$8,844 Canada WEPP Benefit: When life throws you a curveball and your employer goes bankrupt or into receivership, losing your hard-earned money can be a tough blow. But hey, Canada’s got your back with the Wage Earner Protection Program (WEPP), designed to help employees like you get the pay you’re owed. For October 2025, eligible workers can get a one-time payment of up to $8,844—a serious assist if your employer folded. This article breaks down everything about the WEPP benefit, from who qualifies, how much you can get, and when you’ll see that cash. Whether you’re a regular worker or a savvy pro, you’ll find simple explanations, practical tips, and clear examples to get your claim rolling confidently.

$8,844 Canada WEPP Benefit

Losing your job is tough enough, but not getting your earned wages? That’s next-level stress. Thankfully, Canada’s Wage Earner Protection Program (WEPP) is designed to step in, protect you, and get that $8,844 payout flowing to eligible workers as fast as possible. This program powers financial relief for thousands every year, making sure workers earn what they deserve, even when their employer goes bust. Get your papers ready, file your claim fast, and lean on WEPP to get you back on your feet. Remember, knowledge is power—and knowing your rights under WEPP can be a game-changer.

| Feature | Details |

|---|---|

| Maximum Benefit (2025) | $8,844 (equivalent to 7x max weekly insurable EI earnings) |

| Eligibility | Employment ended due to employer’s bankruptcy/receivership, owed wages in prior 6 months |

