The Triple Lock Pension Increase will raise the UK State Pension from April 2025, following a year of rising wages and persistent inflation. The Department for Work and Pensions (DWP) confirmed that the annual uplift will again be calculated using the triple lock formula — the highest of inflation, average earnings growth, or a 2.5% minimum guarantee.

This decision means millions of pensioners are set to receive a larger weekly payment, with the full new State Pension projected to increase from £221.20 to £230.25 per week.

Table of Contents

£538 Triple Lock Increase for these Pensioners from October 2025

| Key Fact | Detail/Statistic |

|---|---|

| Full new State Pension 2025 | £230.25 per week |

| Current full new State Pension | £221.20 per week |

| Implementation date | April 2025 |

| Eligibility | Pensioners with qualifying National Insurance records |

| Official Website | DWP |

What the Triple Lock Pension Increase Means

The Triple Lock was designed to ensure the value of the State Pension keeps pace with the cost of living. Under the system, pensions rise each April by the highest of inflation (Consumer Prices Index), average earnings growth, or 2.5%.

In 2024, average wage growth reached 5.7%, outpacing inflation. If this trend holds, it will be the benchmark for April 2025, according to data from the Office for National Statistics (ONS). That would push the full new State Pension to £230.25 per week, a significant rise for those on fixed incomes.

A Brief History of the Triple Lock

The triple lock was introduced in 2010 by the Coalition Government, replacing the previous earnings-linked uprating. At the time, inflation and low earnings growth had eroded pensioners’ purchasing power.

Since its introduction, the triple lock has led to several large increases, particularly in years when wage growth or inflation spiked. The largest increase on record came in April 2023, when payments rose by 10.1%, reflecting the previous year’s inflation surge.

This mechanism has helped lift pensioner incomes in real terms, but it has also raised questions about cost and fairness compared to benefits for working-age people.

Who Qualifies for the 2025 Pension Increase

Eligibility is tied to National Insurance (NI) contribution history.

- Full new State Pension: At least 35 qualifying years.

- Basic State Pension: At least 30 qualifying years.

- Partial entitlement is possible for those with fewer years.

Importantly, pensioners living abroad in countries without a reciprocal uprating agreement — including Canada and Australia — will not benefit from the increase. This affects roughly 500,000 British pensioners overseas, according to parliamentary data.

“Many retirees depend on their State Pension as their primary source of income,” said Helen Morrissey, head of retirement analysis at Hargreaves Lansdown. “Even a modest rise can make a meaningful difference to their budgets.”

Case Study: The Real-World Impact

Margaret Lewis, 72, from Derbyshire, has relied on the State Pension since 2017.

“Every increase matters,” she said. “My bills have gone up, especially food and heating. Knowing my pension will rise in April gives me some peace of mind.”

For pensioners like Lewis, the 2025 increase represents an additional £468 per year for those receiving the full new State Pension.

International Comparison: How the UK Stacks Up

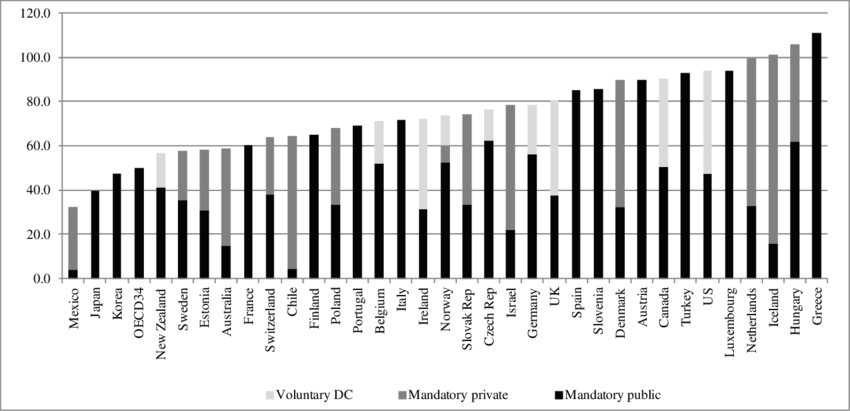

The UK’s triple lock system is considered generous compared to many other developed economies.

- Germany indexes pensions primarily to wage growth but does not guarantee a minimum increase.

- France ties increases strictly to inflation.

- Australia uses a hybrid approach but does not provide guaranteed uprating for all overseas pensioners.

However, the OECD notes that while the UK has strong uprating mechanisms, its overall State Pension replacement rate remains lower than several European countries, meaning many retirees rely on private or workplace pensions to supplement their income.

Political Landscape and Election Implications

The triple lock has become a politically sensitive issue, particularly in the run-up to the next general election.

- The Conservative Party has reaffirmed its commitment to maintaining the triple lock until at least 2030.

- The Labour Party has also signalled broad support, though it has hinted at the need for long-term review.

- Some smaller parties and fiscal watchdogs argue for a modified version to balance intergenerational fairness.

