DWP Urges Pensioners to Check for Back Payments Now: If you’ve ever assumed that government systems always get your payments right, think again. Across the United Kingdom, thousands of retirees are discovering that the Department for Work and Pensions (DWP) owes them significant sums of money — in some cases, as much as £8,300 or more in missed State Pension payments. This isn’t a scam or a rumor — it’s a legitimate issue, confirmed by official reports and government statements. The DWP has begun a massive correction effort, urging pensioners, particularly women, to check their records and claim back what’s rightfully theirs.

DWP Urges Pensioners to Check for Back Payments Now

This story is a powerful reminder that financial awareness doesn’t stop at retirement. Thousands of people are learning that decades-old paperwork mistakes cost them thousands of pounds. Whether you’re a UK pensioner, a U.S. retiree, or a professional managing clients’ finances, the lesson is universal — check your records, question assumptions, and stay proactive. It’s not just about the £8,300 back payment; it’s about making sure your lifetime of work is properly valued.

| Topic | Details |

|---|---|

| Who’s Eligible | Primarily women who claimed Child Benefit before 2000, or anyone with missing National Insurance (NI) credits |

| Average Underpayment | Around £8,300 per person |

| Total Owed by DWP | More than £800 million identified so far |

| Number of Affected Pensioners | Over 130,000, with more still being found |

| Root Cause | Missing “Home Responsibilities Protection (HRP)” credits in National Insurance records |

| Years Impacted | Mainly between 1978 and 2010 |

| How to Check | Visit the official site: https://www.gov.uk/check-state-pension |

| Support Services | Age UK, Pension Advisory Service |

| Latest Update | September 2025 |

The Story Behind the DWP Urges Pensioners to Check for Back Payments Now

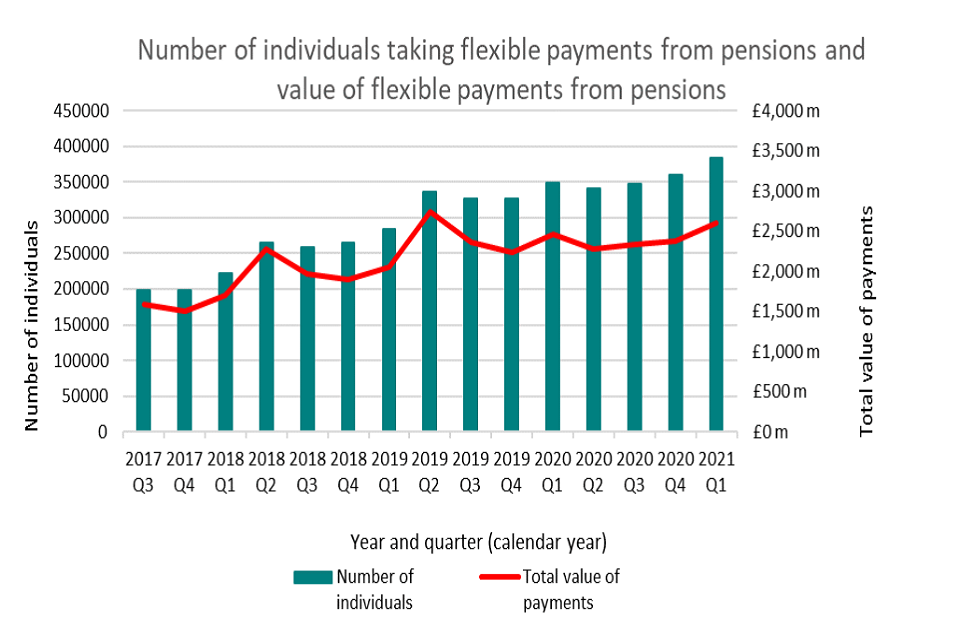

This whole back payment situation began decades ago, long before digital records became the norm. Back then, much of the UK’s social benefit information was handled through paper forms, local offices, and manual data entry. Between 1978 and 2010, the British government ran a scheme called Home Responsibilities Protection (HRP).

The goal of HRP was simple: to protect the State Pension rights of parents and caregivers, often mothers, who took time off work to raise children or provide care. Those years were supposed to count toward the State Pension, even if the person wasn’t paying National Insurance (NI) contributions at the time.

But here’s where things went sideways — many of those HRP credits were never properly transferred into the main NI records. Missing NI numbers, incomplete forms, or system changes meant thousands of people’s caring years were never recorded. As a result, their eventual pension payments were calculated too low. Some pensioners have been unknowingly underpaid for years — even decades.

