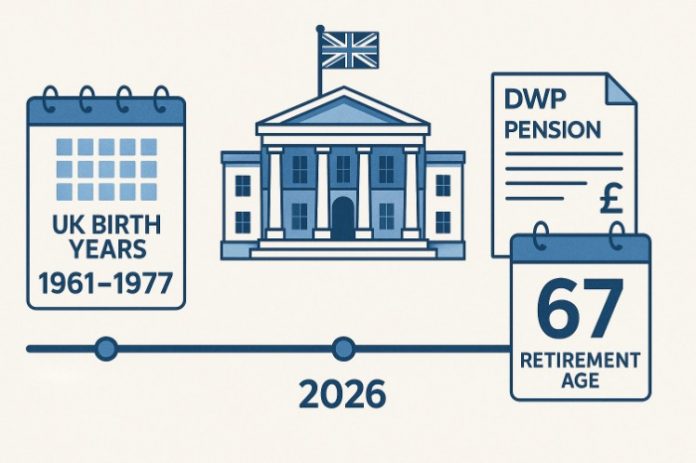

You Could Lose £13,000 in 2026: If you were born after April 6, 1960, you might be facing an unexpected hit to your retirement income starting in 2026. The UK government plans to increase the State Pension age from 66 to 67, meaning millions of people will have to wait an extra year before collecting benefits they’ve been paying into for decades. Financial analysts estimate that this delay could cost some people around £13,000 ($16,500) in missed payments — sparking a heated debate across the country. Critics are calling it a “pensions steal,” while officials argue it’s a necessary step to keep the system sustainable.

You Could Lose £13,000 in 2026

Whether you see it as a smart reform or a pensions steal, the reality is this: if you were born after April 6, 1960, your retirement just got pushed back. That delay could mean missing out on around £13,000, but you can take steps now to soften the impact. Review your pension records, start saving strategically, and plan for that “gap year” between retirement and eligibility. The earlier you act, the smoother your transition will be. As the saying goes, “The best way to predict your future is to plan it.”

| Topic | Details |

|---|---|

| Affected Birth Date | Born on or after April 6, 1960 |

| Policy Change | State Pension age rising from 66 to 67 between 2026–2028 |

| Estimated Financial Impact | Up to £12,849–£13,000 in lost payments |

| Full State Pension (2025) | £221.20 per week (£11,502 annually) |

| Official Source | UK Government Pension Age Review |

| Why It Matters | Delayed eligibility means smaller lifetime payout |

| Next Scheduled Change | Pension age may rise again to 68 by 2044–2046 |

| Action Steps | Check eligibility, fill NI gaps, plan bridge income, diversify savings |

Understanding the Pension Age Shift

The State Pension is one of the cornerstones of the UK’s social welfare system. It’s a guaranteed income from the government for those who’ve reached retirement age and made enough National Insurance (NI) contributions during their working years.

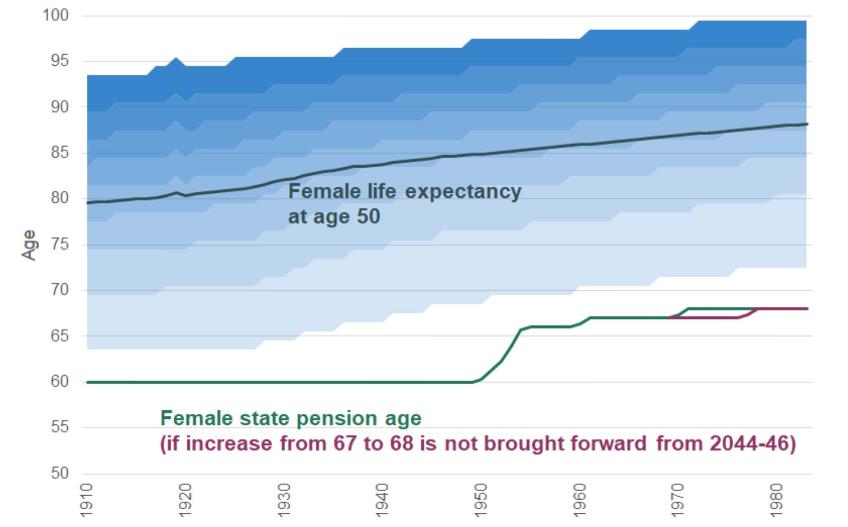

However, the age at which people can claim this benefit hasn’t been static. Over the decades, as life expectancy climbed, policymakers began adjusting the pension age upward.

