$5,000 Wells Fargo Settlement: In 2025, Wells Fargo is rolling out a landmark $5,000 settlement program designed to compensate customers affected by one of the biggest banking scandals of recent decades. If you had accounts opened without your permission, were hit with surprise fees, or were enrolled in financial products you never requested, this guide will walk you through who qualifies, how to claim, payment details, deadlines, and much more — written plainly but with depth for readers of all backgrounds.

Table of Contents

$5,000 Wells Fargo Settlement

The Wells Fargo $5,000 settlement is a pivotal opportunity for customers harmed by unethical and illegal account and fee practices over more than a decade. This guide provides a clear road map toward filing a successful claim and receiving your rightful compensation. Beyond money, the settlement marks a cultural reckoning for Wells Fargo and a push for better banking ethics and customer respect moving forward. Act now: gather your proof, file on time, and take advantage of this historic settlement to claim what’s yours.

| Highlight | Details |

|---|---|

| Maximum Payment Per Customer | Up to $5,000 |

| Eligible Timeframe | Customers impacted between 2011 and 2022 |

| Covered Issues | Unauthorized accounts, improper fees, unauthorized insurance |

| Dispute Types Included | Fraudulent accounts, misapplied fees, unauthorized insurance |

| Claim Submission Methods | Online portal and mail-in forms accepted |

| Claim Deadline | Typically November 1, 2025 (verify current deadlines online) |

| Payment Distribution Begins | Starting November 2025 |

| Check Claim Status | Via official Wells Fargo settlement portal |

The Origin of the Settlement: The Wells Fargo Cross-Selling Scandal

Between roughly 2011 and 2016, Wells Fargo employees opened millions of unauthorized checking, savings, and credit accounts in customers’ names without their knowledge or consent. This was driven largely by intense pressure to hit aggressive sales targets — a culture deeply entrenched in the bank’s management practices.

Employees sometimes created accounts and credit cards without customer consent, falsified signatures, and even enrolled customers in insurance policies they never requested. Customers faced fees for these accounts and products they didn’t approve.

It wasn’t until 2016 that the scandal broke wide open:

- Regulatory agencies, including the Consumer Financial Protection Bureau (CFPB), fined Wells Fargo $185 million.

- Investigations revealed as many as 3.5 million fraudulent accounts.

- CEO John Stumpf resigned amid public outcry and congressional hearings.

- Wells Fargo paid billions more in related penalties, lawsuits, and settlements in subsequent years.

The cross-selling scandal severely damaged Wells Fargo’s reputation, forcing a major cultural and operational overhaul.

Who Qualifies for This $5,000 Wells Fargo Settlement?

To be eligible for payment under this settlement, you generally must meet these criteria:

- Have held a Wells Fargo financial product between 2011 and 2022.

- Experienced one or more of the following:

- Unapproved accounts or credit products opened in your name.

- Improperly charged fees for products or services you did not request.

- Unauthorized enrollment in insurance policies.

- Documented evidence of financial harm, or clear proof of unauthorized product enrollment.

There is also a specific settlement for California residents who had their phone calls recorded without consent, allowing payouts based on the number of recorded calls.

This settlement program is designed to ensure customers who suffered harm due to Wells Fargo’s unethical sales culture receive fair restitution.

The Step-by-Step $5,000 Wells Fargo Settlement Claims Process — How to Get Your Money

1. Visit the Official Settlement Website

Start by going to the Wells Fargo settlement site. This is your resource hub for claim forms, detailed FAQs, and status updates.

2. Fill Out the Claim Form

Complete the claim form by providing:

- Personal information

- Wells Fargo account numbers (if known)

- Details about unauthorized accounts, fees, or insurance policies

- Supporting documents (bank statements, emails, or letters)

You can file online (recommended for speed) or mail a paper claim.

3. Submit Before the Deadline

All claims must be submitted by November 1, 2025, although this date can vary slightly — always check the official site for the latest.

4. Keep Track of Your Claim

Once you submit, use the online portal or customer service to track claim status and follow up as necessary.

5. Receive Your Payment

Approved claims will receive payments starting in November 2025, via direct deposit or mailed check.

What Kind of Payment to Expect?

Eligible claimants could receive:

- Up to $5,000 each depending on the nature and severity of harm.

- Payments could be prorated if total claims exceed the fund.

- Strong documentation maximizes the likelihood of full payment.

- Amounts depend on settlements related to specific product categories (checking account fraud, insurance policy mis-sellings, fee reimbursements).

Wells Fargo’s settlement fund aims to make restitution to as many harmed customers as possible.

