The U.S. government is set to distribute a significant stimulus payment of up to $5108 for seniors in October 2025. This sum, however, is not a new one-time stimulus check, but rather part of the regular Social Security benefits. Understanding how this figure is derived and what it means for eligible seniors is crucial.

Table of Contents

$5108 Stimulus Payment

| Key Fact | Detail/Statistic |

|---|---|

| Maximum Stimulus Payment | $5108 monthly for eligible seniors |

| Payment Type | Social Security retirement benefit |

| Average Monthly Payment | $1915 for individuals, $3,230 for couples |

| Eligibility Criteria | Age 70+, high earnings history |

| Official Website | Social Security Administration |

The $5108 payment for seniors, while not a stimulus check, is a crucial part of the financial security for those who have contributed to Social Security and delayed their retirement. Understanding how these benefits work and the strategies available to maximize them is essential for seniors planning for retirement.

With inflation adjustments and ongoing support from various programs, the U.S. government continues to assist seniors in maintaining their financial independence during retirement. For those who qualify for the highest benefits, October 2025 will be a reminder of the importance of financial planning throughout one’s career.

What is the $5108 Stimulus Payment?

The $5108 payment that is being highlighted for October 2025 is not a traditional one-time stimulus check. Instead, it is the maximum Social Security benefit available for those who have delayed retirement until the age of 70 and have a high earnings history. This amount is part of the standard Social Security system, designed to provide financial support to seniors during retirement.

Eligibility for the $5108 Payment

To qualify for the highest Social Security payment, individuals must meet certain criteria, such as reaching age 70 and having consistently high earnings throughout their career. Social Security benefits increase with delayed retirement, and for those who have worked at higher income levels, the benefit can reach up to $5108 per month.

This figure is the highest monthly benefit available through Social Security, but the average payout is much lower. In 2025, the average Social Security benefit for individuals is approximately $1,915 per month. For couples, it is about $3,230.

The Larger Context of Social Security Payments for Seniors

Social Security remains the cornerstone of financial support for millions of Americans, especially seniors who rely on it as a primary source of income during retirement. According to the Social Security Administration (SSA), more than 65 million Americans receive benefits, with a significant portion being retirees. For many seniors, Social Security payments are essential to maintaining their standard of living.

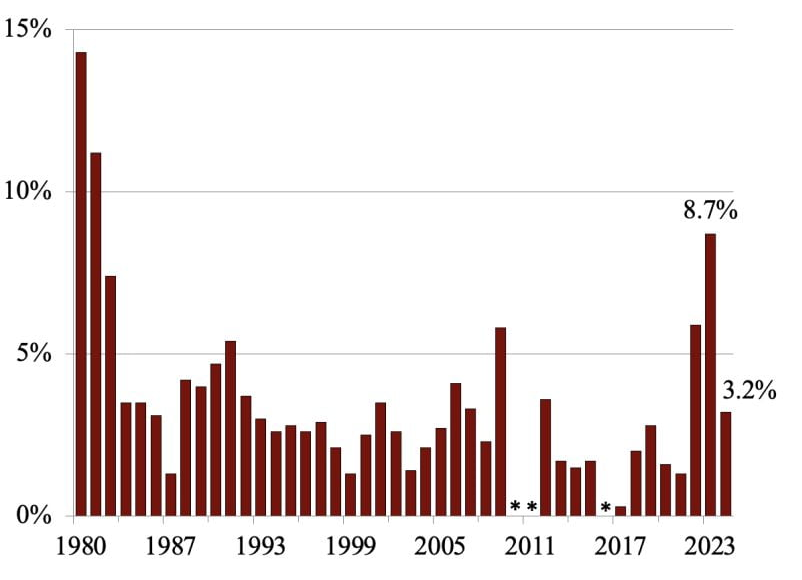

As of 2025, the federal government continues to adjust Social Security payments based on inflation, ensuring that the purchasing power of these payments does not erode over time. These adjustments, known as Cost-of-Living Adjustments (COLA), are based on inflation rates and are made annually to account for changes in the cost of goods and services.

How Seniors Can Maximize Their Social Security Payments

For seniors looking to maximize their Social Security benefits, understanding the timing and strategy behind claiming is key. The longer an individual delays claiming Social Security, up to age 70, the higher their monthly payments will be. This is particularly important for those in good health who anticipate a long retirement, as waiting until age 70 can significantly boost their lifetime earnings from Social Security.