Here’s how it’s evolved:

- Pre-2010: Women could retire at 60, men at 65.

- 2010–2020: The ages were equalized and raised to 66 for everyone.

- 2026–2028: The next planned increase — 66 to 67.

Future reviews suggest a possible jump to 68 between 2044–2046, though that could change depending on government assessments of national longevity and economic conditions.

According to the Office for National Statistics (ONS), the average life expectancy in the UK is now about 79 for men and 83 for women, meaning retirees collect pensions for far longer than in previous generations. The government argues that without raising the pension age, the system could become financially unsustainable.

Why Experts Call It a “Pensions Steal”?

Financial planners and consumer advocates say the change feels unfair — especially for those born just days after the cut-off date.

Imagine this scenario:

- Linda, born on April 5, 1960, can retire at 66.

- Sarah, born on April 6, 1960, must wait until 67.

That one-day difference means Sarah misses out on a full year of State Pension payments — roughly £11,500 to £13,000, depending on inflation.

It’s easy to see why people are frustrated. As Martin Lewis of MoneySavingExpert.com puts it,

“It’s like finishing a marathon and being told they’ve just moved the finish line another mile down the road.”

The frustration stems not just from lost money, but also from lost time — especially for those in physically demanding jobs who were counting down the days to retirement.

Who Will Be Affected the Most?

The pension age increase affects anyone born between April 6, 1960, and April 5, 1968.

But the impact isn’t equal for everyone. Certain groups will feel the squeeze more sharply:

- Manual laborers who may find it physically difficult to keep working into their late 60s.

- Low-income earners with little or no private savings.

- Women born in the early 1960s, who already faced previous pension reforms.

- People in poor health, who might not live long enough to enjoy many years of pension payments.

Meanwhile, wealthier retirees with private pensions, ISAs, or property income will likely weather the change more comfortably.

The Numbers Behind the £13,000 Estimate

Let’s break it down.

The full new State Pension (as of 2025) is £221.20 per week, which equals about £11,502 per year.

If your pension is delayed by a year, you lose that income for 12 months. Add in the annual increase from the “triple lock” (which ensures the pension rises each year by inflation, 2.5%, or average wage growth — whichever is higher), and the real-term loss can easily reach £12,849–£13,000.

That’s the rough equivalent of a year’s living expenses for a modest lifestyle — or a serious dent in your retirement cushion.

The Government’s Side of the Story On You Could Lose £13,000 in 2026

According to the Department for Work and Pensions (DWP), these changes are about “fairness and long-term sustainability.”

Their rationale is simple:

