Georgia has begun issuing $500 relief checks to eligible taxpayers as part of a record $6.6 billion budget surplus refund. The program, launched in early June, aims to ease financial pressure on millions of residents while highlighting the state’s robust fiscal position. Payments are being distributed automatically to those who meet filing and eligibility criteria set by the Georgia Department of Revenue.

Table of Contents

$500 Relief Checks Coming to One State

| Key Fact | Detail |

|---|---|

| Maximum relief check amount | $500 for married filing jointly; $375 head of household; $250 single |

| Eligibility requirement | Filed Georgia state tax return for 2023 and 2024, with tax liability |

| Payment start date | Week of June 2, 2025 |

| Payment method | Direct deposit or mailed check |

| Estimated number of recipients | Approximately 4.1 million Georgians |

| Official Website | Georgia Department of Revenue |

Georgia Relief Checks: A Major Refund Initiative

Georgia began distributing relief checks of up to $500 in early June 2025 as part of its latest state surplus tax refund program. Governor Brian Kemp announced the initiative after state revenues exceeded expectations for the third consecutive year.

The refund is funded by a $6.6 billion budget surplus, which Kemp described as “the result of conservative budgeting and strong economic growth.” Lawmakers overwhelmingly supported the measure in the 2025 legislative session.

“Georgia’s strong fiscal management has allowed us to return money to the taxpayers,” Governor Brian Kemp said in a June statement. “This refund is a recognition of their contribution to the state’s success.”

Eligibility Criteria and Payment Amounts for $500 Relief Checks

Who Qualifies

Taxpayers are eligible for the Georgia relief checks if they:

- Filed a Georgia Individual Income Tax Return for tax years 2023 and 2024.

- Had a tax liability in 2023.

- Are a Georgia resident (full-year or part-year) or a qualifying nonresident.

- Have no outstanding obligations to the state that could offset the refund.

The Department of Revenue will automatically issue payments — no application is required.

Payment Amounts by Filing Status

| Filing Status | Maximum Payment |

|---|---|

| Married Filing Jointly | $500 |

| Head of Household | $375 |

| Single / Married Filing Separately | $250 |

Payments may be reduced if the taxpayer owes money to the state. Refunds are either deposited electronically or mailed by paper check.

Payment Timeline and Process

The Georgia Department of Revenue (DOR) began issuing payments the week of June 2, 2025, prioritizing direct deposits. Paper checks will follow later in June and early July.

- Early Filers: Residents who submitted tax returns by May 1 will receive their payment first.

- Extension Filers: Those who filed later or requested extensions will receive refunds after processing.

- Final Deadline: Most eligible residents should receive payments by mid-July 2025.

“We expect the majority of payments to be completed in the next six weeks,” said Robyn Crittenden, Georgia’s Revenue Commissioner. “We are balancing speed with accuracy to ensure every eligible Georgian gets what they’re owed.”

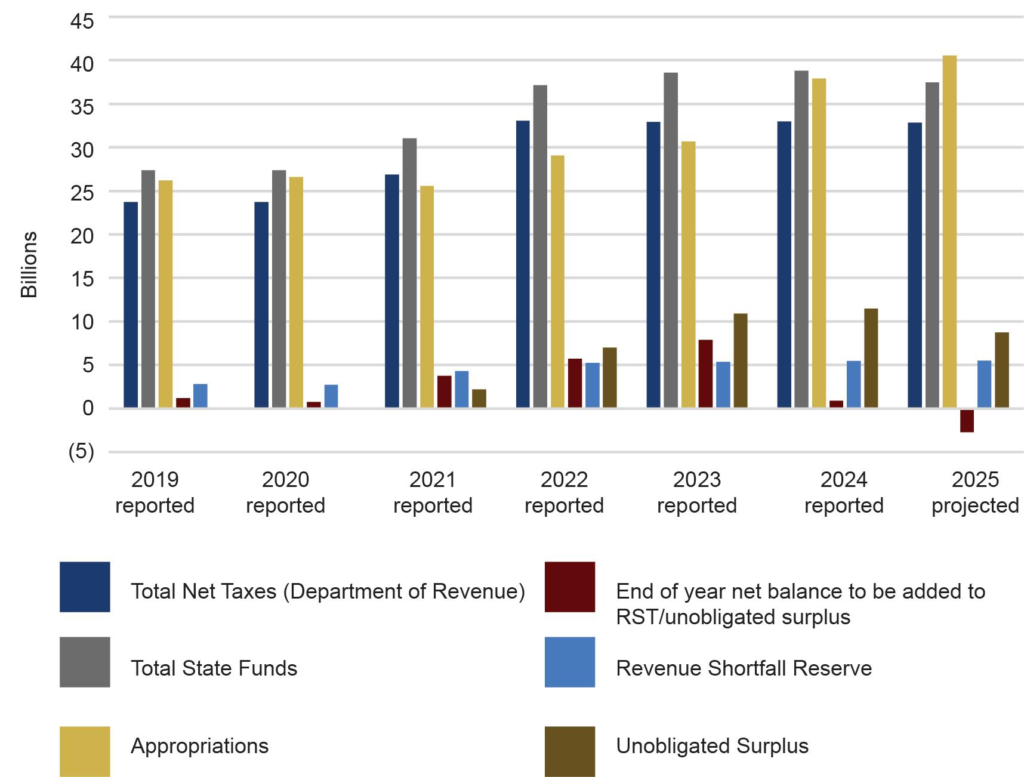

Historical Context: Georgia’s Third Consecutive Surplus Refund

This marks Georgia’s third consecutive year issuing surplus refunds. Similar payments of $250–$500 were distributed in 2022 and 2023, following years of strong tax collection and conservative fiscal policy.