Seniors should also consider other factors like additional income sources and tax implications. Working with a financial advisor can help clarify when to begin claiming benefits to make the most of the available resources.

Additional Benefits and Programs for Seniors

While Social Security remains the central financial support system for retirees, several other government programs also provide assistance to seniors. These include Supplemental Security Income (SSI), Medicaid, and the Low-Income Energy Assistance Program (LIHEAP), which help low-income seniors with healthcare and utility bills. Seniors may also qualify for special tax credits, housing assistance, and other programs designed to support older adults.

How Inflation Affects Social Security Payments

Inflation is a key factor that affects the purchasing power of Social Security payments, particularly for seniors. As the cost of living rises, the value of fixed income sources like Social Security can erode, leaving beneficiaries with less money to cover their expenses. To address this, the Social Security Administration implements Cost-of-Living Adjustments (COLA) each year.

For example, in 2025, the COLA increase was 3.2%, which resulted in higher Social Security payments for many recipients. This increase helps ensure that seniors’ benefits are adjusted to keep pace with inflation, mitigating the impact of rising prices on everyday goods and services. The COLA increase is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which tracks the cost of a basket of goods and services.

The Financial Landscape for Retirees in 2025

In 2025, the financial landscape for retirees is more complex than ever. With the rising costs of healthcare, housing, and daily living expenses, many seniors find it difficult to maintain their standard of living. According to a report from the AARP, nearly half of seniors over the age of 65 have little to no retirement savings outside of Social Security. This underscores the importance of understanding how Social Security benefits work and how to plan effectively for retirement.

The challenges of retirement in 2025 are also compounded by uncertain market conditions and fluctuating interest rates. Many retirees rely on investment income in addition to Social Security to cover their expenses. However, volatile financial markets can impact the returns on investments, making it important for seniors to diversify their financial portfolios and adjust their retirement plans accordingly.

Tax Implications for Seniors Receiving Social Security Benefits

Another important consideration for seniors receiving Social Security benefits is taxation. While Social Security benefits are not taxed at the federal level for all recipients, certain income levels may subject benefits to taxation. The IRS uses a formula to determine whether your benefits are taxable based on your combined income, which includes adjusted gross income, nontaxable interest, and half of your Social Security benefits.

If your combined income exceeds $25,000 for individuals or $32,000 for couples, a portion of your Social Security benefits may be subject to federal income tax. Understanding these thresholds and planning for taxes is crucial for seniors, particularly those who may have additional income from pensions, retirement accounts, or investments.

Planning for Healthcare Costs in Retirement

Healthcare costs are one of the biggest financial challenges for retirees. According to a study by Fidelity, the average couple retiring in 2025 can expect to spend nearly $300,000 on healthcare throughout retirement. Medicare, the federal health insurance program for seniors, helps cover many healthcare costs, but it doesn’t cover everything. Seniors are still responsible for out-of-pocket expenses such as premiums, deductibles, and copayments.

For seniors relying on Social Security benefits, understanding how Medicare works and the costs associated with it is essential. Some retirees may also consider supplemental health insurance policies, also known as Medigap, to cover additional healthcare costs that Medicare does not address.

Future of Social Security: Challenges and Reform

The long-term sustainability of the Social Security program remains a hotly debated issue in the U.S. policy landscape. According to the 2025 Social Security Trustees Report, the program’s trust fund will begin to be depleted by 2035 unless reforms are implemented. This could result in a reduction in benefits for future retirees unless adjustments are made to the system.

Several proposals have been discussed to ensure the solvency of Social Security, including raising the payroll tax rate, increasing the taxable income cap, or changing the way benefits are calculated. While the future of Social Security remains uncertain, it is clear that any changes to the program will have significant implications for seniors, who depend on these benefits for their financial security.

Millions of Californians Can Now Get Up to $1,789 in CalFresh; Here’s What Changed Overnight

$1000 PFD Stimulus For Everyone in this month – Is it true? Check Eligibility & Payment Date

FAQ

Q: How can I qualify for the $5108 payment?

A: To qualify for the highest Social Security benefit of $5108, you must have delayed your retirement until age 70 and have had high earnings throughout your career.

Q: Is this a new stimulus check?

A: No, the $5108 payment is part of the regular Social Security benefits and not a one-time stimulus payment.

Q: What is the average Social Security benefit in 2025?

A: The average Social Security benefit is approximately $1915 for individuals and $3230 for couples in 2025.