The $680 CRA One-Time Payment widely shared on social media platforms is not an official program, according to the Canada Revenue Agency (CRA) and the Department of Finance Canada. Government officials have confirmed that no new one-time benefit of $680 has been announced or approved for 2025.

The clarification follows a surge in misleading posts and fraudulent websites claiming that eligible Canadians would receive a lump-sum payment this fall. Officials say these messages are part of an ongoing wave of financial misinformation.

Table of Contents

$680 CRA One-Time Payment 2025

| Key Fact | Detail |

|---|---|

| Program status | No official $680 one-time CRA payment exists |

| Date of clarification | October 27, 2025 |

| Risk to the public | Potential phishing scams and identity theft |

| Official Website | Canada.ca |

Government Response to Viral $680 CRA One-Time Payment Claims

In an official statement, a CRA spokesperson said the agency “has not announced any new one-time payment of $680 for 2025,” urging Canadians to verify all benefit information only through official government channels.

“We are aware of misleading posts circulating online. Canadians should rely only on Canada.ca for information about government benefits,” the CRA spokesperson said.

Officials confirmed that no such payment appears in the 2025 federal budget, nor in any parliamentary record or press release. The false claims mirror tactics previously used in phishing campaigns designed to harvest personal information.

How Real CRA Payments Are Announced and Distributed

Legitimate federal benefit programs in Canada — such as the Canada Child Benefit (CCB), Goods and Services Tax (GST) credit, and Canada Carbon Rebate — are announced through federal budgets, official statements, or ministerial briefings.

Once legislated, such payments are distributed through the My Account portal or direct deposit, never via unsolicited emails or text messages.

“If you receive a message promising quick access to new benefits or asking for your banking information, it’s a scam,” said Jeff Thomson, senior intelligence analyst at the Canadian Anti-Fraud Centre (CAFC).

A Historical Look at One-Time Government Payments

Canada has a history of issuing targeted one-time payments during times of economic pressure:

- Canada Emergency Response Benefit (CERB) during the COVID-19 pandemic (2020–2021).

- GST top-up payment to offset rising living costs (2022).

- Canada Dental Benefit for children under 12 (2023).

- Grocery Rebate to help low-income families with food inflation (2023).

Each of these programs followed a formal legislative process, with announcements in Parliament and clear eligibility criteria published on official government websites.

“The federal government does not create new benefit programs through social media posts or anonymous websites,” explained Dr. David Macdonald, senior economist at the Canadian Centre for Policy Alternatives.

Why Economic Misinformation Thrives in 2025

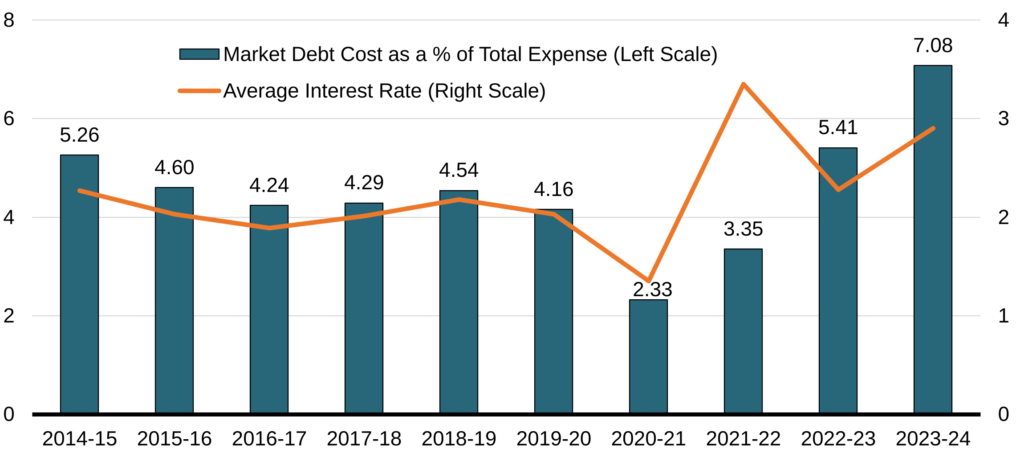

Experts say scams like the fake $680 CRA payment often emerge during periods of economic uncertainty. With Canada facing higher living costs, housing affordability concerns, and increased interest rates, people are more vulnerable to offers of financial relief.