A Broader Look at the Wells Fargo Scandal: The Culture and Fallout

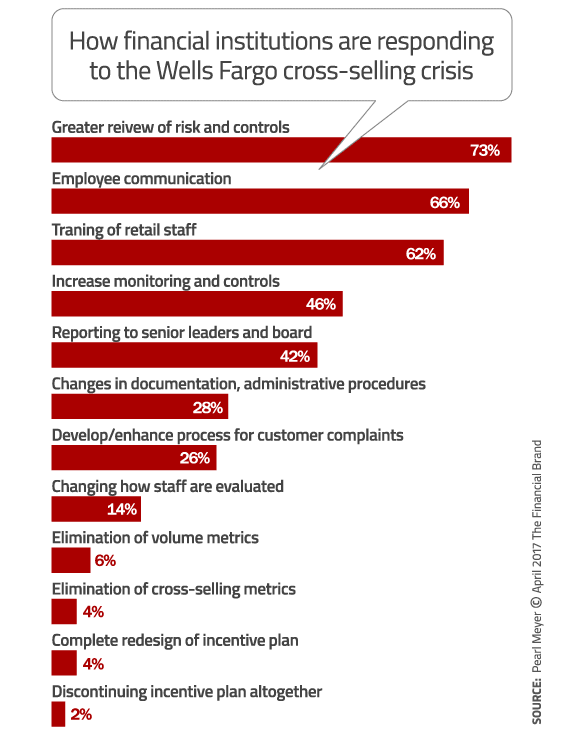

The scandal was rooted in a toxic sales culture, where employees faced immense pressure to cross-sell multiple products like checking accounts, credit cards, and insurance policies to a single customer.

- Unrealistic quotas pushed frontline workers to forge signatures, create fake accounts, or enroll people without their consent.

- Investigations showed systemic issues ignored or downplayed by management.

- CEO John Stumpf was heavily criticized and left with a clawback of tens of millions in salary.

- Wells Fargo committed to restructuring its incentive programs, compliance, and customer protections.

The scandal also revealed risks of aggressive sales strategies without checks and balances in financial services—serving as a warning for the industry at large.

The Broader Legal Battles: Wells Fargo’s Class Action Lawsuits and Securities Litigation

