$600 Singapore Cost of Living Payment: If you’re living in Singapore or just keeping tabs on how the city-state manages inflation, here’s some good news: the government is rolling out a $600 Cost of Living Payment in October 2025 for eligible citizens. This move is designed to help millions handle rising expenses from everything like groceries to electricity bills. So whether you’re a working professional, a retiree, or just curious, this article walks you through the details in a clear, friendly style. The aim is to make sure anyone who qualifies can access the funds easily, understand the eligibility criteria, and make the most of this support.

Table of Contents

$600 Singapore Cost of Living Payment

The $600 Singapore Cost of Living Payment coming in October 2025 is a thoughtful, well-calibrated government effort to help citizens manage rising costs in a world where inflation is a constant challenge. By ensuring funds go to those with the greatest need, especially seniors, Singapore demonstrates a targeted approach to social welfare. Citizens are encouraged to prepare by verifying their Singpass and banking information, understanding the income and property rules, and staying alert. When paired with other ongoing rebates and vouchers, this payment will help soften monthly expenses and improve quality of life for many.

| Feature | Details |

|---|---|

| Total Payout Amount | $600 (additional $600 for seniors 60+) |

| Eligibility Age | 21 years and older (seniors 60+ get double) |

| Income Cap | Annual assessable income ≤ SGD 34,000 |

| Property Ownership Rules | Maximum 1 property ownership, main residence ≤ SGD 21,000 AV |

| Payment Method | Direct bank credits through Singpass-linked account |

| Payment Window | October 1 to October 15, 2025 |

| Official Info & Eligibility | Check on SupportGoWhere SG |

What’s Behind This $600 Singapore Cost of Living Payment?

The world has been feeling the squeeze of inflation for a while now, and Singapore is no exception. The Consumer Price Index (CPI) inflation rate hovered near 4.5% for the year 2024, driven by rising fuel costs, food prices, and international supply chain issues. Utilities and healthcare expenses have also risen, putting pressure on household budgets.

Rising inflation affects everyone differently. For lower- and middle-income households, even small price hikes can mean stretching the grocery budget thinner, cutting back on non-essentials, or delaying medical appointments. Recognizing these pressures, the Singapore government designed this cash payout as part of a multi-year Assurance Package—its way of cushioning the blow for families and seniors.

This $600 payment aims to put a direct boost into wallets, helping cover everyday necessities like groceries and public transport, or even unexpected expenses.

Who Qualifies for This Relief?

Here’s the lowdown on who gets the help:

- Must be a Singapore citizen aged 21 or over by December 31, 2024.

- An annual income cap of SGD 34,000 or less based on the latest tax assessment works as the threshold.

- Must own no more than one property. The property’s annual value must not exceed SGD 21,000.

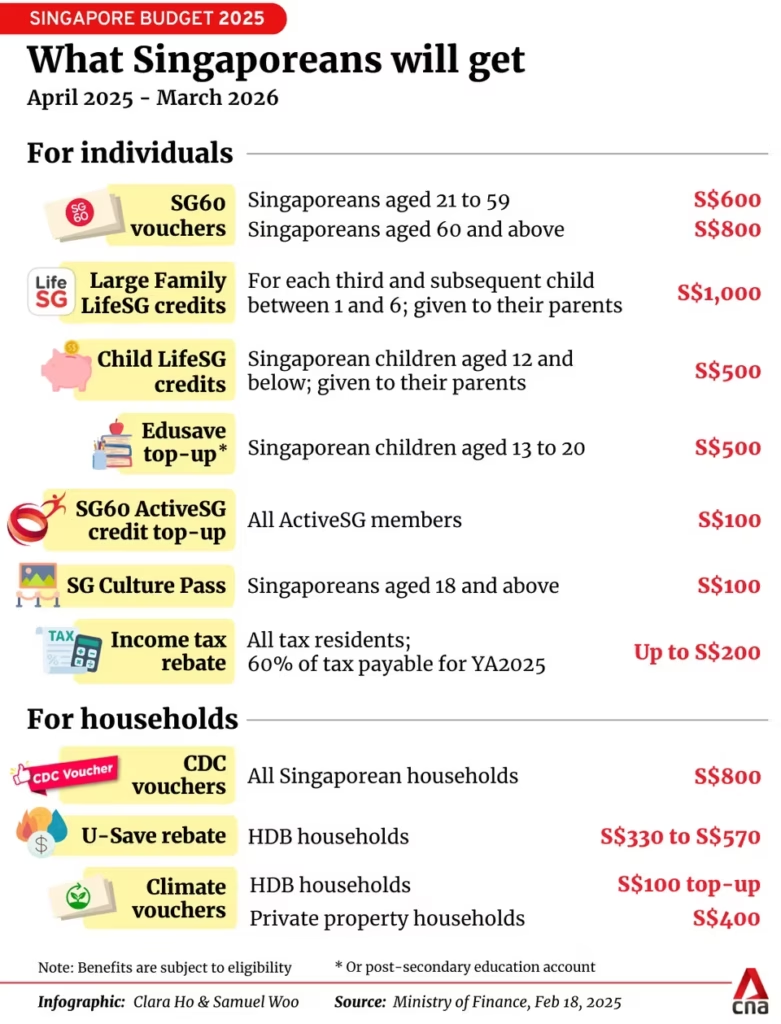

- For seniors aged 60 and above, the payout is doubled to $1,200.

