£4,200 Pension Credit Boost in 2025: If you or someone you love is heading into retirement or already enjoying those well-earned golden years, the £4,200 Pension Credit boost in 2025 is big news that could change the game when it comes to making ends meet. This extra financial help, provided by the UK government, is designed to support pensioners navigating the rising cost of living. Whether a retiree, a caregiver, or a financial pro looking out for clients or family, knowing the ins and outs of this boost can make a big difference for peace of mind and financial security. Simply put, if you’re eligible, you could get up to £420 extra each month, which adds up to a solid £4,200 per year in additional income. That’s no small change; it’s real money to cover essentials like heating, food, prescriptions, or maybe even a little luxury once in a while. So, let’s break down how this boost works, who qualifies, and exactly what you need to do to claim it.

£4,200 Pension Credit Boost in 2025

The £4,200 Pension Credit boost for 2025 is here to help UK pensioners fight back against rising costs. Don’t miss out—if you or someone you know could benefit, get informed, check eligibility, and apply today. Combining this with smart retirement planning can make your golden years comfortable and worry-free.

| Feature | Details | Reference Link |

|---|---|---|

| Maximum Boost Amount | Up to £420 per month (£4,200 annually) | Official GOV.UK Pension Credit Guide |

| Eligibility Age | State Pension age (~66 years in 2025) | |

| Income Thresholds | £227.10 per week (single), £346.60 (couples) | |

| Application Methods | Online, phone, postal | Apply for Pension Credit |

| Backdating Claims | Claims can be backdated up to 3 months |

What Is Pension Credit and Why Does It Matter?

Pension Credit acts like a financial cushion when your income in retirement doesn’t quite stretch far enough. This benefit tops up your guaranteed income if it falls below a certain threshold set by the government. It’s particularly important now with inflation hiking prices on everything from energy bills to groceries.

In 2025, the government increased the Pension Credit boost to about £420 per month, or £4,200 a year. That’s a serious chunk of cash to help pensioners manage rising living costs and maintain a decent standard of living.

Pension Credit has two parts:

- Guarantee Credit tops up your weekly income to a set minimum level—currently around £227.10 per week for single pensioners and £346.60 for couples.

- Savings Credit rewards those who have saved additional money in pensions or investments, but it only applies to those who reached State Pension age before April 2016.

Together, these credits work to help pensioners stay financially secure and access additional benefits.

Who Is Eligible for £4,200 Pension Credit Boost in 2025?

The basic eligibility criteria are pretty straightforward:

- You must have reached the State Pension age, which is currently around 66 years but depends on your birth date.

- Your weekly income must be below the threshold: £227.10 for singles and £346.60 for couples.

- You must reside in England, Scotland, or Wales.

- Extra allowances exist for certain groups: disabled individuals, carers, and those with housing costs.

- Savings over £10,000 affect how much Pension Credit you might get.

If you’re unsure whether you qualify, it’s definitely worth checking. Many slip through the cracks by assuming they don’t qualify when they actually do.

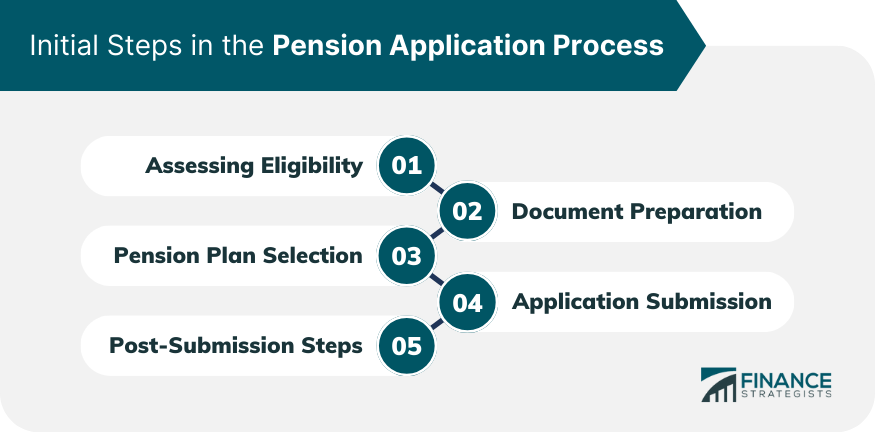

How to Apply for £4,200 Pension Credit Boost in 2025: A Simple Step-by-Step Guide

Step 1: Gather Your Essential Documents

Before you start your application, make sure you have:

- Your National Insurance number.