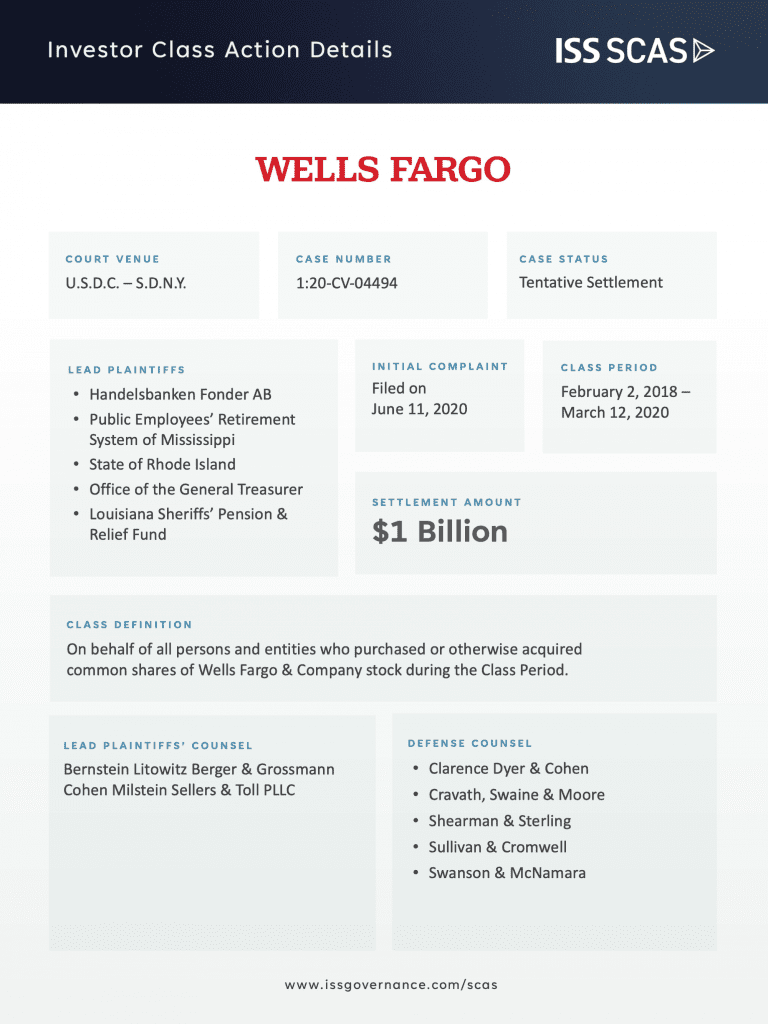

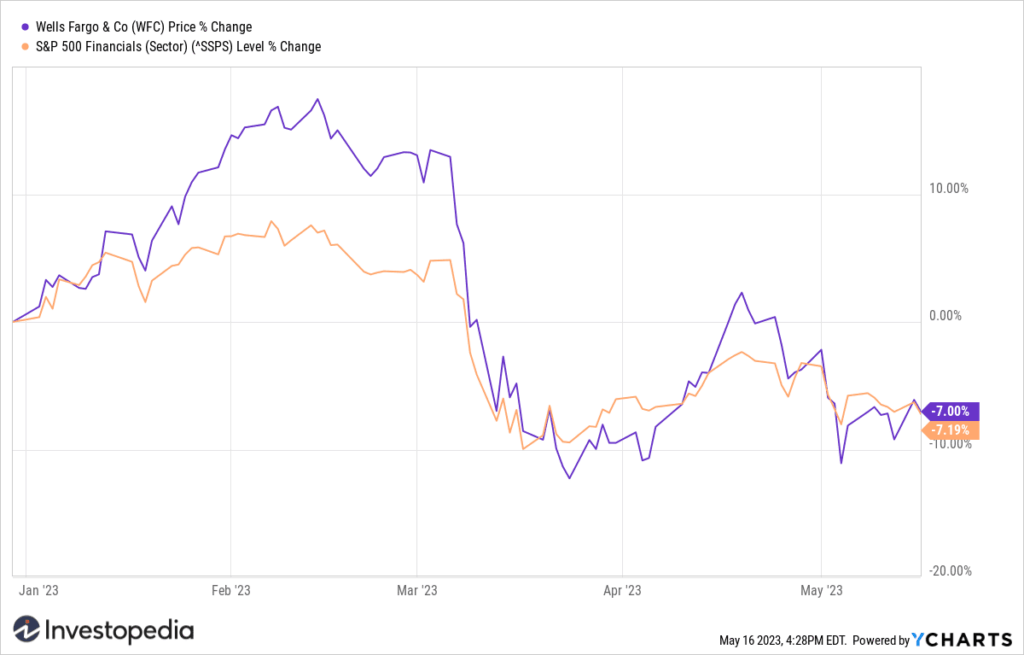

Beyond customer settlements, Wells Fargo has faced significant legal challenges in the courts regarding its misconduct. Over the years, multiple class action lawsuits have been filed not only by affected customers but also by shareholders. One of the largest securities fraud class actions was filed on behalf of investors who purchased Wells Fargo stock between 2018 and 2020. These investors alleged that Wells Fargo misled the market by making false claims about its compliance with regulatory consent orders imposed after the scandals broke.

In 2023, Wells Fargo agreed to pay $1 billion to settle this securities litigation, resolving claims that it failed to disclose ongoing compliance failures and misrepresentations that contributed to a significant drop in its stock price. This settlement illustrates the extensive scope of Wells Fargo’s accountability — from direct customers to investors — and shows that the ripple effects of the misconduct have been felt throughout the financial ecosystem.

This ongoing legal scrutiny underscores the importance for banks to operate transparently and highlights the risks companies face when internal controls and ethical standards break down. It also ensures Wells Fargo remains under close regulatory watch, safeguarding consumer and investor interests moving forward.

Important Timeline and Financial Penalties

- September 2016: $185 million fine levied against Wells Fargo for unauthorized accounts.

- Multiple settlements: Including a $575 million settlement with 50 state attorneys general for unauthorized accounts and insurance mis-selling, and other class-action payouts.

- 2025: The launch of this $5,000 settlement to compensate individual customers affected over 11+ years.

- Wells Fargo spent billions on settlements, legal fees, refunds, and culture reform efforts.

Tips to Maximize Your Settlement Experience

- Keep organized records of your Wells Fargo accounts and any suspicious activity.

- File claims early to avoid missing deadlines.

- Only use the official Wells Fargo settlement website or trusted legal services.

- Ask for help from consumer protection groups if you feel overwhelmed.

- Stay informed by regularly checking the settlement website for status updates or additional notices.

Cash App $12.5M Settlement Over Spam Text Class Action; You can get $147, Check Eligibility

$5,000 Wells Fargo Settlement 2025: How to Claim Your Share Today

Capital One Settlement in October 2025: Who’s Getting Paid & How to Claim Your Share