- Permanent Residents, unfortunately, are not eligible.

This eligibility framework targets those who are most likely to feel financial pinch from inflation, making sure the money reaches the right pockets.

The government uses income data from the Year of Assessment (YA) 2024 to determine eligibility, which is based on the income earned in the calendar year 2023. This means residents should ensure their tax returns and income reports to the Inland Revenue Authority of Singapore (IRAS) are accurate to avoid delays or issues.

When And How Will The Money Land?

Singaporeans who qualify should expect their payment between October 1 and October 15, 2025. The process is designed to be hassle-free:

- If you have a bank account linked to your Singpass through PayNow or other official channels, your money will be credited directly there.

- If no account is linked, the government will send a cheque to the registered mailing address.

- Recipients will receive SMS alerts and notifications through Singpass ahead of the disbursement date.

Additionally, the payment system is designed with security in mind. Recipients are advised to monitor their accounts carefully and report any fraudulent or unauthorized transactions immediately.

For those new to Singpass or unsure about linking their bank account, the government website provides easy step-by-step guidance on setting this up to ensure smooth receipt of funds.

How Does This Compare To Other Countries?

While Singapore’s $600 one-time payment might look modest, it’s part of a systematic multi-layered support system including vouchers, rebates, and healthcare subsidies—all aiming to consistently support living costs over the year.

Compared to other high-cost countries, Singapore’s approach stands out for its precise targeting and integration with larger social welfare measures. For example, the United States delivered multiple rounds of stimulus checks during the height of the COVID-19 pandemic, with payments ranging up to $1,400 per eligible adult; however, those were broad-based emergency responses.

Singapore’s method focuses on calculated support based on income and property ownership, making sure aid reaches the citizens who need it most without overextending public finances. The government also emphasizes complementary support such as utility rebates and healthcare savings programs, which many other countries do not always combine efficiently with direct payments.