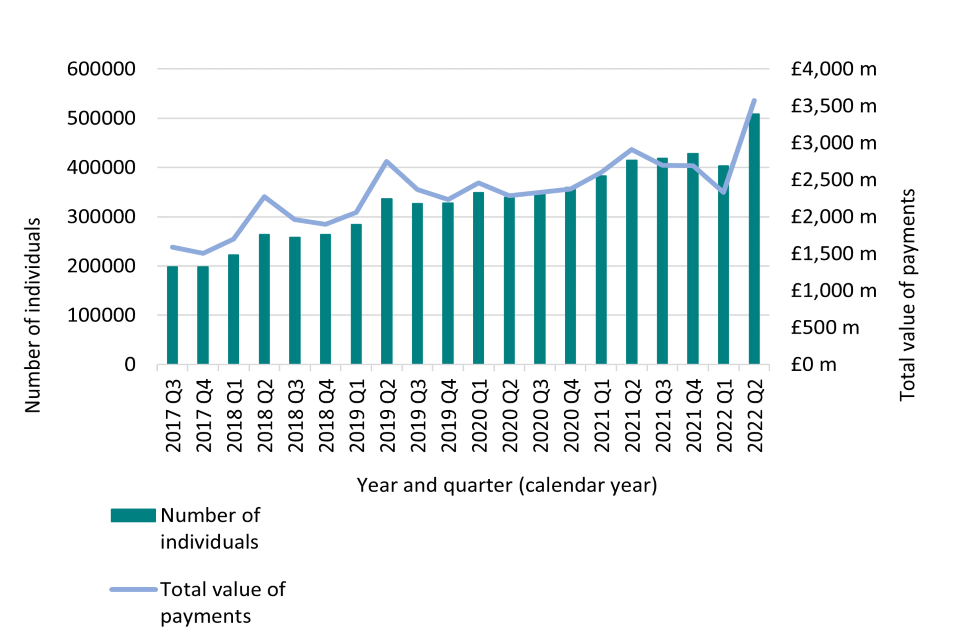

The Scale of the Problem

The UK’s National Audit Office (NAO) and Financial Times estimate that the DWP owes at least £804.7 million in backdated payments as of early 2025. That number continues to grow as more people are identified.

So far, the correction exercise has found:

- Over 130,000 pensioners underpaid.

- An average repayment of £8,300 each.

- In some cases, individual payouts exceeding £15,000–£20,000.

These aren’t rare mistakes. They reveal long-term structural issues in how pension and social records were handled before modern systems took over.

For retirees living on limited incomes, that kind of underpayment can make a life-changing difference.

Who Is Most Likely Affected?

According to DWP’s internal review, the following groups are most likely to qualify for back payments:

- Women who claimed Child Benefit before 2000 but didn’t include their National Insurance number on forms.

- Individuals who took career breaks for caregiving or child-raising between 1978 and 2010.

- Pensioners who changed names after marriage or divorce and whose records didn’t get updated.

- People who moved frequently during those years and missed correspondence about HRP eligibility.

Although women represent the majority of cases, a smaller number of men — especially widowers or single fathers — could also qualify.

How to Check for Back Payments Now?

The DWP and HM Revenue & Customs (HMRC) have begun sending letters to potentially affected individuals. But if you haven’t received one, you shouldn’t just wait. You can — and should — take action on your own.

Step 1: Review Your National Insurance Record

Head to the official GOV.UK portal:

https://www.gov.uk/check-state-pension

You’ll need your Government Gateway ID. Once logged in, review your National Insurance contribution history. Look for any “gaps” or “incomplete years” — these are potential problem areas.

If you notice missing years during which you were raising children or providing care, those could be HRP years that weren’t recorded.

Step 2: Review Your Child Benefit Claims

If you received Child Benefit before the year 2000, double-check that your NI number was linked to your Child Benefit claim.

You can call or write to HMRC to verify whether your HRP credits were correctly applied.

Step 3: Contact DWP or HMRC for Clarification

If you suspect an issue, contact the DWP Pension Service or HMRC National Insurance helpline. Provide as much evidence as possible — Child Benefit numbers, NI numbers, and any proof of caregiving periods.

You can also request an HRP review form directly from HMRC. It’s free, and many people have reported receiving refunds within a few months of filing.

Step 4: Seek Help from Trusted Organizations

Groups like Age UK and the Pension Advisory Service can help you fill out forms and navigate the process if government language feels overwhelming.

Real-Life Examples

To understand just how real this back payment issue is, consider the following examples reported in the UK press:

- A retired teacher in Manchester discovered her record was missing six years of HRP credits. After contacting HMRC, she received £11,900 in back payments and an increase of £48 per week in her pension.

- A woman in Kent, who had taken time off to raise three children in the 1980s, was refunded £14,500 after a correction.

- One widower, initially told he wasn’t eligible for a full pension, later found missing credits and was repaid £9,200.

These cases show that persistence pays off — literally.

Why This Story Resonates Beyond the UK?

Even if you live outside Britain, there’s a larger lesson here. Bureaucratic systems, whether in the U.S. Social Security Administration or any other government agency, rely on accurate record-keeping.

In the U.S., similar problems can occur when employers fail to report wages correctly or when self-employment earnings aren’t recorded by the IRS.

Moral of the story:

Always verify your government and retirement accounts. Once an error compounds over decades, the loss can be massive.

Expert Insight: What Financial Professionals Are Saying

Pension analysts say this episode highlights the importance of regular audits and transparency. According to Sir Steve Webb, a former UK Pensions Minister, underpayments often occur because people trust the system too much.

He emphasized in an interview with MoneySavingExpert.com:

“People assume their pension is correct because the government is paying it. Unfortunately, history shows that’s not always the case.”

Financial advisors recommend checking your pension record every few years, especially before retirement. It’s one of the simplest ways to protect your long-term financial stability.

What the UK Government Is Doing About It?

The DWP and HMRC have launched what’s known as the Correction and Reconciliation Exercise. This initiative reviews pension cases for potential HRP-related errors.

So far, more than 500 staff members are dedicated to the project. The government aims to contact all known back payment affected individuals by the end of 2026.

However, experts warn that some cases may go unaddressed unless individuals step forward. That’s why awareness is crucial — the government can’t fix what it doesn’t know about.

Practical Tips to Avoid Future Pension Errors

Here’s what every retiree or future retiree should keep in mind:

- Check your records annually. Log into your pension or Social Security accounts once a year to ensure everything is accurate.

- Keep physical and digital copies of employment, tax, and benefit records.

- Update your name and address immediately after any life event — marriage, divorce, or relocation.

- Confirm your National Insurance or Social Security number is linked across all benefit programs.

- Educate family members. Many older adults may not be tech-savvy. Help parents or grandparents access their pension portals.

These steps apply worldwide, not just in the UK. A little vigilance now could prevent a costly oversight later.