- Proof of income (pension slips, bank statements).

- Details of capital and savings.

- Housing cost information, if applicable.

- Bank or building society account details.

Step 2: Use the Online Pension Credit Calculator

Head over to the gov.uk website and use their Pension Credit calculator. This tool quickly estimates how much you could be eligible to receive, saving you time and helping you know what to expect.

Step 3: Start Your Claim

You can claim Pension Credit in several ways:

- Online: The quickest and easiest method through the GOV.UK website.

- Phone: Call the Pension Service at 0800 99 1234 for help or to apply.

- Post: Download the form, complete it manually, and mail it in if you prefer.

Step 4: Backdating Your Claim

Good news! If you’ve been eligible but didn’t claim, you can backdate your application by up to 3 months to receive payment for that period.

Step 5: Keep Your Information Updated

If your circumstances change—like income or savings—notify the Pension Service promptly. It helps keep your payments accurate.

Unlocking Additional Benefits with Pension Credit

Pension Credit doesn’t just mean extra cash in your pocket. It also opens doors to other benefits, including:

- Help with housing costs: discounts on council tax or help with rent.

- Free prescriptions and dental care for those eligible.

- Free TV licence if you’re over 75.

- Cold Weather Payments: extra cash during winter months to help pay heating bills.

- Discounts on local bus passes and in some cases help with telephone costs.

All these extras add up to meaningful support beyond just the monthly top-up.

The Triple Lock Guarantee and Pension Security

The government backs pensioners with a unique “triple lock” policy, ensuring that pensions increase annually by the highest of:

- Inflation rate,

- Average earnings growth, or

- 2.5%.

This policy guarantees pensions keep pace with general living costs or wage growth and plays a big part in sustaining the value of the £4,200 boost as part of the overall income pensioners receive.

Real-Life Examples: How Does This Look in Action?

- Mary, 67, Single Retiree:

Mary’s weekly income from her State Pension and small workplace pension adds up to £205. Since the Guarantee Credit minimum is £227.10, she receives a top-up of about £22.10 a week—that’s more than £1,100 a year, helping her cover essentials without stress. - John and Sue, 68, Retired Couple:

Their combined income is £320 a week. The minimum weekly threshold for couples is £346.60, so they get a £26.60 weekly top-up—roughly £1,380 annually for essentials like heating, groceries, and meds.

Common Mistakes to Avoid When Applying

- Assuming you’re not eligible without checking.

- Not applying as soon as you hit State Pension age.

- Missing the backdating window.

- Failing to update your circumstances leading to overpayment or underpayment.

- Overlooking linked benefits unlocked by Pension Credit.

How Pension Credit Fits Into Your Broader Retirement Plan

Pension Credit isn’t a standalone fix; it’s a vital component of your retirement income strategy. When combined with your State Pension, savings, workplace pensions, and other benefits, it helps create financial stability.

It’s smart to:

- Review your income sources and see if Pension Credit can fill gaps.

- Plan your savings and investments considering the pension credit eligibility rules.

- Consult professionals or trusted organizations like Citizens Advice or Age UK for advice.

A Quick Comparison: UK Pension Credit and US Social Security

For readers stateside, here’s a quick point of reference: the UK’s Pension Credit is somewhat like supplemental income (SSI) or Supplemental Security Income in the US, providing extra funds to those with low retirement income.

While the systems differ in funding and structure, the goal is the same: to ensure seniors don’t fall through financial cracks.

Why £4,200 Pension Credit Boost in 2025 Matters: Pension Poverty in the UK

Roughly 1.7 million pensioners are living in poverty in the UK, according to government statistics. The Pension Credit is one of the biggest tools to lift them out of hardship.

With inflation driving up energy and grocery bills, this £4,200 boost is more than a number—it’s a lifeline that can keep homes warm and cupboards full.

Are You Missing £8,300? DWP Urges Pensioners to Check for Back Payments Now

Born After This Date? You Could Lose £13,000 in 2026; Experts Warn of ‘Pensions Steal’