“Financial misinformation preys on real anxieties,” said Dr. Anita Bhatia, senior researcher at the University of British Columbia. “People want to believe in quick solutions, especially when inflation erodes purchasing power.”

The Bank of Canada recently projected inflation at 3.2 percent for Q4 2025, above the 2 percent target. This environment creates fertile ground for fraudulent benefit claims.

How the Scam Works: Real-World Examples

The CAFC reports that recent scam messages include subject lines like “You have been approved for a $680 relief payment” or “Claim your CRA one-time payment now”. These messages contain fake links that mimic the CRA’s website.

Victims are asked to provide Social Insurance Numbers (SIN), banking details, or upload identification documents. Once entered, this data is used for identity theft or financial fraud.

One Ottawa resident, who asked to remain anonymous, described receiving a text message that appeared to come from “CRA Payments.” The link led to a convincing clone of the government portal.

“It looked real. The logo, the language, even the address bar seemed legitimate,” the resident said. “I almost entered my information.”

Rising Trend in Phishing and Benefit Fraud

The Canadian Anti-Fraud Centre has recorded a 22 percent year-over-year increase in government impersonation scams. Many of these involve fake benefit programs.

“Scammers adapt quickly to headlines and economic narratives,” said Thomson. “When cost-of-living issues dominate the public conversation, fake benefit programs appear.”

How Canadians Can Protect Themselves

To verify the legitimacy of any government payment, experts recommend the following steps:

- Visit Canada.ca directly, not through links in texts or emails.

- Access personal benefit information only through the CRA My Account portal.

- Check announcements through trusted media and official government press releases.

- Contact CRA directly at 1-800-959-8281 for confirmation.

- Report phishing attempts to the Canadian Anti-Fraud Centre.

“The CRA will never ask for personal or banking information by text message or email,” said Marie Lemay, a cybersecurity specialist at the University of Ottawa. “Any such messages should be treated with caution.”

Impact on Vulnerable Populations

Misinformation campaigns disproportionately affect seniors, newcomers, and low-income Canadians — groups less likely to have access to up-to-date cybersecurity information.

“Many of these groups rely heavily on digital messages without strong verification mechanisms,” said Carla Mendes, executive director of the Canadian Seniors Council. “They are prime targets for fraudsters.”

In 2024, nearly 40 percent of reported CRA-related scams involved seniors. Fraudulent activity often leads to financial losses and emotional distress.

Government and Law Enforcement Response

The CRA, CAFC, and the Royal Canadian Mounted Police (RCMP) have intensified monitoring and public education efforts. A national awareness campaign launched in October aims to teach Canadians how to identify phishing scams.

The Public Safety Canada cybercrime unit is also coordinating with major telecommunications providers to block known fraudulent domains and phone numbers used in scams.

“We’re taking a layered approach — prevention, education, and enforcement,” said Superintendent Julie Carrière, head of the RCMP’s Cybercrime Coordination Centre.

The Misinformation Ecosystem: Why It Spreads So Fast

Financial misinformation spreads rapidly through social media due to algorithms designed to amplify emotionally charged content. According to a 2025 report by MediaSmarts, misinformation about government benefits is shared four times faster than verified announcements.

Researchers attribute this to the combination of economic stress and the low friction of digital sharing.

Upcoming Federal Benefit Payment Dates (Verified)

While the $680 claim is false, several legitimate payments remain scheduled for late 2025, including:

- GST/HST credit — November 5, 2025

- Canada Child Benefit (CCB) — November 20, 2025

- Canada Carbon Rebate — December 15, 2025

A full list of payment dates is available on Canada.ca.

Massive $7,997 Canada Child Benefit 2025 – CRA Announces New Monthly Payouts for Families!

CRA Confirms $3900 One-Time Payment – When It’s Coming and Who’s Eligible in Canada

CRA Payment Dates for October 2025: What Benefits Are Arriving & How Much You’re Getting

Looking Ahead: Policy and Public Trust

Experts warn that misinformation, if left unchecked, can undermine public trust in real government programs. This can discourage vulnerable people from applying for legitimate benefits, leaving them without critical support.

“Misinformation is not just a nuisance. It has real economic and social costs,” said Dr. Bhatia. “Building public trust requires transparency, digital literacy, and timely communication.”

The federal government has indicated that any new benefits — if introduced in the upcoming 2026 budget cycle — will be announced publicly and subject to parliamentary approval.