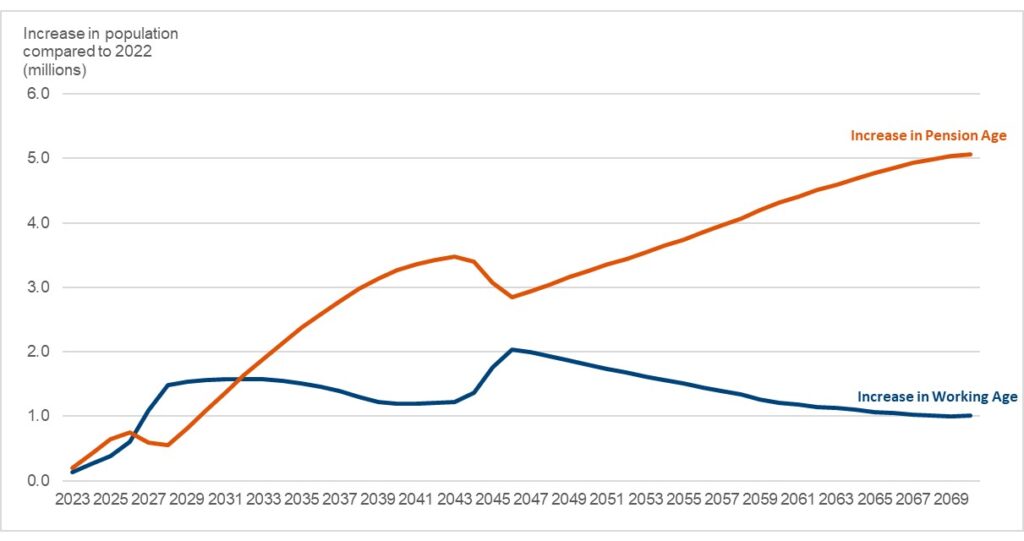

- People are living longer, so the pension fund must stretch further.

- The working-age population is shrinking, reducing the tax base that funds pensions.

- The adjustment will save an estimated £9 billion per year by 2028.

Still, critics argue that average life expectancy growth has slowed in recent years, especially in poorer regions, meaning many might not enjoy as many years of retirement as government forecasts suggest.

How to Prepare for the Change As You Could Lose £13,000 in 2026

This isn’t a hopeless situation. There are clear, practical steps you can take today to prepare financially for the pension age increase.

Step 1: Check Your State Pension Age

Head to the official government calculator. Enter your birth date, and you’ll see your exact pension eligibility age and year.

Step 2: Review Your National Insurance Record

You need at least 35 qualifying years of NI contributions for the full State Pension.

If you’ve got missing years, you can make voluntary contributions to fill those gaps — often a smart investment for boosting your future income.

Step 3: Strengthen Your Private or Workplace Pension

Even small contributions can make a huge difference. Take advantage of employer matching programs and tax reliefs to maximize growth. Think of it like building a financial safety net that catches what the State Pension won’t cover.

Step 4: Plan a “Bridge Year”

If you were planning to retire at 66, plan for how you’ll cover that extra year without pension income. Options include:

- Using savings or ISAs.

- Working part-time or freelancing.

- Drawing on private pensions slightly earlier.

This “bridge” approach keeps your finances stable until your State Pension kicks in.

Step 5: Talk to a Professional

A financial advisor can help you create a personalized retirement plan, weighing factors like inflation, investment returns, and health status.

Real-Life Story: The One-Day Difference

Take Sarah, who was born April 6, 1960. She’s worked for 40 years in retail and planned to retire at 66. Her friend Linda, born April 5, can do just that — but Sarah must work another full year before she’s eligible.

That one-day difference equals more than £11,500 lost. For Sarah, that’s not just numbers on paper — it means another year of physically demanding work and delayed plans for rest, travel, or time with family.

Stories like Sarah’s have become common talking points across the U.K., with social media campaigns urging policymakers to reconsider or soften the transition.

Global Perspective: The U.K. Isn’t Alone

The U.K. isn’t the only nation facing this challenge. Across the developed world, countries are increasing retirement ages to keep pension systems viable.

For example:

- In the United States, the “full retirement age” for Social Security is 67 for anyone born after 1960.

- In Germany, it’s climbing to 67 by 2031.

- In France, protests erupted in 2023 when the government raised the pension age from 62 to 64.

In short, retirement reforms are becoming a global norm, not an exception. The underlying issue — longer lifespans and financial strain — affects every major economy.

Expert Insights: How to Stay Ahead

Financial professionals stress that preparation, not panic, is the key.

Sarah Pennells, Consumer Finance Specialist at Royal London, says:

“If you’re in your 50s or early 60s, now’s the time to take control of your retirement planning. Even modest changes today can make a big difference in your future income.”

Practical tips include:

- Automate pension contributions to ensure consistency.

- Delay drawing down private pensions if possible — the longer they stay invested, the more they grow.

- Consider flexible retirement — working fewer hours while easing into retirement.

These small, smart moves can make the pension-age delay far less painful.