In 2022, approximately 4.3 million residents received surplus checks totaling $1.1 billion. In 2023, the state issued $1.6 billion in refunds.

“This pattern reflects a deliberate strategy to keep spending below revenue growth,” explained Dr. Marcus Tinsley, a public finance expert at the University of Georgia. “Unlike many states, Georgia has used surpluses to offer direct refunds rather than expanding permanent programs.”

Economic Context and Impact

Georgia’s 2025 refund comes at a time when inflation remains elevated, though easing from its 2022 peak. Economists say the checks could provide short-term relief but are unlikely to significantly impact the broader economy.

“For most households, $250 or $500 is helpful but not transformative,” said Dr. Lisa Murray, senior economist at the Economic Policy Institute. “It may boost consumer spending modestly, especially in lower-income brackets.”

However, critics argue the funds could be better spent on long-term investments, such as infrastructure or healthcare.

“These are politically popular moves, but they don’t address structural needs,” said Sen. Elena Parent (D-Atlanta). “Georgia still faces underfunding in areas like education and rural healthcare.”

How Georgia Compares to Other States

Georgia is one of several states issuing relief checks or tax refunds this year.

Here’s how it stacks up:

| State | Max Payment | Eligibility Notes |

|---|---|---|

| Georgia | $500 | Must have 2023 tax liability; resident or qualifying filer |

| California | $1,050 | Based on income and filing status |

| Minnesota | $520 | Surplus rebate |

| Colorado | $750 | Flat refund for most taxpayers |

Human Stories Behind the Numbers

In Atlanta’s West End neighborhood, Maria Hernandez, a 38-year-old single mother, received her $375 relief check last week. She used the funds to pay for her son’s summer camp and cover a rising utility bill.

“It’s not a huge amount, but it takes some pressure off,” Hernandez said. “It helps bridge the gap until the next paycheck.”

For some, however, the payment barely covers increasing expenses. Thomas Lee, a 62-year-old retiree from Augusta, noted that the $250 check “covers about a week’s worth of groceries.”

This mix of gratitude and realism reflects how the checks may ease but not solve everyday financial challenges.

Fraud Prevention and Practical Tips

Officials are warning residents to be on alert for scam attempts surrounding the relief program. Common schemes involve fraudulent texts or emails asking for personal or banking information.

The Georgia DOR emphasized it will never ask for personal details over text or social media.

How to Protect Yourself:

- Check payment status only through the official DOR Refund Portal.

- Do not respond to unsolicited calls, texts, or emails claiming to offer “expedited” refunds.

- Update your banking or mailing address directly with DOR if needed.

Political Implications Ahead of 2026 Elections

Although framed as fiscal policy, the relief checks are also politically significant. Governor Kemp and other Republican leaders have tied the refunds to their economic stewardship narrative.

Democrats support the refunds but emphasize the need for long-term investment.

“This is a fiscal choice that reflects the administration’s priorities,” said Dr. Elaine Harmon, a political scientist at Emory University. “Heading into the 2026 gubernatorial race, these checks will likely be cited as evidence of sound management.”

Future of Georgia’s Surplus Strategy

With revenues continuing to exceed forecasts, Georgia may repeat the refund program in 2026. Lawmakers are also considering targeted tax credits for families with children, small businesses, and low-income workers.

“This refund is part of a broader fiscal strategy,” said House Speaker Jon Burns. “But we are also examining sustainable ways to invest surplus funds in education, infrastructure, and economic development.”

How to Check Your Refund Status

Residents can verify their refund status at the Georgia DOR Surplus Tax Refund Portal.

To check, taxpayers must provide:

- Social Security Number or ITIN

- Expected refund amount

- Tax year filed

New U.S. Work Permit Rules 2025: How Foreigners Can Apply and What’s Changed

13 New Conditions Added to Fast-Track Social Security Benefits, Confirms SSA – Check Details

Millions of Californians Can Now Get Up to $1,789 in CalFresh; Here’s What Changed Overnight

FAQ About $500 Relief Checks

Who qualifies?

Residents or part-year residents who filed 2023 and 2024 tax returns and had tax liability.

How much will I get?

$250 for single, $375 for head of household, $500 for married filing jointly.

Do I need to apply?

No. Payments are issued automatically to eligible taxpayers.

When will payments arrive?

Direct deposits began the week of June 2. Paper checks are expected by mid-July.

What if my check is delayed?

Contact DOR directly and verify your mailing or banking information.

Looking Ahead

The Georgia Department of Revenue is expected to release an updated disbursement report in early July, detailing how many residents received payments and how much money was distributed.

Whether future surpluses will continue to fund refunds or shift toward new spending remains an open question.

“Our fiscal house is in order,” Governor Kemp said at a recent event. “That means we can both return money to taxpayers and prepare for the future.”