| Eligible Payments | Wages, vacation pay, termination pay, severance pay |

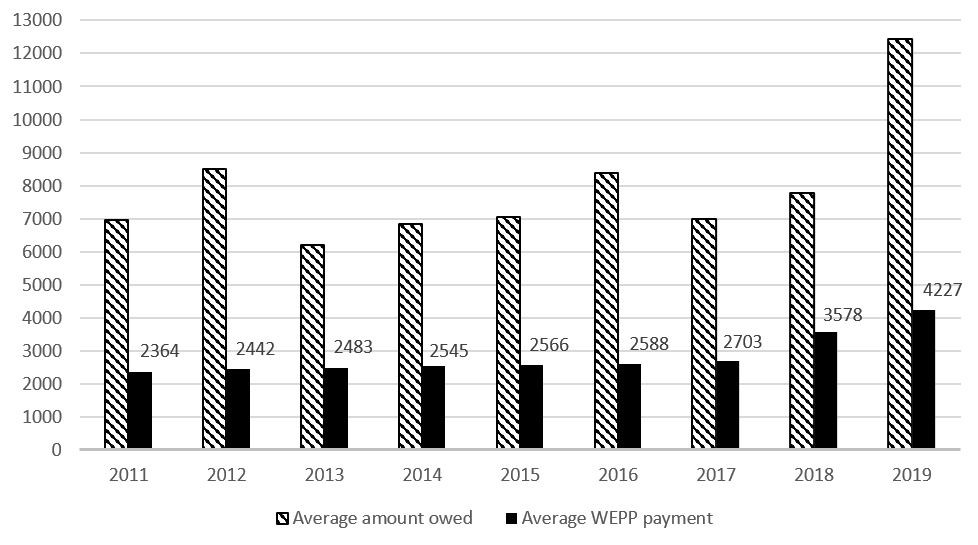

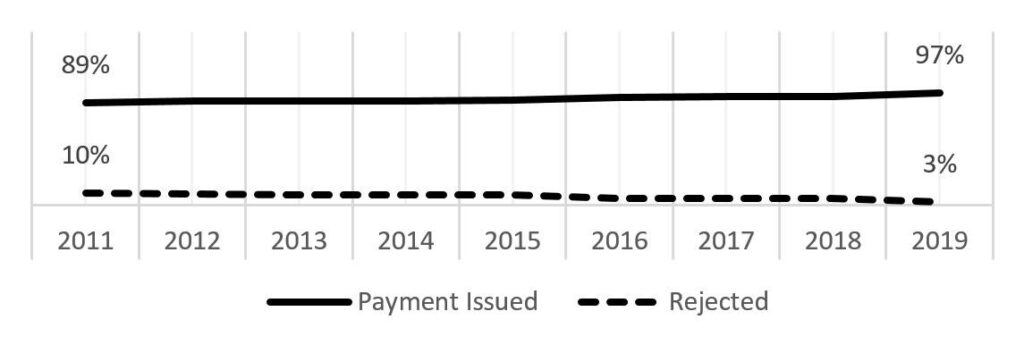

| Approval Rate | 89% – 97% historically |

| Average Payment | Covers 60% – 76% of owed wages |

| Claim Submission | File proof of claim ASAP with the trustee or receiver |

| Payment Timing | Typically processed within 42 days after approval |

| Official Website | Canada WEPP Official |

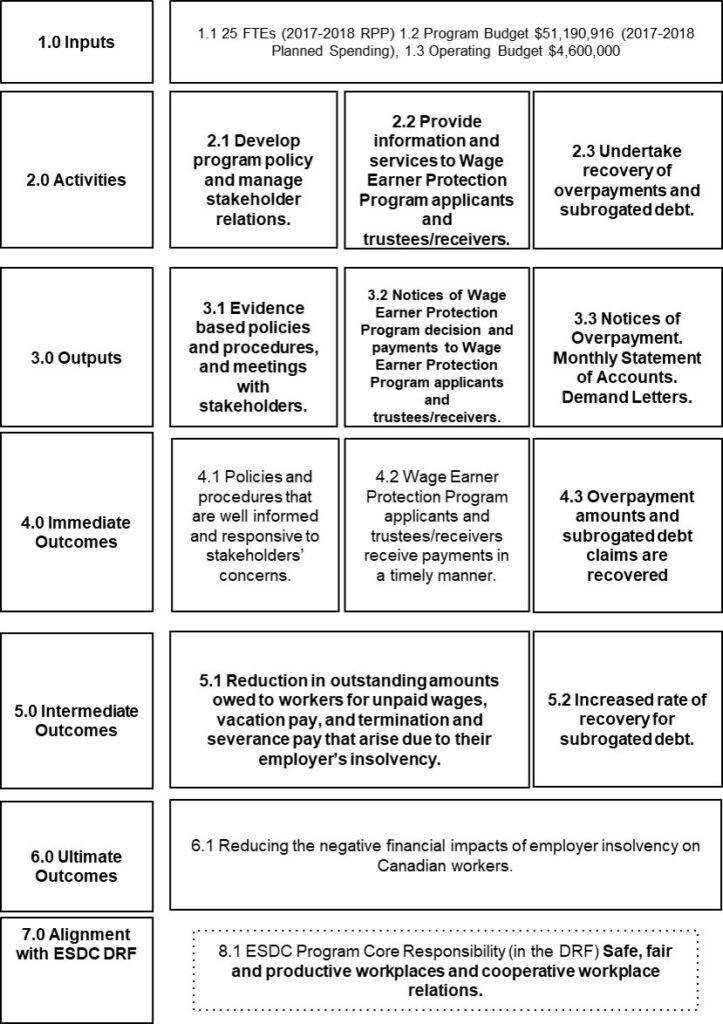

What is the Wage Earner Protection Program (WEPP)?

Put simply, the WEPP is Canada’s safety net for workers who get the short end of the stick when their boss’s business crashes. When an employer goes bankrupt or moves into receivership, chances are some folks might not get their full paycheck, vacation cash, or severance. WEPP steps in to cover those unpaid earnings—up to a certain limit.

The program was created by the Canadian government and kicked off in 2008. Since then, it’s been a crucial lifeline for tens of thousands of workers who’ve been left high and dry by insolvent employers. By the end of 2019, the program paid out over $318 million to workers in need, showing just how big a role it plays in protecting employees.

Who Can Get the $8,844 Canada WEPP Benefit?

This is where things get real important—not everyone qualifies. The basic criteria for eligibility are:

- Your employment was terminated due to your employer’s bankruptcy or receivership.

- You are owed unpaid wages or other eligible payments from your employer.

- These unpaid earnings were earned within 6 months before your employer’s bankruptcy or receivership date.

- You have a valid Social Insurance Number (SIN).

- And here’s the catch—if you were a boss, manager making financial calls, or had controlling interest in the company, you’re likely not eligible for WEPP.

If you fit the profile of a regular employee, part-timer, seasonal worker, or even a temporary worker who lost wages because the employer tanked, you can apply.

What Kind of Money Does WEPP Cover?

WEPP covers a range of unpaid eligible wages, including:

- Your basic wages or salary earned.

- Vacation pay that was owed but not paid.

- Termination pay when your employment ended.

- Severance pay if applicable.

These cover the types of money you’d rightfully expect to get after working, but your employer can’t or won’t pay because they are insolvent.

How Much Money Can You Get in October 2025?

For 2025, the max payout is set at $8,844 — that’s seven times the highest weekly insurable earnings under the Employment Insurance Act. This is a one-time payout meant to cover as much of your unpaid wages as possible.

Historically, claims generally cover between 60% to 76% of the wages owed on average. So, while you might not get 100% back, this program ensures a significant portion of your rightful money lands in your pocket faster than waiting around for bankruptcy proceedings, which could take years.

How to Apply for $8,844 Canada WEPP Benefit?

Here’s a quick guide on how to get your claim started:

Step 1: Gather Your Documentation

Get your proofs ready—pay stubs, employment contracts, a record showing the wages owed, and details of your employer’s bankruptcy or receivership. You’ll also need your Social Insurance Number.

Step 2: File a Proof of Claim

Contact the trustee or receiver managing your employer’s bankruptcy or receivership estate and file your proof of claim. This step is crucial because it officially notifies the managing party that you are owed money.

Step 3: Submit WEPP Application

Once you’ve filed your claim, apply to the WEPP through Service Canada online or by paper application. Provide all required details and documentation.

Step 4: Wait for Approval and Payment

Your claim usually gets reviewed within around 42 days (6 weeks), and payments are made directly to eligible workers shortly after.

Real-Life Example of the WEPP in Action

Imagine Tina worked at a small retail shop. One month, the shop suddenly shut down due to bankruptcy, and Tina found out her last two weeks’ pay plus vacation days weren’t paid. Tina wasn’t sure where to turn, but she learned about WEPP.

She gathered her pay stubs and the bankruptcy notice, filed her claim, and applied to WEPP. A few weeks later, she got a payment close to $7,000, which helped cover her bills until she landed a new job. Without WEPP, Tina might have waited years or only gotten pennies on the dollar.

Why WEPP Matters: The Bigger Picture

Before WEPP, unpaid workers ranked behind secured creditors in bankruptcies, meaning they got just crumbs after years of waiting. Now, thanks to this program, workers are prioritized, and the government steps in to provide quicker relief and reduce financial hardship.

With over 18,000 payments issued in 2018-2019 alone, WEPP proves to be a powerful tool in protecting workers and their families from economic insecurity when companies go under.

Canada Revenue Agency Dodges Key Question: How Many Call Centre Workers Are Coming?

Canada Housing Benefit $500 Payment in October 2025: Are You Eligible to Get it?

CRA Slaps Taxpayer With $5,000 Penalty Over Simple U.S. Reporting Mistake