary pressures have caused the Bank of Canada to increase interest rates, which, in turn, elevates mortgage payments.

- Inflation and living costs: General inflation has increased prices for everything from groceries to utilities, stretching household budgets thin.

- Regional disparities: While Toronto and Vancouver remain the priciest markets, cities like Ottawa, Calgary, and Halifax are also experiencing upward price pressures.

The aftermath of the COVID-19 pandemic, combined with geopolitical tensions and economic uncertainties, has caused compounded housing challenges. Many families are now spending more than they can comfortably afford, leading to increased requests for government support.

Why Is the Canada Housing Benefit Being Rolled Out?

In response, the Canadian government has introduced several targeted initiatives over the years. The October 2025 $500 Housing Benefit is part of this broader strategy. Launched as a one-time, quick relief measure, it recognizes that many households face sudden financial burdens, especially as rent increases or mortgage payments become harder to sustain.

The goal of this payment is simple: help Canadians stay afloat during a time when housing costs threaten their financial stability. This particular benefit is designed mainly to assist low- and moderate-income families, seniors, and individuals who are most vulnerable to economic shocks. It aligns with Canada’s commitment to foster inclusive growth and support affordable housing for all.

Who Is Eligible for This Canada Housing Benefit?

While the specifics can vary based on provincial or territorial rules, the core eligibility criteria include:

- Age: Must be 18 years or older.

- Residency: Must be a Canadian citizen or a permanent resident. Temporary residents and certain visa holders generally do not qualify.

- Income Thresholds: Household income must be below specified limits, which differ depending on your province or territory and family size.

- Housing Payments: You must pay rent or have an active mortgage on your primary residence.

- Application Status: You need to apply before the deadline, typically through the Canada Revenue Agency (CRA).

It’s important to note that individuals already receiving other benefits like the Canada Child Benefit or GST/HST credit may find the application process more straightforward, as some eligibility checks are automated.

How and When to Apply for Your Canada Housing Benefit?

Getting your hands on this relief is straightforward if you follow the right steps:

Step 1: Verify Eligibility

Visit the CRA website or use their online eligibility calculators to check if you qualify based on income, residency, and housing costs.

Step 2: Submit the Application

- Online: Use the CRA’s “My Account” portal for a quick, hassle-free process.

- By Mail: Fill out the paper application form and send it through the mail if you’re not comfortable online.

Step 3: Set Up Direct Deposit

Link your bank account with CRA for faster payments. If you choose mailing, your cheque will arrive by mail.

Step 4: Receive Payment

The government plans to issue payments starting in late September 2025, with most beneficiaries receiving the $500 benefit in October.

Practical Tip

Applying early maximizes your chances of receiving the payment before the deadline—late applications may be rejected or delayed.

A Broader View: Other Canadian Housing Programs and Support

Apart from this one-time benefit, Canada’s government has been actively developing ongoing programs to help households:

- Canada-Ontario Housing Benefit (COHB) and similar provincial programs offer monthly rent supports.

- Emergency housing funds are available in some regions for those facing urgent homelessness or eviction.

- First-time homebuyer grants provide financial assistance for those entering the housing market.

The $500 payment complements these ongoing initiatives and provides quick relief for those in immediate need.

How This Benefit Fits In: Comparing to Other Support Options

This $500 is not designed to replace long-term support initiatives but is an emergency measure. It’s especially helpful for those facing unforeseen rent hikes or short-term income disruptions. Its simplicity and one-time nature make it accessible, but it’s essential to combine it with other strategies for sustained housing affordability.

Managing Housing Costs Beyond the Benefit

While the $500 gives visible relief, some steps can help you better manage housing costs:

- Refinance your mortgage if possible, to secure a lower interest rate.

- Negotiate with your landlord if rent is rising unexpectedly.

- Explore provincial or municipal assistance programs for renters or homeowners.

- Keep an eye on educational resources from financial experts on budgeting and debt management.

- Consider shared housing or downsizing if your financial situation demands drastic measures.

Expert Insights and Future Outlook

According to Dr. Lisa Carmichael, a housing policy expert, “While one-time benefits like this $500 payment are valuable short-term solutions, Canada must focus on long-term, systemic reforms to address housing affordability. This includes increasing supply, enhancing non-market affordable housing, and reforming zoning laws.”

Looking ahead, Canada’s housing market faces ongoing challenges. The latest CMHC reports suggest that housing prices may stabilize somewhat but will remain high relative to income levels in many urban centers. Policymakers continue to work on broader solutions, but immediate relief like this benefit provides essential support.

Canada Revenue Agency Dodges Key Question: How Many Call Centre Workers Are Coming?

CRA Slaps Taxpayer With $5,000 Penalty Over Simple U.S. Reporting Mistake