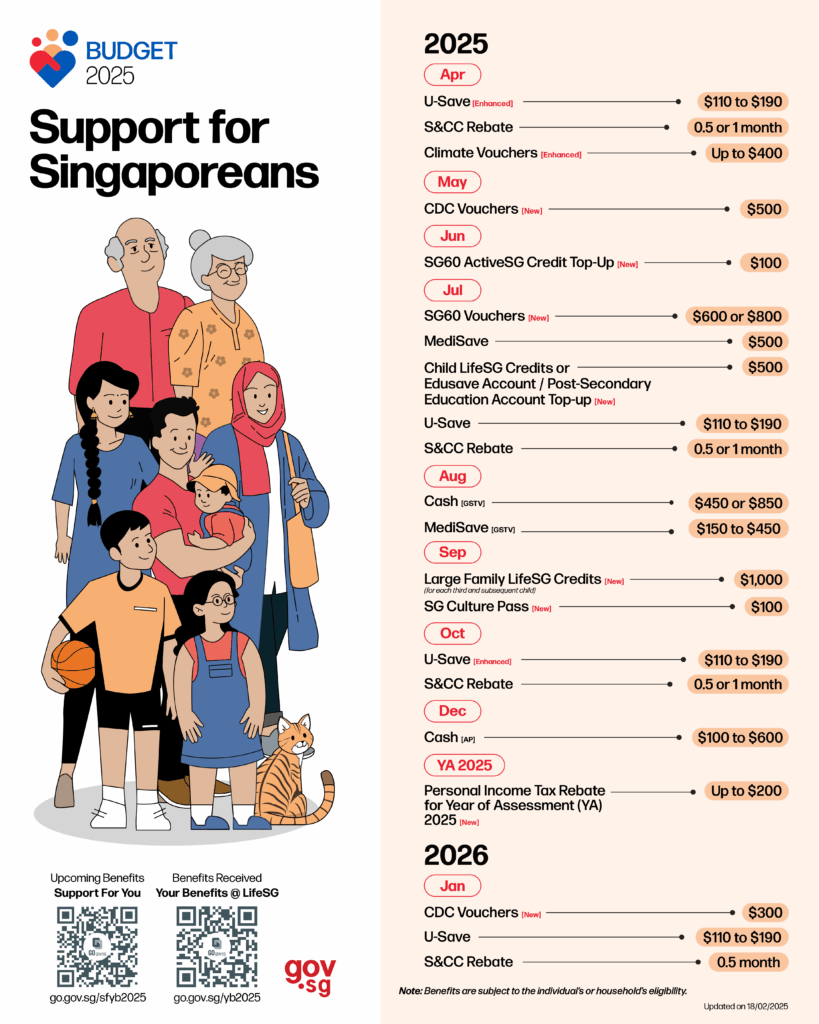

Additional Government Support You Should Know About

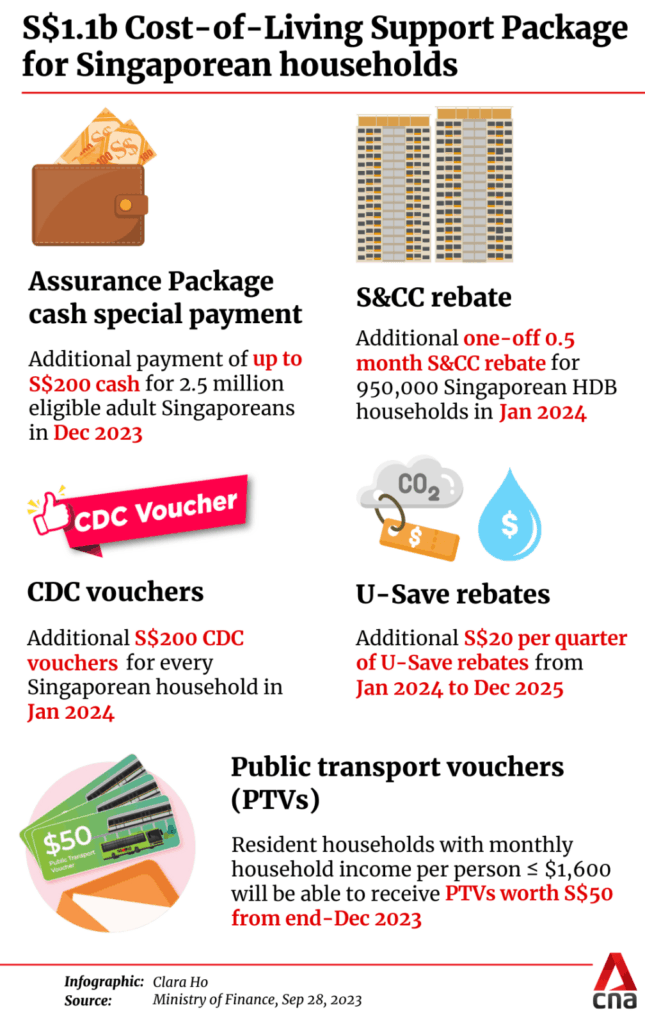

Besides the cash payout, Singaporeans also benefit from:

- GST vouchers and rebates: These reduce the Goods and Services Tax (GST) burden, providing credits to help offset everyday tax expenses.

- Community Development Council (CDC) vouchers: Valued around $800 annually per household, these vouchers can be used at local businesses, supporting community spending and helping smaller enterprises.

- U-Save rebates: Specifically for HDB (Housing Development Board) public housing residents, this lowers monthly utility fees.

- MediSave top-ups: Targeted to seniors, this boosts their healthcare savings, crucial for managing out-of-pocket medical and long-term care.

Together, these programs form an ecosystem of support, aiming to reduce financial stress throughout the year rather than just one-time help.

Practical Budgeting Tips to Maximize Your $600 Singapore Cost of Living Payment

Getting this extra cash? Great! Here’s how to make it count:

- Prioritize essential bills first: Utilities, groceries, and medical expenses often take the largest chunk of monthly budgets.

- Consider bulk buying and discount shopping: Singapore’s supermarkets and online retailers regularly run promotions you can leverage.

- Set aside a little for emergencies: Maintaining even a small buffer can reduce stress when unexpected expenses pop up.

- Combine cash with vouchers: Use government-issued vouchers alongside the payment to stretch your dollars further on essentials.

- Explore community programs: Some CDC voucher uses include local events and services that might offer additional value or entertainment for families.

How It Benefits Businesses And Communities?

These government payments don’t just help households—they also provide an indirect boost to local businesses. When citizens have a bit more spending power, they are more likely to shop, dine out, or pay for services, which supports small businesses and the wider economy.

Community Development Council vouchers funnel money into local areas, fostering neighborhood projects, support groups, and cultural events. This strengthens social cohesion, promotes local commerce, and keeps the community vibrant.

What If You Think You Were Left Out?

Sometimes, despite best efforts, mistakes happen. If you believe you should have received the payment but didn’t:

- Double-check your income and property status against official criteria.

- Verify that your Singpass account and bank details are up to date.

- Contact the government’s helpdesk via SupportGoWhere.

- File an official inquiry or appeal for reassessment.

- Keep records handy like notices from IRAS and correspondence in case of disputes.

Transparency and responsiveness are government priorities to ensure fairness and accuracy in payouts.

The Economic Impact And Government Investment

Singapore has committed billions of dollars over several years for this cost-of-living relief, reflecting a strong social contract between the state and citizens.

These investments not only ease the financial burden on families but also help stabilize the economy by sustaining consumer spending during times of inflationary pressure. The government’s thoughtful balancing act aims to maintain fiscal prudence while delivering effective social support—a model for sustainable economic resilience.