“The triple lock is politically untouchable right now,” said Paul Johnson, director of the Institute for Fiscal Studies (IFS). “But over the next decade, fiscal pressures will make reform unavoidable.”

Economic Context: Rising Costs and Sustainability Questions

Inflation remains above the Bank of England’s 2% target, and energy prices continue to strain household budgets. According to the Office for Budget Responsibility (OBR), maintaining the triple lock in its current form could add more than £2 billion per year to public spending by 2027.

Critics say this diverts funds from younger generations. Supporters argue it is essential to protect vulnerable pensioners who have limited ability to increase their income.

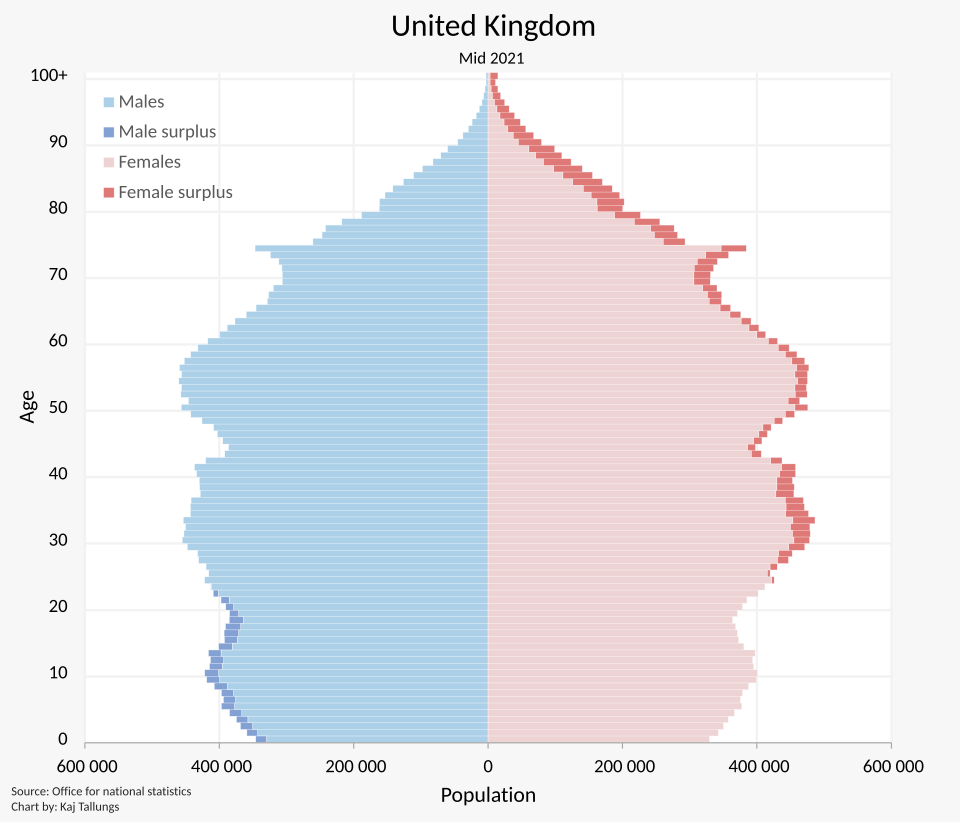

“Britain faces a demographic shift,” said Torsten Bell, chief executive of the Resolution Foundation. “By 2040, one in four people will be over 65. Any pension policy must balance generosity with sustainability.”

Future of the Triple Lock: Reform or Endure?

Several options are being discussed:

- Modified triple lock — linking to the highest of inflation or wages, but removing the 2.5% guarantee.

- Inflation-only uprating — which would save billions but risk reducing real pension value.

- Means testing or targeted support — which could shift resources to lower-income retirees.

Any reform would likely involve phased changes to avoid sudden income shocks for pensioners.

FAQ

Who is eligible for the 2025 Triple Lock Pension Increase?

UK pensioners who meet National Insurance contribution requirements and receive the State Pension. Those in some overseas countries are excluded.

How much will the State Pension rise in April 2025?

The full new State Pension is expected to rise from £221.20 to £230.25 per week.

Will this affect private pensions?

No, the triple lock applies only to the State Pension. Private and workplace pensions follow separate rules.

Could the triple lock be reformed?

Yes. While all major parties currently support it, several economic bodies have called for a review to ensure long-term sustainability.

When does the increase take effect?

The uprating begins in April 2025.

DWP Confirms Universal Credit Changes: How Much More Will You Get in October 2025?

£200 Cost of Living Boost in 2025 – Who Qualifies & When Will You Get Paid?

DWP confirmed £5,600 per year to State Pensioners born before 1959: Check Eligibility Conditions

The Road Ahead

The Triple Lock Pension Increase remains a cornerstone of retirement income in the UK. For millions, it provides stability in uncertain times. But as demographic and fiscal pressures build, the debate over its future is likely to intensify.

“Retirement security is about more than just the next April increase,” said Johnson of the IFS. “It’s about designing a system that works for decades to come.”